Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English

- 中文版

Nvidia Q1 2026 Earnings Preview: What to Expect and How to Trade It

Nvidia’s Q126 Earnings: When are the earnings due out?

Nvidia will report earnings 20 minutes after the closing bell on Wednesday at 16:20 ET (21:20 UK, 06:20 29 May AEST), with CEO Jensen Huang stepping up shortly after to deliver his outlook to investors.

Traders can look to react immediately to the announcement through our US 24-hour share CFDs and will be able to trade any further changes in price through Asia, even when the traditional post-market session in closed.

Should we see an outsized move in Nvidia’s share price, this should spill over into increased movement in the other AI plays (Broadcom, Marvell, Super Micro, AMSL and AMD) and have a strong impact on the NAS100 and US500 as well.

The options market implies a move in the share price (on the day of reporting) of -/+7.2%, which, if that implied move is realised, in isolation, it would impact the NAS100 by around -/+0.5%.

For a company with a $3.21t market cap, a 7% move on earnings is highly impressive, however, investors are conditioned to such moves on earnings, with Nvidia recording an 8.5% average (absolute) move on earnings in the past 8 quarters. The market, therefore, typically goes into Nvidia’s earnings release expecting a strong reaction, which for traders offers both opportunity and heightened risk to manage.

Consensus expectations for Nvidia’s earnings

Nvidia do have truly exceptional form when it comes to beating the consensus expectations set by analysts. Since 2017, they’ve beaten expectations on revenue by an average of 5.4%, and have only missed expectations for both the reporting quarter and in their explicit guidance for the following reporting quarter twice throughout that extensive period.

They also have a strong form in overdelivering on gross margins (GM), having beaten the street's consensus estimate in 8 of the past 10 quarters. While there is always a lot to look out for in Nvidia’s earnings, the initial reaction (in the share price) will likely come from whether it can beat expectations for Q126 sales and gross margins, as well as the guidance for these metrics for the next reporting quarter (Q226).

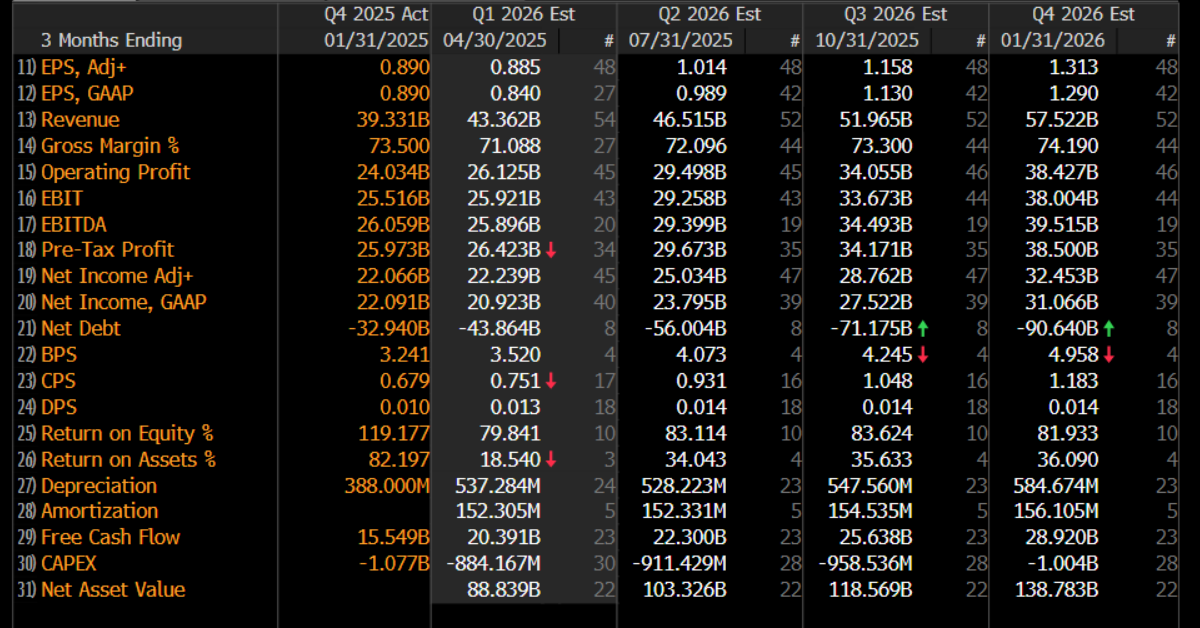

We can see that the analyst’s central case is for Q126 sales to come in at $43.36 billion (+10.3% q/q), which falls in line with the guidance Nvidia detailed in the Q425 earnings report (reported on 26 Feb).

The consensus expectation for guidance on Q226 revenue sits at $46.51 billion.

Company guidance for Q226 GMs is expected to lift to 72.09% before further rising to 74% by Q426. GMs are an important metric to consider, as margins have been negatively impacted by increased costs associated with the ramp-up of GB200 and GB300 chips. With reduced friction to meet the high demand for its chips, GMs are expected to tick higher in the coming quarters; subsequently, the market will want to see evidence of this.

The trade?

While the macro environment will have a continued influence on the share price in the weeks/months ahead, there is little doubt that investors are looking at this earnings announcement very closely, with many seeing this as the final hurdle to gain real conviction to hold the stock.

While there is still some overhang stemming from the final AI diffusion ruling (the date remains unknown), investors see increasing evidence that the GB200 ramp is firmly on track and set to deliver increased sales and margin growth in 2H26, backed by news of new supply to the Middle East.

Investors have also seen confirmation that the capex intentions from Microsoft and the other US hyperscaler businesses remain as hot as ever, and that has removed a major overhang and has helped push the stock into $130.

The final big overhang holding investors back

While Nvidia can’t do much to influence the macro environment and the sentiment shifts driven by Trump’s various policy initiatives, investors look to Nvidia’s earnings for confirmation of yet another quarterly beat and raise.

Should Nvidia positively surprise, with Jensen Huang offering his typical highly upbeat outlook, it should solidify the view that Nvidia are set for a strong 2H26 and be seen as the final big overhang that has held many back from buying the former market darling.

For those trading Nvidia on our US 24-hour share CFDs, headlines on sales, earnings, and GMs will be known shortly after US cash equity close, and with the market anticipating another big move on earnings the reaction in Nvidia’s share price has the potential to move the whole semiconductor complex and US indices too.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted..