- English

- Italiano

- Español

- Français

Analysis

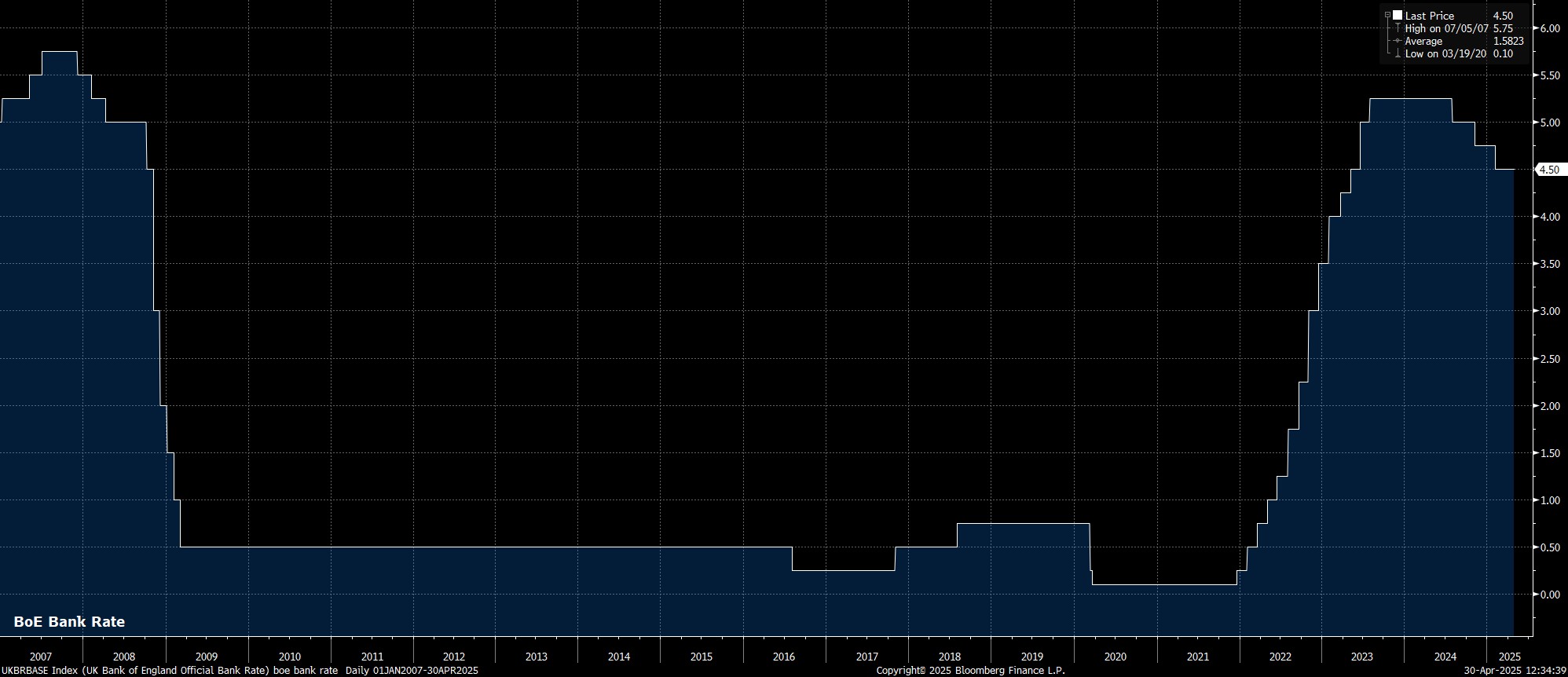

As noted, Bank Rate is likely to be reduced by 25bp at the May meeting, in a move that will mark the second rate cut this year, and the fourth rate cut of this cycle, taking Bank Rate to 4.25%, its lowest level since the autumn of 2023.

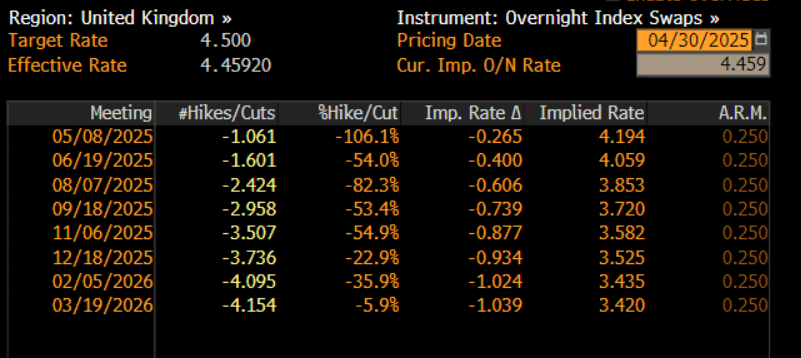

Money markets, per the GBP OIS curve, fully discount a rate reduction at the May meeting, seeing around a 95% chance of a 25bp cut, while also pricing a modest 5% chance of a larger 50bp move, though this latter outcome seems a long shot. Looking further ahead, the curve discounts a total of 95bp of easing by year-end, expecting Bank Rate to end the year around 3.50%.

As has been the case for some time now, when it comes to the ‘Old Lady’, of much more interest than the rate decision itself, will be the vote split and diverging views of MPC members. This time around, it seems nailed on that all 9 members of the MPC will vote in favour of a rate reduction, the only question being whether they prefer a 25bp, or 50bp move.

External member Dhingra, by far the most dovish on the MPC, seems likely to vote in favour of a larger cut, given long-standing concerns over downside growth risks facing the UK economy, which are likely to have intensified in recent weeks amid further headwinds stemming from President Trump’s tariff policies. Fellow external members Taylor and Mann are also candidates to dissent in favour of a larger move, though the former seems a more likely candidate to do so, given how Mann’s previous dissent in favour of a 50bp cut was designed to send a forceful signal as to the appropriate level of restrictiveness, as opposed to being an outline of her preferred future policy path.

The remaining MPC members – Governor Bailey, his three deputies, Chief Economist Pill, and external member Greene – are all likely to vote in favour of a 25bp cut. Hence, my base case stands as a 7-2 (25bp/50bp) vote split, though a more dovish outcome is a distinct possibility.

Meanwhile, the MPC’s updated policy statement will also be closely watched, again as the chances of a dovish pivot grow, amid increasing downside growth risks facing the UK economy.

Up to now, since the easing cycle begun, the MPC have noted how a ‘gradual’ approach to removing policy restriction is appropriate, adding that such an approach must also be ‘careful’ in the February statement. This language, however, could well be tweaked this time around, either via the removal of the ‘careful’ guidance, or the removal of both words, to imply a more rapid pace of policy easing now being appropriate.

Sticking with the statement, it will also be pivotal to see whether the MPC reiterate that policy must ‘remain restrictive for sufficiently long’ in order to bear down on the risks of persistent price pressures becoming embedded within the UK economy. While a more unlikely change than the aforementioned tweak, a shift in language here would also be a dovish signal, opening the door to faster cuts moving forwards. In any case, the MPC will likely still reiterate that policy will be made on a ‘meeting-by-meeting’ basis.

The May MPC meeting will also see the Bank release an updated round of economic forecasts, as part of the latest Monetary Policy Report.

Clearly, since the last forecast round in February, the entire global economic outlook has been turned on its head, as a result of the sizeable tariffs that the US has imposed on imports from all trading partners. While the UK appeared to get off relatively lightly, with ‘only’ a 10% levy imposed on exports to the US, such a tariff rate, and the uncertainty that the ever-changing nature of US trade policy brings, both pose significant downside risks to the UK’s growth and inflation backdrops.

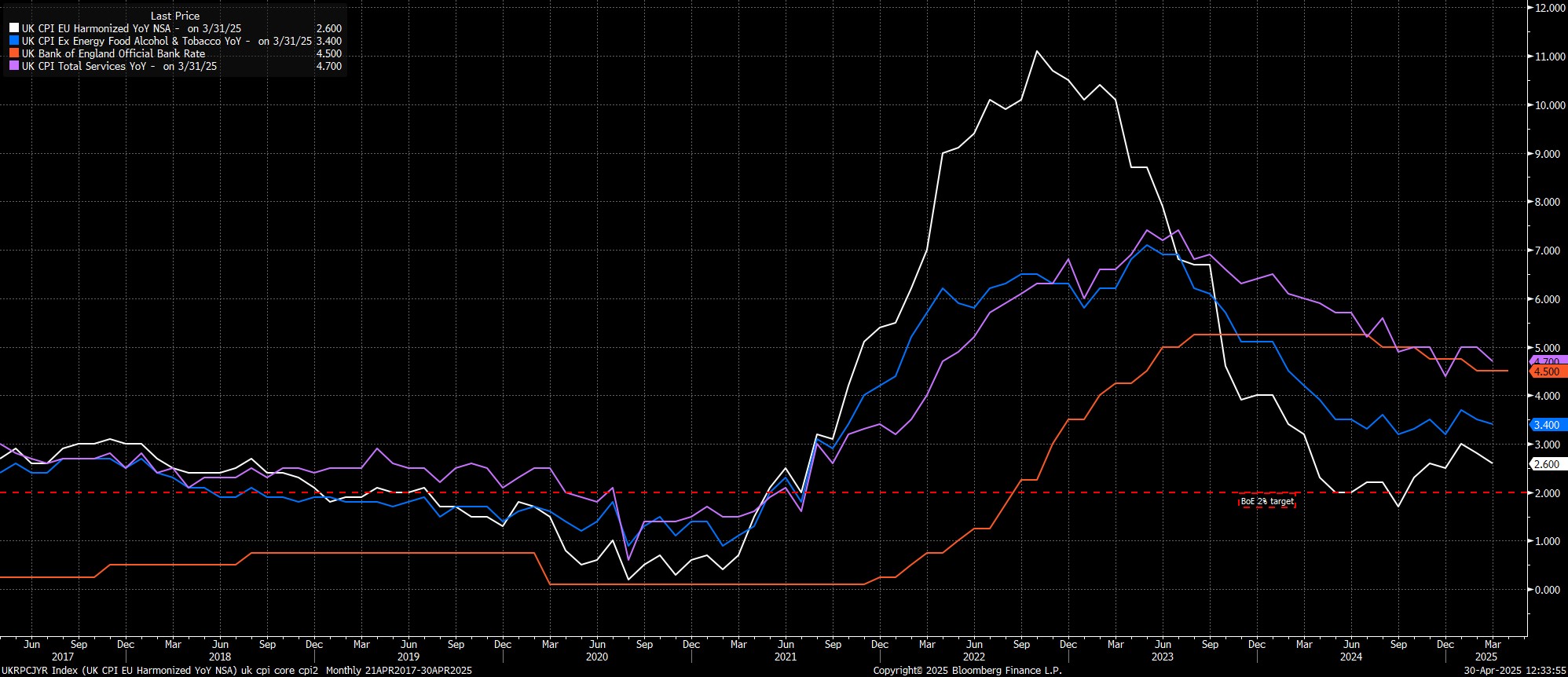

On inflation, the CPI path seems likely to be revised lower throughout the forecast horizon, owing not only to the aforementioned tariff impact, but also to the softer than expected price pressures seen during Q1, particularly in the services sector. Though a ‘hump’ in Q2 & Q3 remains likely, as the effects of April’s annual price hikes, and the National Insurance changes, are passed through, the Bank may revise their CPI peak down from the prior 3.7% call, while also potentially bringing forward expectations of when inflation will achieve the 2% target, from the current Q4 2027.

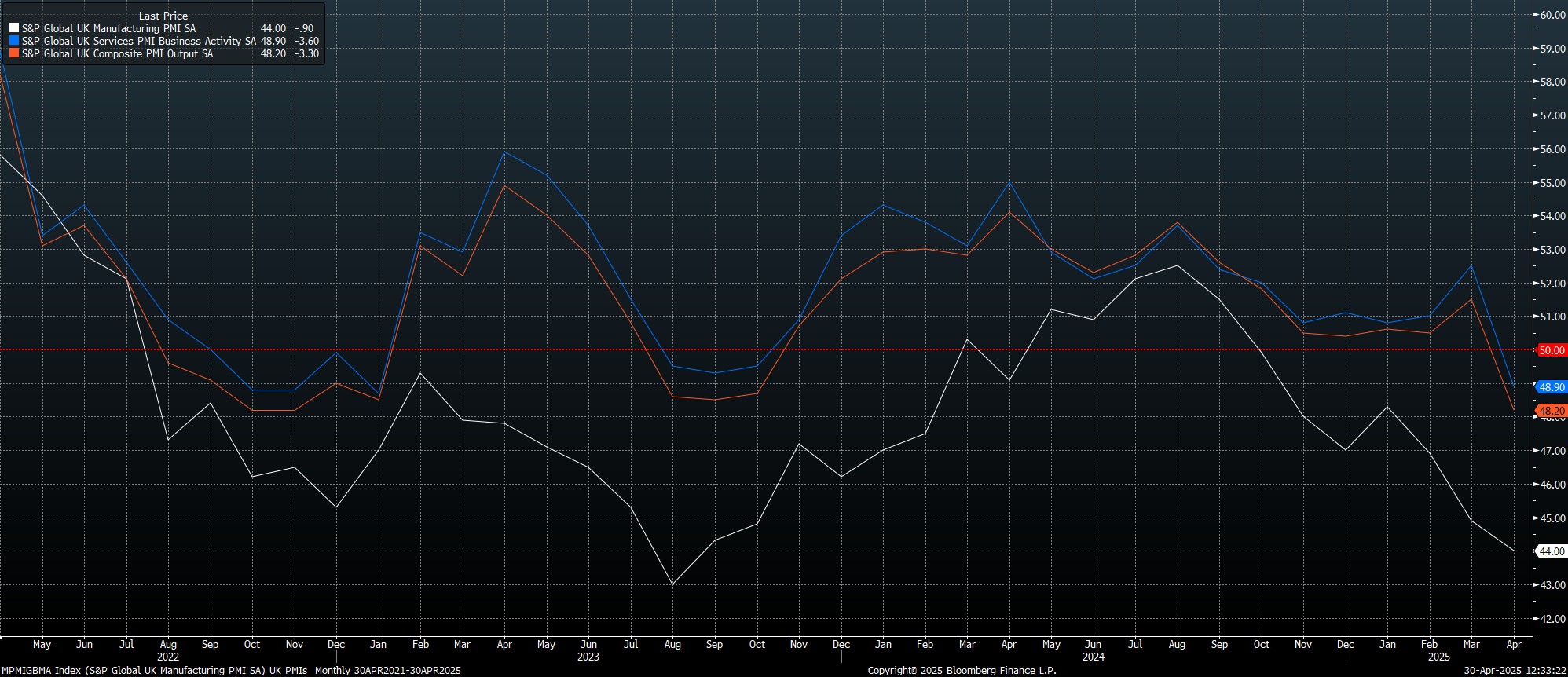

Meanwhile, on the growth side of proceedings, the Bank seem likely to revise down the GDP growth profile, at least in the short term, reflecting the initial economic headwinds posed by the tariffs that have been imposed. February’s call for 0.3% GDP growth in the second quarter, and for 0.8% GDP growth this year, both now seem rather over-ambitious, especially considering the recent plunge in PMI surveys, with the composite output gauge slumping to a 29-month low in April.

This slower pace of economic growth, where risks also tilt firmly to the downside, is also likely to result in a more significant degree of labour market slack developing, potentially nudging the peak in unemployment closer to 5% towards the back end of the forecast horizon.

After digesting all of that, participants’ attention will shift to Governor Bailey’s post-meeting press conference.

The presser will provide another opportunity for policymakers to signal an openness to a more rapid pace of easing in the months ahead, with Bailey likely to broadly mirror his recent comments, noting that the MPC is focused on the “growth shock” stemming from tariffs, but that policymakers will also ensure the upcoming “hump” in CPI does not translate into more persistent price pressures. On the whole, though, Bailey is highly unlikely to offer any sort of firm pre-commitment to a particular policy path, even if his language is more dovish than that used previously.

Taking a step back, the May MPC seems like an opportune venue for the ‘Old Lady’ to take a step in a more dovish direction, opening the door to consecutive rate cuts over the summer, providing that the inflation backdrop evolves in line with expectations. Given recent remarks, and amid an increasing belief that the pop in CPI will prove temporary in nature, the MPC’s mindset is increasingly shifting towards cushioning the economic hit that tariffs will inflict on the UK economy.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.