- English

A Traders’ Week Ahead Playbook – On my command unleash rate cuts

Geopolitical concerns have been raised, with Israel responding militarily to a drone attack by Hezbollah, conducting an offensive in a “targeted manner” on sites in Lebanon. The escalation may well support oil and gold, but I am sceptical it has a lasting impact on sentiment towards other areas of the markets (such as equity or risk FX), that is unless we see signs the conflict brings in other nations, or we saw a risk of an energy supply shock.

Nvidia’s Q225 earnings will also get great focus, where the guidance could resonate across the broader semis space. Traders also navigate month-end portfolio rebalancing flows, which could impact at a time when tier 1 economic data through the week is limited.

_(1).png)

Chair Powell sends a defiant message to markets

Last week set an important precedent for markets and offered a definitive view around the Fed’s current thinking - a view that has surprised many in the markets. The July FOMC minutes were clearly dovish, but Chair Powell’s speech at Jackson Hole was arguably his most dovish in years, and it was firm and clear. It will be remembered as the cementing factor that told the market that cuts start in September.

Powell was defiant that the Fed’s job on fighting inflation is essentially over, and with the balance of risks having shifted, and with Fed policy seemingly behind the curve, the Fed move to a new phase with a growing sense of urgency to take policy to a neutral setting.

Powell offered a strong level of optionality, but that optionality is skewed on whether the first cut is 25bp or 50bp. For anyone still holding a legacy view that the Fed may hold off from easing in September, it seems that ship has well and truly sailed.

The August US Nonfarm payrolls to settle the Fed rate cut debate

It’s hard to deny how important the August nonfarm payrolls (NFP) print (on 6 Sept) will likely be and could be the defining data point that settles the September FOMC rates debate, and whether the Fed cut by 25bp or 50bp.

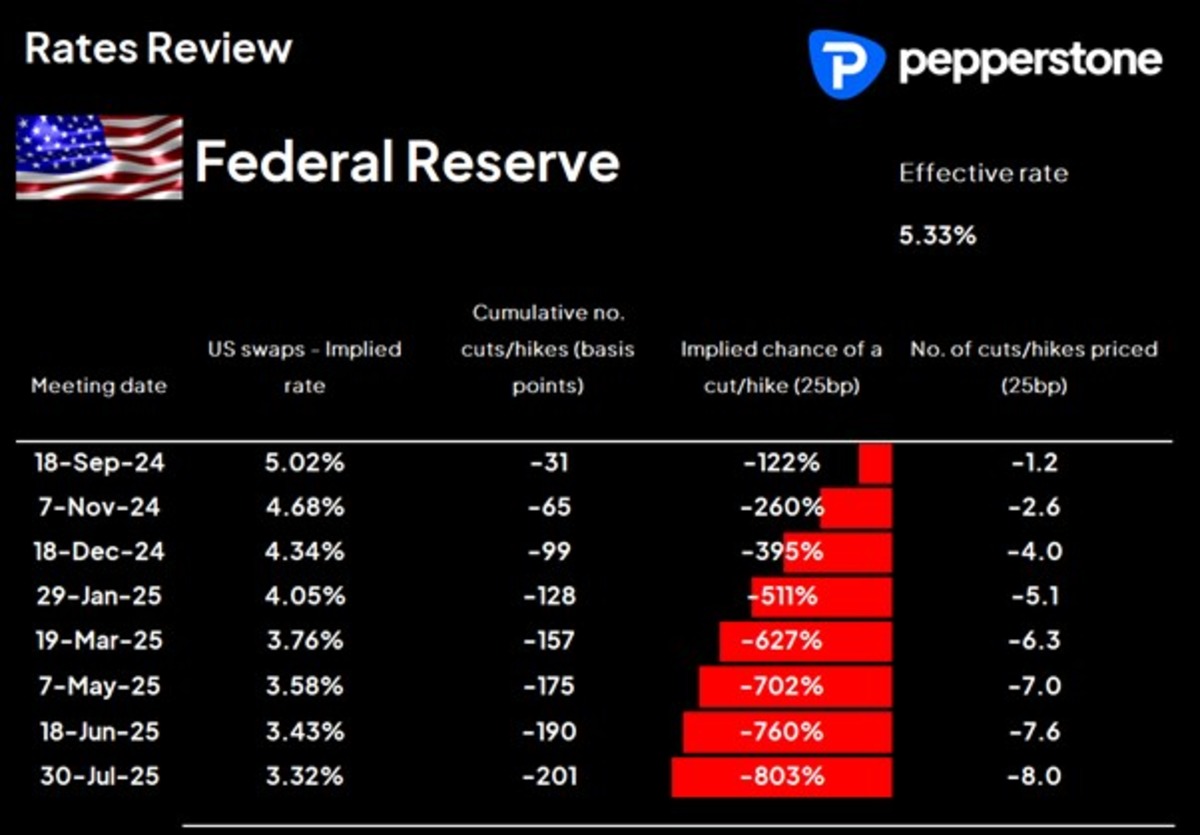

US interest rates swaps pricing per FOMC meeting

Chair Powell essentially made it clear with his view that a “cooling labor market is unmistakable” and that they no longer “seek or welcome further cooling in labor market conditions”. A weak NFP, say below 130k jobs and an unchanged unemployment rate at 4.3%, will likely see many of the economists who were calling for a 25bp cut for September change to 50bp, and US rates markets will price 50bp as its central case.

One counterargument to that call would be the influence of US election on 5 November. The Fed like to claim they are independent, but there is a school of thought that voters within the Fed ranks may be more comfortable pulling out a larger 50bp cut at the FOMC meeting after the election on 7 November. One issue with that call is that there is no guarantee we’ll know the outcome of the election by then, so if there is a greater need to bring rates out of a restrictive setting, and the election result is not known, then the Fed will have to wait until the 18 December meeting – an outcome that the markets will see as a policy mistake and take the Fed to task.

For now, though, the 'Fed put' is alive and well, and unless the geopolitical news flow negatively impacts sentiment Fed cut insurance should support global risky assets (such as equity).

However, a more concerned Fed – and one that many are increasingly thinking should have moved away from higher for longer sooner - does give us reasons to believe there could be a tipping point where ‘goldilocks’ macro conditions lead to something more sinister.

That is a concern for another time, and as we roll into the new week with sentiment strong, and with the market so intently focused on the NFP report, one questions how impactful the incoming economic data this week will prove to be. Many will note the US core PCE inflation report as the marquee data point this week, but with Powell stressing that the US labour market is no longer adding to inflation risk, the PCE inflation report may only move the dial if we see a print closer to 3% y/y (currently 2.6%).

Nvidia’s Q225 earnings to get significant focus

A clear risk for equity markets comes from Nvidia’s Q25 earnings (due to Wednesday after market) and the guidance for Q325. Nvidia will beat consensus expectations, they always do, but investors are so ingrained in seeing revenue come in $2b+ above the analysts’ consensus that Nvidia will need to report Q225 sales of $30b+ (consensus $28.77b) and guidance for Q325 of $33b+ (consensus of $31.78b) or we could easily see a sell the news event.

Naturally, there are other factors that could impact, with a big focus on gross margins, capex, and guidance on potential delays to Blackwell GPUs which could impact revenue expectations for the January quarter (reported in late February). The options market implies a -/+9.4% move on the day of earnings, so one can certainly expect some punchy post-market movement in the share price, and the NAS100.

EU CPI to cement an ECB September rate cut

European preliminary CPI (due Friday) may get some attention but with a 25bp rate cut from the ECB all but assured, and a 50bp cut not given any consideration, we’ll need to see a big miss/beat to the 2.2% consensus estimate on headline CPI, and the 2.8% consensus on core CPI to get the EUR pumping.

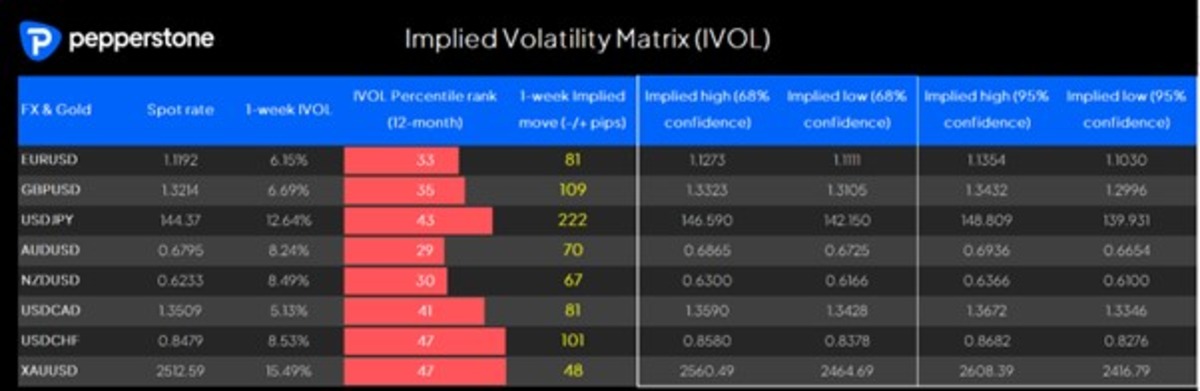

Like many, I have been surprised at the extent of the rally in EURUSD, and the sell-off in the USD more broadly, where the move in EURUSD on the week was far greater than options had implied.

EURUSD 1-week options implied volatility closed Friday at 6.15%, which equates to an implied move this week of -/+81-pips (with a 68.2% level of confidence). This projects an implied range of 1.1111 to 1.1273, which conveniently is 3-pips shy of the July 2023 high of 1.1276.

If looking to express a more bearish view on the EUR, then EURNZD is breaking down and seeing strong bearish momentum. If equity remains supported and we don’t see markets respond to the geopolitical news flow, then the bearish momentum in EURNZD should build.

The focus in Australia: Monthly CPI and ASX200 earnings in play

In Australia, we get the July (monthly) CPI print, with the median estimate from economists feeling headline CPI falls 40bp to 3.4% - the lowest level since December 2023. This should support expectations of a 25bp cut this year, where Aussie interest rate swaps currently price a full 25bp cut for the December RBA meeting. A monthly CPI print closer to 3% and the market may price a 50% probability that cuts could play out in November.

AUDUSD sits at the best levels of the year, caring little about relative interest rates, and taking its steer from the USD and equity sentiment.

On the equity front, With the ASX200 called to open +0.6% at 8070, the bulls would need to find a further 1% for a test of the all-time high of 8148 (8121 for SPI futures). Earnings will continue to impact, with 53 ASX200 companies reporting through the week – notable plays being Woodside, BHP (Tuesday), Woolworths, Fortescue, Qantas, and Wesfarmers. BHP may get the lion’s share of attention, however, after the share price readjusts to the earnings outcome and the guidance, will likely revert to closely tracking the iron ore futures price.

So, it’s another big week ahead for traders. We question if the tailwinds to equity from Powell’s Jackson Hole speech spill over into full green on screen in Asia, and can build in US equity, and whether the USD can find a better tone into month-end.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.