- English

- عربي

S&P500

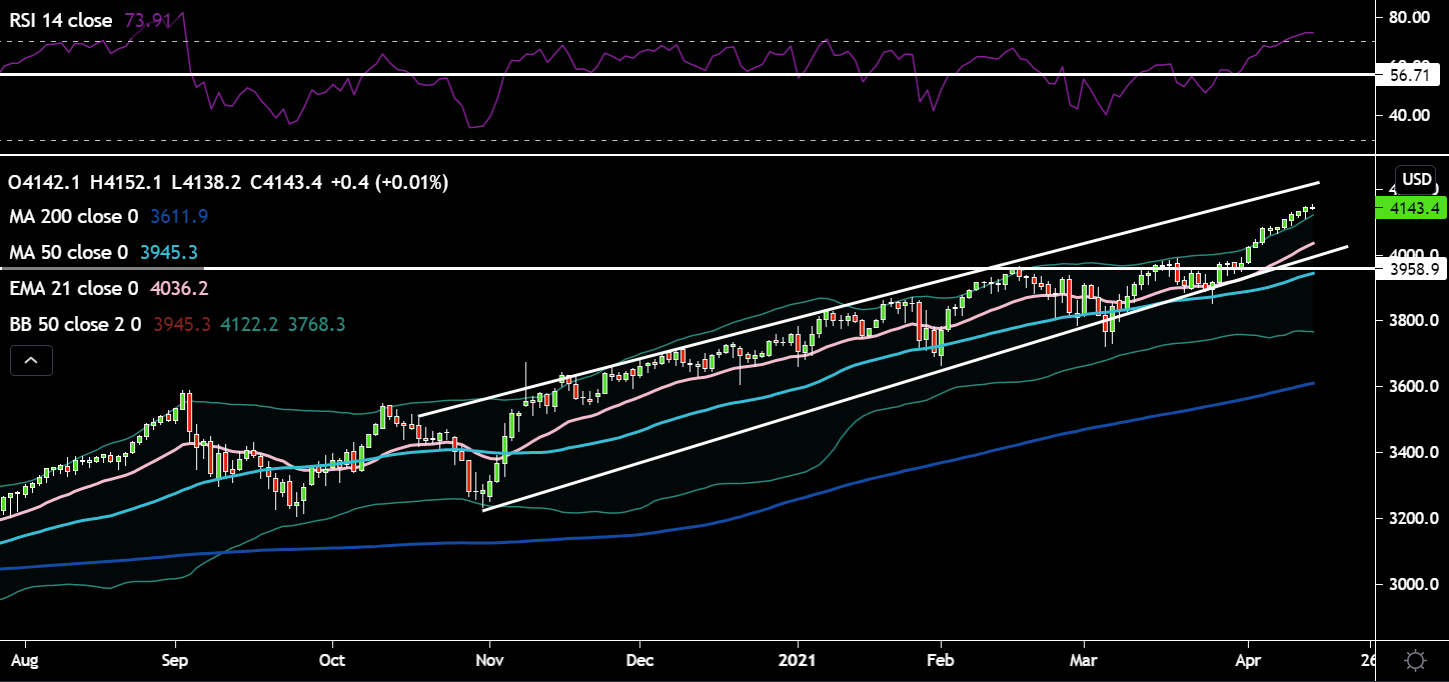

The S&P 500 has continued to push higher and higher over the last few months, achieving a new all-time high as the US economy roars back to life with progress on the virus front - buttressed by a very supportive monetary and fiscal backdrop. Clearly, markets have become more complacent towards risk as the VIX now tries to target 15, finally trading below the dreaded sticky 20 handle. We’re smack bang in the middle of Q1 earnings season, which should be one of the strongest on record especially from a YoY perspective, given the severe damage witnessed in Q1 2020. Strong earnings across the board should help keep a strong bid in the in the overall index. Retail Sales out on Thursday should comfortably beat expectations on the back of bad weather in Feb and stimulus checks, further driving the superior US economic growth narrative. Recently, the rangebound price action in the US 10-year yield, has eased some of the pressure on high growth equity names from a valuation perspective. Interestingly, we also had James Bullard (non-voting Fed President) drop hints for a potential timeline for tapering with his comments about a threshold of 75% of Americans being vaccinated a necessary condition for the central bank to consider tapering its bond-buying program. Equity markets like their QE so this is a theme which will be very important as we move into H2 of this year. The geopolitical space is becoming interesting again with tensions between Russia and Ukraine causing the US to send 2 warships to the Black Sea as a warning to Russia. China and Taiwan relations are souring too. Could we see some risk premium priced back into markets if these situations escalate? Despite a mild hiccup on the vaccine front with the temporary suspension of the J&J vaccine over blood clot fears, traders have pushed it to the back of their minds with risk-on animal spirits remaining firmly entrenched.

The technicals are beginning to look a tad stretched. The RSI is fairly deep in overbought territory, price is above the 50-day upper Bollinger Band and above all its moving averages both short and long term. Price is trying to have a go at the top of the ascending channel around the 4200 level. April is one of the strongest months for the S&P 500 from a seasonality perspective so we could continue to push higher, then maybe see some profit taking into May, causing a mild reversion in price back down to key support of 4k.

DAX

There are early signs of the market becoming slightly more positive about Europe’s prospects as the vaccine rollout continues to gather pace. The suspension of the J&J vaccine though could stymied efforts further. Any further delays could put Europe’s summer tourism season in jeopardy, which is in desperate need of a boost. German ZEW sentiment indicators were bad, but in this market data becomes stale almost as soon as it’s released. On Thursday and Friday we’ll receive German, French, Italian as well as Euro Area inflation data. The following week we have the European Central Bank meeting who with their tools can influence European equity markets. Euro weakness of late will have helped drive indices like the DAX higher over the last couple of months given the cyclical and multinational nature of the companies in the index.

The Dax looks as if it wants to potentially rollover in the short term and test the 15k level just above the 21-day EMA (acted as good support on prior pullbacks). The RSI is rolling over in overbought territory and price is currently stuck in a mini range, which will need to resolve in either direction soon. The high of 15.2k, needs to be cleared decisively if price is to continue its uptrend.

FTSE100

The FTSE 100 has been struggling to keep up with US and European benchmark indices and has not been able to surpass pre-covid highs. However, this may present more of an opportunity for price appreciation. Sterling strength has clearly been a headwind for the index as foreign revenues get translated back into a lower value. Brexit was capping gains in the FTSE for a long time, with that issue now out the way a strong economic recovery (IMF forecasts upgraded) could set the FTSE up for sizeable gains. The vaccine rollout has had some minor speedbumps, but still remains solid. One should monitor a slowdown in the vaccine department, but with the minimum threshold for herd immunity in touching distance, how bad would a mild slowdown actually be? The Scottish elections on May 6 could bring some weakness to the FTSE if the SNP achieve a decent majority. Chief Economist at the BoE, Andy Haldane stepped down yesterday, making the composition of the MPC more dovish which could bode well for equity prices in the UK.

On the charts we see price has formed an ascending channel and is now bumping up against horizontal resistance of 7k. Examining the RSI points to some minor negative divergence which could pressure price lower. If price can push higher above the horizontal resistance and the upper line of the channel, the FTSE would then move into the 7k region where price traded in a range prior to covid between 7k and 7.7k. I’d be worried about the uptrend if price were to break through the recent swing low around 6618 on March 25, which would also mean slicing through the 50-day SMA and uptrend line.

ASX200

Australia's ASX 200 index sits in a tight little range since breaking above the 6.9k resistance level. Australia has abandoned its vaccine timeline due to delays making the projections difficult. The Prime Minister remains hesitant in setting another deadline for Australians to receive their doses. Concerns about blood clots with AstraZeneca and export restrictions curbing supply are combining to delay the rollout further. Given the large weight in the index to financials and materials, a strong cyclical economic recovery will be necessary to keep the ASX200 grinding higher. Given the large reliance on commodity exports like coal, iron ore, copper and gold, their price path will also help shape sentiment around the Aussie economy and equity flows. Australian 10-year yields have been moving sideways since March and should remove a temporary headwind to the ASX200. China’s economic results tend to have a ripple effect over into Australia – this Friday’s Q1 GDP and retails sales numbers out of China could see a boost for Asian indices including the ASX200.

Technicals are a bit lacklustre and are waiting for a new catalyst to drive price direction. The RSI is not far off overbought levels, but still has room to make a push to pre-pandemic highs around 7200. 6950 will act as a good support level for any price pullbacks as well as the 21-day EMA, 50-day SMA and uptrend line in the 6780-6720 region. If however the S&P rolls over, the ASX200 will most likely follow given its close correlation to risk.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg)