Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English

- 中文版

March FOMC meeting preview – The Fed to soldier on with hikes

Times to be aware of:

23 March at 5 am AEDT (22 March 6 pm GMT) – Chair Powell’s press conference at 05:30 AEDT

While there is much debate around this call given the concerns on financial stability, I still think we’re staring at the Fed delivering a 25bp hike at the upcoming FOMC meeting. Where the risks to the USD are still skewed to the long side.

It is a call that is certainly being hotly debated and while economists at Nomura see a 25bp rate cut and a pause in QT (Quantitative Tightening), and we see Goldman’s, Wells Fargo and Barclays calling for no change in rates, nearly 90% of economists (polled by Bloomberg) still see a 25bp hike.

Most importantly, when we’re thinking of the potential reaction in the USD, gold, and equity markets, is the current market pricing and positioning.

The move in interest rate futures or swaps to the FOMC statement is typically the first derivative and it is what the US 2-Year Treasuries and the USD (and other markets) will correlate to – higher yields should equate to a stronger USD, and a lower gold and equity price and vice versa.

Market pricing is key

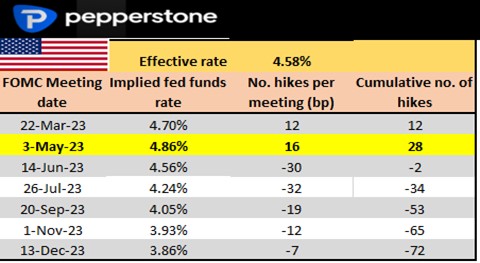

At this moment we see interest rate markets pricing 12bp of hikes at this FOMC meeting, so that’s a 50/50 chance of a 25bp hike. We reach peak pricing of 4.86% by the May FOMC meeting, before falling towards 3.86% by year-end – equating to just over 4 rate cuts (or 100bp).

Swaps pricing per meeting - prices correct as of 16 March

This interest rate pricing changes dynamically and could look very different in the hours before the meeting.

If it weren’t for the news flow and volatility in the banking space, then we’d be arguing about a 25bp or 50bp hike.

A 50bp hike is clearly off the table and would be seen as a mistake in the eyes of the market.

Of course, Chairman Powell only recently opened the possibility of a 50bp at his testimony to the Senate Banking Committee – but given the brewing risks, a 50bp would shock and risk assets would be punished.

As it is we’re debating a 25bp hike or a pause. I think the Fed will acknowledge they’re watching developments in the banking space, but they are far more reactive these days and set policy to what they can see in front of them – and the data supports a 25bp hike.

We’ve some cooling in the labour market but it’s still hot. The Feb US CPI print can be sliced and diced to fit any bias, but I see it supporting a 25bp hike, especially if we look at the month-on-month metrics, which have shown acceleration. The Fed focus heavily on core CPI ex-shelter which increased +0.5% MoM, in fitting with a central bank that needs to do more.

What are the key drivers of market volatility?

When 12bp of hikes are priced, if the Fed hike by 25bp then all things being equal the USD should initially spike higher. If rates are kept unchanged then the USD should fall and equities (like the NAS100) rally. So what they do with the fed funds rate at this meeting is the first consideration.

However, perhaps the more lasting impact on markets will come from the ‘dots plot’ projection – this is where the individual Fed members provide their estimates for where the fed funds rate could be by year-end 2023, 2024 and 2025.

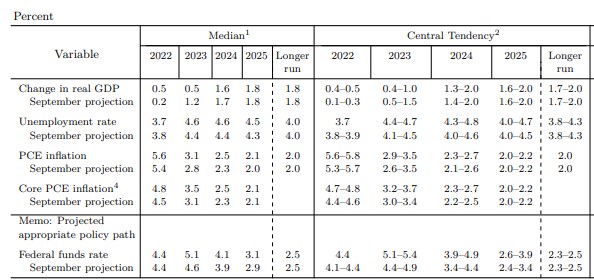

Fed’s dots and economic projection – December FOMC

At the December FOMC meeting the median projection for the fed funds rate by end-2023 was5.12% and 4.12% for end-2024. However, given market expectations and pricing (in interest rate swaps) are far lower at 3.86% and 3.15% for these periods respectively, there is a clear disconnect.

This divergence between the current set of Fed fund projections (‘dots’) and the market pricing suggests the market feels strongly that the Fed will lower its forecasts for the fed funds rate for these dates.

Should the Fed fail to do this, and especially if the FOMC statement shows little concern for the issues afoot in the banking sector and the potential for new regulations, with far tighter credit conditions and increased charges for borrowers, then markets could light up with volatility.

Conversely, if the market does see the Fed coming sufficiently towards market pricing it could be a very important moment in this cycle – in theory, it should support growth stocks, high beta FX (such as the AUD) and gold, while the USD is sold. However, much depends on the statement and the level of concern expressed as to why they have lowered its projections.

The balance of risk

My own view is that the Fed will hike by 25bp and fail to lower its ‘dot plot’ projection sufficiently and market pricing will be disappointed – this could potentially lead to a higher USD and drawdown in equity and gold. As always trading over news has its challenges, but for all risk managers will measure where the skew in risk is over key events.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted..