Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English

- 中文版

April 2024 ECB Preview: One Last Meeting Before Cuts Commence

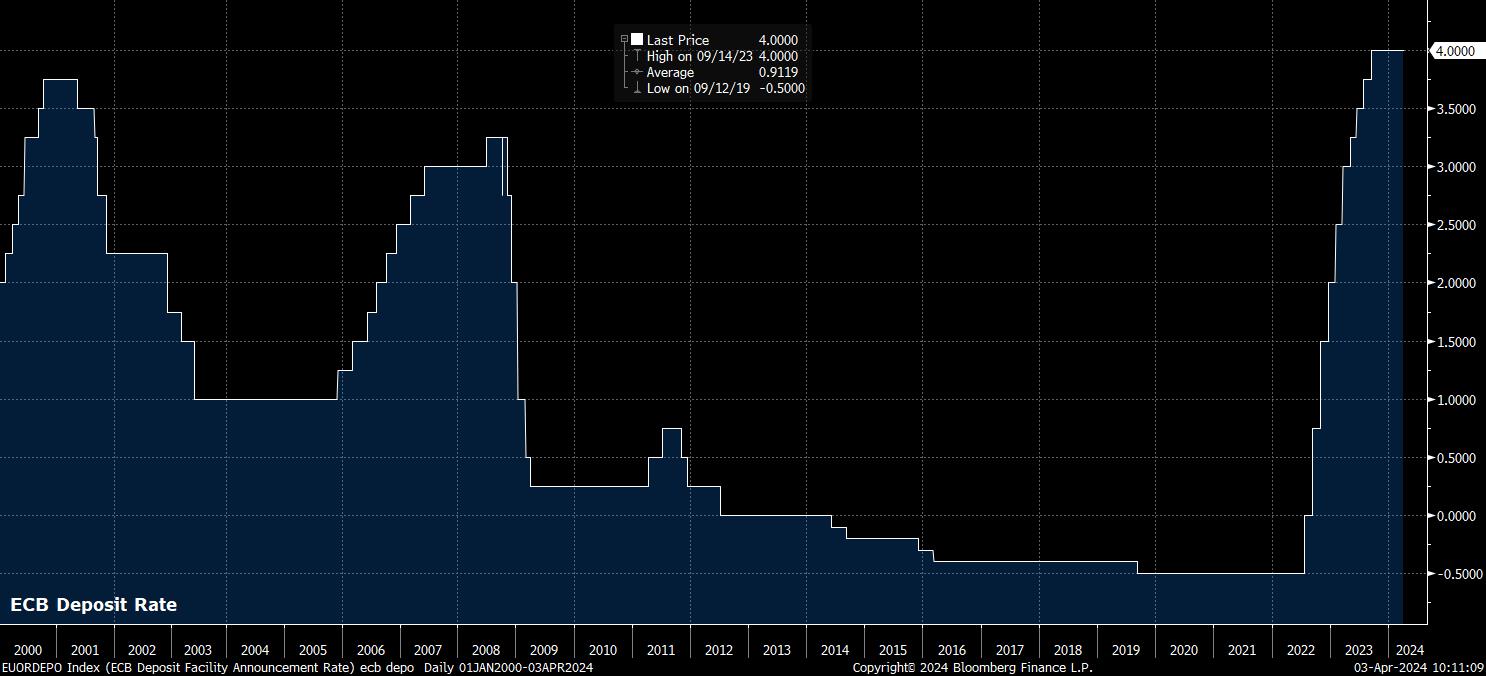

For what will likely be the final time this cycle, the Governing Council are likely to leave all of the ECB’s key interest rates unchanged, therefore maintaining the deposit rate at a record high 4.00%, the level at which it has been since last September. EUR OIS, unsurprisingly, prices almost no chance of a rate cut this month, while fully pricing the first 25bp cut for June.

In many ways, had the ECB not boxed themselves into a corner by effectively pre-committing to a June cut, there would be a strong case to be made that the first cut of the cycle should be made at the April meeting. However, with President Lagarde, and the majority of other GC members having repeated, ad nauseum, the line that policymakers will know “a little more” by April, and “a lot more” by June, a rate cut before the latter meeting seems highly unlikely.

In a similar vein, market participants will again pay close attention to the guidance that policymakers issue, accompanying the likely decision to keep rates on hold. For some time now, the GC have indicated that policy will need to remain ‘sufficiently restrictive for sufficiently long’, in order to bring inflation back to target. Furthermore, Lagarde has noted, as recently as March, that she is “confident”, but not “sufficiently confident” that inflation is on its way back to 2%.

While the former line is unlikely to change, any shifts in the latter stance will be significant, particularly if Lagarde makes mention of “almost” having sufficient confidence in inflation returning to target, as this would be a clear indication that policymakers are laying the groundwork for the first cut to be delivered at the subsequent meeting in June.

Nevertheless, one must also think back to the beginning of the ECB’s tightening cycle, in mid-2022. Then, as inflation ran rampant across the globe, the Governing Council used the June statement to explicitly flag a hike at the following meeting, noting that “the Governing Council intends to raise the key ECB interest rates by 25 basis points at its July monetary policy meeting”. While a comparable uber-dovish line is highly unlikely, there are no doubt likely some doves on the Governing Council who will be pushing, in vain, for such a shift.

In any case, as alluded to above, the key questions with regards to the ECB are now what comes after June, not what is delivered at that meeting itself.

There are two key questions that market participants continue to ponder in this respect – both how much easing is likely to come as rates return to a more neutral setting, and at what pace said policy normalisation is likely to be delivered.

In an ideal world, it seems plausible that the Governing Council would seek to normalise policy at a relatively conservative pace, most likely delivering a 25bp cut once per quarter, in line with the release of the quarterly staff macroeconomic projections. Such a pace would result in a total of 75bp of easing being delivered this year, a marginally more hawkish path than markets currently price, with EUR OIS discounting around 92bp of cuts by December.

Policymakers will, though, need to strike a delicate balance here. Although a more rapid pace of easing may well be desired by some of the GC’s more dovish members, and in fact be necessary to achieve the 0.6% annual real GDP growth projection outlined in March, policymakers will likely seek to avoid cutting rates at too fast a clip for two obvious reasons – to avoid the appearance of panic, and to prevent policy becoming too ‘out of sync’ with that of the FOMC.

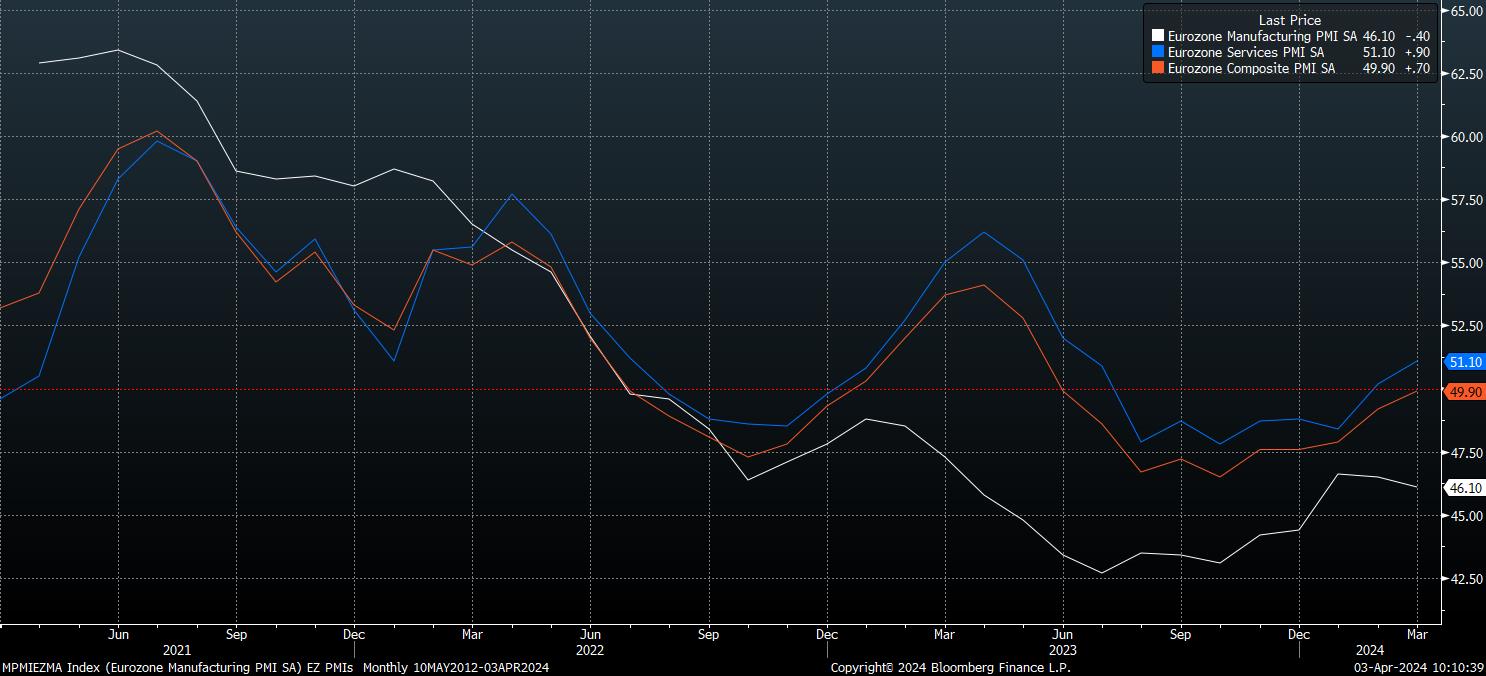

In terms of the economic outlook, however, the picture has brightened somewhat since the March decision. While risks to growth remain tilted to the downside, amid ongoing geopolitical tensions, and the continued lack of sustained recovery in China, recent indicators have pointed to signs that the months-long economic slowdown may well be bottoming out.

The most recent PMI surveys, for instance, pointed to a substantial pick-up in activity in the services sector, with said index rising to 51.1, its highest level since last June. In turn, this dragged the composite output gauge to just shy of the 50.0 breakeven level, also to a 9-month high. Concerns do persist, however, about ongoing weakness in the manufacturing sector which, per the PMIs, has contracted in every month since July 2022, while the German economy, Europe’s engine room, also remains on incredibly fragile ground.

Of course, there is a case to be made that the ECB beginning policy normalisation may put something of a floor under the economy, and help to spur a more rapid and sustained economic rebound in the second half of the year.

Meanwhile, on inflation, progress in returning to the 2% target continues, and has in fact been more rapid than policymakers expected, with the March macroeconomic projections having not foreseen the 2% target being achieved until the third quarter of 2025. Instead, it seems increasingly likely that said target will be achieved at some point in the second half of this year, with headline CPI having fallen further to 2.4% YoY in March, while core inflation dipped beneath 3% YoY for the first time in two years.

Putting all this together, one comes to the conclusion that the April ECB decision is unlikely to see policymakers spring any surprises, instead taking further steps toward endorsing the market rate path which fully prices the first 25bp cut for June.

That said, the bar for a dovish surprise from the ECB is a relatively high one, with markets already pricing around 92bp of easing by year end, a path that seems marginally more hawkish than that which the ECB would be minded to deliver if the economy continues to evolve in line with expectations.

In any case, further sustained downward pressure on EUR/USD remains likely in the medium-term, as risks to the ECB outlook continue to tilt in a dovish direction, owing to the fragile growth backdrop, and as risks to the FOMC outlook become increasingly hawkish, particularly as Fed speakers increasingly stress that they are in ‘no rush’ to cut rates. A grind lower towards the 1.05 figure seems plausible, particularly if what has proved relatively stubborn support around the 1.07 figure finally gives way.

_eur_spot_2024-04-03_10-09-53.jpg)

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted..