Analysis

The Daily Fix

While we await Trump’s inauguration on 20 January, the process of placing key personnel into Trump’s cabinet will set the foundations for future policy implementation, and as we start to learn more about Trump’s key appointments over the coming weeks, this recruitment drive will go some way to help shape market expectations and subsequently drive broad market moves.

Reports of Robert Lighthizer as Trump’s pick for US Trade Representative have been passed around, with John Paulsen and Scott Bessent seen as the leading candidates to become the US Treasury Secretary. A short-list of who will replace Gary Gensler as chair of the SEC is also making headlines, and this will certainly be closely watched by those involved in the crypto space, as whoever comes in will presumably be sympathetic to the crypto cause.

Crypto having a fine weekend

Weekend liquidity conditions are always a consideration, but a change of regulatory guard may be part of the reason why crypto has had a fine weekend’s trade, with some of our coins seeing sizeable underlying momentum. Bitcoin remains at the centre of our flows with price having tested $81k, although as liquidity kicks back in as we enter the new trading week, sellers are being seen more liberally.

Is Trump fiscal a 2026 story?

Many debate if Trump’s more impactful fiscal rollout is indeed a 2026 story, and therefore will not offer the sort of positive tailwinds to US growth until the years ahead. With the US Treasury Department well-funded through most of 2025, the idea of 10% fiscal deficits and increased Treasury issuance, while clearly a reason to think US bond yields and the USD head higher, is perhaps a factor to discount in 2025. A resumption of the bear trend in the US 10Yr Treasury above 4.40% would suggest that may not be the case.

Another growing debate on Trump 2.0 is on the effective passing of policy and legislative change. Assuming every Republican in the House and Senate votes through each respective policy put to them seems a somewhat naïve view to hold. However, until we know the full advantage the REPs command in the House and consider which elected REP members would likely put up resistance to a potential fiscal blowout, then the market can’t readily price the prospects of smooth policy implementation and tax cuts, deregulation and fiscal.

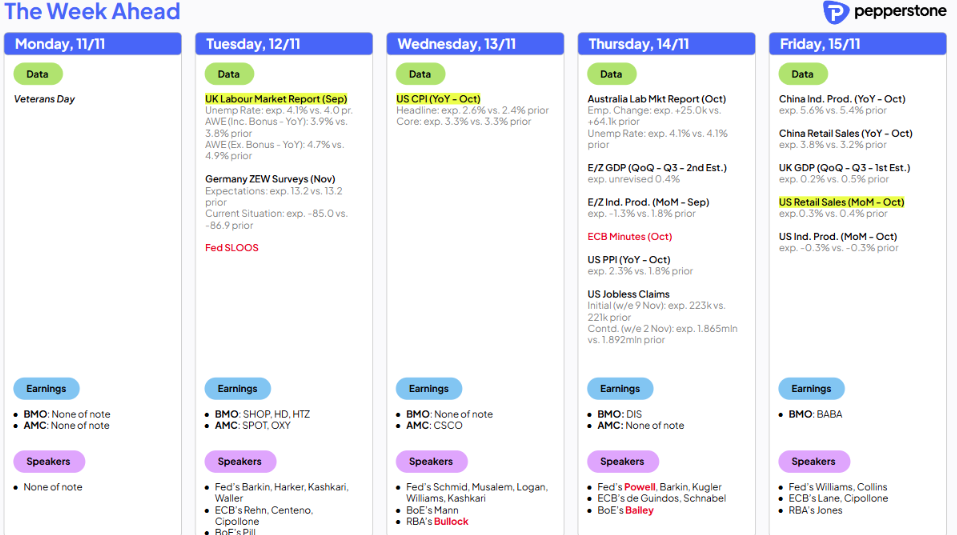

US data to navigate – CPI, retail sales and Jay Powell front of mind

Trump 2.0 aside, in the week ahead US data will need to be monitored, with traders navigating the US CPI, PPI, and retail sales reports, while the noise from the Fed ramps up, with 18 separate Fed speeches scheduled. These include speeches from the more influential Christopher Waller, John Williams, and Jay Powell.

It’s the US data flow that is likely the bigger influence on US interest rate expectations, the USD and equity markets. A 0.3% m/m lift in US core CPI could see some questioning the pace of disinflation – should inflation be backed by a hotter-than-expected retail sales print and the USD index (DXY) should break 105.50 as the market reduces the prospect of a further 25bp cut in the December FOMC meeting.

Chair Powell speaks 6.5 hours after the US CPI print, so he may offer insight into how inflation data influences his thinking on the path to near-term rates.

China reserving its tactical powder for the next phase

China released further colour on its fiscal plans in Friday’s NPC meeting and once again failed to set the market ablaze, with the details offering limited definition on policies that will drive demand. The ensuing weakness in the A50 futures, and CNH (offshore yuan) in response to what was heard from the Chinese policy makers, a testament to the modest disappointment expressed in China’s markets. Many feel that China is keeping its tactical powder in play for such time as the Trump-China tariff negotiations build, and they can respond in a more targeted fashion to stem the likely economic fallout. In the short-term, however, it does suggest downside risk to China/HK equity and the CNH.

On the economic data flow, through the week China release October industrial production, retail sales, property sales and new yuan loans. Given many are more concerned with how the economy may fare under a future higher tariff regime and China’s possible counter measures, in theory, the market may not react too intently to this data flow.

On the equity side, we see earnings from Alibaba and Tencent, which could get attention from both equity and HK50 traders.

Event risks away from the US and China

US and China aside, we see event risk in the UK focus on the September employment rate, Q3 GDP, and speeches from BoE royalty may get some focus, with chief economist Pill, Catherine Mann and Gov Bailey speaking. The market now expects the BoE to hold rates steady in December and the respective speeches from MPC members should reflect this.

Aussie jobs may offer some steer to AUD and ASX200 traders

We also get the monthly employment report in Australia, where the market looks for 25k jobs to be created in October. Prior to that, we see the Q3 Wage Price Index, which is unlikely to move the AUD to any great degree, even if the RBA does review it closely. Speeches from both Gov Bullock and Deputy Gov Jones throughout the week may offer small insights, but the RBA is sitting pretty, and in no mood to rush through policy change, and the respective speeches should be consistent with the recent RBA meeting statement.

While political developments in Germany are a growing focal point, the event risk calendar in Europe is on the light side this week, and the raft of ECB speakers due out shouldn’t move the dial on the EUR or EU equity to any great extent. The set-up in EURUSD looks heavy, and a break of 1.0682 should see encourage further sellers into the mix, for a move into 1.0500.

In LATAM FX, Banxico is set to ease the Overnight rate by 25bp to 10.25% on Thursday, a factor that is well discounted into the MXN.

So, as we turn the page on the US election and head into a new phase, new questions have come to light – for the Trump/red sweep trades to kick up a gear the market may have to wait for a period for new information to come to light, and in a world where market players demand immediate certainty, that waiting period is not something that many will appreciate.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted..