Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English

- 中文版

A traders’ week ahead playbook – finding trades in a lower volatility market

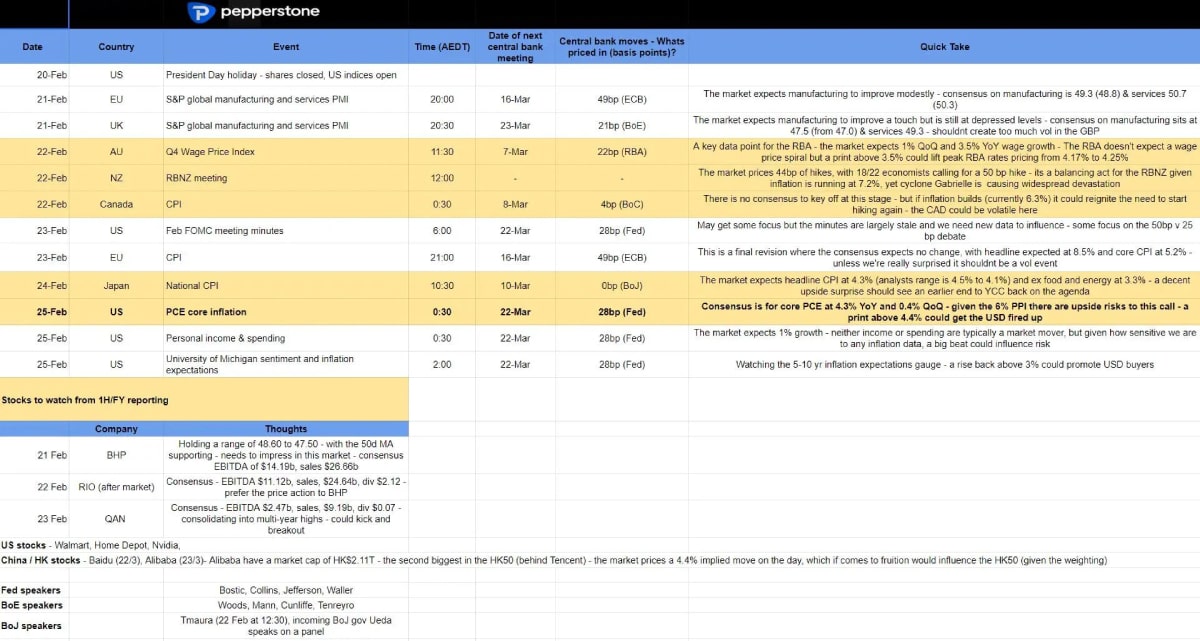

The event risk that could impact

*If this doesn’t come out well on email, see this Twitter post for better clarity.

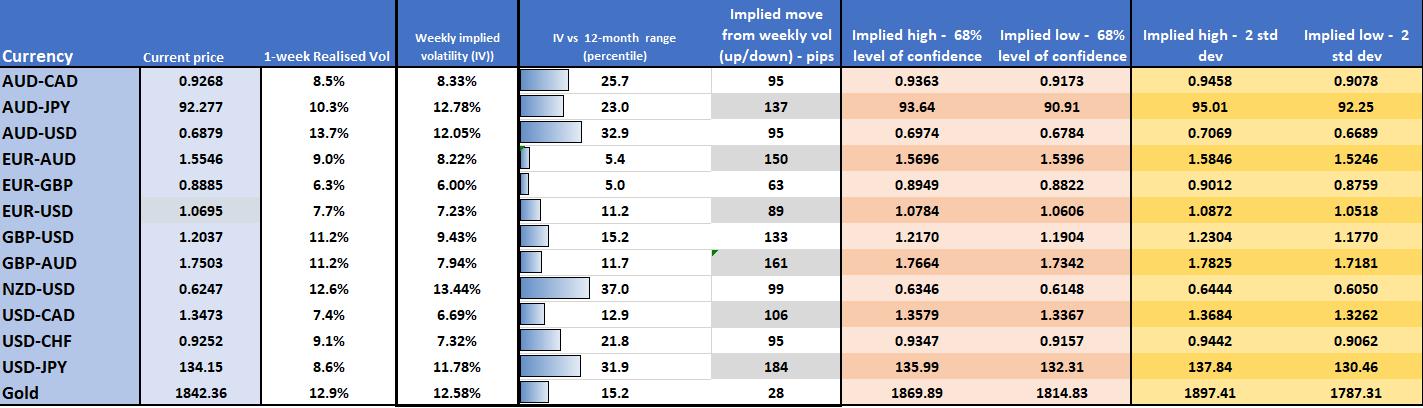

Looking at FX 1-week implied (options) volatility, we are guided by how the market sees the upcoming event risk impacting how far price can extend and subsequently our potential trading environment. It’s the percentile rank that jumps out here, as most FX pairs and gold are closer to the bottom end of their own 12-month range – in essence, the market is not expecting big moves – up or down – and while this is a reflection that price moves have realised at low levels, the data and known event risk are not expected to materially change the fundamental landscape.

Implied volatility matrix

The bond market is as influential as ever

The bond market remains such an important driver of all markets, but after moves higher in yield on the week, we see fatigue in the selling in 2 & 5-year Treasuries - this has caused some angst to push the USD higher, after giving the USD bulls hope of a bullish breakout (USDX) from the consolidation zone. For example, we saw US 5yr Treasury rise to 4.14% on Friday but reverse to close at 4.02% and this has kept the yield premium over German bunds unchanged last week at 1.20% - it’s part of the reason why EURUSD held the 1.0655 support well.

I am guided on the USD by UST 5’s this week, and while it still holds the premise to kick higher (USD positive) my base case is this price action becomes choppy and range-bound – it seems the volatility markets agree.

The next big event risk remains Powell’s testimony

This week’s US data holds some risk for traders to hold exposures over, but as we gear up for the 22 March FOMC meeting, the eyes of the world really look forward to Jay Powell’s Congressional testimony (7 March) as the next tier 1 event risk – we could see some better vol conditions leading into that speech. For this week, while we get a few Fed speakers, the Feb FOMC minutes are largely stale but could still hold some nuggets for the market to work with. Expectations for US core PCE look a tad low, with the consensus not having been adjusted for the big PPI surprise.

We get idiosyncratic global event risks that could be vol events, but unlike US data which resonates through multi-asset markets, should be confined.

Global events to put on the radar

Canadian CPI could impact the CAD in a big way if we get a hot number above 6.3%. The RBNZ meeting could be also one to put on the radar – the market prices 44bp of hikes here, and NZD implied volatility is priced higher than other FX pairs. While inflation is rampant in NZ, the announcement of the state-wide emergency in response to Cyclone Gabrielle could see the RBNZ look to reduce the blow to households, such as we saw for the support to the Christchurch earthquake. I am not sure that hits home and households feel the support on a below-expectations 25bp hike - so it’s either 50bp (consensus) and be the bad guys (but they have a job to do right?) or leave rates unchanged in my mind – the latter an outcome that could mean the NZD gets smacked off the bat – a compelling risk-reward event-driven view here when only 1 of 22 economists are calling for it, although I’d be getting out quickly on that.

Aussie wages hold significance – the bigger reaction in the AUD comes if the market gets a sense that the RBA’s sanguine view on a wage-price spiral is misplaced – as we see in the playbook above 3.5% YoY wage growth and it could get spicy. AUD positioning, however, leveraged accounts (typically hedge funds) are already long and the market AUDUSD is far more correlated to copper, AUS-US 5yr yield differentials and USDCNH. See the neckline of the head and shoulders pattern at 0.6877, where a break would target 0.6650 – I’m personally not the biggest H&S fan, but one man’s trash….

AUDNZD looks the better play for trading Aussie data and the daily looks ready to kick higher – I am on notice.

Staying on the positioning vibe, I notice the JPY is by far and away the professional leveraged accounts' biggest long exposure at present – this could get tested this week with incoming BoJ gov Ueda speaking as part of a panel, while Nat. CPI could push further higher and see calls for an end to YCC kickback into gear – both clear risks for JPY and JPN225 exposures.

Equity market moves

On the equity side, we continue to watch the USD and bond market plays – the terminal fed funds pricing (now 5.28%) looks fair and I can't see it moving much higher than 5.3% at this point. Equity markets could find some support from that, but the bears will want to see 4050 give way in the US500, and 12,200 in NAS100 – That’s where the buyers are stepping in and a daily close below here could see a higher vol priced.

The HK50 always gets a good look-in from clients and that seeing better-trending conditions, with traders selling into rallies into the 5- or 8-day EMA. Earnings from Alibaba and Baidu this week could impact the HK50, especially Alibaba given the implied move and sizeable weighting a HK$2.11t market cap hold.

A big week of AUS200 earnings

On the earnings side – in the US, while 81% of corporates may have reported, this week we get earnings and outlooks from several of the big retailers and that could impact at a macro level too. In Australia, we’ve seen 47% of the Aussie index report earnings, with 63% of those having beaten (or come in line) expectations on EPS, while 67% have beaten on sales, with an aggregate 12% sales growth seen. It’s the big week of earnings here too, with this being the week where the biggest absolute number of companies hit the wires – BHP, RIO, WOW, and QAN to name a few. It could get a level in the AUS200, which like the HK50 is also trending lower and needs to see support at the 38.2% fibo (of the Jan-Feb rally) at 7321 holds.

Play of the week? CADCHF – one of the best mean reverting plays at present, with the market playing an ever-narrowing trading range – 46 days in a 200-pip range. The Bollinger Band squeeze could result in something explosive, and as we’ve seen in the past five years the cross can have some explosive moves when it does break out after a quiet period.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted..