- English

Like most, I had expected tweaks to the statement of ‘sometime’ before substantial progress was made, so the fact this remained in the statement speaks to the dovish lean. Price pressures considered ‘transitory’ was a common theme and in essence, all you really needed to hear was that the Fed is not talking about tapering. As well as knowing that you could save yourself 60 minutes of your life reading the statement and listening to the press conference.

I've put together a video explaining what went down and the reaction, and some key dates for your diary. Do watch the video here.

While clients tend to hold positions for around 80-90 minutes on average (depending on the asset class), it's worth understanding the timeline for tapering and as we head into the weeks ahead, you're going to hear the words “Jackson Hole” come up a whole lot more. It feels incredibly likely that if we’re to see higher vol in markets and that includes crypto, that's likely going to be in the weeks leading into the Jackson Hole Symposium in late August. In Powell we trust, although I for one am pro-volatility.

We have also seen some blockbuster numbers from Apple and Facebook, and again I touch on those – will Apple show signs of leadership within the index, which has been missing for a while? The numbers seen from the tech giant were nothing short of exceptional and I’m surprised it's ‘only’ up 3% in after-hours trade.

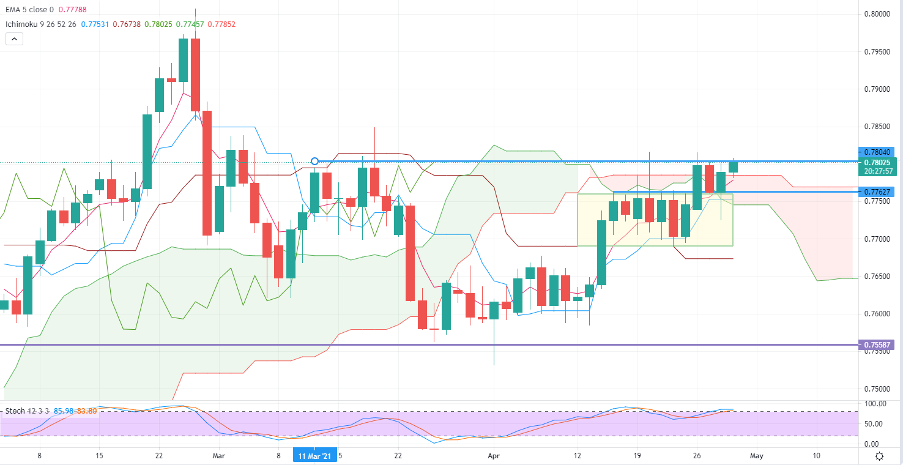

(AUDUSD daily)

(Source: Tradingview)

I'm still long EURJPY as an idea and holding for now, and watching for AUDUSD to break 0.7800.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.