Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English

- 中文版

標普500中74%的成分股收高,看跌/看漲期權比率跌至0.57,接近過去一年的最低水平。在多頭充分掌控局面的情況下,恐慌指數VIX(標普500的未來一個月的隱含波動率)已經降至15.6%,這意味著股市將變得較為平靜,風險對沖的意願不強。不過值得註意的是,12月到期的VIX期貨顯著升高,暗示美國政府的債務上限問題可能成為聖誕節前的不確定因素。

強勁的企業財報無疑提振了市場的信心。FactSet的數據顯示,在已經公布業績的41家標普成分股中有80%的公司的收益超過預期。剛剛出爐的Netflix財報顯示,其三季度凈利潤和新增用戶數好於預期,而公司預計第四季度的訂閱數將繼續大幅增加,股價在盤後時間上漲2%。特斯拉將在周三盤後發布財報。

貨幣市場中,隨著風險偏好的升高和股市的上漲,避險美元已經連續四天回落。不過由於不斷強化的加息預期拉動了各期限收益率,美元指數(USDX)破位下行的可能性不大。

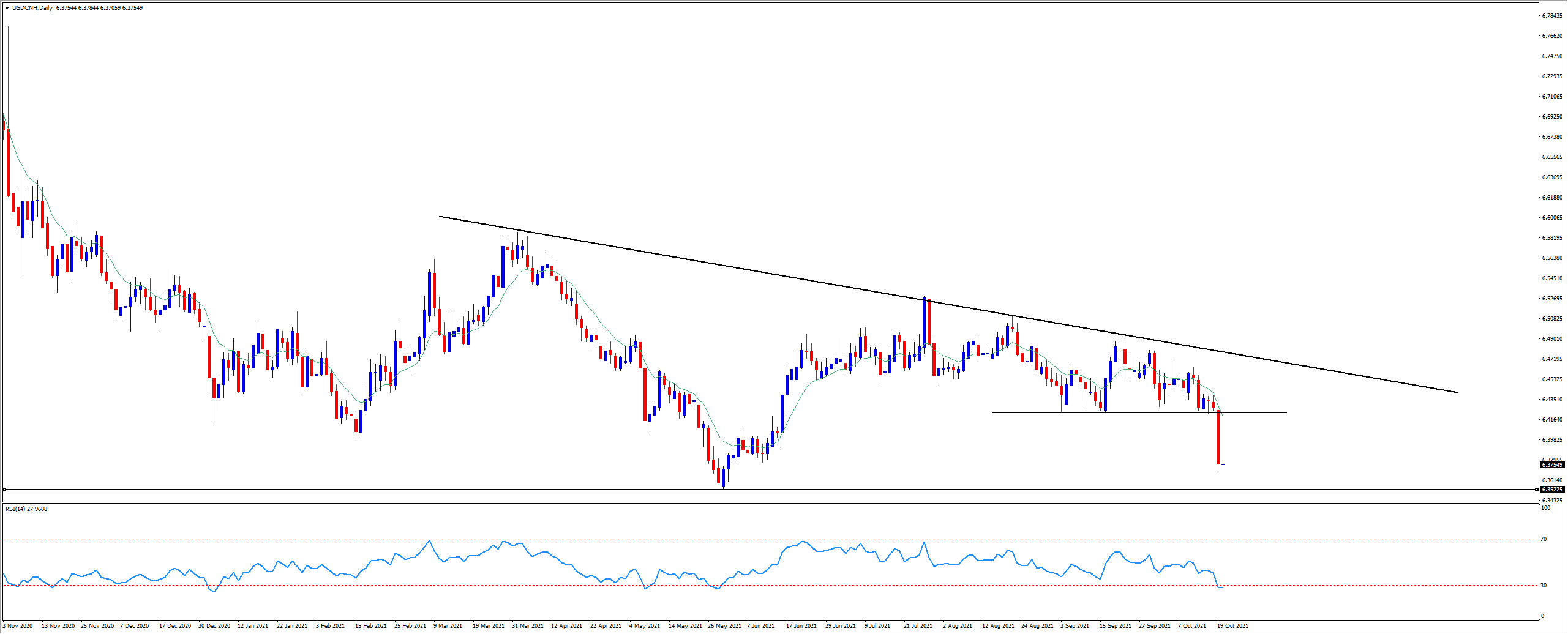

值得關註的是美元兌離岸人民幣(USDCNH)昨天跌破此前的關鍵支撐,人民幣可能是受到了恒大按時支付人民幣債券利息的提振。匯價的下一個支撐為5月低點6.3522。

USDCNH

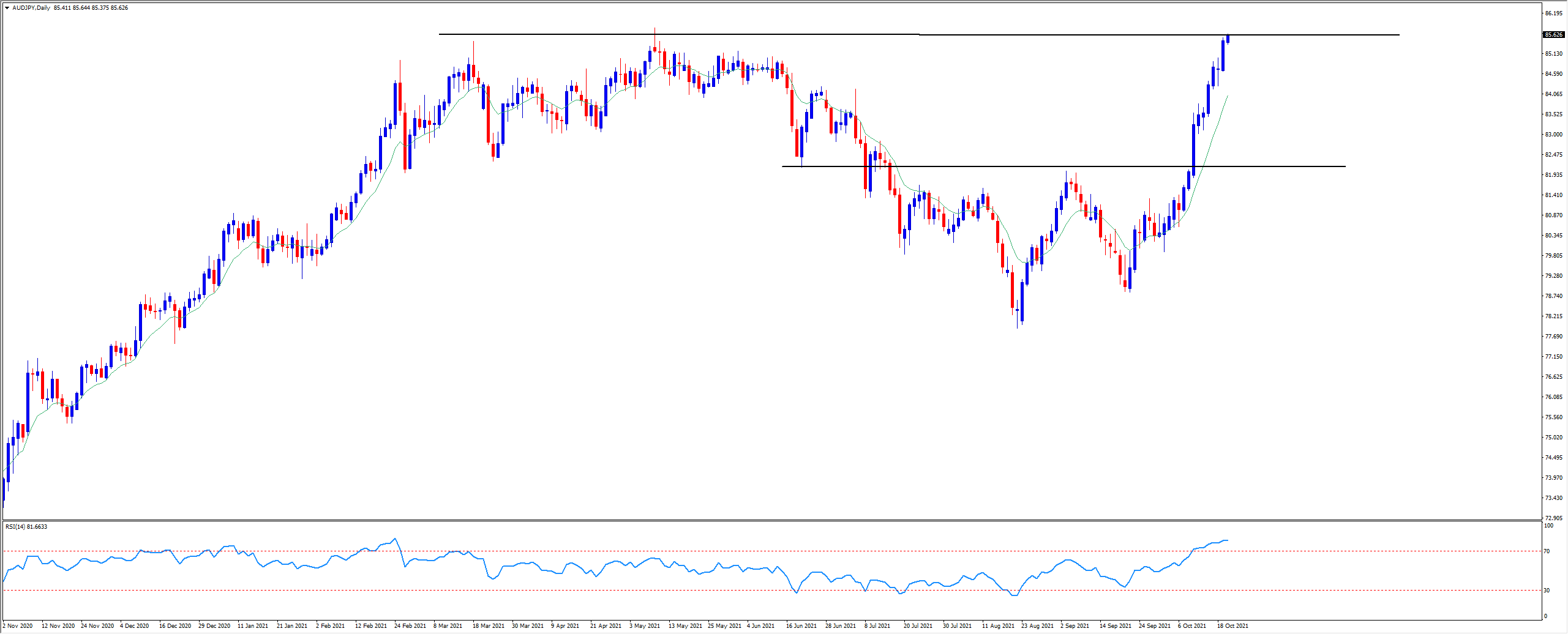

人民幣的走強對商品貨幣來說無疑是一劑強心劑,再結合著大宗商品和能源價格的上漲,澳元和紐元雙雙升至七周新高,加元則處於7月以來的高點。另外,由於近來日元的疲軟,我們就看到了AUDJPY從9月底以來的一波爆發式的上漲。

AUDJPY(風險貨幣vs避險貨幣)是非常典型的衡量市場風險情緒的投資標的,這波的上漲和股市回暖基本吻合。其實就像我們之前提到過的,日系貨幣對(GBPJPY、NZDJPY等)最近都有著類似的走勢。

AUDJPY

相比來看,英鎊似乎並沒能完全兌現英國今年的加息預期和2年期收益率飆升的利好。如果今天公布的9月份CPI和PPI能跑贏預期,通脹壓力可能促使英國央行提前行動,並幫助英鎊延續漲勢。

WTI和布倫特原油繼續刷新數月高位,天然氣(NatGas)價格反彈,能源短缺的困境在短期內難以徹底解決。黃金昨天沖高回落,小幅收漲於1769.41。白銀漲幅超過2%,而鈀金(XPDUSD)更是跳升4%。

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted..