- English

- عربي

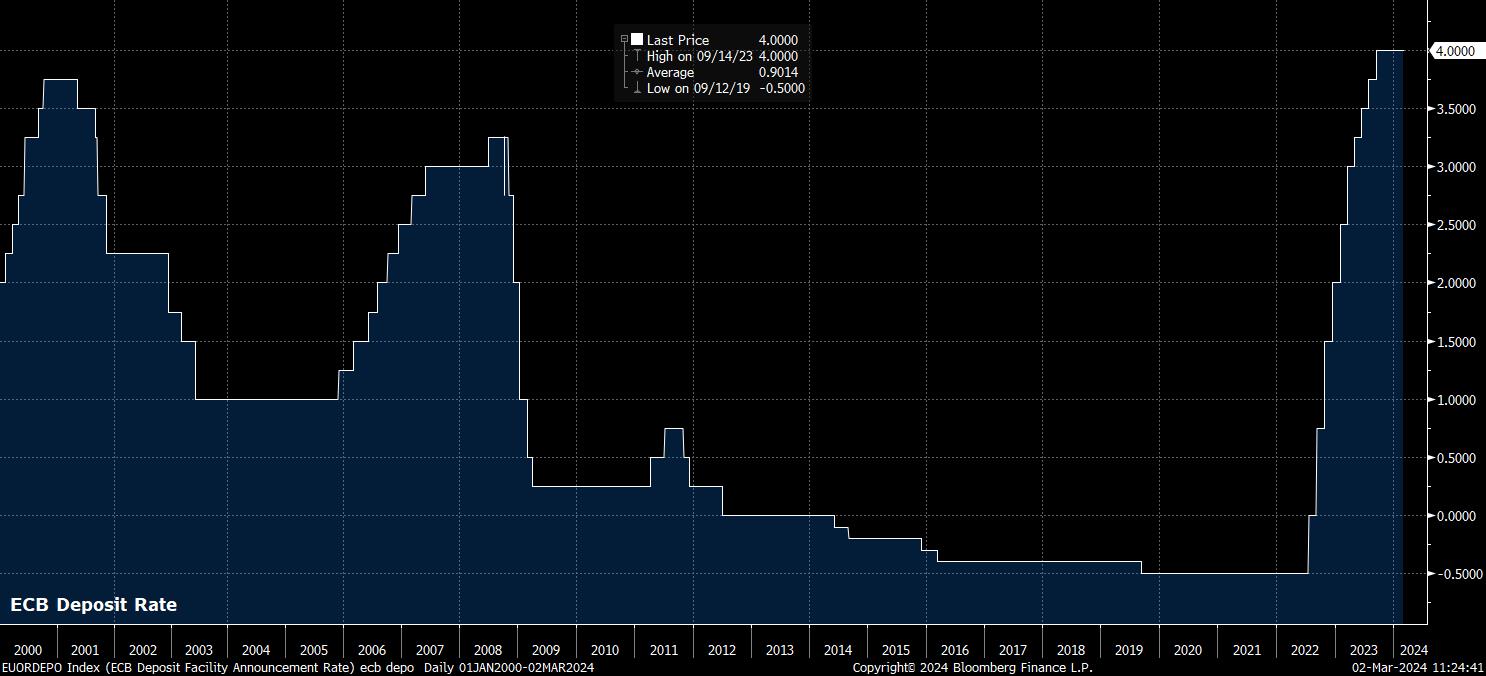

As noted, the ECB are almost certain to maintain the deposit rate at a record high 4.00% at the conclusion of the March meeting. EUR OIS prices no change of any shift this month, while pricing just 5bp of easing for the April meet, with the first 25bp cut fully priced for June; in all, the curve seems relatively accurately priced for the base case outlook, particularly after February’s hotter-than-expected CPI figures.

The GC’s forward guidance is similarly likely to remain unchanged. Rate cuts or policy normalisation are both highly unlikely to be mentioned in the policy statement, which should instead once again repeat that rates will remain at “sufficiently restrictive levels for as long as necessary”.

Note, however, that ‘sufficient restriction’ can still be achieved even after a rate cut has been delivered. A crude calculation points to the real ECB deposit rate currently sitting around 1.4%, using the headline YoY HICP figure to make the appropriate adjustment, above the median estimate of eurozone r*, which sits around 0%. Hence, even once the first cut has been delivered, and policy normalisation begins, rates are likely to remain at a relatively restrictive level for some time.

On the subject of normalisation – where, incidentally, EUR OIS prices around 104bp of cuts in total this year – the policy statement seems set to reiterate the “data-dependent” approach which policymakers continue to follow, with particular emphasis being placed on underlying inflation dynamics.

Given that neither the rate decision, nor the policy statement, seem likely to bring much in the way of surprises, all eyes will naturally fall on the latest round of ECB staff macroeconomic projections, released along with the policy statement.

Taking into account the more rapid than expected disinflationary process, even if core CPI did surprisingly remain north of 3% YoY in February, the latest forecast round will likely result in a fairly significant downgrade to the ECB’s inflation projections. Substantially lower gas prices will also help here, while the projections will also have likely been modelled and calculated before the February inflation data release.

The 2024 headline inflation forecast is likely to be revised around 0.3-0.4pp lower than December’s 2.7% expectation, while likely also pointing to the 2% inflation target being hit, or close to hit, in the second half of the year. The 2025 inflation projection will likely also be revised a touch lower, probably to 2.0%, from the present 2.1%.

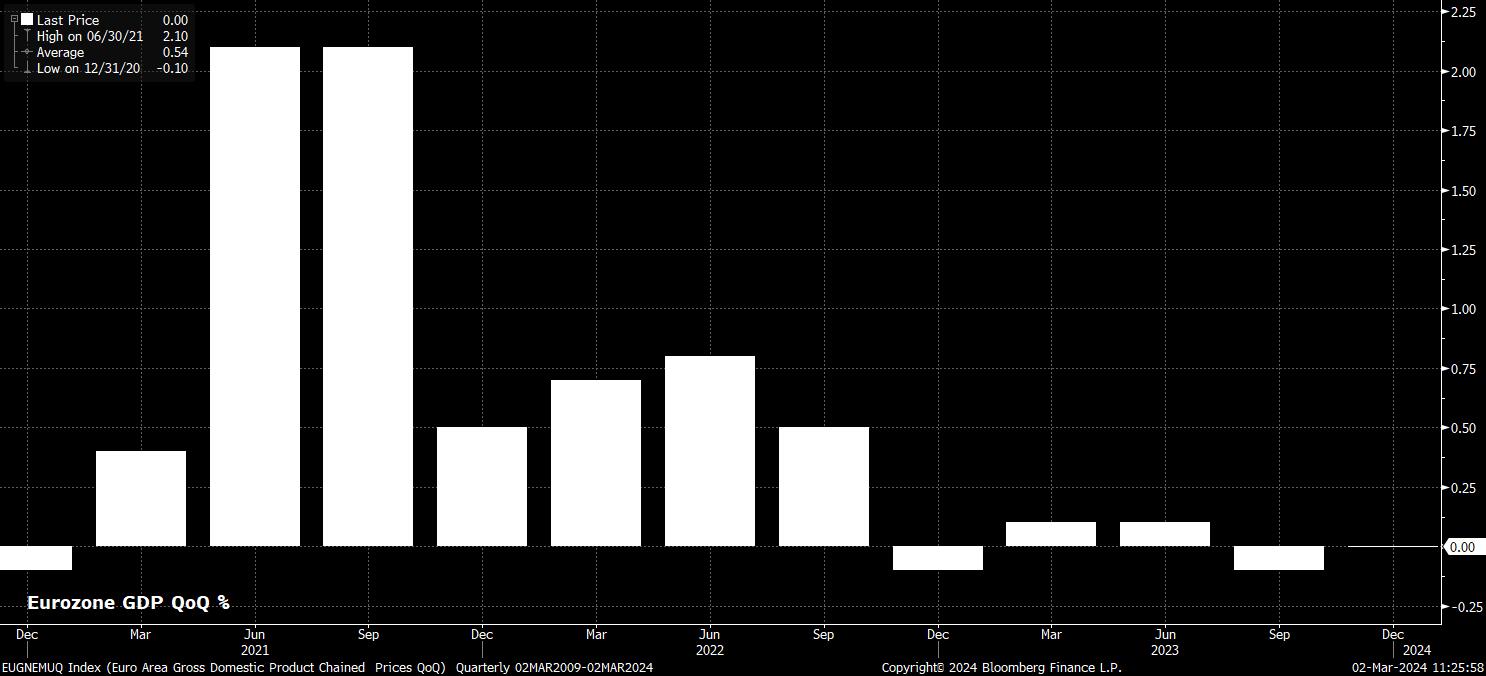

Meanwhile, on the growth front, the outlook has continued to deteriorate since the prior forecast round, as seems to almost constantly be the case with the eurozone economy at present.

Not only did the bloc’s economy stagnate in the final three months of last year, below the ECB’s expectation of modest 0.1% QoQ growth, but there has also been little sign of a substantial pick-up in economic activity in the early part of this year, with the latest round of PMI surveys pointing to continued contraction in the manufacturing sector, while services stagnates. Furthermore, Germany’s continued struggles will remain a drag on the bloc at large, particularly with the eurozone’s largest economy set to contract once more in the first quarter of the year.

In addition, risks to the growth outlook remain tilted firmly to the downside, with continued geopolitical tensions in both Ukraine and the Middle East both likely to pose ongoing headwinds, while the continued dismal performance of the Chinese economy is yet another issue that the eurozone economy will need to navigate.

All in all, these factors should contribute to a further downward revision to the ECB’s GDP forecasts, with 2024 GDP growth unlikely to be seen much above 0.5%, a pace that could – at best – be described as anaemic. Longer-run growth expectations, however, are likely to remain unchanged at 1.5% in both 2025 and 2026, reflecting looser financial conditions in the latter part of the forecast horizon; though, given recent form, it would not be at all surprising to see these expectations eventually also revised downwards in due course.

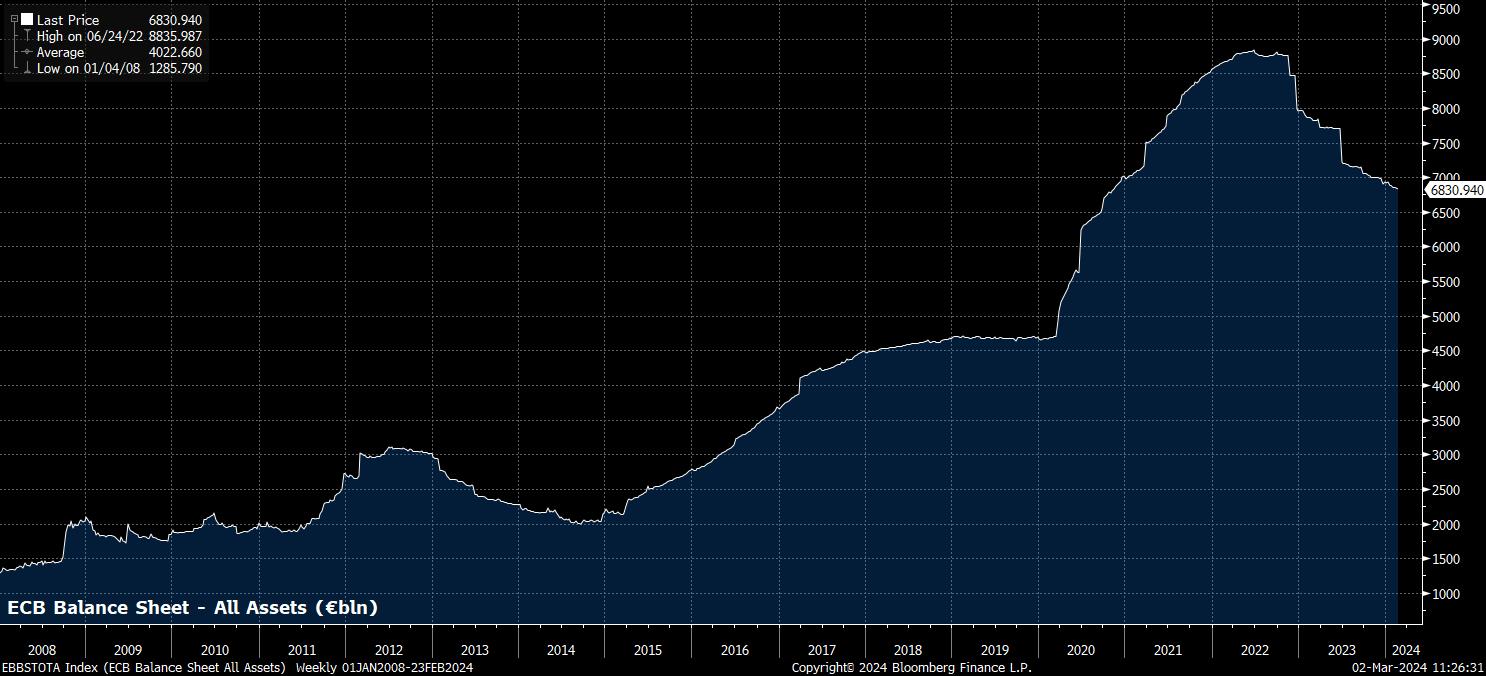

Before turning to President Lagarde’s post-meeting press conference, it’s worth touching on the other tool in the ECB’s box – asset purchases. No changes to the previously announced balance sheet plans are likely to be announced, or are necessary, at the March meeting, with the gradual tapering of PEPP reinvestments in the second half of the year, with a view to these concluding at the end of 2024, still on track.

In terms of the aforementioned press conference, it seems unlikely that we will receive much by way of fresh guidance or communication on the normalisation outlook.

President Lagarde is, again, likely to ‘stick to the script’ that has been used recently, stressing the data-dependent, rather than time-based, approach that the Governing Council will continue to take. Again, this will probably lead to great importance being placed on first quarter wage data, with policymakers continuing to seek greater evidence that inflationary pressures have been adequately squeezed out of the economy before beginning to move to a less restrictive stance.

On that note, it will be interesting to see whether the topic of rate cuts was discussed at the Governing Council meeting. In January, per the meeting account, there was a consensus that it was premature to be discussing the subject. Since, however, a handful of the GC’s more dovish members have been vocal in noting that easing should be discussed sooner rather than later. Though this represents a relatively small minority at present, it would be significant were Lagarde to officially communicate that the discussion as to how and when to normalise policy is now underway, even if further data is required before the process begins.

Taking all this into account, it seems unlikely that the March ECB meeting will be a game-changer for the EUR, or EUR-denominated assets.

It seems difficult to imagine the ECB shifting to a materially more dovish stance, particularly after the hotter than expected February inflation report, meaning that an April cut is now off the cards, with June becoming the base case. EUR OIS is already perfectly priced for such a scenario. It is also relatively difficult to see the ECB shifting to a substantially more hawkish stance, especially as growth remains anaemic, and risks to the outlook remain firmly tilted to the downside.

With that in mind, the common currency seems likely to remain within its recent 1.08-1.09 range over the short-term, though risks for the EUR do tilt more significantly in a bearish direction, particularly with the market remaining convinced of a ‘soft landing’ being achieved stateside, and with the ‘US exceptionalism’ narrative set to continue to underpin USD demand for some time to come.

_eur_spot_2024-03-02_11-28-00.jpg)

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.