- English

- عربي

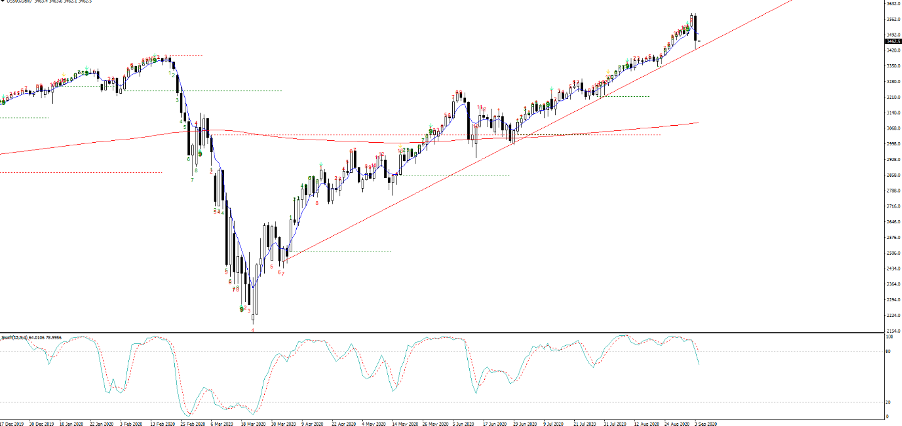

A review of the intra-day tape (S&P 500 futures) and we see after about 30 minutes into US cash trade the sellers came hard in. The algo’s sensed it and the buyers moved fully aside. It was a tough day at the office for those long equity, with the 5.2% move in the NAS100 the biggest since March and a 4 standard deviation event. The S&P 500 lost 125-handles and closed -3.5%, with price pulling back to the March uptrend. This sets the upcoming session to be very interesting indeed, especially with US non-farm payrolls a potential risk event. If US500 trend support goes then it could get a little wild in equity land. Volumes were also very high, with 2.77m S&P 500 futures trading and S&P 500 turnover 45% above the 30-day average.

(Daily of US500 – watch that trend)

Head into the vol space and we see the VIX moving into 33.6%, up a sizeable 7 vols on the day. This time around it was all put buying, as traders paid up for equity downside protection. A VIX at 34% equates to daily moves of 2.1% in the S&P 500, which may suit some and for others it’s a touch too volatile. However, if equity volatility results in higher FX volatility then I’m all for it. We now see Apple’s implied vol at 65%, indicative of 4% daily moves (higher or lower). That’s a lot of market cap being made or lost each day. In fact, Apple’s 8% decline saw the market cap drop by $180b.

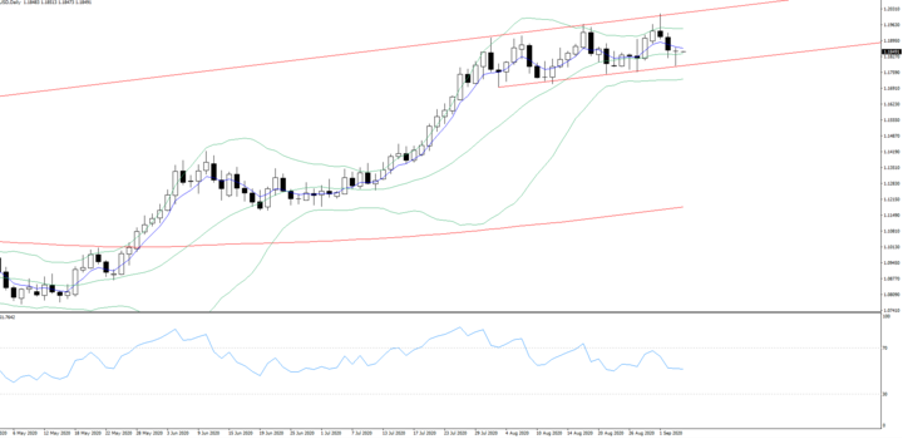

Outside of equity and things do make sense today, with a real risk-off feel across markets. It won’t surprise to see the CHF and JPY as the best performers in G10 FX. That said, things could have become far livelier cross-markets if the USD had moved more aggressively vs the EUR, where EURUSD had a technical rally off the session low of 1.1789 and still holds the channel. We’ve seen some movement in AUD, NZD and NOK, with AUDUSD getting a solid work out from clients and ultimately we see price closing below the 5-day EMA which needs to be monitored to see if the move can get momentum. Although, we’re seeing some technical support at the 19 August high. A break of 0.7274 and I’d be looking for 0.7150.

EURUSD daily

US Treasuries are small bid with a small flattening of the curve. Real (inflation-adjusted) Treasury yields are 5bp higher (5-year), copper and lumber are -1.4% and -8.1% respectively, crude closed -0.5% and gold -0.6% at 1930, having traded a range of 1946 to 1921 through EU/US trade. My model is working on a $23 move in the session ahead, which puts the range at 1954 to 1908, but I’ll update Telegram as the day gets underway and we see more life come into XAU daily options.

In terms of drivers, I thought it of interest that Fed member Bostic commented “we should be concerned about the risk of asset bubbles”. That’s not to say he thinks there is one now and to be fair the Fed is not going to alter its policy settings at a time when the economy needs to be run hot. Chicago Fed President Charles Evans, one of the leading advocates of Average Inflation Targeting says he’d be prepared to tolerate 2.5% inflation. He also said it will take time for inflation to get back above 2% and that a full recovery won’t take place until late 2022.

On the data side, we saw a solid jobless claims report (881k vs 950k eyed) and a slightly below par services ISM (59.6), but not sure how relevant they are on a day when it’s about order book dynamic and flow. All eyes on payrolls through and a poor number could be interesting. One to watch, but the question of the day will centre on how sensitive markets are to payrolls. I think more so after the US move and bad news will be bad news for risk assets.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.