- English

- Italiano

- Español

- Français

Analysis

They're not alone in that call. Like any call, one should not blindly follow it in, but for me the logic and reasoning is always fascinating and is most important.

I don’t trade TIPS (Treasury Inflation Protected Securities) specifically, which would be a direct way to trade the call, but over the past decade we've seen US Treasuries adjusted for expected inflation or ‘real’ yields, being the independent variable, driving the USD, Gold and Tech. It made me consider the USD and more so Gold.

You can find more on US bond markets on the St Louis Fed website, although it's delayed.

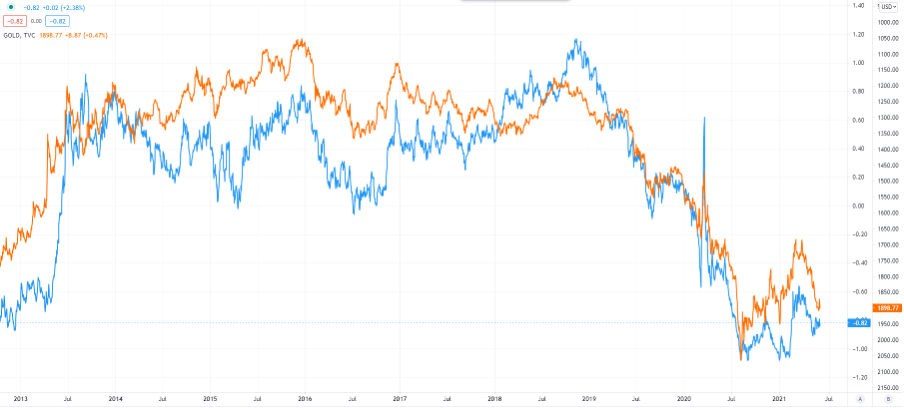

Orange – Gold (inverted). Blue – US 10yr real yield

(Source: Tradingview)

To visualise the dynamics, I've put together a playbook which focuses on the core driver of the Gold market – US Treasuries, real and nominal. The VIX index you can see on the MT4/5 or cTrader platforms is effectively the implied volatility in the S&P 500 over the coming 30 days – a proxy of equity volatility.

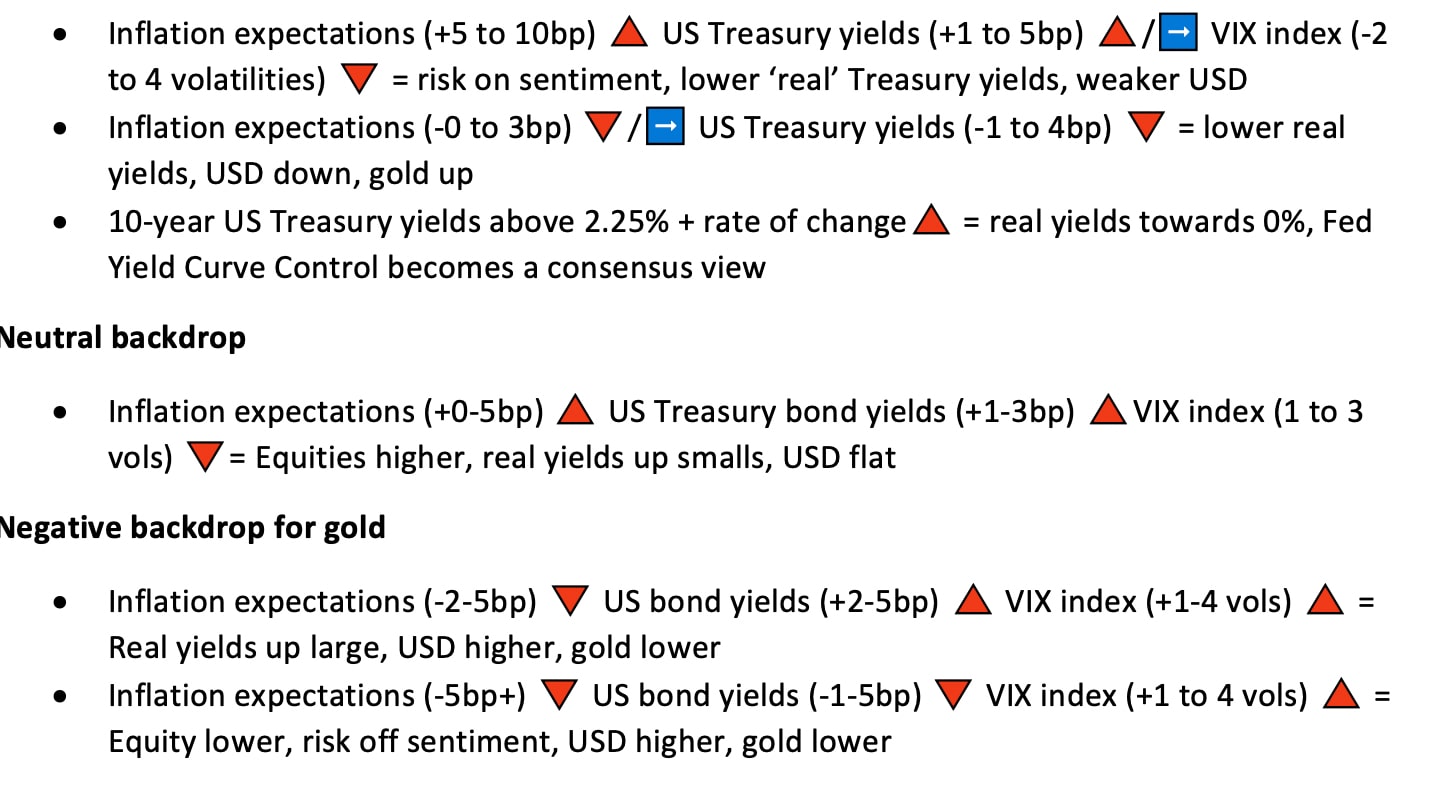

Here’s how I see the plays and breakevens equal inflation expectations over the coming 5 or 10 years.

Bullish backdrop for gold (in order of impact)

This may be confusing to some, which is why price action is always the best place to start in this business. For macro heads, this matrix could be helpful and if indeed we're moving into a higher real rates environment, the prospect is of a stronger USD, then a weaker Gold price could play out.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.