How to choose the best CFD broker

Picking the right CFD broker can make a world of difference to your CFD trading. It can give you the confidence to trade smarter and help you keep costs down.

This guide breaks down what you need to look for in a CFD broker and why Pepperstone is a top choice, with insights into fees, platform dependability, risk management, and the advanced tools that can help you stay ahead.

What to look for when choosing a CFD broker?

Picking the right CFD broker can really make or break your trading experience. Think of it as choosing a travel buddy; you want a reliable broker, who won’t surprise you with hidden fees or crash when you need them most. Let’s break down the main things you should be looking at to make this choice simpler—covering everything from regulatory security to trading costs, platform stability, and customer support.

1. Is your broker regulated and trustworthy?

The first thing to check when picking a broker is whether they’re regulated by top-tier authorities. Brokers under these regulators follow high standards to keep your funds safe, separate from the broker’s funds, so you’re protected if something goes wrong on their end. Being regulated by these big names is a sign that a broker takes security, fairness, and transparency seriously—qualities that’ll help you trade with confidence.

2. Understanding fees — keeping costs under control

Trading can be expensive if you don’t keep an eye on fees. A few things to pay attention to:

- Spreads: This is the difference between the buy and sell price of an asset, which is effectively your cost per trade. Look for low, competitive spreads to keep your expenses manageable.

- Commissions: Some brokers charge a small commission on top of the spread. This can be better for high-volume trading since you’ll know exactly what you’re paying.

- Overnight fees: If you plan on holding positions overnight, check the broker’s swap rates. These fees can add up over time, so it’s worth understanding how they’ll affect your profits.

- Deposit and withdrawal fees: Some brokers charge for moving money in and out of your account. A good broker keeps these fees low, if not free, so you don’t get stung with unexpected charges.

In the end, transparent fees are your friend, and brokers that keep it simple make trading less stressful.

Hint: Low fees can make a big difference over time

Even small fees add up with frequent trades. For traders who trade often, choosing a broker with low spreads or commission-only fees can help keep costs down.

3. What’s in their asset range?

Look for a broker that gives you access to different types of assets, so you can diversify or switch things up as needed:

- Forex pairs: Major, minor, and exotic pairs let you dive into different currencies with varying volatility.

- Commodities: Precious metals like gold, plus oil and silver, add diversity to your trading options.

- Indices: Popular global indices like the S&P 500, FTSE 100, and NASDAQ 100 are a good choice if you want to trade entire markets.

- Shares: Trading individual shares through CFDs lets you tap into popular stocks.

Hint: Diversifying assets is like having options on a menu

A good broker offers a variety of assets (forex, commodities, indices, etc.), allowing you to adjust your trading as markets change. More asset options mean more flexibility and potential strategies.

A well-rounded asset selection can give you more options to find your ideal trading setup, all from all from a single platform. This flexibility means you’re not limited to one market, allowing you to pivot between asset types as market conditions change. With a versatile broker, you’re equipped to explore different strategies, adjust your risk, and capitalise on opportunities across multiple sectors.

4. Platform quality —user-friendly, stable, and packed with tools

Your broker’s platform is basically your trading home base, so it needs to be solid, easy to use, and equipped with the tools you need to make informed decisions.

- User-friendly interface: you want a platform that’s easy to navigate with clear menus and customisable layouts.

- Advanced tools: Good charting tools, customisable indicators, and analysis features are essential. Whether you’re into trend lines or Fibonacci retracements, make sure the platform has you covered.

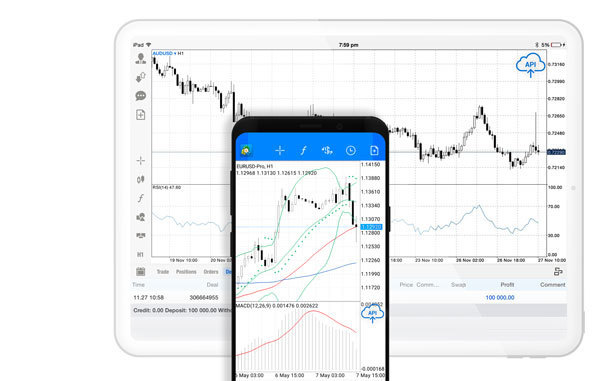

- Mobile compatibility: The option to trade on the go is invaluable. A good mobile app means you can manage trades from anywhere.

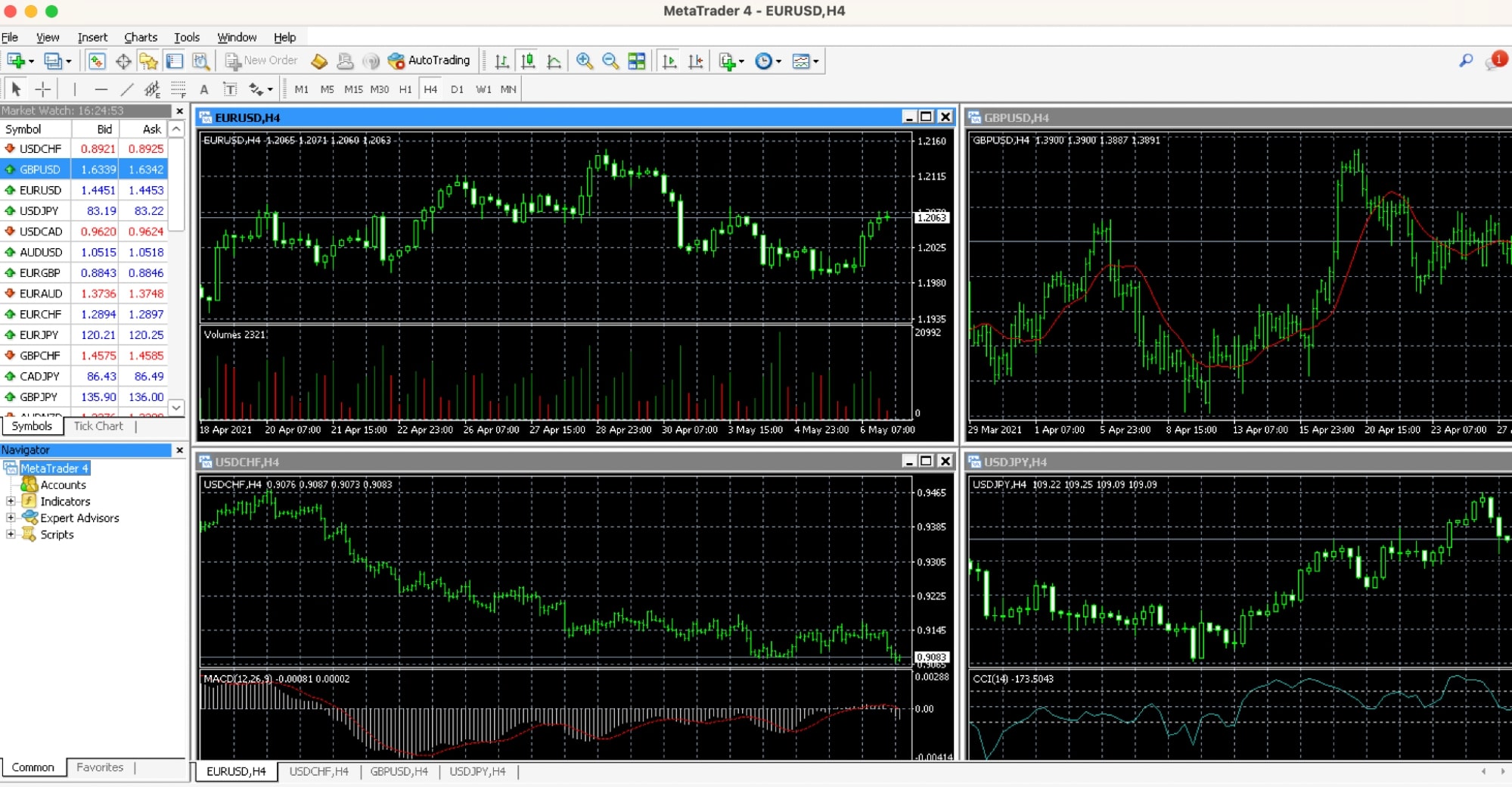

- Stability: You need a platform with high uptime and fast, stable performance. Look for brokers that offer well-known platforms like MetaTrader 4, MetaTrader 5, or cTrader, known for their reliability.

Testing out a demo account first is a great way to see if a platform feels right for you.

Hint: Test the Platform with a Demo Account first

Trying out a demo account is like taking a car for a test drive. It lets you experience the platform’s speed, features, and ease of use without risking real money. A must-do before committing!

5. Execution speed — fast and efficient trading

Fast execution means you’re more likely to get the price you expected, and it’s especially important when markets are moving fast. Here’s what to keep in mind:

- Low latency: Brokers with low-latency servers can execute trades quickly, reducing the chance of slippage (the difference between the expected and executed price).

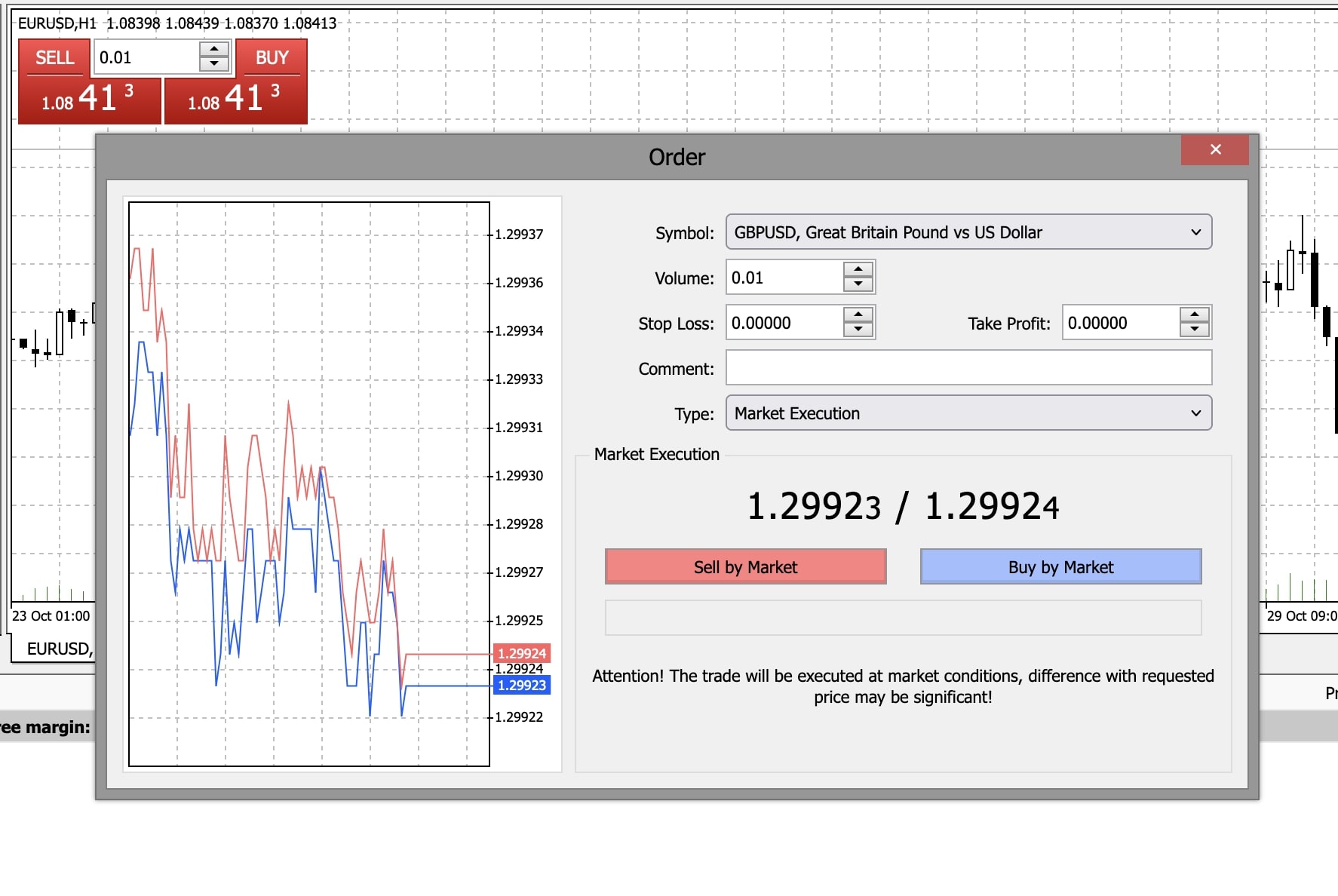

- Order types: Besides standard market and limit orders, look for Stop-Loss and Take-Profit orders for easier risk management.

Hint: Execution speed matters, especially in fast markets

In volatile markets, every millisecond counts. A broker with fast execution can help prevent slippage—meaning your trades happen at the price you expect, reducing unwanted surprises.

6. Risk management tools — keeping your losses in check

Good risk management tools are vital in CFD trading, where things can change fast. Top brokers offer features that help you protect your account balance and manage risks.

- Stop-Loss and Take-Profit orders: These allow you to set predefined levels for your trades to close automatically, helping you try to lock in profits or cut losses.

- Negative balance protection: This feature ensures you don’t end up owing more than what’s in your account, especially helpful during market turbulence.

- Risk calculation tools: Some platforms provide calculators to help you assess your potential risks before placing a trade.

These tools make it easier to manage your trades with confidence, which is key to keeping your trading sustainable.

Hint: Risk Management tools are your safety gear

Just as seat belts are essential in a car, tools like stop-loss orders and negative balance protection are vital in trading. They help limit losses, making your trading experience safer and more controlled.

7. Reliable customer support — help when you need it

Customer support might not seem like a big deal until you really need it. Look for brokers that offer:

- Multiple channels: Phone, email, and live chat support options give you flexibility in how you reach out.

- Quick and knowledgeable responses: Ideally, the support team should know the ins and outs of the platform and be able to solve issues quickly.

Hint: Customer support is your lifeline

Customer support can be a real lifeline when you’re trading, so it’s worth testing a broker’s responsiveness before signing up.

8. Educational resources and market insights

No matter your experience level, the best brokers provide resources to help you learn and improve your trading skills.

- Tutorials and webinars: Video tutorials, webinars, and guides can help you learn strategies, platform basics, and more advanced topics.

- Daily market analysis: Look for brokers that offer regular market insights or news to help you stay updated on the latest events and trends.

- Trading tools and demos: Some brokers offer demo accounts or simulated trading environments where you can practise without risking real money.

Having these resources at your fingertips helps you make more informed decisions and keep up with changing markets.

Hint: Look for a broker with education resources

The best brokers are invested in your growth, offering webinars, tutorials, and guides. This is like having a personal coach to help you sharpen your skills and make better-informed trading decisions.

9. Try before you buy — the value of a demo account

Most brokers offer demo accounts, and it’s well worth spending time on one before you commit. With a demo account, you can:

- Practice trading: Test out the platform’s features without risking real money.

- Get a feel for fees: Understand how spreads and commissions apply to your trades.

- See execution speeds: Get a sense of how quickly the platform processes your orders.

Trading on a demo account lets you evaluate the platform’s speed, asset variety, and fee structure in a low-risk environment. It’s the best way to make sure everything feels right before you go live.

Why trade CFDs with Pepperstone?

Security you can rely on

With top-tier regulation from authorities like the FCA, ASIC, BaFin and CySEC, Pepperstone has your back. Brokers with these regulations must maintain high standards in security, transparency, and fairness, so you can trade knowing your funds are in safe hands.

Competitive fees and spreads

Pepperstone offers a Razor account with super-low spreads (starting from 0.0 pips!) and a small commission, ideal for high-frequency traders who want to keep costs down. If you prefer spread-only pricing, the Standard account is straightforward and hassle-free. With no hidden charges and low fees, Pepperstone makes cost-effective trading accessible to all.

A world of assets

Pepperstone provides access to over 1,200 CFD instruments, including forex pairs, commodities, indices, and shares. This extensive range lets you diversify and tap into various markets, all on one platform

Flexible, user-friendly platforms

Pepperstone offers MetaTrader 4, MetaTrader 5, and cTrader, some of the most popular trading platforms around. These platforms are easy to navigate and packed with tools for everything from scalping to long-term strategies. You can even trade on the go with Pepperstone’s mobile apps, keeping you in control no matter where you are.

Fast execution you can rely on

In fast-moving markets, execution speed is crucial. Pepperstone’s low-latency servers ensure that trades happen at the speed you need, reducing slippage and executing your trades without delay. Whether markets are steady or volatile, Pepperstone’s platforms remain stable, giving you peace of mind.

Powerful risk management tools

Pepperstone equips you with essential tools like Stop-Loss and Take-Profit orders, as well as negative balance protection. These features let you manage risk effectively—crucial if you’re dealing with volatile markets and looking to keep losses in check.

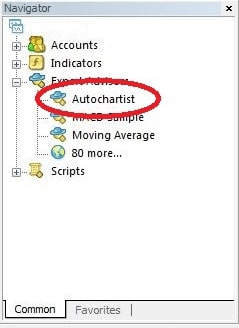

Advanced tools to keep you ahead

Pepperstone also has some useful advanced tools like Smart Trader Tools. These add-ons provide automated alerts, advanced charting, and insights to help you spot potential patterns. If you’re big on technical analysis, these tools can give you an edge.

Learning resources and market insights

No matter where you are on your trading journey, Pepperstone’s educational resources—webinars, tutorials, and in-depth guides—make it easy to build confidence. Plus, their market insights keep you updated on trends and events, helping you make smarter, more informed moves.

Reliable customer support

Need help? Pepperstone has a responsive team available 24/5 to help with questions, from platform features to account questions. Support is quick, knowledgeable, and ready when you are.

Quick-start checklist for choosing a CFD broker

Here’s a checklist to help you understand what you need to look for in your CFD broker:

Getting started with Pepperstone

Step 1: Open your account

Start by creating a Pepperstone account and complete ID verification for added security.

Step 2: Test the waters with a Demo Account

Use a demo account to get a feel for the platform and try out strategies risk-free.

Step 3: Fund your live account

Once you’re ready to go live, fund your account using one of Pepperstone's 9 available payment methods, including credit/debit cards, PayPal, Neteller, Skrill, and bank transfers. Pepperstone has no strict minimum deposit requirement, although they recommend starting with at least $200 for margin requirements

Step 4: Customise your platform

Set up MT4, MT5, or cTrader to fit your trading style by adding indicators and setting timeframes.

Step 5: Place your first trade

Execute your first trade, using stop-loss and take-profit orders to manage risk.

Wrapping up how to choose the best CFD broker

When it comes down to it, picking the right CFD broker is about finding a platform that fits your needs and trading style. Take your time comparing brokers on these key points—regulation, fees, platform features, execution speed, and customer support. Ultimately, your broker should be a reliable partner that supports your trading goals, keeping costs manageable and providing the tools you need to succeed.

FAQs on how to choose a CFD broker

Is Pepperstone trustworthy?

Yes! With regulation from the FCA, SCB, DFSA, ASIC, CMA, BaFin and CySEC, Pepperstone follows strict standards, so you can trust them with your funds.

Are there any hidden fees?

No. Pepperstone has clear, competitive fees, with low trading costs and no hidden surprises.

Which trading platforms does Pepperstone support?

You can trade with MT4, MT5, Tradingview and cTrader, all offering advanced tools and mobile compatibility.

How many assets does Pepperstone offer?

Pepperstone provides access to over 1,200 CFD instruments across major markets like forex, commodities, indices, and shares.

Can I start with a demo account?

Yes, Pepperstone offers a demo account, allowing you to explore the platform and practice strategies risk-free.

How fast is Pepperstone’s order execution?

Pepperstone’s low-latency servers ensure fast, accurate execution, which is ideal for active and high-frequency traders.

Ready to begin your CFD trading journey with Pepperstone?

With competitive fees, reliable platforms, flexible deposit options, and a strong regulatory framework, Pepperstone is designed for traders looking to maximise their CFD trading potential.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore should not be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.