Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English

- 中文版

November 2024 FOMC Review: Continuing The Journey Back To Neutral

As had been fully expected, and discounted by money markets, Powell & Co. delivered a 25bp cut at the conclusion of the November FOMC meeting, lowering the target range for the fed funds rate to 4.50% to 4.75%.

Such a cut marks the second step in the journey back to a more neutral policy setting, albeit a more modest step than the ‘jumbo’ 50bp cut seen last time around, and comes as policymakers continue to normalise policy, in an attempt to stick the ‘soft landing’ which the economy appears on course for.

In contrast to the September meeting, the decision to deliver a 25bp cut this time around was unanimous, with Governor Bowman falling back in line with the remainder of the Committee, having dissented against the 50bp cut last time out.

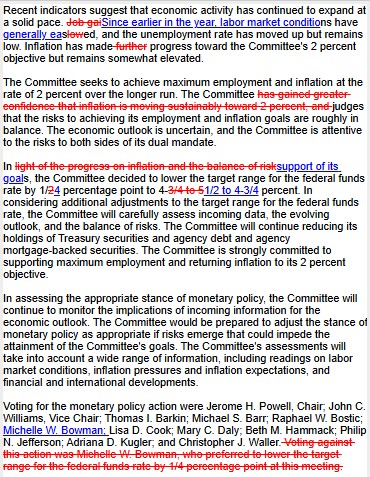

As always, accompanying the rate decision was the FOMC’s updated policy statement.

By and large, the statement was a ‘carbon copy’ of that delivered after the September decision, albeit with a different date, and different magnitude of rate cut! As such, the statement continued to characterise economic growth as ‘solid’, and noted that inflation has ‘made progress’ to 2%, despite remaining ‘somewhat elevated’. One subtle tweak was the characterisation of the labour market, where conditions are now said to have ‘generally eased’, though this seems just a re-framing of the prior remark that job gains have ‘slowed’ in recent months.

Given that no updated economic projections were released this time around, with the next SEP not due until December, focus quickly turned to Chair Powell’s post-meeting press conference.

During the presser, Powell was peppered with questions pertaining to the election results, chiefly as to how policy may evolve under a second Trump Administration, which is likely to deliver significant fiscal loosening. Though the FOMC will, likely, have to grapple with a reflationary fiscal stance in 2025, Powell predictably played these questions with a ‘straight bat’.

Besides politics, Powell stuck to what is now an incredibly familiar script, largely repeating recent rhetoric. Namely, reiterating that risks to each side of the dual mandate are “roughly in balance”, that the economy and labour market remain ‘solid’, and that while policy will move to neutral ‘over time’, rates will be made on a ‘meeting-by-meeting’ basis.

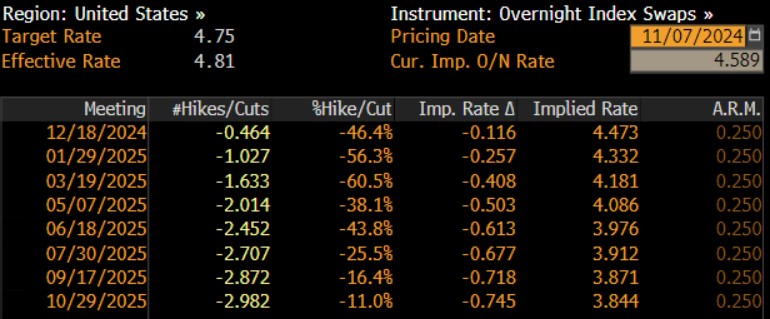

Given the lack of any significant surprises from the FOMC, market-based rate expectations were little changed. Consequently, the USD OIS curve continues to price around 14bp of easing for the December meeting, with a total of 80bp of cuts priced by this time next year.

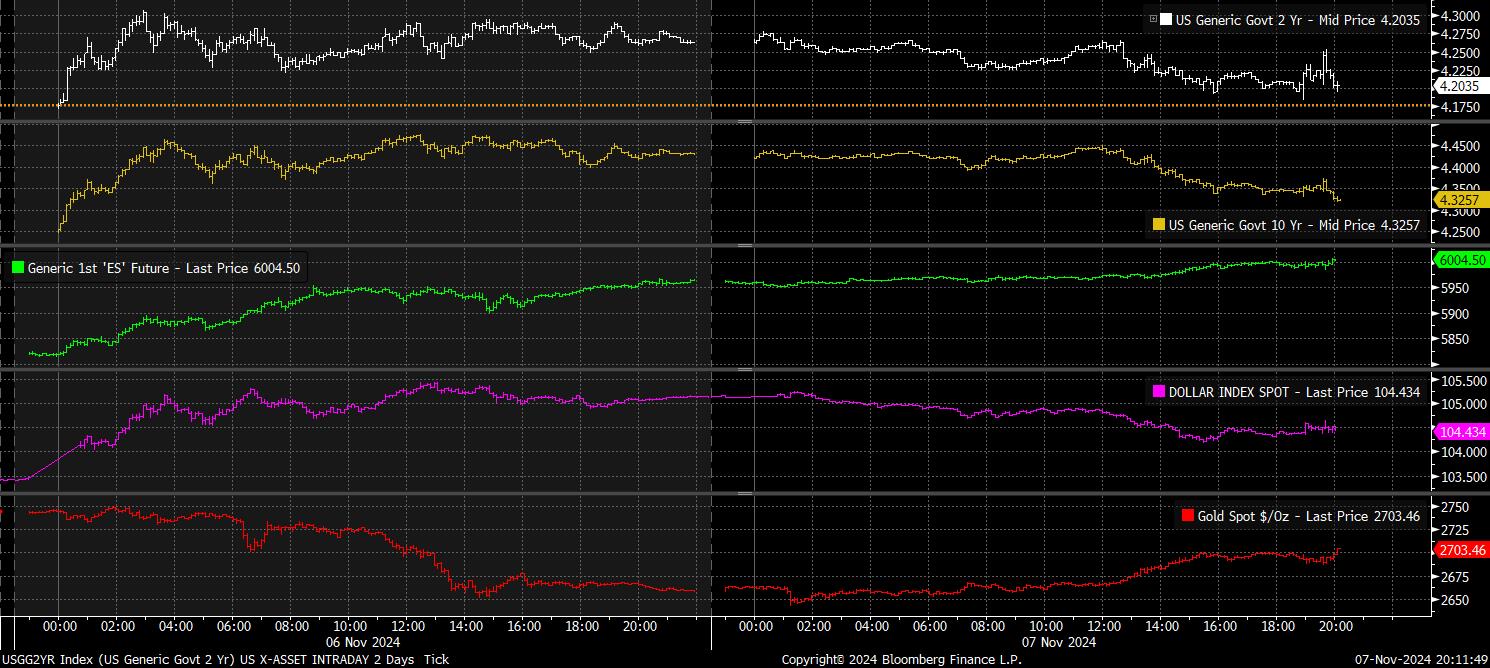

More broadly, market participants took today’s decision in their stride.

Hence, Treasuries held on to earlier intraday gains, albeit paring a touch of the move at the front-end of the curve. The dollar also gained some very modest ground, rallying 30-ish pips against most G10 peers, while equities held close to earlier highs, with the front S&P future just under the 6,000 handle.

On the whole, the November FOMC decision does little to materially alter the policy outlook. My base case remains that the Committee will continue to deliver 25bp cuts at every meeting, until a neutral rate, around 3%, is reached next summer. Risks, though, to this path have now become more two-sided since the election.

Were the labour market to weaken unexpectedly, and unemployment rise north of the SEP median 4.4% expectation for this year, and next, the prospect of a larger 50bp cut would come back onto the table. On the other hand, President Trump’s likely reflationary agenda represents a hawkish risk, particularly if the imposition of tariffs reignites inflationary pressures.

It is, obviously, too early to say how significant this latter risk could prove, though in early-2025, the FOMC will likely need to take policy off its current ‘autopilot’ setting, and become considerably more nimble.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted..