- English

- عربي

In the US, the S&P 500 gained 0.3% with the Russell 2k +0.7%. In the S&P 500 sectors, energy gained 3.1% with our SpotCrude price breaking $70, before closing just below the figure and +2% on the day. Outside of energy, there were no clear themes, with no dominant cyclical, growth or value vibe playing through. Material names didn’t truly fire up, with a mixed picture across iron ore futures (SGX futures +0.8%), copper +0.6% and gold -0.2% and holding an 1817-1805 range.

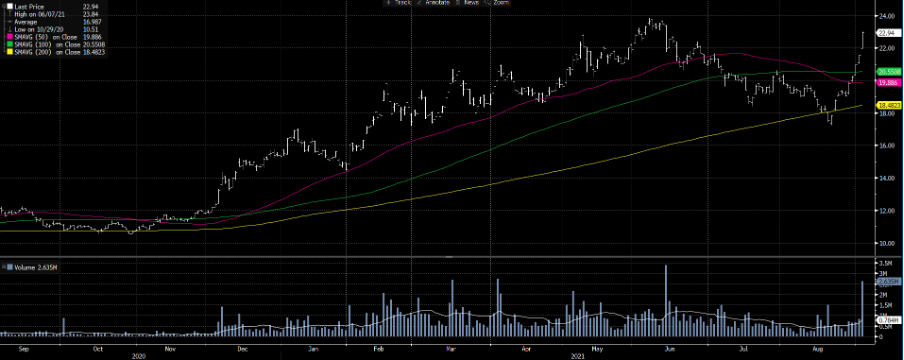

URA daily – trade on MT5

(Source: Bloomberg - Past performance is not indicative of future performance.)

On the ETF side, URA ETF (Global X Uranium) has come up on a couple of my scans, having rallied 33% in the past 9 sessions and looks the goods at the moment – it is up for five straight days, so I am sure a few will be looking at shorts for a slight mean reverting move, but it's like standing in front of a train at the moment. Anyhow, one for the radar, especially with 1.93m shares traded on the day, the highest volume since 14 June and 3.6x the 30-day average.

The market is seemingly running a progressive short USD position into today’s non-farm payrolls (NFP), partly as a result of poor Homebase employment data, but also the ADP payrolls were well below expectations in the prior session. While the consensus for today’s NFP sits at 725k and I hear the so-called ‘whisper’ number sits at 715K, I’d argue the market is positioned for around 600k. I’d also argue a number sub-550k should see calls for the start date for Fed tapering from a few analysts is likely pushed out to 2022.

We’ve seen the DXY move from 93.72 and through the 13 August swing low of 92.47 – this now puts the 30 July low of 91.78 in play, but I’d be looking to fade weakness here on the day. EURUSD has naturally been at the heart of the move with its push into 1.1900 and the 30 July highs – this is not just a USD move, but a play on next week’s ECB meeting, with some talk the central bank could signal a slower pace of asset purchases – this effectively cements a view that when the QE juice stops flowing in March 2022, they will not pull out another round.

EURCHF daily

(Source: Tradingview - Past performance is not indicative of future performance.)

EURCHF is a good one for the radar here, as price has broken out and is now testing downtrend resistance. On a break, I’d be fading this into the 200-day MA, for a re-test of the former trend – 74% of open positions held by clients are short, so clearly there would be some believing this EUR move has gone too far. Especially given the lack of movement in German bunds, which tend to drive the funding currencies.

Arguably the trade to watch though has been the higher beta FX play. The ZAR has been strong of late, moving from 15.33 to 14.49, but seems to find the 100-day MA hard to break – are we seeing a dead cat bounce or ‘value’ to buy USDs here? US NF Payrolls will obviously dictate. The NZD has been the star of the session closing up +0.6% and breaking above 0.7100 and the highest levels since 16 June - a solid rally from 0.6805 on 20 August. AUDUSD is threatening a break of the July/August range highs and a weekly close above 0.7400 would get a few excited – with the RBA meeting next week, the debate around whether the bank suspends tapering QE to $4b/week or continue to plod on.

(Source: Tradingview - Past performance is not indicative of future performance.)

The move in the AUD has clearly caught a few by surprise, but we’re seeing stability in Chinese equities, relative nominal and real rate differentials are working in favour of AUD appreciation and the change of tact from VIC and NSW state governments, to learn to live with COVID if vaccine rates are high enough could be a game-changer. Let’s not forget both leveraged accounts and asset managers are short AUD in some size, and with a weaker USD it's not hard to see why the AUDUSD has rallied 4.2% off its lows.

Good luck to all trading payrolls and you can trade the potential opportunity with Pepperstone.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.