Analysis

The Daily Fix: The worlds central banks becoming ever more optimistic

We subsequently find ourselves looking for a move below the 90-handle, naturally driven by EURUSD, which is having a bit of a resurgence and eyeing a move back into 1.2200. GBP and NOK have also worked well, with cable moving into 1.3746 and are therefore currently receding at the 83rd percentile of the session range.

The ECB meeting offered little new policy measures, but then little was expected and the tone of Christine Lagarde’s narrative was deemed modestly optimistic. The tone in-fitting with that expressed in the Bank of Canada meeting, where we saw the BoC upgrade its growth and inflation forecasts and offered some degree of freedom to taper its future QE purchases. Are we moving to a regime where central banks start to focus more on upside risks to economics?

One questions whether the FOMC offers a similar cautious optimism next Wednesday (Thursday 6:00am AEDT) when it meets. It also makes me feel there could be upside to the NZD as a longer-term cross FX play given there's about a 20% chance of a cut from the RBNZ into August.

It wasn’t all sunshine and lollipops. There's caution from Lagarde but given the poor economics and ever tougher lockdowns across the respective nations, the fact is she detailed risks “are tilted to the downside but have become less pronounced”. So enough to compel EUR shorts to cover.

On the EUR itself, there's limited concerns around levels in the EUR, although the ECB is monitoring the EUR “very carefully” and perhaps this would've been a different affair if the trade-weighted EUR wasn’t actually weaker than the December meeting. Perhaps a move towards 1.2400/2500 will promote greater concern, but with EUR inflation expectations (5yr inflation swaps) pushing to 1.32% (the highest since January 2020), there is currently less need for concern.

There's certainly a focus on “favourable financing conditions”, which most have taken to mean Italian bond yields are in a good place and at just 118bp over German bunds, one can understand this. Can this spread pull in to 100bp? This is a question for those trading EURJPY which is the best way of playing collapsing Italian sovereign debt risk (given the correlation) and should this yield spread contract then EURJPY should push into 1.2700/1.2800.

My own personal view is that the ECB will not move policy anytime soon and still have over EUR1t of bonds left in its ‘envelope’ to purchase govt debt under its QE program (PEPP). This is where the policy support will come from should real-time economics deteriorate and inflation expectations really roll over.

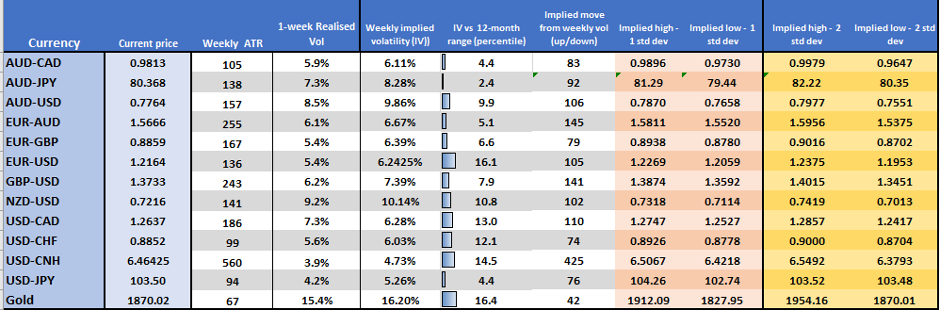

On volatility, EURUSD 1-week implied volatility fell post the meeting with vols falling from 6.89% to current levels at 6.21%. EURUSD has traded into 1.2173 and on the 4-hr chart we see a bull flag in play and it feels as though 1.2211 could be tested. At 6.21% weekly EURUSD vol implies a move of 106-pips over the coming week or a 0.4% daily move. Higher volatility in FX markets would be welcomed and personally speaking, I’d like this closer to 9-10%. However, until we start seeing rates and bond volatility moving higher then FX volatility will remain sleepy.

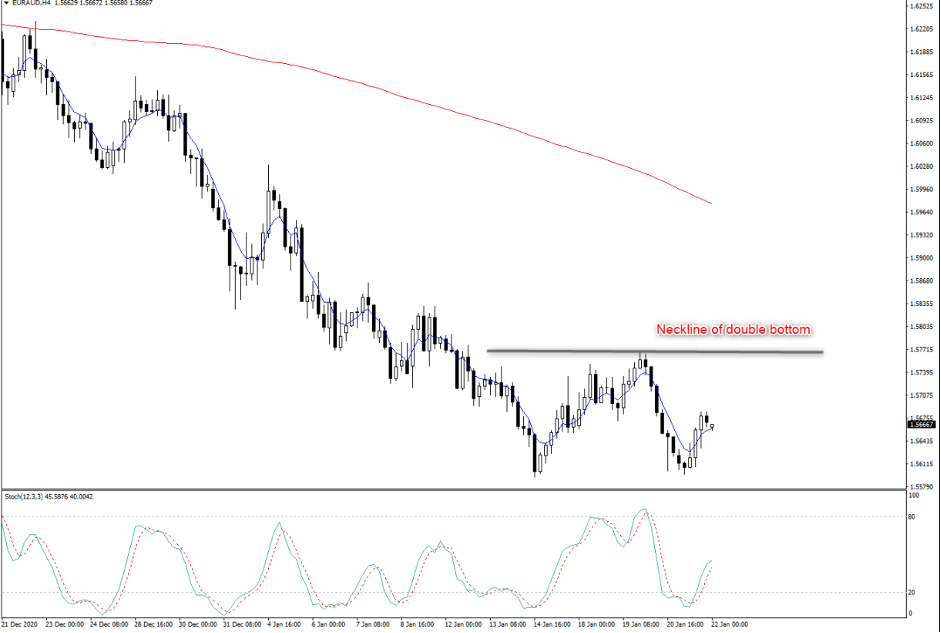

Drawing attention away to EURAUD as this has been well traded of late, we see solid support of 1.5600 and a pronounced double bottom. The neckline comes in at 1.5769 so a break of here and the pair targets the 1.5950 region. It’s hard to be short the AUD with any conviction though, notably with huge inflows into Aussie bond funds (largely from Japanese funds) and unless equity volatility ramps up and we see Asian equities trend lower then the AUD remain attractive. That said, the world is short this cross and a position unwind would clean this up a bit.

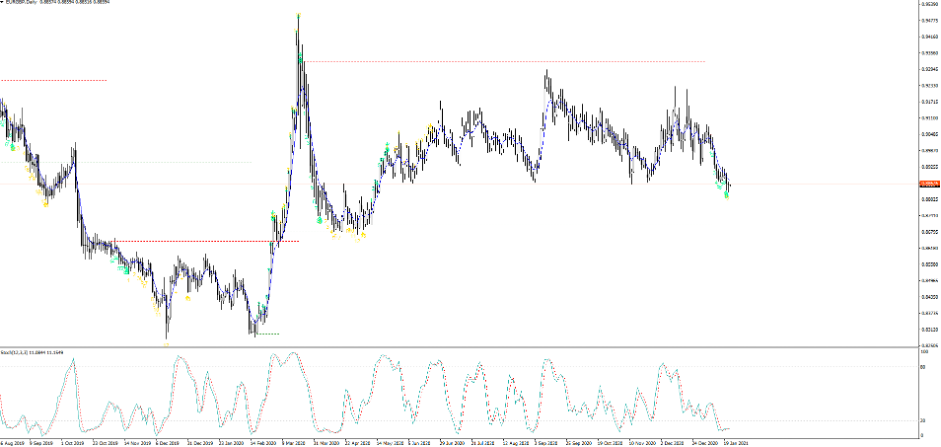

With the GBP looking strong too, EURGBP has seen some flow with the pair tracking into 0.8829 and finding buyers on the S1 pivot point. Clearly, one to have on the radar as price is holding onto the low of its trading range it held since June at 0.8864. One for the breakout traders as there's a science to this and the buyers either stand up or this breaks and establish a new range. Make or break time and as always trade the flow.

Elsewhere we’ve seen good flow in gold, although the moves have been limited to an 1875 to 1858 session range despite US breakeven inflation expectations firing up and 10yr real yields lower by 3bp and the USD index -0.4%. I’m surprised XAUUSD is not up over 1%, but there's indecision to push this into the 100-day MA in 1884. Crypto has taken a beating and FOMO has clearly swung the other way. Fear of not getting out in time, although I won’t make an acronym for this. That said, the 11 Jan low of 30,285 looms large and this could be an area we see the buyers start to accumulate again after a genuine flush out.

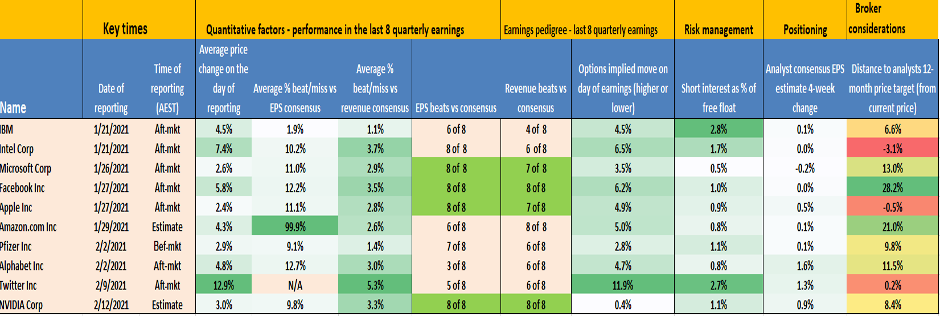

On a stock level, we’ve just seen numbers drop from Intel and IBM. Intel’s numbers look good, but as we see from the earnings pedigree, they tend to be a market darling when it comes to earnings. Like the story, let’s see if it can test $65 in the days ahead.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted..