CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.1% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

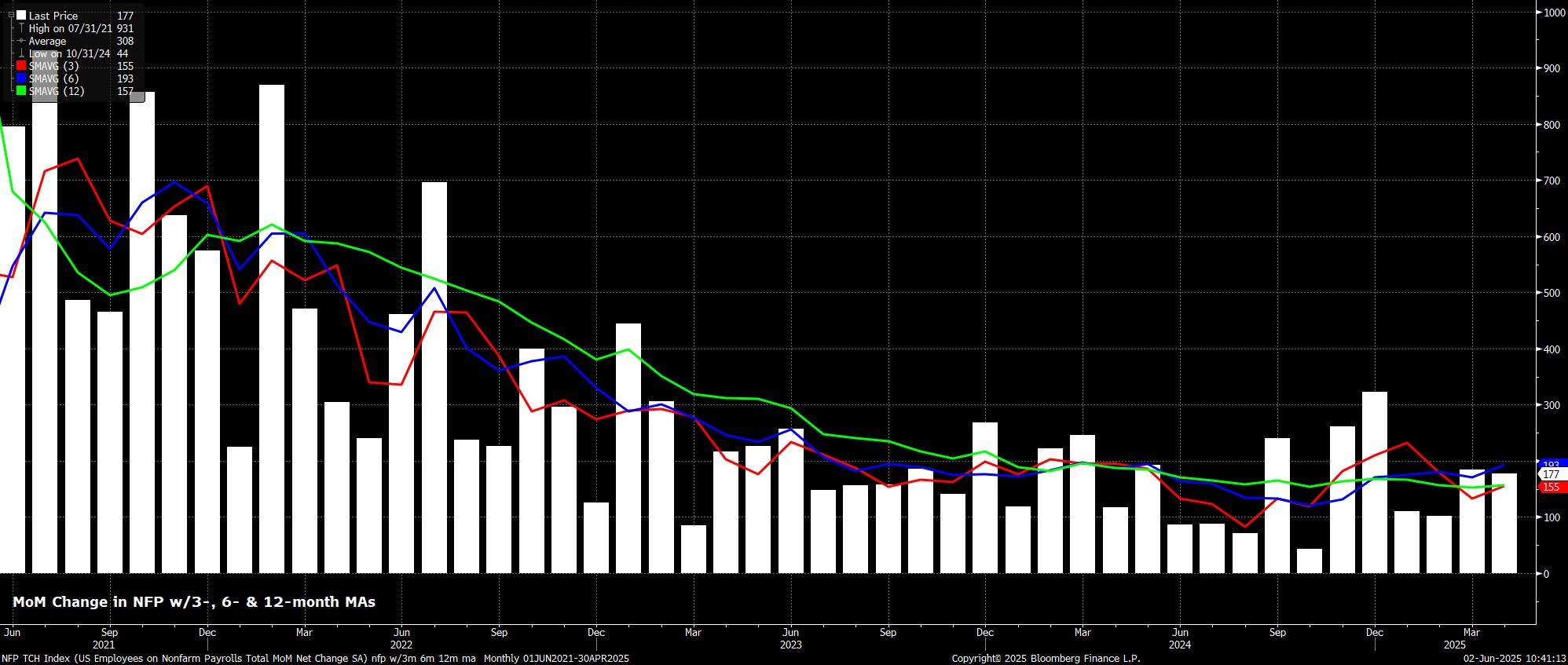

Headline nonfarm payrolls are set to have increased by +125k last month, a notable slowdown from the +177k pace seen in April, albeit one that would still be just north of the breakeven rate – approx. +100k – required for employment growth to keep pace with the increasing size of the labour force. Somewhat unusually, the range of estimates for the print is relatively tight, from +105k to +190k, despite the huge degree of economic uncertainty which continues to prevail. As always, though, revisions to the prior two months of data will be worth watching closely, in addition to the headline print.

Leading indicators for the payrolls print point to the potential for a soft figure. While neither of the ISM surveys have yet been released, both initial and continuing jobless claims rose notably from one survey week to the other, by +10k and +86k respectively, with the latter rising to cycle highs. Meanwhile, though not yet released, the ADP employment metric continues to demonstrate little relationship with the ‘official’ payrolls data, while I’ve been forced, at least temporarily, retire the NFIB hiring intentions survey as a leading indicator, given some rather erroneous projections in recent months.

In addition to those leading indicators, there are a host of other factors that could influence the payrolls print.

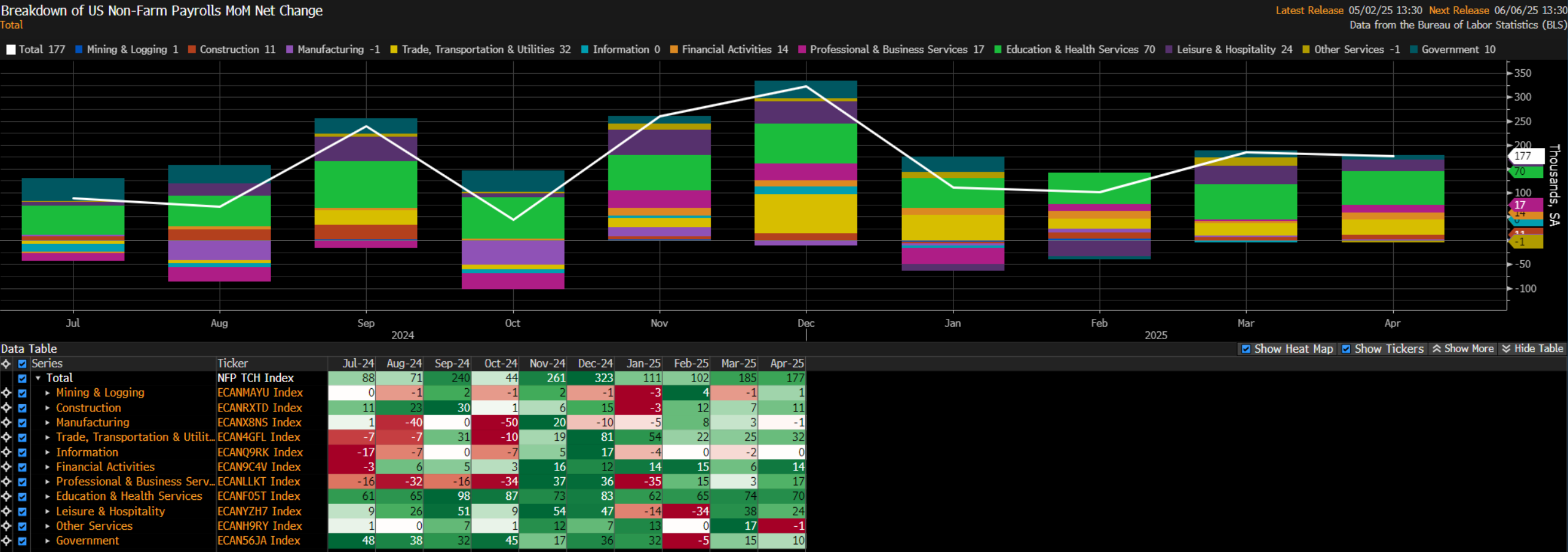

Once again, the timing of the survey week will be key. The ‘trade truce’ agreed between the US and China came right at the start of the survey week, meaning that any positive impact on employment as a result of the détente between the world’s two largest economies is unlikely to have been captured. Furthermore, taking into account the timing of Easter this year, temporary hiring around the holiday likely boosted the April data, and will hence likely be given back this month. Finally, on the timing issue, the transportation sector will bear watching closely, given that the surge in employment as a result of tariff front-running is likely now at an end.

The ongoing federal hiring freeze is another factor which bears consideration, though thus far hiring in both State and Local Government has more than offset any job losses at a national level. Weather may also play a role in skewing the NFP print to the downside, especially with May having seen particularly heavy rainfall, with the most significant impact set to emerge in the Construction and Leisure & Hospitality sectors.

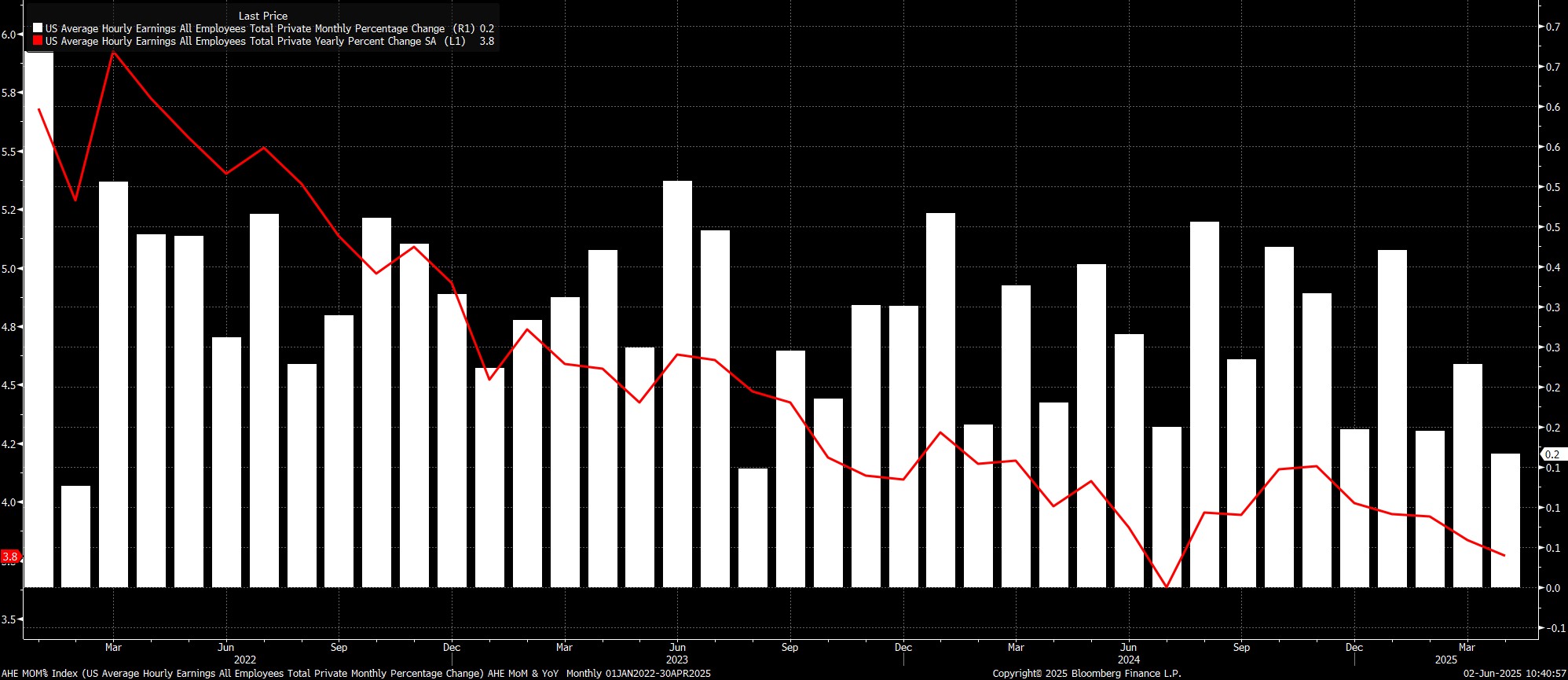

Sticking with the establishment survey, average hourly earnings are seen having risen by 0.3% MoM, just 0.1pp above the pace seen last month, though base effects should ensure that the annual rate cools to 3.7% YoY, from 3.8%. Another factor worth watching here is average work week hours, which may pull back from the prior 34.3 as a result of the slowdown in logistics activity, in turn further skewing the AHE data to the upside.

Even so, earnings figures in or around consensus are unlikely to be of particular concern to FOMC policymakers, though near-term upside inflation risks as a result of sizeable tariffs offset any comfort that this data may bring.

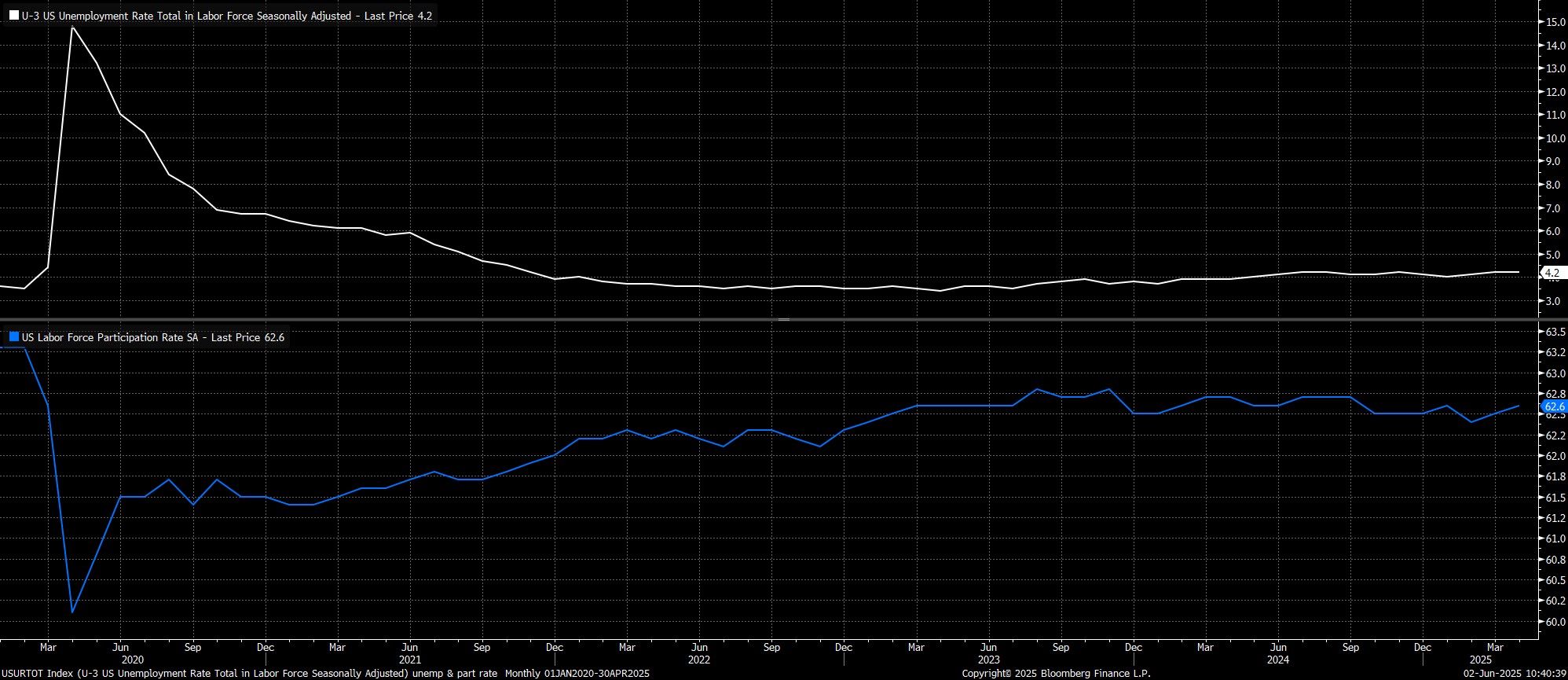

Turning to the household survey, headline unemployment is seen holding steady at 4.2% in May, with labour force participation also set to have remained unchanged, at 62.6%. While the data remains highly volatile, largely owing to falling survey response rates and the impacts of immigration, data of this ilk would reinforce how the labour market remains one where, while the pace of hiring may be slowing, the pace of firing is not picking up.

Also worth noting here is that the unrounded unemployment rate was a relatively ‘inline’ figure last time out, at 4.1874%, further lessening the potential for a shift away from the prior print.

Taking a step back, from a monetary policy perspective, the broader implications of the May jobs report are likely to be relatively limited.

As noted, the FOMC remain firmly in ‘wait and see’ mode, with policymakers attempting to gauge not only how trade developments are shifting the balance of risks to each side of the dual mandate, but also attempting to ensure that inflation expectations remain well-anchored despite ongoing policy uncertainty. With that in mind, and with incoming data thus far painting the picture of a solid underlying economy despite tariff-related shenanigans, any rate cuts before the fourth quarter appear, and will likely remain, a very tall order indeed for the time being.

Meanwhile, from a market perspective, participants appear to remain of the view that good news is exactly that, emblematic of a resilient economy shrugging off trade-related headwinds, but that bad data can be ignored as it’s likely skewed by those very headwinds. This mindset seems unlikely to materially change any time soon and, with the direction of travel remaining one away from escalating tensions, and towards trade deals being struck, the path of least resistance should continue to lead higher for risk assets for the time being.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.