- عربي

- English

History would suggest we can, but while liquidity will be poor today (due to the US observing Juneteenth – US cash markets are closed, futures partially open) much depends on whether traders and funds roll their puts into far lower strikes, or whether dealers cover their hedges (meaning buying back S&P 500 futures shorts), in turn, driving the equity market higher. My base case is the S&P 500 trades into 3300/3400 over time but that call is obviously not this coming week – trading wise, if I'm buying risk it's for a scalp or a day trade, but swing is out of the question and I want to be in front of the screens when holding exposures…sleep is a good thing.

As it is, all the distribution of probabilities points to equity markets likely to be sold on any rally – the job of the trader is to understand how far these rallies can go before getting set into shorts. The moves in crypto over the weekend are a case in point that former liquidity beneficiaries cant find a friend, although we’re seeing the likes of Bitcoin now back above 20k - the weekend focus on crypto on social media has been wild and there is literally no one who is bullish, and if they are then they don’t want to publicly declare their hand. It feels like if this is to rally then it's short-covering over organic buying.

A 5.6% decline in crude on Friday (WTI crude fell 8.6% on the week) is a silver lining and the weekly chart of US 5yr Treasuries suggests exhaustion in the rampant bond sell-off – if the equity market is to rally we need a lower crude price, not just in spot but throughout the futures curve, and bond bulls need to drive down yields too – perhaps then we can squeeze to 3900 in the US500, but that is a stretch, and gold will like lower bond yields.

One to watch as we focus on Jay Powell's testimony to Congress this week, where Powell will be grilled but continue to push for credibility in his myopic inflation fighting stance. In FX markets, the CHF was the superstar last week, and the momentum players are long the 'swissy' and eyeing follow-through -GBPCHF is a favourite from clients who were magnetised to the movement.

Anyhow, while the investment community manage drawdown, the trading community get set for another wild week – I want to be long risk this week, but I'll let the market guide – it feels so wrong to be long as I know there is more pain to come – either way, having an open mind, reacting to price and let the market guide will always serve any trader well.

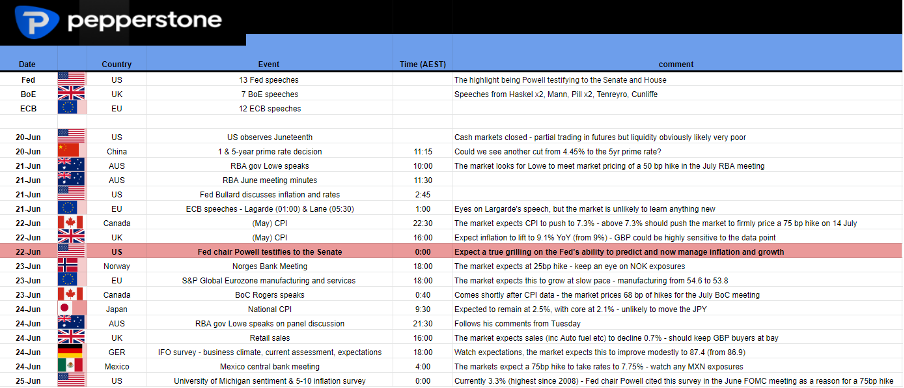

So, what's on the docket this week? I’ve put a few thoughts together on event risk this week.

(Source: Pepperstone - Past performance is not indicative of future performance.)

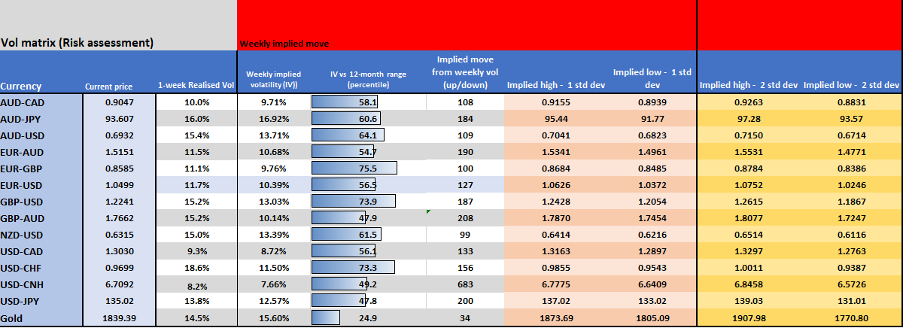

Implied volatility matrix – with the event risk mentioned above, here's the implied volatility (priced by options) and the expected movement. I like to use for risk and mean reversion purposes, but it offers a guide on the expected movement on the week in some key FX/XAU pairs.

(Source: Pepperstone - Past performance is not indicative of future performance.)

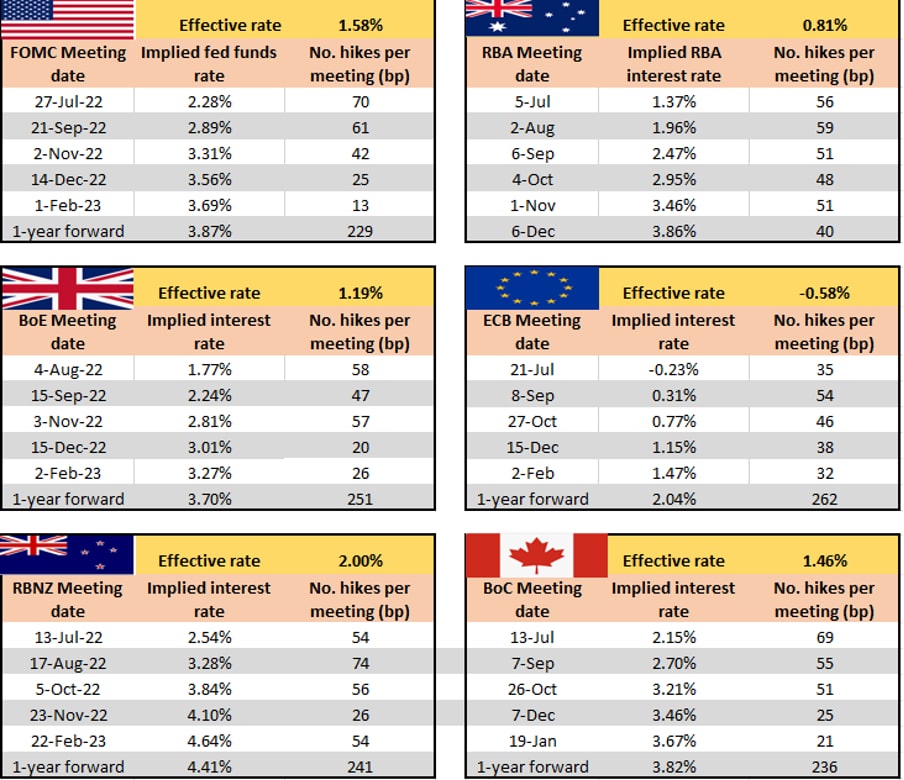

Interest rates expectations – with the markets so interested on upcoming central bank meetings, I’ve looked at interest rate pricing. Here’s my matrix on the upcoming meetings and what’s priced into markets by way of priced hikes. I feel this helps traders manage event risk far better. As an example, we see 70bp of hikes priced for the July FOMC meeting, 56bp for the next RBA meeting.

(Source: Pepperstone - Past performance is not indicative of future performance.)

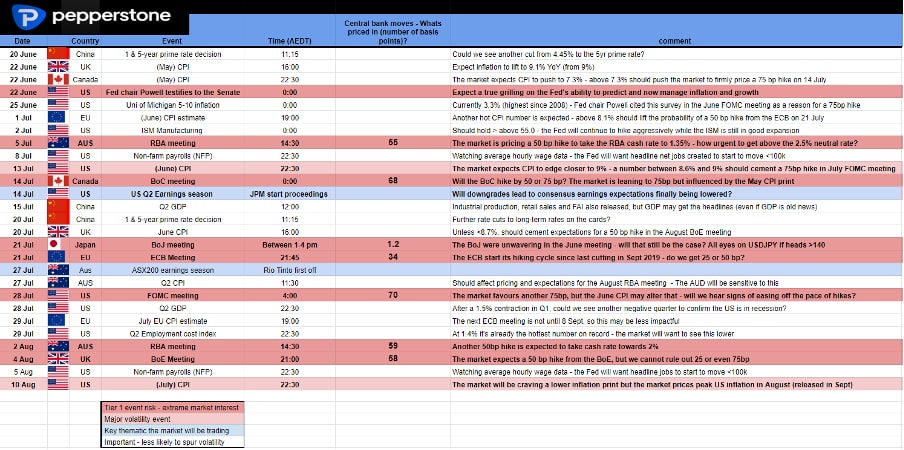

Looking ahead at the key event risk – here we list the marquee event risks on the docket over the next 6-8 weeks. These are the events that the market will look at front and centre and above all others. Be aware of these, they mean everything to markets.

(Source: Pepperstone - Past performance is not indicative of future performance.)

Related articles

مستعد للتداول؟

يمكنك البدء بسرعة وسهولة. إفتح حساب الآن في دقائق معدودة.

"لم يتم إعداد المواد المقدمة هنا وفقًا للمتطلبات القانونية المصممة لتعزيز استقلالية البحث الاستثماري، وعلى هذا النحو تعتبر بمثابة وسيلة تسويقية. في حين أنه لا يخضع لأي حظر على التعامل قبل نشر أبحاث الاستثمار، فإننا لن نسعى إلى الاستفادة من أي ميزة قبل توفيرها لعملائنا.

بيبرستون لا توضح أن المواد المقدمة هنا دقيقة أو حديثة أو كاملة ، وبالتالي لا ينبغي الاعتماد عليها على هذا النحو. لا يجب اعتبار المعلومات، سواء من طرف ثالث أم لا، على أنها توصية؛ أو عرض للشراء أو البيع؛ أو التماس عرض لشراء أو بيع أي منتج أو أداة مالية؛ أو للمشاركة في أي استراتيجية تداول معينة. لا يأخذ في الاعتبار الوضع المالي للقراء أو أهداف الاستثمار. ننصح القراء لهذا المحتوى بطلب المشورة الخاصة بهم والإستعانة بخبير مالي. بدون موافقة بيبرستون، لا يُسمح بإعادة إنتاج هذه المعلومات أو إعادة توزيعها.

تداول العقود مقابل الفروقات والعملات الأجنبية محفوف بالمخاطر. أنت لا تملك الأصول الأساسية و ليس لديك أي حقوق عليها. إنها ليست مناسبة للجميع ، وإذا كنت عميلاً محترفًا ، فقد يؤدي ذلك إلى خسارة أكبر من استثمارك الأساسي. الأداء السابق في الأسواق المالية ليس مؤشرا على الأداء المستقبلي. يرجى النظر في المخاطر التي تنطوي عليها، والحصول على مشورة مستقلة وقراءة بيان الإفصاح عن المنتج والوثائق القانونية ذات الصلة (المتاحة على موقعنا على الإنترنت www.pepperstone.com) قبل اتخاذ قرار التداول أو الاستثمار.

هذه المعلومات غير مخصصة للتوزيع / الاستخدام من قبل أي شخص في أي بلد يكون فيه هذا التوزيع / الاستخدام مخالفًا للقوانين المحلية."