Analysis

- Any impact the lower liquidity environment has on market movement

- Whether funds square positions into year-end or chase the tape

- Trends in Omicron and public health officials’ views on restrictions

- US Core PCE inflation – the market expects 4.5%, the highest level since 1989 – a number north of 4.7% would be a surprise and get the USD firing.

The USD index found support into and below 96 throughout last week and eyes a move to the top of the range and double top at 97 – a break of 1.1186 in EURUSD would subsequently see the USDX break 97 so that should be on the radar. On the week, the bigger USD moves were seen vs the CAD and NOK, and this bring crude into the picture, where we see WTI crude breaking below the $73.30 to $69.40 range it held for over a week – a closing break here could set off negative directional flow in the petrocurrencies.

EURUSD daily

(Source: TradingView - Past performance is not indicative of future performance.)

Positioning is skewed long in USDs, so the prospect of position squaring into year-end is elevated, as it is with equities and other markets. That said, Fed governor Waller gave the USDX a tailwind on Friday when he suggested balance sheet runoff (or ‘Quantitative Tightening’ or QT) could commence in one or two meetings after rates ‘lift-off’.

Jay Powell lay the groundwork on QT in the last FOMC meeting, but this is a new development the market will have to grapple with, as letting Treasuries mature and passing back the principal and interest back to the US Treasury in Q3/Q4 2022 is genuine monetary tightening, especially when it occurs concurrently with rate hikes.

The last case study where the Fed tried to tighten through both reducing its balance sheet and rate hikes was 2018, with the markets forcing the Fed to pivot dovish is fresh in many traders’ minds.

Still, a lot must go right to get here to get to the double tightening scenario and I sit in the camp that the Fed may be hitting the right notes to a broad range of market watchers, but they retain strong optionality here - a decent tightening of financial conditions – say a 10% drawdown in the S&P 500 - will have them walking back the tightening fairly quickly.

Again, we go back to our friend the (bond) yield curve – if we see signs of inversion (i.e. longer-term yields fall below short-term yields), as we saw in 1999 and 2006, and the Fed will have no choice but to pivot or the market will take its pound of flesh.

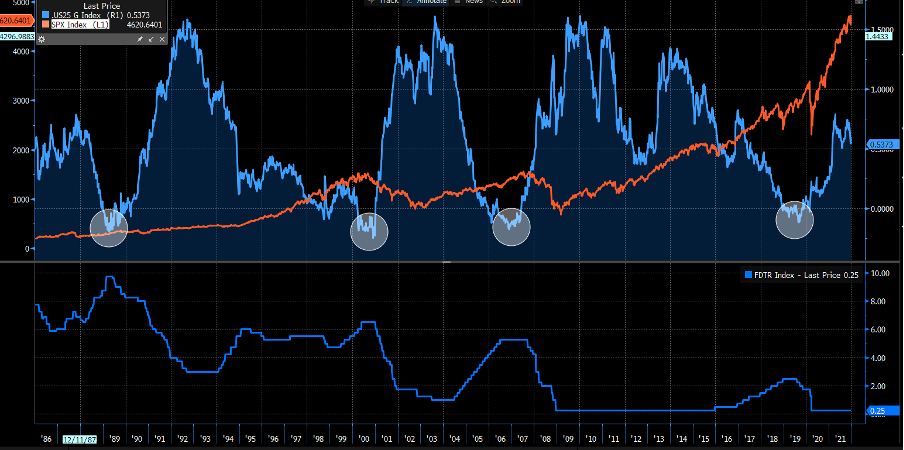

Top pane – US 2 v 5 yield curve & S&P 500, lower – fed funds rate

(Source: Bloomberg - Past performance is not indicative of future performance.)

Most will look at the US 2s v 10s yield differential and whether we see this break down through 73bp – a factor which could negatively impact equities and risk FX – ironically, in this scenario while we may see rate hikes modestly priced out of the USD, we could see it outperform on safe-haven flows – the left side of the USD smile theory.

It seems a tall order to think we’ll get a volatility shock this week, but the platform is certainly growing for this to play out in the weeks ahead.

The S&P 500 fell four of five days last week and much attention has been placed on big tech being shunned. The NAS100 and QQQ ETF getting a workout from both longs and more progressively shorts and the NAS100 fell -3% for the week and eyeing the 100-day MA. S&P500 futures are 0.3% lower on the re-open. Unless we see this flow turn around then it feels like we could be at the mercy of position squaring, rather than chasing, and longs taking some off the table ahead of the calendar year-end.

The idea of poor liquidity could exasperate moves, so this is certainly a consideration. We also have an eye on covid trends and the propensity for restrictions as the case numbers spike. We’re seeing economists already cutting growth numbers for Q1 in various geographies, offsetting this view with a positive bump to Q2 – in the US, Dr Fauci has detailed that he doesn’t see the need for lockdowns at this stage, while the Netherlands has imposed lockdowns and the UK eyeing them. But while central bank actions are the real issue, headlines on Omicron could be seen as the smoking gun for position squaring.

There's simply too many unknowns to make any real calls here. However, as always have an open mind but be mindful that shifts in sentiment could be felt far more than would typically be seen given the time of year. We live in very interesting times in markets and you can trade the potential opportunity with Pepperstone.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted..