- English

- عربي

Analysis

September 2024 FOMC Review: Kicking-Off With A Jumbo Cut

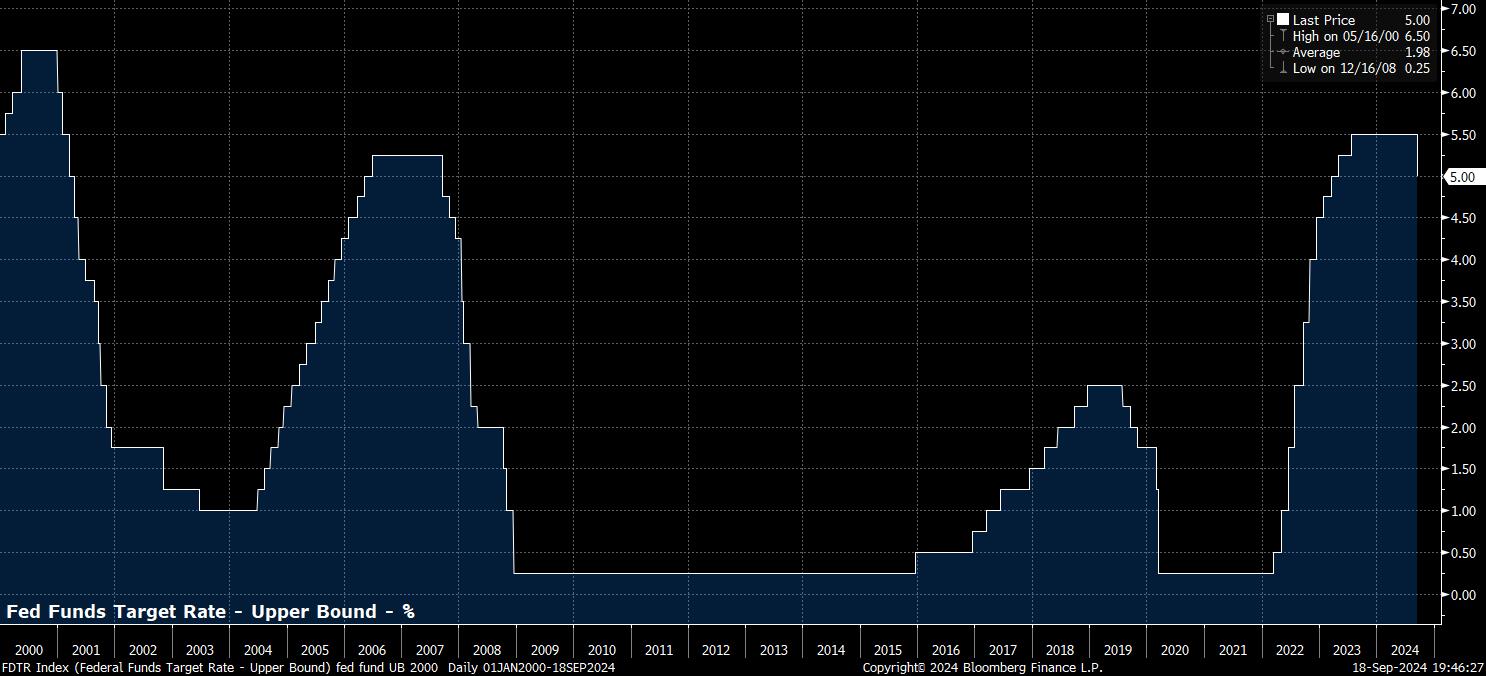

Powell & Co. kicked-off the easing cycle at the September FOMC with a 50bp cut, mirroring the way in which normalisation began in both 2007 and 2001, historical omens that the FOMC will naturally be seeking to avoid this time around.

The ‘jumbo’ cut, which wasn’t my base case, but to which markets had assigned a roughly 60% probability before the decision, seems over-the-top given recent economic data, though has clearly been delivered by policymakers beginning to worry about whether or not the ‘soft landing’ will stick. The target range for the fed funds rate now stands at 4.75% - 5.00%, after the first rate cut since March 2020.

Interestingly, the decision to deliver a 50bp cut was not a unanimous one, with Governor Bowman dissenting in favour of a more modest 25bp cut, the first dissent by a Governor since 2005. This is an interesting shift as one of the hallmarks of Powell’s chairmanship so far has been unanimity among FOMC voters. One wonders whether this is a sign of things to come, as the FOMC could well become more fractured were data to continue to paint a mixed picture as the easing cycle progresses.

Accompanying the rate decision, was the eagerly-anticipated policy statement, which market participants parsed closely for hints on the future policy outlook, chiefly the pace, and magnitude, of further easing.

Unsurprisingly, the statement didn’t make any pre-commitments to the timing, or the size, of any additional rate cuts, instead noting that policymakers will take a data-dependent approach in determining the size of any “additional adjustments” to the fed funds rate. Nevertheless, policymakers did note that risks to each side of the dual mandate are now “roughly” in balance, implying an equal weight on incoming inflation, and jobs, data going forward.

There were a couple of other dovish tweaks to the statement, with the Committee flagging that job gains have “slowed”, while also noting a ‘strong commitment’ to both supporting maximum employment, and returning inflation to 2%, as opposed to solely the latter in the July statement.

Along with the statement, the September FOMC also saw the release of the Committee’s ‘dot plot’, showing individual policymakers’ expectations of the appropriate future level for the fed funds rate.

Including the cut delivered today, the median dot now indicates that the fed funds rate will end the year between 4.25% - 4.50%, compared to the 5.00% - 5.25% expectation outlined in June. With just two further FOMC meetings this year, and a 50bp cut having been delivered today, the dots imply that the remaining decisions this year will each result in a 25bp reduction. Further out, the dots continue to see 100bp of cuts in 2025, while both the 2026 dot, and the longer-run estimate of the fed funds rate, now stand at 2.875%. The latter figure, interestingly, is 12.5bp higher than that foreseen in June, perhaps indicating that estimates of the neutral rate are rising.

Nevertheless, the main message from the dots is one of huge policy uncertainty. 9 FOMC members placed their ‘dot’ above the median, compared to 10 at or below it. Meanwhile, the dispersion of dots was incredibly wide, with 2 Committee members seeing just one more cut this year, in contrast to one policymaker seeking another 100bp of easing before 2024 draws to a close. The FOMC are sure of the direction of travel, but not sure of the speed at which that journey will be taken.

In addition to the dots, the SEP also included the FOMC’s latest economic projections. Likely driving the decision to deliver a larger-than-expected 50bp cut was a rather ugly unemployment forecast, with joblessness now expected at 4.4% this year, 0.4pp higher than in June, while remaining at that level into next year, before dropping to 4.3% - still 0.2pp above the prior forecasts – in 2026.

Despite increased labour market slack, the economy is still expected to grow at a solid pace, with real GDP growth of 2% foreseen in each year of the forecast horizon, broadly unchanged from the prior projections. Such growth is set to come against a ‘goldilocks’ backdrop of continued cooling inflation, with core PCE still seen falling to 2.0% by 2026, while headline PCE is set to be within inches of target, at 2.1%, next year.

Having digested all of that, participants then had to grapple with Chair Powell’s post-meeting press conference.

During the presser, Powell stressed that policymakers would take a meeting-by-meeting approach to future decisions, framing rate cuts as a “policy recalibration”, which is not on “any preset course”, and which will take place “over time”. Powell also stressed the Fed’s flexibility, being able to go “quicker, slower, or pause” if appropriate, while also flagging that the SEP does not show policymakers rushing to get rates back to a neutral level.

Furthermore, Powell was clear that “no one” should extrapolate from today’s 50bp cut and assume that this is the new pace that the FOMC will follow going forward, even if policymakers are ‘ready and able’ to react if the labour market were to slow unexpectedly.

In reaction to the September FOMC, money markets priced an even more dovish outlook. The USD OIS curve now sees the fed funds rate at 4.5% - i.e., another 25bp cut – in November, around 10bp lower than what was priced prior to the decision. By December, the curve prices the fed funds rate at 4.15%, also around 10bp below its pre-release level. Of course, this pricing is also considerably more dovish than the path outlined in the updated ‘dot plot’.

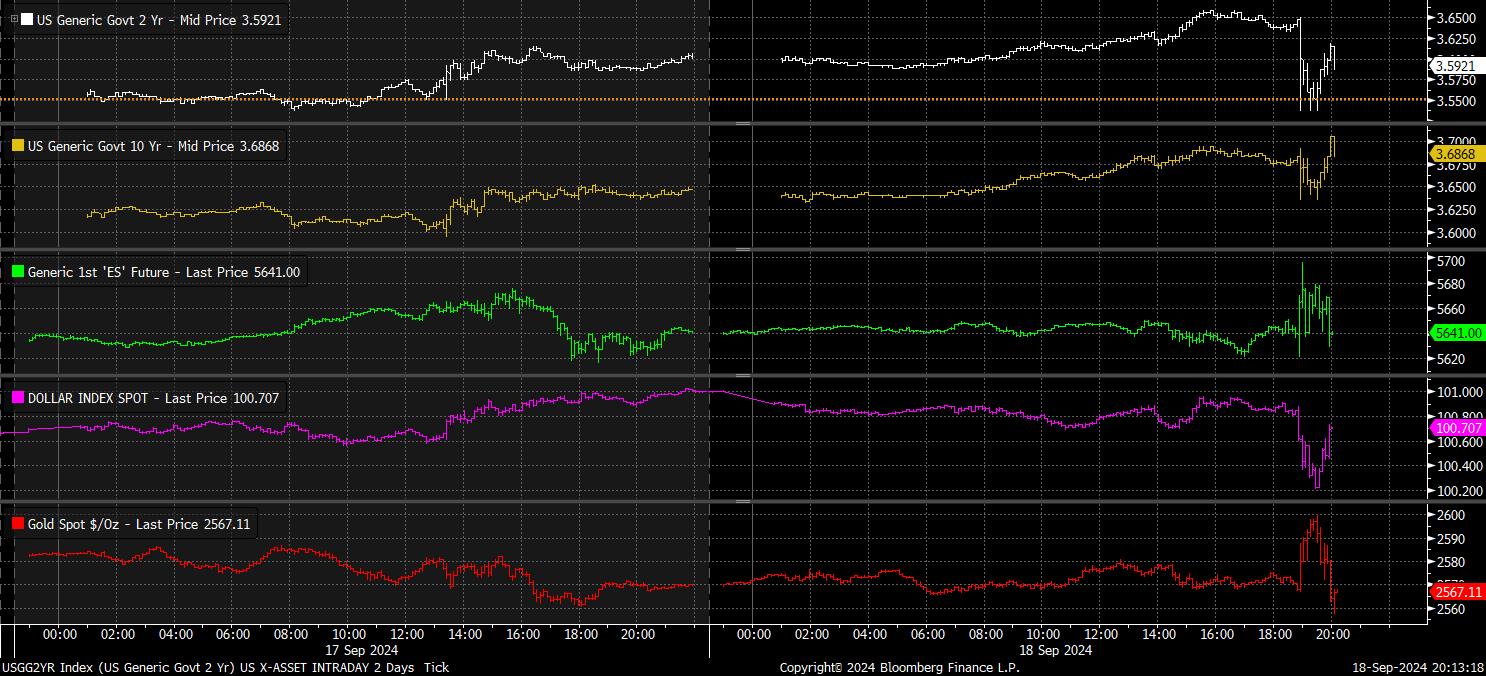

Amid this repricing, markets largely took things in their stride.

Equities initially popped on the 50bp cut, though pared gains as time went on, trading in particularly choppy fashion during the press conference, as Powell stressed policymakers not being “in a rush” to get back to neutral. Treasuries were similarly choppy, with the 2-year yield paring around half of the 12bp advance seen on the policy announcement.

The greenback, meanwhile, was also choppy, with the DXY recovering from a fresh YTD low as the presser progressed, while gold also experienced a rollercoaster ride, paring gains from a new record high just shy of $2,600/oz.

On the whole, the ‘jumbo’ rate cut seems unlikely to be a game-changer on its own, even if it is now followed by a series of more modest, 25bp moves. Risk sentiment continues to hinge not on what the Fed will do, but what policymakers can do if required. With rates still approx. 200bp above neutral, plus quantitative tightening likely to wrap up before year-end, the FOMC’s toolbox is full to the brim with potential support measures.

When coupled with the forceful ‘Fed put’ that remains in place, and desire to prevent further weakness in the labour market, investors should remain confident to reside further out the risk curve, with any dips set to remain shallow in nature. Nevertheless, if the FOMC were to plot a quicker path back to neutral, the USD is liable to face relatively stiff headwinds, particularly as other G10 central banks take a much more cautious approach to the normalisation process.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.