CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.1% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

A Traders’ Week Ahead Playbook: living in interesting times

Tesla and Netflix will be the trader favourites this week, with the options markets implying moves (on the day of reporting) of -/+ 5.4% and 7.5% respectively. Tesla needs to pull something out of the bag to turn sentiment around and we see price having lost 20% in the past 14 days. Netflix comes off the back of a 16.1% rally on the day of reporting Q323 numbers, so longs will be hoping for something similar, to take price above $500. A daily close below the 50-day MA and I’d be exiting longs.

Conversely, the HK50 and CHINAH were savaged by over 5% and shorts continue to be the play, although a surprise cut to the 1 & 5-year Prime Rate would cause a decent reversal higher.

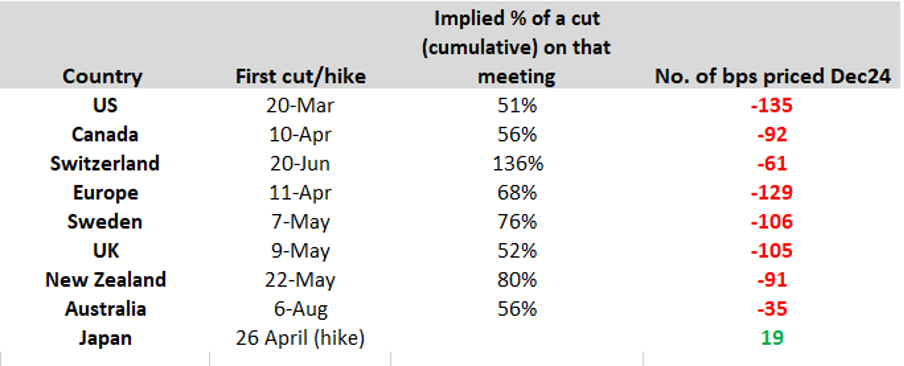

Pushback from several central bankers on the start point and extent of rate cuts (priced into swaps markets) caused front-end bond yields to move higher last week, with the market reevaluating whether March is indeed the start date for many central banks to start a cutting cycle. In the case of the Fed, the implied probability has fallen to 50%, and this pricing should hold firm until we see core PCE print later in the week – The USD holds a fair relationship with the evolving implied pricing for a March Fed cut, where rate cut probability falls the USD rallies (and vice versa).

The broad USD vs implied chance in % of a 25bp cut in the March FOMC

The USD was the best performing G10 currency last week but with the ECB meeting in play this week, there are reasons to think EURUSD could push back into the 1.0950/70 area. The NZD gets close attention given the Q4 CPI print due and we’re seeing signs of diverging paths between the RBA and RBNZ in market pricing – looking for NZDUSD shorts on a momentum move through 0.6100 and AUDNZD longs at current spot levels, adding on a close through the 200-day MA.

The flow and set-up in gold is a little messy and the price is chopping about – no real directional bias in the near term and would look at selling rallies on the week into $2055 and buying dips into $2000.

While Nat Gas is getting good attention given price is in freefall, Crude is also on the radar with rallies recently sold into $75.20 and dips bought at $70 – A break on either side of that range could be meaningful.

Politics also comes into focus with the New Hampshire REP primary held on Tuesday – it won’t be a market event but could pull Trump one step closer to becoming the REP nominee, a fate most fully expect.

Good luck to all.

Marquee economic data for traders to navigate:

China 1 & 5-year Loan Prime Rate – After the PBoC surprised and left the Medium-Lending Facility (MLF) rate unchanged last week the market now assumes the PBoC will also leave the 1 & 5-year prime rate unchanged at 4.2% & 3.45% respectively. The CHINAH was the weakest major equity market last week (-6.5% wow) and could revisit the October 2023 lows unless we see something far more definitive from the Chinese authorities.

BoJ meeting (23 Jan no set time) – this should be a low vol affair, where expectations for policy change at this meeting are incredibly low, and one would be highly surprised if the BoJ lift rates out of negative territory. Consider the BoJ will provide new CPI and GDP forecasts at this meeting, and they could be very telling of the future need to move away from a negative rate setting.

NZ Q4 CPI (24 Jan 08:45 AEDT) – the market sees Q4 CPI running at 0.5% QoQ / 4.7% YoY (from 5.6%. This is a clear risk for NZD exposures, where the outcome could see the market questioning if the RBNZ cut before/later than current pricing (in swaps) to start easing in May with 91bp of cuts priced by year-end. I like AUDNZD upside on growing central bank policy divergence.

EU HCOB manufacturing and services PMI (24 Jan 20:00 AEDT) – the market sees both surveys modestly improving at 44.8 (from 44.4) and 49.0 (48.8) respectively. A services PMI read above 50 would likely promote EUR buying.

UK S&P manufacturing and services PMI (24 Jan 20:30 AEDT) – The consensus is that we see the manufacturing diffusion index improving a touch to 46.7 (from 46.2), while services should grow at a slower pace at 53.0 (53.4). GBPUSD is carving out a range of 1.2800 to 1.2600 and I’m happy to lean into these levels for now.

US S&P global manufacturing and services PMI (25 Jan 01:45 AEDT) – the market looks for the manufacturing index to come in at 47.5 (from 47.9) and services at 51.0 (51.4). A services PMI print below 50 could cause some gyrations in the USD and equity.

Norges Bank meeting (25 Jan 20:00 AEDT) – The Norwegian central bank will almost certainly leave interest rates will stay unchanged at 4.5%. The market prices the first cut from the Norges Bank in June, with 107bp of cuts priced this year.

Bank of Canada meeting (25 Jan 01:45 AEDT) – the market prices no chance of action at this meeting. The first cut from the BoC is priced in April with 101bp of cuts priced this year, so USDCAD (and the CAD crosses) tone of the statement.

Japan Tokyo CPI (26 Jan 10:30 AEDT) – the market looks for headlines CPI to come in at 2% (from 2.4%), and super core at 3.4% (3.5%). The CPI print would need to miss/beat by some margin to cause a move in the JPY given the print is seen so soon after the BoJ meeting.

ECB meeting (26 Jan 00:15 AEDT) – the market ascribes no chance of a cut at this meeting, but the ECB will provide new growth and inflation forecasts. Recent communication from multiple ECB members suggests a growing consensus for a cut in June, although EU swaps pencil in the first cut in April (priced at 82%), with 136bp of cuts priced by December.

US core PCE inflation (27 Jan 00:30 AEDT) – the median estimate is for headline PCE to come in at 0.2% QoQ / 2.6% (unchanged) and core at 0.2% QoQ / 3% YoY (from 3.2%). US swaps put the probability of a cut in the March FOMC at 50%, so the PCE inflation data could influence that pricing and by extension the USD.

New Hampshire (NH) REP Primary (23 Jan) – Donald Trump is leading Nikki Haley in the polls by 15ppt in NH, with Trump picking up votes with Vivek Ramaswamy recently exiting the race, while Nikki Haley is benefiting from Chris Christie’s recent departure. Haley must win here or come very close, or her chances of becoming the REP nominee drop sharply. There is talk that Haley may drop out after NH if she doesn’t come close to gaining the most votes in NH, although she may still run in the South Carolina Primary (24 Feb) given it’s her home state – either way, the race for the REP nominee could essentially be over depending on the outcome of the NH primary. Polls close at 8pm EST, so we should know the outcome shortly after that.

US earnings – GE, Procter & Gamble, IBM (24 Jan after-market), Netflix (24 Jan 08:00 AEDT), Tesla (24 Jan after-market), Visa, Amex, Intel

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.