What are the strongest currencies in the world? (2024)

The United Nations recognizes 180 currencies as legal tender, including the Dollar, euros, pound, pesos, and yen. While many currencies exist, the strongest currencies dictate the global scenario. In this article we list the current strongest currencies in the world.

Key Takeaways

- Top Strongest Currencies: The Kuwaiti Dinar, Bahraini Dinar, and Omani Rial lead the strongest currencies in 2024, bolstered by substantial oil revenues and prudent fiscal policies.

- Global Economic Impact: Strong currencies influence global trade, foreign direct investment, and tourism, affecting import/export balances and attracting or deterring investors and travellers.

- Forex Trading Insights: Trading strong currencies in the forex market requires analysing economic indicators, political stability, and market trends to make informed decisions and manage risks effectively.

- Staying Informed: Keeping up with currency strength and trends is crucial for effective financial planning, impacting personal and professional decisions in trade, investment, and travel.

Currency strength is vital to global finance, influencing international trade, investment, and economic stability. The strongest currencies in the world are typically highly valued relative to others, reflecting the economic robustness, political stability, and financial soundness of their respective countries. In 2024, several currencies continue to dominate the global market, holding their ground as the most powerful and reliable. This article explores the top contenders and the factors contributing to their strength.

Understanding Currency Strength

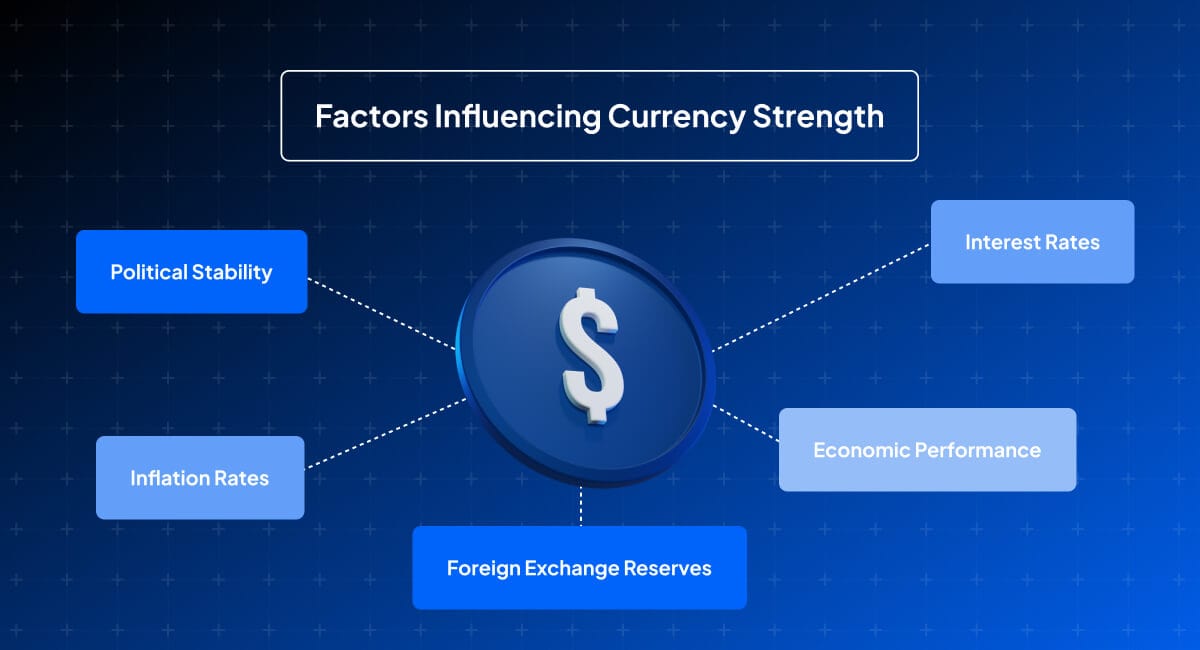

Currency strength is determined by several factors, including economic performance, interest rates, inflation, political stability, and foreign exchange reserves. Strong currencies often belong to countries with low inflation rates, high interest rates, and significant foreign exchange reserves. They are also associated with political stability and robust economic policies that inspire investor confidence.

Factors Influencing Currency Strength

- Economic Performance: Countries with strong economic growth, low unemployment rates, and high GDP often have stronger currencies.

- Interest Rates: Higher interest rates attract foreign investment, boosting currency demand and increasing value.

- Inflation Rates: Low and stable inflation rates maintain the purchasing power of a currency, making it stronger.

- Political Stability: Countries with stable governments and sound economic stability tend to have stronger currencies.

- Foreign Exchange Reserves: High reserves buffer against economic shocks, bolstering currency strength.

The Top 10 Strongest Currencies in the World (2024)

The currencies below have been benchmarked against the U.S. dollar, which is considered the universal currency for trade and global commerce.

Remember that exchange rates constantly fluctuate, so the top 10 countries may see shifts in their rankings over time. Since exchange rates are dynamic, the values listed below are not fixed and can change frequently.

1. Kuwaiti Dinar (KWD)

The Kuwaiti Dinar remains the strongest currency in the world in 2024. Kuwait's wealth, derived primarily from its substantial oil reserves, underpins the Dinar's strength. The country's prudent fiscal management and significant foreign exchange reserves further enhance the Dinar's value, making it a prime example of currency value and strength. Kuwait's stable political environment and strategic economic policies are critical currency strength factors that maintain Dinar's top position in global currency performance.

2. Bahraini Dinar (BHD)

The Bahraini Dinar is another robust currency, benefiting from Bahrain's economic stability and strategic financial sector. Bahrain's wealth is also largely attributed to its oil exports. The Bahraini government’s commitment to maintaining a fixed exchange rate with the US dollar and its substantial foreign exchange reserves bolster the Dinar's strength. Bahrain's open economy and investment-friendly policies further enhance the Dinar’s value.

3. Omani Rial (OMR)

The Omani Rial remains one of the strongest currencies in the world due to Oman’s substantial oil revenues and strategic economic diversification efforts. Oman’s fixed exchange rate policy and significant foreign exchange reserves support the Rial's high value. The country’s ongoing economic reforms and investments in infrastructure and tourism also contribute to the strength of Rial.

4. Jordanian Dinar (JOD)

The strength of the Jordanian Dinar is underpinned by Jordan’s strategic economic policies and foreign aid. Jordan maintains a fixed exchange rate with the US dollar, providing stability to the Dinar. The country's political stability, economic reforms, and prudent fiscal management further support the Dinar’s high value. Additionally, remittances from Jordanians working abroad and foreign investments are crucial in bolstering the Dinar.

5. British Pound Sterling (GBP)

The British Pound Sterling is one of the world’s oldest and strongest currencies. The United Kingdom's diversified and robust economy, strong financial sector, and high foreign exchange reserves underpin the pound's value. The GBP benefits from London’s status as a global financial hub, attracting significant foreign investment. Political stability and sound economic policies further enhance the Pound’s strength.

6. Euro (EUR)

The Euro is the official currency of the Eurozone, comprising 19 of the 27 European Union member states. The Euro’s strength stems from its economic power, which includes some of the world’s largest economies, such as Germany and France. The European Central Bank's prudent monetary policies and the Eurozone's significant foreign exchange reserves contribute to the Euro’s stability and strength. The Euro is widely used in international trade and finance, further bolstering its position.

7. Swiss Franc (CHF)

The Swiss Franc is renowned for its stability and safety and is often considered a "haven" currency. Switzerland’s strong economy, low inflation rates, and political neutrality underpin the Franc’s value. The Swiss National Bank’s prudent monetary policies and substantial foreign exchange reserves support the CHF’s strength. Additionally, Switzerland’s robust financial sector and reputation for stability attract significant foreign investment.

8. United States Dollar (USD)

The US Dollar is the world’s primary reserve currency and the most widely used currency in international trade. The USD's strength is supported by the size and resilience of the US economy, its stable political environment, and the Federal Reserve's monetary policies. The US Dollar's role as a global reserve currency and its widespread acceptance in international transactions reinforce its value and stability. High foreign exchange reserves and strong investor confidence further bolster the USD.

9. Cayman Islands Dollar (KYD)

The Cayman Islands Dollar is a strong currency, supported by the island's status as a major financial hub. The Cayman Islands' robust financial services sector, which includes banking, investment funds, and insurance, underpins the KYD’s value. The government’s sound fiscal policies and substantial foreign exchange reserves further enhance the Cayman Islands Dollar's strength.

10. Canadian Dollar (CAD)

The Canadian Dollar is one of the strongest currencies globally, supported by Canada’s stable economy, rich natural resources, and sound fiscal policies. Canada’s robust financial sector, significant foreign exchange reserves, and political stability underpin the CAD’s value. The Canadian economy’s diversification and strong trade relationships, particularly with the United States, further enhance the CAD’s strength.

Impact of Currency Strength on Global Trade and Economy

How Strong Currencies Affect Import/Export Balances

Strong currencies significantly impact a country’s import and export activities. A strong currency makes imports cheaper, benefiting consumers and businesses that rely on imported goods. However, it can also make exports more expensive and less competitive globally, potentially leading to a trade deficit. Countries with strong currencies often need to balance benefiting from cheaper imports and maintaining a competitive export edge.

Influence on Foreign Direct Investment

Foreign direct investment (FDI) is heavily influenced by currency strength. Strong currencies attract foreign investors looking for stable and profitable opportunities. A strong currency indicates economic stability and growth potential, making it an attractive destination for FDI. However, it can also lead to higher costs for foreign investors, which may deter investment in certain sectors.

Tourism and Expatriate Impacts

Currency strength directly affects tourism and expatriate communities. A strong currency can make a country an expensive tourist destination, potentially reducing tourism revenue. On the other hand, it benefits expatriates by increasing their purchasing power when they convert their earnings into their home currency. Countries with strong currencies must consider these impacts when developing tourism and expatriate policies.

Forex Trading and Strong Currencies

How to Trade Strong Currencies

Trading strong currencies in the forex market involves buying and selling currency pairs based on the strength and performance of the currencies involved. Traders analyse various factors, including economic indicators, political stability, and market trends, to make informed decisions. Utilising Forex investment tips, they use technical, fundamental, and sentiment analysis strategies for financial market analysis to predict currency movements and maximise profits.

Risks and Opportunities in Forex Trading

Forex trading offers numerous opportunities but also comes with significant risks. The high volatility of the forex market means that currency values can change rapidly, leading to potential losses. Traders must manage risks through diversification, stop-loss orders, and careful analysis of market conditions. Forex trading can be highly profitable despite the risks, especially when trading strong currencies with predictable trends.

Tips from Expert Forex Traders

Expert forex traders emphasise the importance of continuous learning and staying informed about global economic and political developments. They recommend developing a solid trading plan, setting realistic goals, and using risk management techniques to protect investments. Additionally, traders should remain disciplined and avoid emotional decision-making, which can lead to costly mistakes.

Conclusion

The strongest currencies in the world in 2024 continue to be those backed by stable economies, robust fiscal policies, and significant foreign exchange reserves. The Kuwaiti Dinar, Bahraini Dinar, and Omani Rial lead the pack, supported by their countries’ substantial oil revenues and strategic economic policies. The British Pound Sterling, Euro, Swiss Franc, and US Dollar remain strong due to their countries’ economic power and global influence. Emerging currencies like the Chinese Yuan, Singapore Dollar, and United Arab Emirates Dirham show promise as their countries grow and expand their global presence. These currencies' positions in the global currency rankings highlight their significant roles in the global economy.

Understanding the strength of these currencies and the factors that contribute to their stability is essential for anyone involved in international trade, investment, or financial planning. Staying informed about currency strength allows individuals and businesses to make better decisions regarding imports, exports, investments, and travel. For professional and personal financial planning, keeping an eye on currency trends helps anticipate economic shifts and opportunities, ensuring a well-informed approach to global financial activities.

FAQs

- What factors determine currency strength?

Economic performance, interest rates, inflation rates, political stability, and foreign exchange reserves. - Why is the Kuwaiti Dinar the strongest currency?

Kuwait's wealth comes from its oil reserves, prudent fiscal management, significant foreign exchange reserves, and stable political environment. - How do strong currencies affect international trade?

Strong currencies make imports cheaper and exports more expensive, affecting trade balances. - What are the risks of forex trading with strong currencies?

High volatility, potential rapid changes in currency values, and the need for effective risk management strategies. - How can businesses benefit from strong currencies?

Attracting foreign investment, benefiting from cheaper imports, and leveraging economic stability for growth.

By exploring these aspects, we comprehensively understand the world's strongest currencies and their impact on global finance, trade, and investment.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.