- English

- 中文版

How is Westpac share CFD price expected to perform during 2022?

Some basic information about Westpac

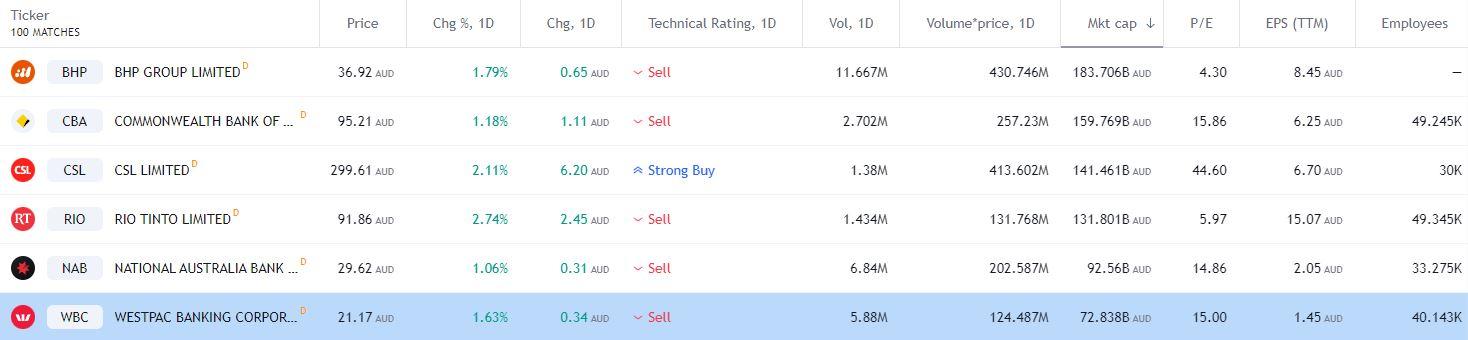

Westpac Banking Corporation, short code WBC, is the third largest bank in Australia by market cap, trailing behind the Commonwealth Bank of Australia and National Australia Bank.

Figure 1 Trading View Market Cap

Referred to simply as Westpac, they are known as Australia’s First Bank and employ over 40 thousand people.

The rally from 2020 lows

The Westpac share CFD price performed well with a rally of just over 100% from the 2020 low of 13.47, to the June 2021 high of 27.12.

Westpac Share CFD Price Monthly Chart

Figure 2 Trading View Westpac 100% increase

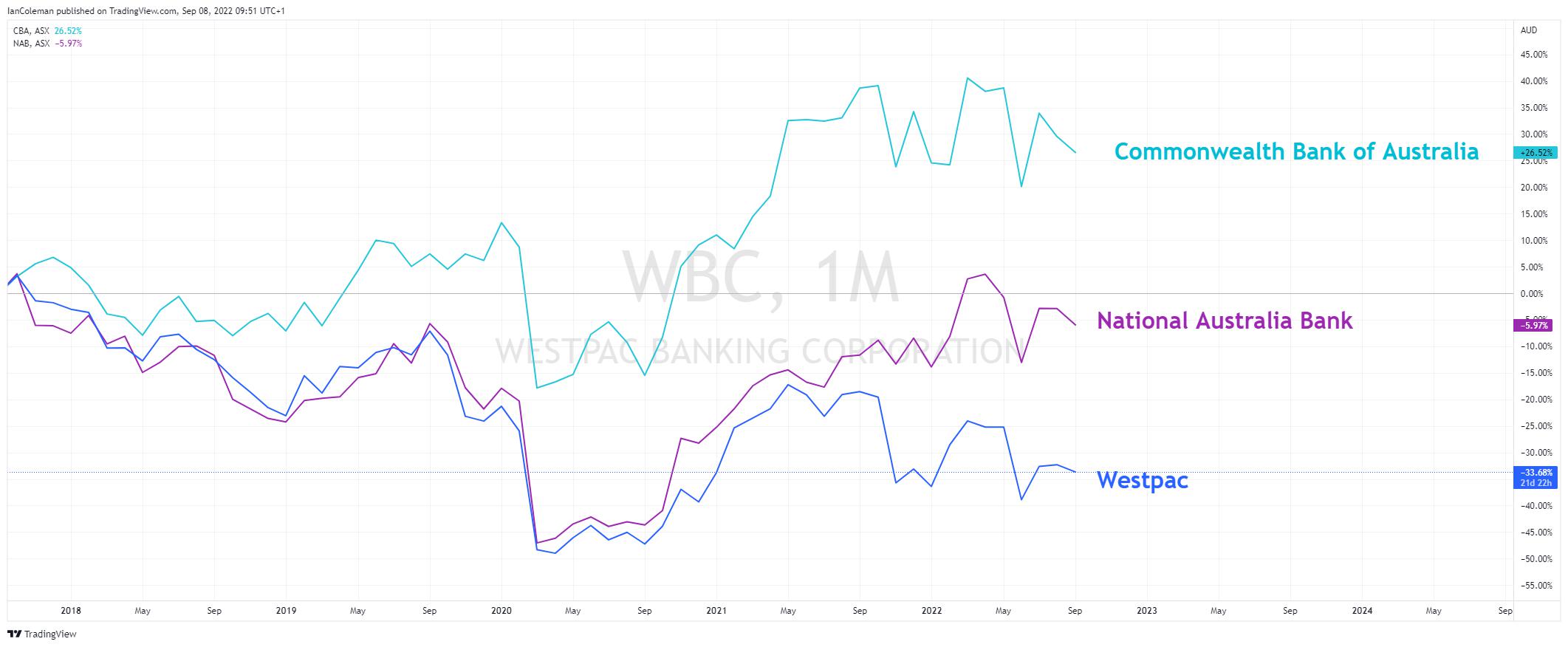

But how did the Westpac Share CFD Price perform against its peers?

The Australian Banking sector has seen a broad-based rally from the 2020 base. In the chart below we can clearly see Westpac underperforming against the likes of Commonwealth Bank of Australia and the National Australia Bank over the same period.

Figure 3 Trading View Banking Sector performance

A look from a technical perspective

A look at the weekly chart and we see two dramatic moves to the downside. The first occurred in the week 1st November. This was after earnings missed by a dismal -5.3%. The second occurred when the RBA, The Reverse Bank of Australia, stunned the market with a higher-than-expected interest hike of +50 basis points. This was the biggest hike in 22 years and took the rate to 0.85%.

Westpac was one of the first big banks to pass on the full increase to its variable home loan customers.

Westpac Share CFD Price Weekly Chart

Figure 4 Trading View Weekly declines

Where to now for the Westpac Share CFD Price?

The choppy and erratic price action in the Westpac share CFD price has resulted in an Expanding Wedge being posted on the weekly chart. Although this formation has a mild bias to break to the upside, there is ample scope for a move in either direction in the short term.

Westpac Share Price Weekly Chart

Figure 5 Trading View Westpac Expanding Wedge

One possible support level to watch is 16.41. That would form a bullish technical cypher pattern known as a Gartley – 222. The next earnings report is due on the week 6th of November.

Westpac Share CFD Price Weekly Chart

Figure 5 Trading View Westpac Gartley

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.