Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English

- 中文版

Clearly, a lot has happened in this cycle; before continuing this note, I’ll just submit that statement as a contender for the ‘understatement of the year’ award.

However, when taking a ‘big picture’ view, it’s worth pondering what the biggest and most significant of these events may be. In fact, events may be the wrong word, suggesting one specific moment in time. Instead, it is the biggest theme or trend that should be the focus of our ruminations.

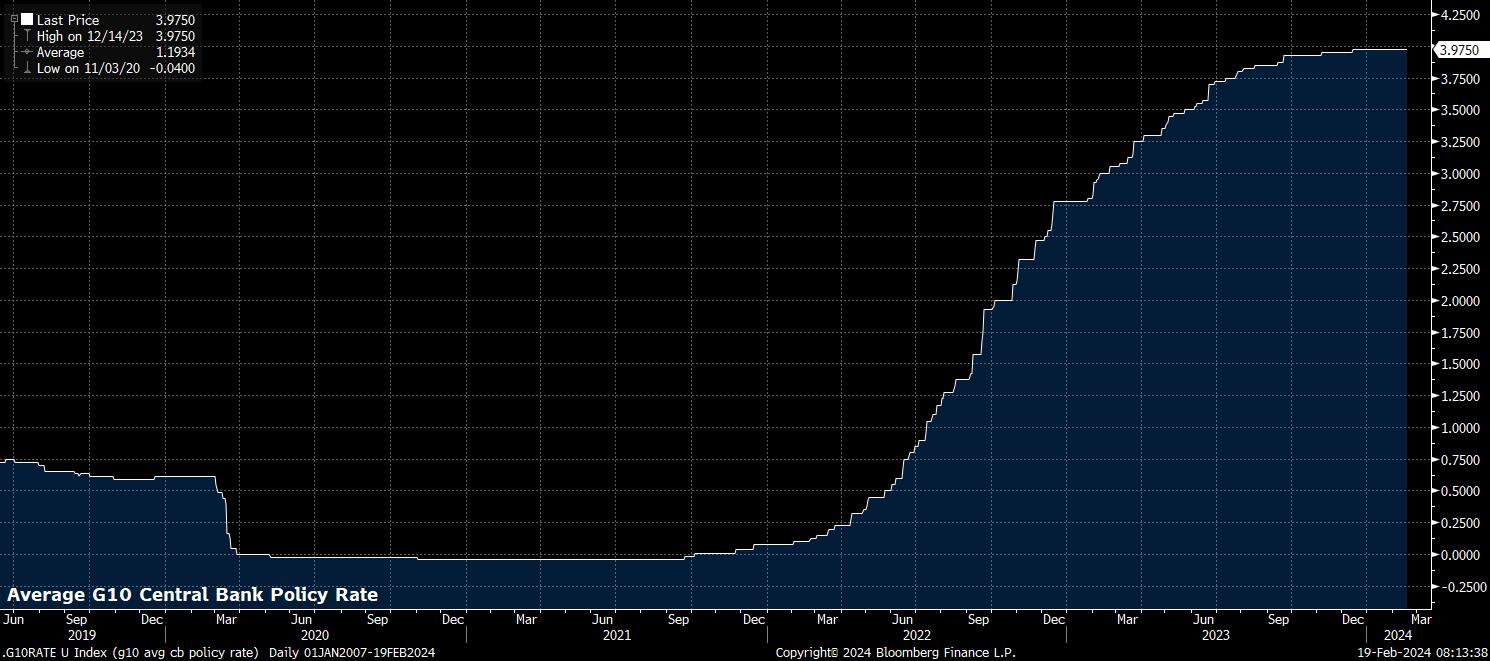

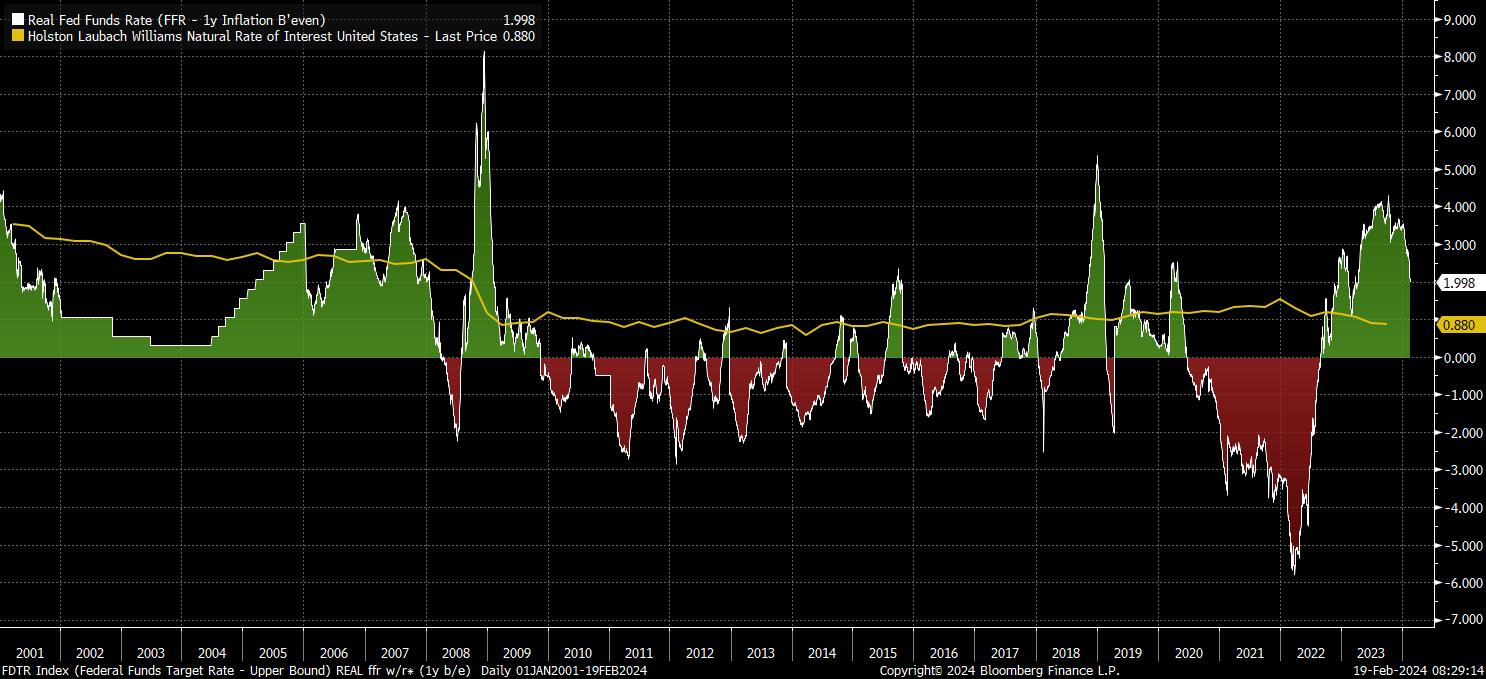

Here, I’d like to suggest, as I have in these pages previously, that the most significant conclusion to be drawn from the last couple of years lies, unsurprisingly, in the realm of monetary policy. Put simply, it is the way in which central banks have managed to separate the two primary tools in their toolboxes - interest rates, and the balance sheet - in order to restore price stability, while also preventing significant financial instability, and ensuring that a financial accident has not occurred, despite the most rapid rate hiking cycle in four decades having wrapped up last year.

I say that price stability has been restored as, though we have not yet got to precisely 2% CPI in the majority of DM economies, we are clearly close to the end of the road back to that target level, even if the ‘last mile’ of said road will be bumpier than the journey we have already travelled, as last week’s US CPI data proved, and the PCE figures due later this month will likely reinforce.

Nevertheless, it seems a question of ‘when’ rather than ‘if’ 2% inflation will be achieved. The answer to that question, however, matters little in terms of timing the first rate cut, with G10 policymakers simply seeking ‘confidence’ that inflation will return to that yardstick before beginning to move to a less restrictive stance.

The reason for this is simple. As was harped on about during the hiking cycle, monetary policy works with ‘long and variable lags’. These lags that were present in the hiking cycle, are still present when rates are reduced. Waiting for 2% on the nose to be achieved would likely end with policy running too tight for too long, and a subsequent undershoot of the inflation target.

Those lags, however, do continue to pose a risk, particularly to rate sensitive sectors of the economy where 500bp of base rate hikes continue to feed through the system at large. Commercial real estate is one such area, which is grabbing significant attention - and taking up a seemingly inordinate number of column inches - at present.

It is here that the separation of interest rate and balance sheet policy becomes critically important to comprehend.

Targeted liquidity injections have become the modus operandi for the central bank put, in the way that a rate reduction, or even blanket QE, was in the past. The BoE led the way on this in Q3 22, delivering a targeted intervention in the gilt market after the Truss/Kwarteng ‘mini-budget’, while continuing to raise Bank Rate in an attempt to tamp down on double-digit inflation. The Fed then followed suit, almost a year ago, with the BTFP programme to support regional banks facing liquidity issues with large HTM portfolios, again while continuing to raise the fed funds rate. Credit for these innovative, and forceful, interventions must be duly given.

_2024-02-19_07-49-47.jpg)

While separation of the policy toolkit is one takeaway, the other is one of flexibility. The current environment is no longer one where policymakers will simply tweak the blunt tool of benchmark rates once every 6 weeks or so, and do little else. Instead, it is one where significant liquidity will be targeted to where it is needed, while the over-arching aim of restoring price stability remains the priority.

This all has significant implications for the year to come.

As noted, the next move in rates in almost all DM economies - Japan excluded - will be a cut. Whether this cut comes in the early spring, or the late summer, is largely immaterial besides those seeking short-term opportunities in the FX space. (For those readers, short the EUR and CHF, long the USD, GBP, and AUD seem attractive ways to position oneself.)

With that in mind, we should all be safe in the knowledge that, as the year progresses, policy will steadily become less restrictive, and likely move back to a neutral level some time in H1 25 (though r* is, obviously, near impossible to measure).

When this knowledge is then coupled with the well-demonstrated desire of central banks to ensure that liquidity remains provisioned where it is needed, when it is needed, it is clear that the overall policy stance will continue to ease.

There are a couple of implications to this.

One is that vol should remain relatively subdued, being capped by the reassurance that the central bank put is alive and well, and more flexible than before.

Another is that risk should remain resilient. Though countless columns have been written on the over-concentration of equity markets among the ‘magnificent seven’, it will likely be tough to bet against equities over the medium-term when Powell & Co are ready and waiting on the sidelines. Particularly when a return of inflation to target likely allows policy to provide more aggressive support than 12-18 months ago.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted..