- English

January 2024 FOMC Review: Cuts Coming But Confidence Needed First

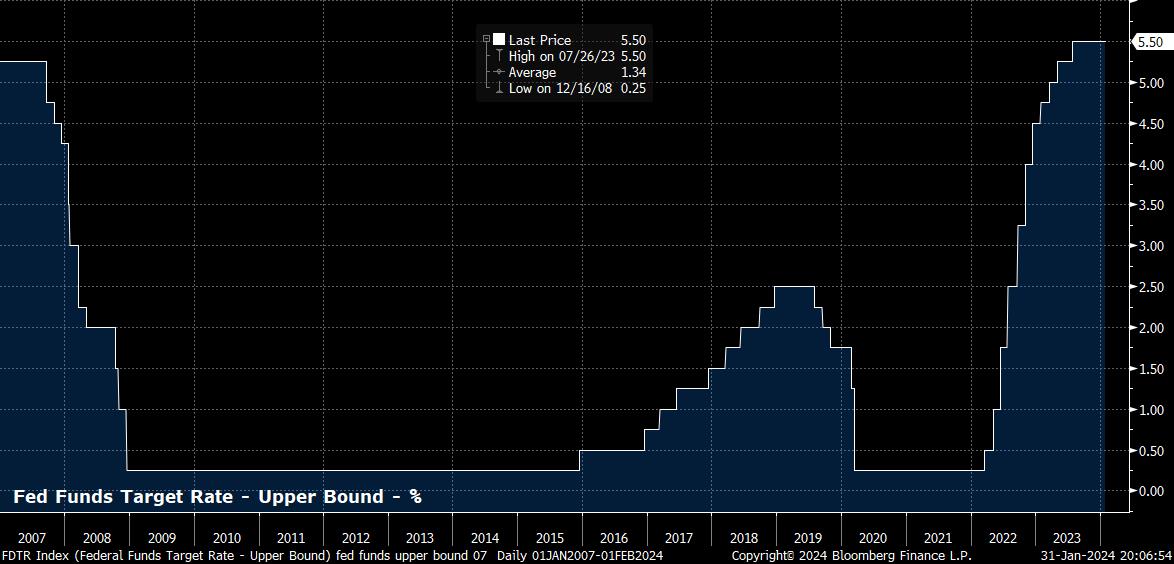

The fed funds rate has now been held steady at five consecutive meetings, with rates having been unchanged since last July. While this may not, yet, quite meet the definition of the ‘higher for longer’ policy stance previously outlined by Powell & Co., it is now clear that the next move will be a cut – with the issues at stake now being when said cut is likely to come, and the magnitude of the easing cycle that will likely follow such a move.

On that note, as mentioned, the FOMC offered some further dovish tweaks to the policy statement, continuing the pivot to a more cautious stance that begun at the December meeting.

The statement brought new policy guidance, removing reference to determining the “extent of any additional policy firming”, by replacing this language with a more evenly-balanced reference to “any adjustments to the target range for the fed funds rate”. While seemingly a minor tweak, this represents an important step from the Committee, in being a formal acknowledgement that it is no longer the case that rate hikes are more likely than cuts in the near-term. Of course, this is the view that markets have now priced for months, though it is significant to have now heard this coming ‘from the horse’s mouth’.

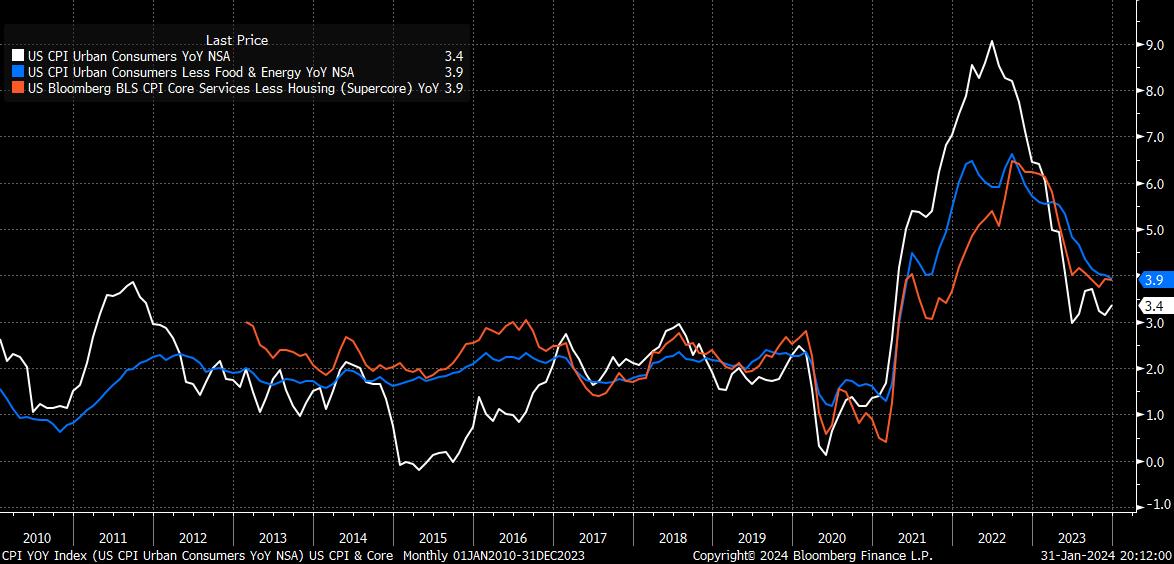

The statement also offered further fresh information, and some relatively firm pushback on the aggressive easing path priced by money markets. The Committee noted that, while risks to the dual mandate are ‘moving into better balance’, rate cuts are not to be expected until the FOMC has gained “further confidence” that inflation is moving “sustainably” towards 2%. Note, the inclusion of ‘towards 2%’ is important, as this gives the FOMC leeway to cut before inflation reaches target, as Chair Powell has indicated they may seek to do so in prior remarks.

Despite the statement touting the prospect of cuts for the first time, this pushback on the idea of any easing being delivered in the near-term drove a modest hawkish repricing of USD OIS. Having viewed a 25bp cut in March as around a 60% chance pre-decision, money markets at one point implied around a 4-in-10 chance of such a move, before that hawkish repricing was somewhat pared.

The market will, eventually, get the cuts that it craves, though it still seems unlikely that said reductions will come as soon, or in the magnitude, that markets price. While the FOMC are clearly still in ‘data-dependent’ mode, a further hawkish repricing of the near-term outlook poses upside USD, and downside stock and bond, risks.

At the post-meeting press conference, Chair Powell leaned into this data-dependency, refusing on numerous occasions to go into specifics as to the amount, or type, of data that the Committee want to see in order to provide the confidence required to deliver this cycle’s first cut. Powell went only as far to note that there has been 6 months of “good” inflation data, and that the Committee want to see a ‘continuation’ of that trend.

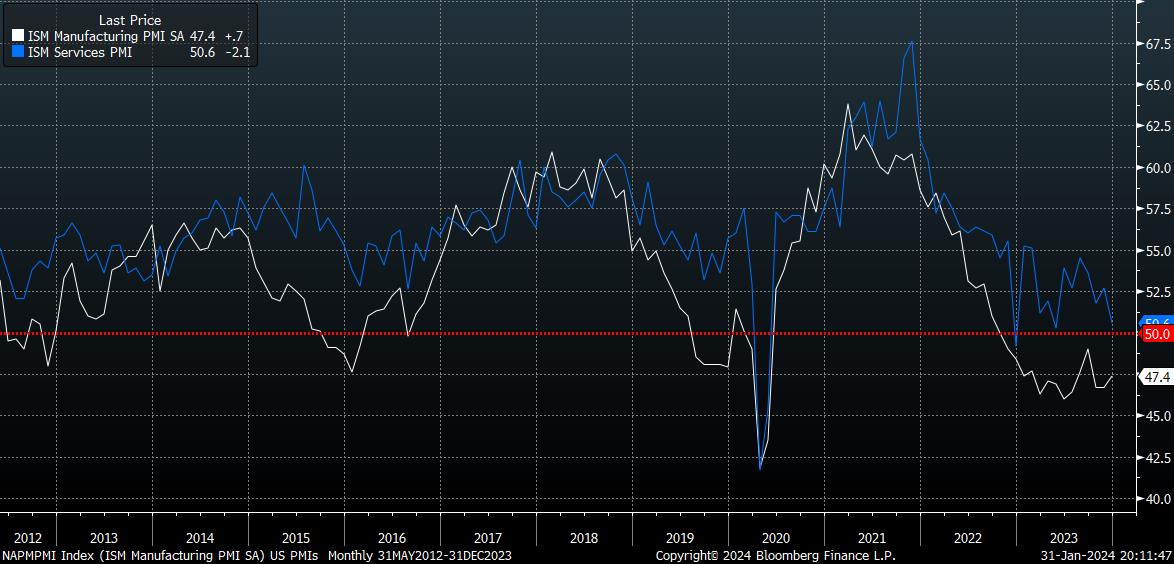

Only an ‘unexpected’ weakening in the labour market was flagged as a risk of leading the FOMC to cut sooner than in the base case of a strong economy, where the Committee can “be careful” in the timing of rate reductions. On which note, Powell also noted that there was no proposal to cut rates at today’s meeting, and that the SEP – which, recall, points to 75bp of cuts this year – was “good evidence” of the FOMC’s current thinking.

Eventually, though, we did get some firmer pushback on the idea of a March cut, with Powell noting that a reduction at that meeting “is not the base case”.

Elsewhere during the presser, it was interesting to see Powell shift his view on both growth and the labour market. Having previously flagged the need for a period of ‘below-trend’ growth to return inflation to target, Powell seems to have pivoted, in ‘not looking at stronger growth as a problem’, nor in seeking a weaker labour market. This seems an important shift and may, at the margin, mean policy is eased a touch sooner, given the perceived lesser upside inflation risks associated with a solid pace of growth.

As for the market reaction to all this, choppy is perhaps the best description. Stocks slipped, Treasuries sold-off, and the buck rallied when the statement dropped; before all of those moves reversed in their entirety during the course of the post-meeting press conference. Leaving us, an hour and a half later, pretty much exactly where we started.

Nevertheless, as noted above, with the market remaining somewhat convinced in its view that cuts will come as soon as the next meeting, and the FOMC singing from a very different hymn sheet, risks appear biased towards the USD continuing its recent upside momentum as OIS reprices in a more hawkish direction, if the FOMC’s message does – finally – stop falling on deaf ears among market participants.

_2024-01-31_20-11-15.jpg)

Overall, then, the January FOMC meeting showed the Committee taking a further step towards eventual rate cuts, though additional data will clearly be required before policymakers have the ‘confidence’ to begin the easing cycle. More broadly, the FOMC continue to walk a tightrope between continued, and faster than expected disinflation, along with impressive economy growth, and a remarkably resilient labour market.

While cuts are, clearly, on the way, it remains the case that they are unlikely to come as soon, or to as great a degree, a markets continue to imply. Data-dependency remains the ‘order of the day’.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.