CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.1% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

Trader thoughts - small de-risking across markets as we look towards the ECB meeting

The VIX has dropped modestly below 18%, although S&P 500 1-month 25-delta put volatility has increased relative to call vol, a small sign of index hedging flow, but not a red flag by any means.

In the sectors, defensives rule the day and utilities, staples and REITS outperform vs energy and materials, which both lost ground. Volumes have been ok, with S&P 500 cash volumes 5% below the 30-day average – breadth was fine, with 50% of stocks higher, not a terrible fate given the S&P 500 close. Looking at the tape of the S&P 500 cash session, after a rocky start and a low of 4493, buyers stepped in to drive the market 0.5% off its low.

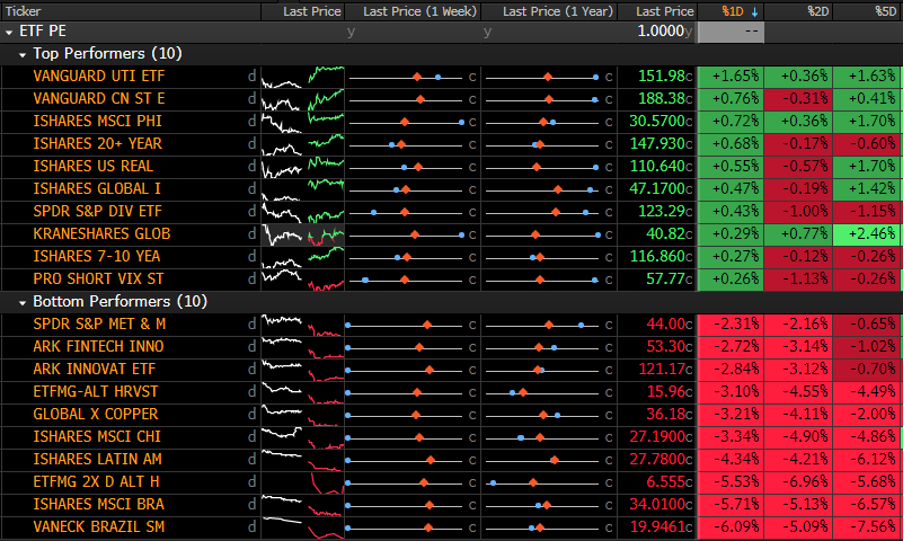

For those who trade ETFs, the VPU ETF (utility ETF) was the best performer in our universe gaining 1.7%, while on the short side, we’ve seen good selling in the XME ETF (metals and mining) and ARK Innovation ETF (ARK). Brazil has also been hit hard, with President Bolsonaro unleashing on the Supreme Court, causing a punchy 3% sell-off in the BRL (real) and seeing investors dump equity - the BRF ETF (Brazil small-cap ETF) has been savaged 6% - one for the radar as the ETF approaches the 18 August swing low of $19.61 – if you like to trade key market thematic’s put our ETFs (found on MT5) on the radar and trade them long and short.

(Source: Bloomberg - Past performance is not indicative of future performance.)

Bonds were bid, with US 10yr Treasuries -4bp to 1.33%, and US real rates fell 5bp to -104bp – surprisingly then XAUUSD closed -0.3% to close at 1789, but found buyers into the 1780 support zone – it feels like 1833 to 1780 is the defined range and this is the level to respect for now – the weekly XAU straddle breakeven is $25, so 1813 to 1764 is the range the market has set with a 68.2% level of confidence – arguably the play for mean reversion traders or for those who plough their trade on 4-hour or daily charts. – I will be doing a live YouTube stream at 3:00pm AEST, so tune in if you can.

Crude has found a better tone rallying 1.5% and eyes a re-test of $70 – We saw supply here last week, so watch price action on a re-run.

USDZAR daily

(Source: Tradingview - Past performance is not indicative of future performance.)

In FX, the USD has firmed modestly, with the DXY +0.2%. ZAR has held in firm on the day despite a fairly dour day across markets and has pushed firmly below the 100-day MA and the 4 August swing – price action-wise, a bearish engulfing on the daily suggests if we see follow-through today that this could really kick lower – happy to trade this from the short side in small size and see a 13-handle as the big figures soon. Consider the AUD, CAD, and KRW – all risk proxies in their own right - have found sellers, with AUDUSD -0.3%. The Bank of Canada meeting was not a vol event and there were no major shocks vs market expectations, leaving asset purchases at C$2b per week.

All eyes on the ECB meeting at 21:45 AEST – my colleague Luke has written on this in more depth if this interests at this stage traders are paring back EUR longs from 1.1900 into the meeting and running a more flat exposure. Our clients are small net short, with 55% of open positions in EURUSD held short, while we see 72% short in EURJPY and 57% in EURGBP.

The big decision for me is what the ECB does when the capital in the PEPP program is exhausted in March 2022 – if they alter the line buying bonds at a “significantly higher pace than during the first half of the year”, changing ‘significantly’ to say ‘moderately’, the market will initially see this that they will be slowing the pace of weekly purchases, but then take that as a sign that the program will expire in March without rolling it over – perhaps a EUR positive. Staff economic projections will garner focus too.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.