- English

Key Trading Insights from 2024 That Can Boost Your Performance in 2025

While market participants focus on pricing future risk, there can be valuable insight to be gained by reflecting on the past. Examining historical behaviours, price movements, and recurring trends provides a foundation of knowledge that can enhance our understanding of the markets.

By thoughtfully analysing past behaviours we can refine our perspective and the environment in which we deploy our trading strategies, and hopefully setting a more informed course for the year to come.

Trading factors that have influenced our thinking in 2024

• It’s flow and sentiment that drive markets

• Have an open mind and become a slave to the price

• The Hindsight Trader; Putting reasoning to a move in price after the fact

• Identify repeatable behaviours and patterns in markets

• Fear sells but events typically turn out positively

• Buying equity at all-time highs works • High-concentration risk is fine but strong breadth is better

• Capital flows to growth, innovation and high return on equity

So hear me out:

• It’s flow and sentiment that drive markets

The Federal Reserve, Trump policy directives and the marque economic data may be seen as the most important inputs that guide the price of money and sentiment in the capital markets. However, it’s the intraday transactional flows put through the market that moves price, and it’s the level, direction and rate of change in price that drives sentiment, and ultimately price is what traders react to.

While these factors are certainly not new to 2024, our understanding of the influence that portfolio and trading flows have on short-term price changes has certainly increased throughout the year. The knowledge and newfound respect for these flows – many of which are opaque and not reported in real-time - reinforces the notion that it can pay to be humble to price action and to align with the underlying trends and momentum in markets.

With so much of the daily volume across all markets driven by high-frequency funds, 0 DTE (Days to Expiry) options and the subsequent dealer delta hedging flows, and end-of-day leveraged ETF rebalancing, we so often see unexplainable intraday momentum shifts and even reversals. We can consider the flows seen from Commodity Trading Advisors or “CTA’s” (systematic momentum/trend-following funds), volatility-targeting and risk parity funds, which can all perpetuate momentum and trends in markets.

• Have an open mind and become a slave to the price

Throughout 2024 we’ve seen notably lasting trending conditions in many of our key markets, including the USD, the S&P500, NAS100, crypto, Nvidia and gold.

Many who don’t follow a rules-based trading strategy frequently question the logic behind a sustained move and see the market as incorrectly priced and the recent move as unjustified, often resulting in traders taking counter-trend positions.

In many cases, taking an opposing view to the aggregation of these flows has had a negative impact on the account balance. Remember, the price represents the collective views in the market and the aggregation of all behaviours, however rational or irrational. Yet, for those trading with leverage, if the collective in the market is acting against your view, it may cost.

Having an open mind to what the collective is therefore expressing is still the best guide on where the market may be heading, and regardless of what any individual thinks, trading is about assessing the probabilities of where the collective will likely take price over a timeframe.

• The Hindsight Trader; Putting reasoning to a move in price after the fact

Again this comes down to having an open mind and just seeing a move for what it is; The aggregation of all beliefs and views and subsequently becoming a slave to price.

If 2024 has taught US equity, Bitcoin and gold traders anything (and often FX traders too), it’s to question the “why” less, and to align with the underlying trends.

Gold is a prime example - where market players have seen an outsized move on the day and the fundamentalists tried to explain – after the fact - what exactly caused the move. Often this reasoning came down to one of a multitude of reasons: Weaker US real rates, increased pricing of implied Fed cuts, a weaker USD, central bank buying or a hedge against US fiscal recklessness or geopolitical anxieties.

Yet, soon after, geopolitical concerns abated, US real rates pushed higher, implied Fed rate cuts were priced out and the USD rallied, and gold still managed to push higher.

We’ve seen throughout 2024 that there has been very little edge gained in trying to pick a solid reason for the move. Let price guide, rather than picking a reason for the move after the fact.

• Identify repeatable behaviours and patterns in markets

It’s always advantageous to understand why we adopt a technical, price action or even quantitative approach to discretionary or automated trading. In essence, most strategies involve identifying repetition in some form. That is seeking out repeatable behaviours and actions that offer a higher probabilistic outcome of reoccurring.

This is why many look at technical patterns, candlestick analysis, statistical relationships between stocks, or on a cross-asset basis, or consistent behaviours in a market at a certain time of day, over a key data release or even over company earnings.

The best way to truly quantify repeatable behaviours is using ChatGPT or Machine Learning, and to objectively understand if there is a higher probability of a set of behaviours observed in a pattern reoccurring.

Of course, if everyone is looking at the same thing then the chances are that any edge, we may obtain in the future is lost. However, it’s my view that repetition is the essence of technical, price action or quant trading and is a reason to start to consider how ChatGPT and GenAI can help with trading in 2025.

• Fear sells but events typically turn out positively

There is nothing inherently wrong with thinking of negative outcomes, preparing for a worst-case scenario and recognising the trigger points that offer a higher probability of it occurring.

These scenarios typically start off as a broad market concern, then evolving with deteriorating liquidity conditions, deleveraging, a rush to buy volatility and options dealers hedging exposures - all cascading to result in big distortions in markets.

However, after the initial ‘excitement’ occurs, time and time again the market is quick to realise a positive outcome, and after a V-shaped reversal in price and markets collectively ‘climb the wall of worry’, the saga is soon forgotten. Throughout 2024, US recession calls, in part driven by the inverted yield curve, have been repriced with US economic resilience and even exceptionalism once again a key theme of 2024.

Case in point, rising concerns of an unwind of the heavily owned JPY-funded carry trade, resulted in extreme moves on 5 August in the JPY, the NKY225 and many tech-heavy markets. However, while some were still peddling doom, the buy-the-dip crowd went to work, and the negativity soon dissipated.

We can add worries perennial about the Chinese economy, the sustainability of US debt levels and fiscal recklessness, the French political situation and now with Trump’s tariff policy – the fact has been, while we see short-term bouts of high anxiety and volatility these things typically resolve in a positive fashion.

• Buying equity at all-time highs works

It's never easy to buy any major equity index trading on a multi-year high P/E ratio, especially one which sits at a 52-week high, let alone at an all-time high. However, while 2025 could see an end to the raging US equity bull market, what we’ve learnt in 2024 is that traders should have no fear in buying the S&P500, the Dow, or even the ASX200 or German DAX at all-time highs.

In fact, the S&P500 has printed 55 separate all-time highs in 2024 and if we remove the extreme liquidation seen in early August, the max drawdown in 2024 was 5.9% in April, with a max drawdown in Q4 of just 3.1%.

• High-concentration risk is fine but strong breadth is better

What has impressed through all the 27% YTD gain in the S&P500 has been the ever-intensifying approach in rotating portfolio holdings within sectors, styles and factors.

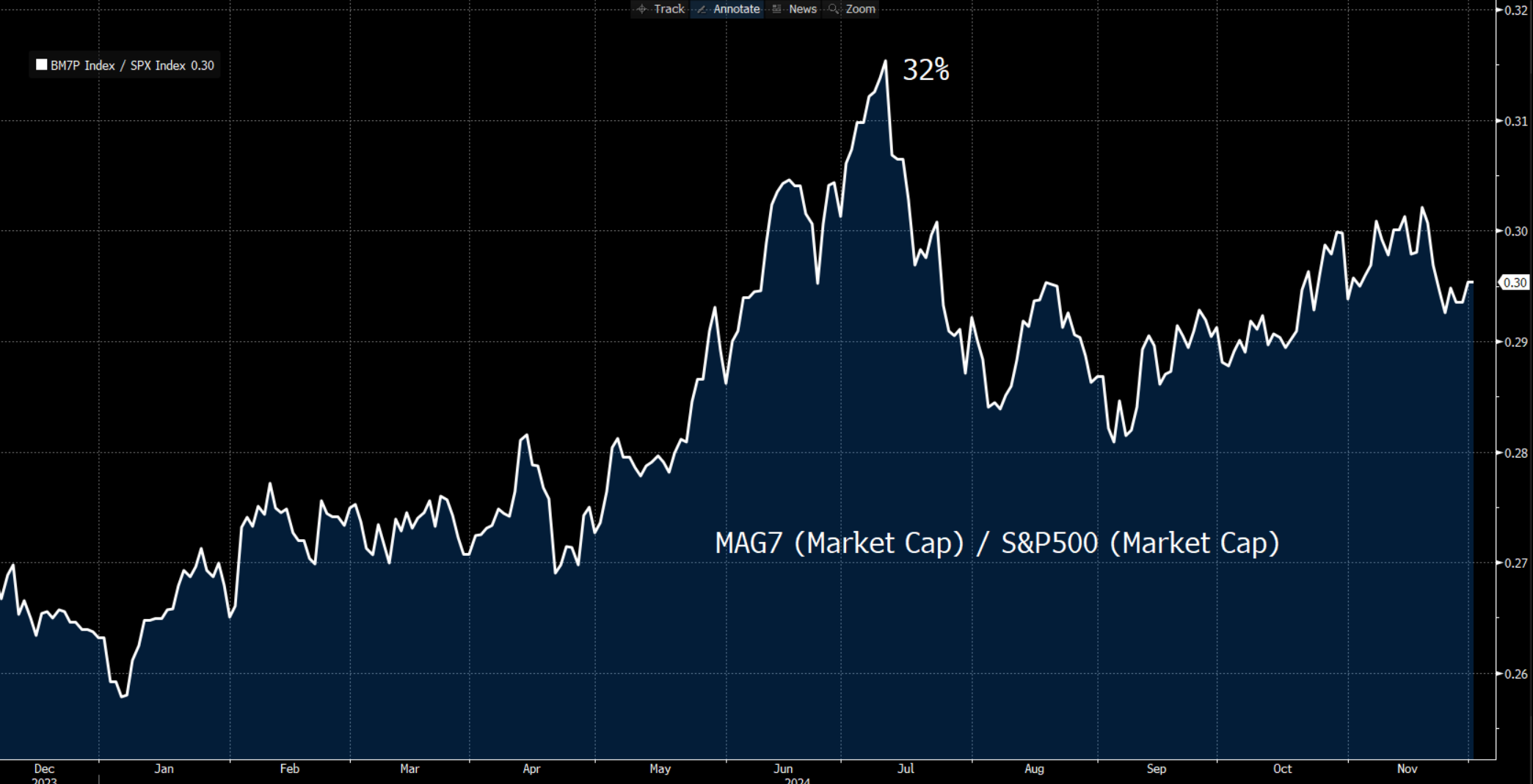

Granted, there have been periods throughout 2024 where there’s been increased concern of concentration risk, with the market cap of the MAG7 stocks accounting for 32% of the total S&P500 market cap. However, The S&P500 has put in some of its best work as concentration risk and poor market breadth were evident.

What was clear is that when the MAG7 names (Nvidia, Meta and Amazon for example) became too hot or the investment thematic changed, investment managers rolled into value, quality defensives and even cyclically sensitive areas of the market. This incredibly active approach to rotate portfolio holdings within sectors and factors resulted in reduced volatility and limited index drawdown and should be seen as the epitome of a healthy bull market.

Whether it continues in 2025 is yet to be seen, but unless we see news that radically changes the investment case for US big tech/AI, then I have limited concerns about the concentration risk in US equity markets.

• Capital flows to growth, innovation and high return on equity

There’s a reason why the USD has worked well throughout much of 2024, and why the S&P500, the Dow and the NAS100 have all outperformed other major equity indices by such an incredible margin. For content, YTD the S&P500 has outperformed the EU Stoxx by 26ppt, China by 14.8ppt and Japan by 19.7ppt. EU Stoxx 50 (priced in USDs) / S&P500

Investors are attracted to earnings growth, but they also want to be leveraged to where domestic GDP is the strongest and where there is the least amount of perceived risk. Not only is the US economy in a relatively strong position, but the Fed has underpinned risk with its commitment to ease rates on any further signs of fragility in the labour market. Both US and international investors have also been drawn to the sheer quantity of high-quality and innovative US businesses, with broad levels of high returns on equity that simply cannot be matched in any other global equity markets.

Whether this preference to “Buy US equity” continues in 2025 is obviously yet to be seen, and perhaps the relatively high valuations will become more of a headwind for US equity outperformance. However, when we consider the likely positive impact of deregulation, tax cuts and the late 2025 boost from fiscal, it’s hard to bet against this two-decade trend of US equity outperformance.

Looking ahead to a big 2025

I have no doubt 2025 will continue to school all who are active in markets – we are always learning, always humble and open-minded to challenges put in front of us. These are a few factors I’ve picked up along the way. There are of course, many more and feel free to reach out to me on what caught your attention and how it will affect the way you think about markets in 2025.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.