Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English

- 中文版

Trader thoughts - Gold flying high as the USD bears take over

Instruments to potentially trade: XAUUSD, USDX, GDX ETF, URA ETF, Newmont

In fact, the USD is finding sellers easy to come by and the 94-handle on the USDX beckons. Strip out energy factors and revert to core inflation and we see this coming in at an expected 0.2%, and we can head into the components that drove the CPI print and see ammunition for both the ‘transitory’ and ‘non-transitory’ inflation crowd to pick out.

What matters though is price and in the interest rate market (Eurodollar futures) – in this case the first derivative – we’ve seen markets price in additional rate hikes, notable in June 2023 to September 2023 period. Positioning aside, the rates market saw CPI as hawkish.

A broad USD decline

In FX markets, after an initial 20bp rally in the DXY, the sellers took over, where the reversal was swift, with the USD is broadly lower on the day. The fact the USD is lower is not a play on the CPI directly and is misleading as a gauge there.

One factor driving the USD is that the US yield curve has flattened – meaning we’ve seen selling (yields higher) in short-term Treasuries (2yr) and a rally in longer-maturities (10yr and 30yr Treasuries). The US 2s10s curve has dropped 5.6bp on the day and is pushing the 100-day MA – by value (as opposed to % change) we see the 30-day rolling correlation between the USD and 2s vs 10s yield spread at 0.82 – that is significant. Either way, the US bond market has driven USD flows. Secondly, while US inflation expectations have risen 3bp (or 0.03%) we’ve seen long-end nominal Treasury rates lower, and subsequently ‘real’ rates are -7bp – another green light for the USD bears.

The beneficiary of lower real rates and a weaker USD in FX has been higher beta FX – ZAR, MXN, and NOK. Interestingly, the CHF has also found form, with USDCHF testing horizontal support into 0.9230. The other clear beneficiary has been the precious metals space, with palladium +2.9%, Silver +2.1%, gold +1.8% and platinum +1.1%. In equities the NAS100 has outperformed the S&P500 and Dow, closing +0.8% and not too far off the session highs.

Gold having a strong reaction to US bonds

(Source: Bloomberg - Past performance is not indicative of future performance)

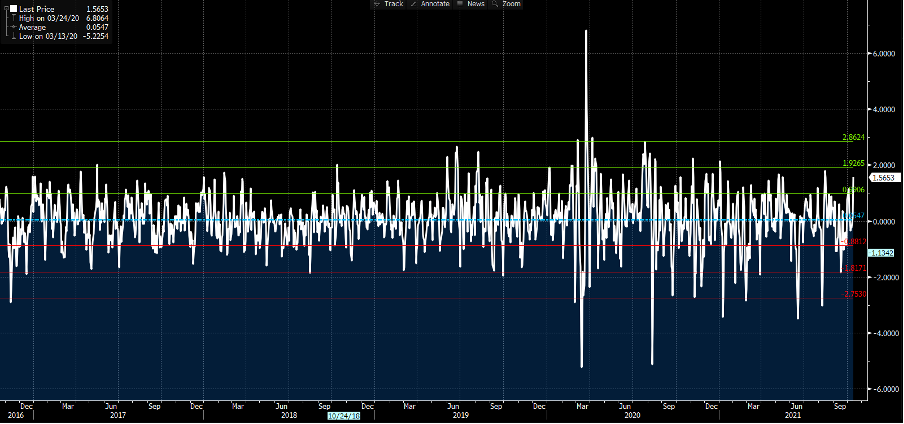

Our flow has centred on Gold, with clients having to react to an initial fall to 1758 (from 1775), before a solid reversal into 1796, where we’ve been consolidating into the 200-day MA since. The move took XAU to a 1.6% premium from its 5-day MA – that’s nearly 2 std deviations (1.9%) from the ultra-short-term average, a level where price has seen mean reversion frequently in the past 5 years.

Gold premium/discount to the 5-day MA

(Source: Bloomberg - Past performance is not indicative of future performance)

On the daily, I see today’s XAU candle sticking out quite prominently and the bulls have made a statement and one that I will look to join depending on behaviours on a re-test of 1781/77. I can, however, sense the gold bulls getting excited by this move and wanting a firm close above 1800 and perhaps a base above the figure to carve out a range. Our clients, on a net basis, are not buying into that theory with 72% of open positions in XAUUSD now held short. A position that marries with the net belief that the USD should find buyers into this pullback.

In our universe of ETFs (traded on MT5), the SIL ETF (silver ETF) has worked well and seen, as has the GDX ETF (gold miners). On the stock side, Newmont (NEM) closed above its top Bollinger Band (3 std dev) – a statement in itself given this has only happened 15 times since 2000. As a play here, if price can push through the 200-day MA then this could be a $60 stock soon enough – happy to cut this through $54 and out through $53.

Staying in the thematic space, uranium is the play of the day, with the URA ETF (Global X Uranium) up 6.8%, to new all-time highs, and seeing massive volume in the process. The LIT ETF (Lithium ETF) has also rallied strongly +4.7%, closing above the 50-day MA- new all-time highs beckon.

Looking ahead

The focus turns to China CPI/PPI (12:30 AEDT) to gain a sense if this spread can blow out even further, pressuring corporate margins. Aussie employment data is due at 11:30 AEDT, where the consensus is for 110,000 jobs lost, and the unemployment rate to push up to 4.8% - the participation rate will be key here - watch AUD exposures here. On the corporate side, JPM get the ball rolling on earnings when they announce at 22:45 AEDT, so one for the stock traders with the market implying a 2.3% move (up or down) on the day.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted..