CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.1% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

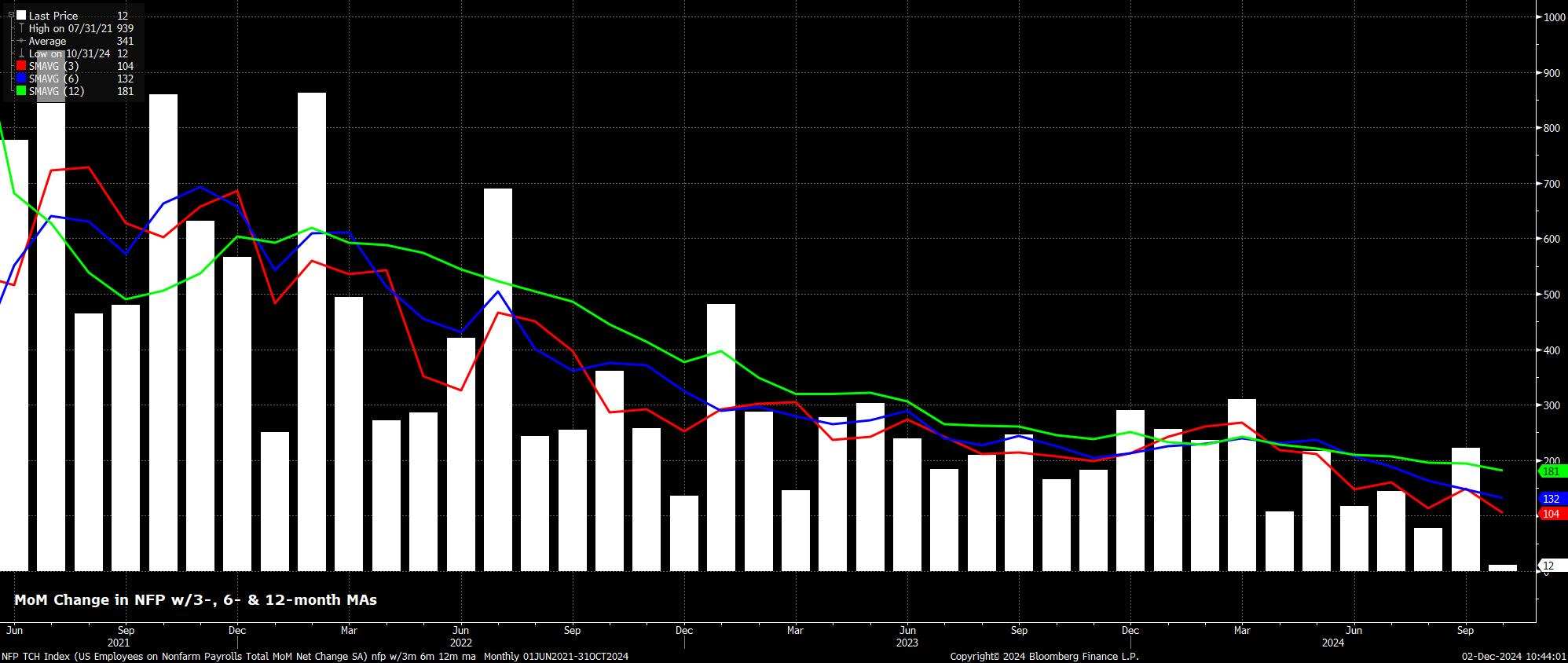

Headline nonfarm payrolls are set to have risen by +200k last month, a considerable improvement from the +12k increase seen in October. That figure, of course, was skewed heavily to the downside by the impacts of strikes at Boeing, as well as Hurricanes Helene and Milton, the vast majority of which should now be unwound, likely adding around 100k to headline payrolls growth. In any case, the range of estimates for the payrolls print is typically wide, from +155k to +270k.

A print in line with consensus would, pending revisions to the prior two figures, take the 3-month moving average of job gains to around +145k – considerably below the breakeven pace required for job growth to keep pace with the expanding labour force, and a sign that the labour market is continuing to normalise in a gradual manner.

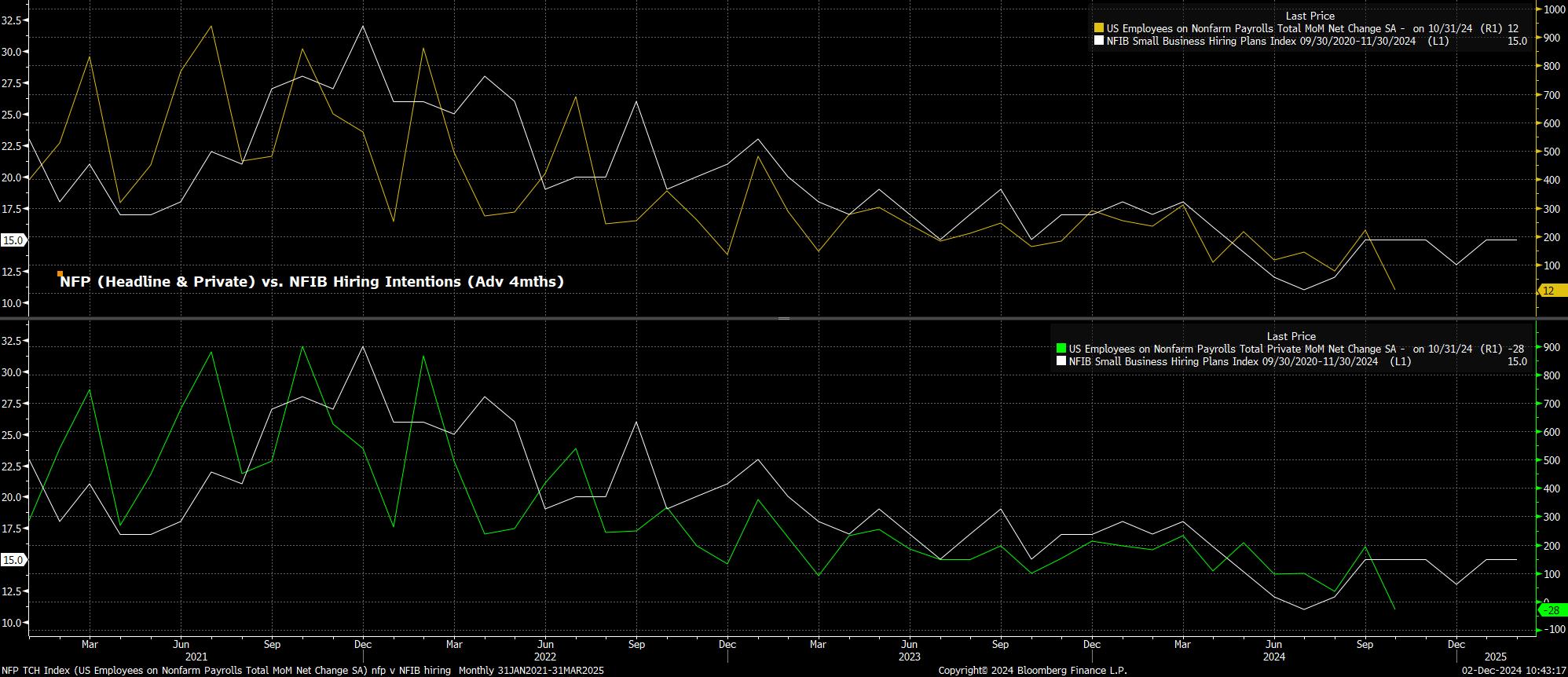

Leading indicators for the jobs report are rather mixed. At the time of writing, neither of the two ISM PMI surveys have yet been released. Furthermore, the ADP report, as always, is barely worth the paper that it’s written on. Meanwhile, initial jobless claims fell by 27k between the October and November survey weeks, touching their lowest level since April. In contrast, continuing unemployment claims have continued to rise, by +19k during the aforementioned period, touching a YTD high 1.91mln in the November survey week.

Nevertheless, the most useful leading indicator of payrolls growth this cycle has been the NFIB hiring intentions index, with a 3-4 month lead. While the survey, understandably, couldn’t predict the weather and strikes which impacted the figure last time around, the index points to headline payrolls growth of around +195k in November, including +150k private payrolls.

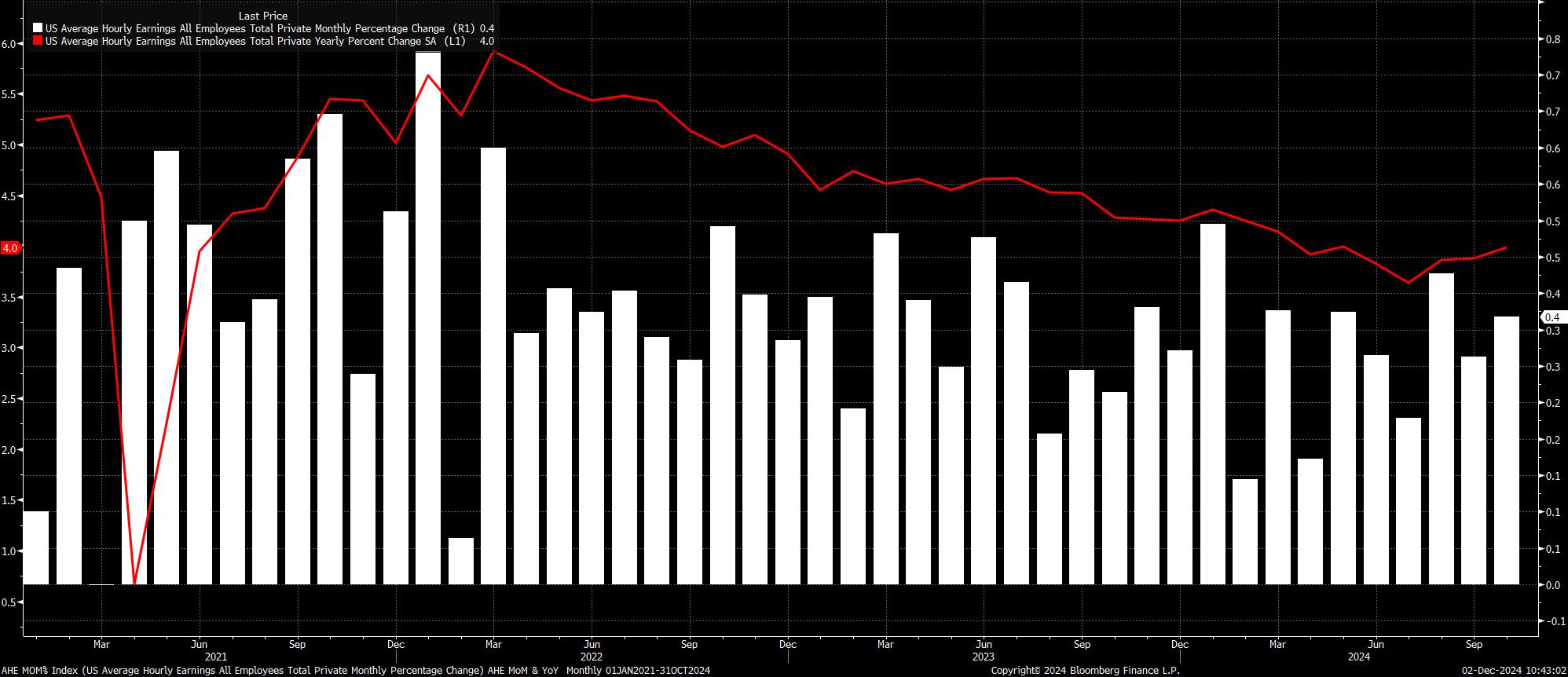

Sticking with the establishment survey, average hourly earnings are set to have risen by 0.3% MoM, just 0.1pp slower than the pace seen in October, likely taking the annual rate of increase to 3.9%, also 0.1pp below that seen a month prior. Risks to these consensus figures is likely tilted to the downside, considering that weather-related job losses disproportionately impacted those on lower incomes, skewing the October earnings figures to the upside.

More broadly, though, the earnings data alone is unlikely to materially alter the policy outlook, with the FOMC having obtained sufficient confidence in inflation returning towards the 2% target, and earnings growth not yet pointing to price pressures becoming embedded.

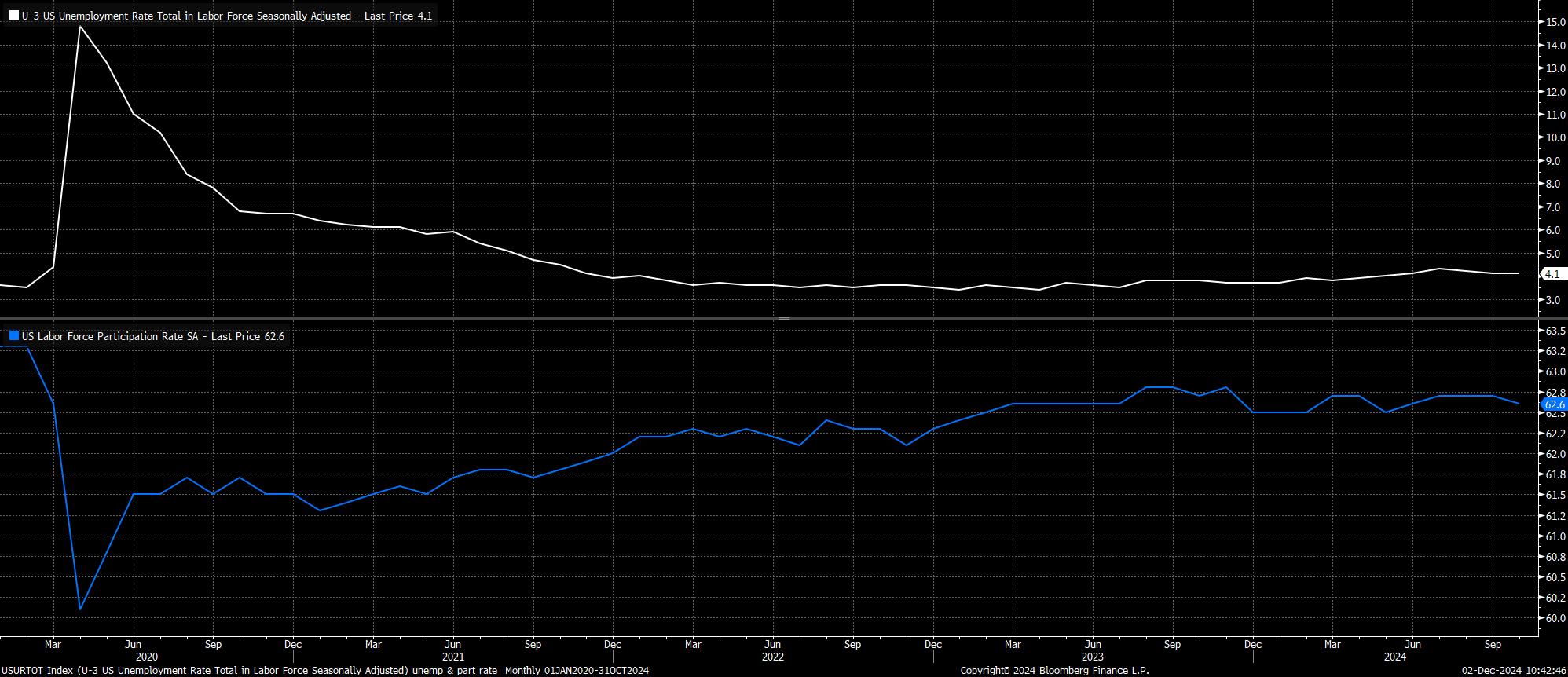

Turning to the household survey, unemployment is seen holding steady at 4.1%, having not risen substantially in October, largely due to those being temporarily unable to work still being classified as employed in the HH survey, in contrast to their classification in the establishment survey.

Concurrently, labour force participation is seen rising to 62.7%, continuing to hold remarkably steady at, or around, the cycle highs seen for much of the last couple of years. As has now become typical, though, the household survey remains highly volatile, owing to falling response rates, and the impact of increased immigration which the figures likely don’t yet fully account for.

Taking a step back, it would likely require a substantially hotter than expected report to deter the FOMC from delivering another 25bp cut at the final meeting of this year, on 18th December, particularly as disinflationary progress has remained intact. While risks around the FOMC outlook are set to become more two-sided into 2025, amid the potential for renewed price pressures as a result of Trump’s tariff plans, the Committee cannot and will not react to this possibility until next year.

For financial markets, the November jobs report is unlikely to be a game-changer, simply reflecting an unwind of the temporary weakness seen a month prior. Furthermore, with liquidity drying up into Christmas, and volumes lighter than usual, markets may suffer with some degree of indigestion as the figures drop.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.