Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

Equity climbs the way of worry – partly a function that no news on US banks is good news for risky assets. While we also see bullish flow in US bond markets, and as yields fall the result growth is working well and tech is on a flyer.

It seems as long as rate cuts remain priced around 50bp for 2H23 in the US that momentum favours the brave.

USD volatility is also on the decline, and we see the USDX seeing grind-type price action. That said, the recent trend lower from 6 March may be called into question given the raft of US data out this coming week.

I'm not sure we’ll learn anything new from the US data this week and it may need a significant beat/miss to have the market questioning the hot labour market or whether equity should be pricing a higher probability of a future recession. Trump in court will get the lion's share of headlines, and while it may shake the social fabric in the US, so far, the markets are portraying that it's not something to trade on.

For now, we continue to watch the tape in the US/EU banks and whether bond traders react to the US data flow – the spillover effect, as we know, are higher highs and lows in equity markets and concerns of underperforming a benchmark.

Interest Rate Review

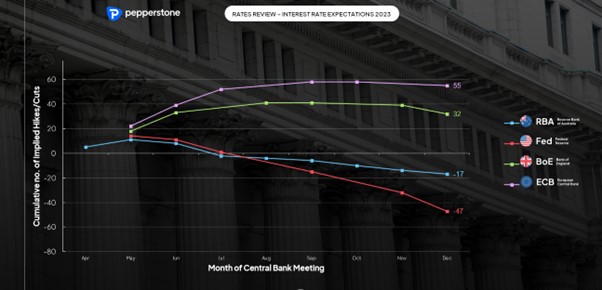

Market pricing and current expectations for the cumulative no. of hikes/cuts for each future central bank meeting this year.

Expected policy response by December:

Fed -47bp

RBA -17bp

ECB +55bp

BoE +32bp

The main event – the key known event risks

US

- ISM manufacturing (4 April 00:00 AEST) – the market eyes the diffusion index at 47.5 (from 47.7), representing a slight increase in the pace of the slowdown in manufacturing. The market is likely more sensitive to a downside surprise (than a beat), where USDJPY shorts would work, and gold could push towards $2000 as US bond yields decline.

- JOLTS jobs openings (5 April 00:00 AEST) – the consensus is for 10.5m job openings, a potential decline from the 10.82m openings seen in Jan. The report could get some headlines but would need a big miss - especially in the job openings to unemployed ratio - to get markets firing on this as the labour market is still very tight.

- ISM services (6 April 00:00 AEST) – consensus is for the index to print 54.3 (from 55.1), a healthy pace for growth in the service sector and in isolation supports a 25bp hike in May.

- US Non-farm payrolls (7 April 22:30 AEST) – while the market is more focused on the banks and inflation, the NFP is still the highlight of the week in terms of economic data – the consensus is for 240k jobs to have been created in March (the economists’ estimates range from 300k to 150k), with the U/E rate held at 3.6% and average hourly earnings falling 30bp to 4.3%. Earnings could be the big factor here, where a weak print could see the NAS100 push further higher and see USDJPY weaker. A big jobs print (above 300k) could sway the prospect of a 25bp hike on 2 May FOMC meeting.

- Fed balance sheet data (H.4.1 report – Fri 07:30 AEST) – The Fed release the take up from financial institutions of credit and loans from its credit programs (including the discount window and Bank Term Funding Program (BTFP)). Can see the update here - https://www.federalreserve.gov/releases/h41/

- Fed speakers – Cook, Mester, Bullard (Bullard discusses the economic outlook on Fri 00:00 AEST)

Australia

- RBA meeting (Tuesday 14:30 AEST) – the market prices just 5bp of hikes for the meeting (a 20% chance), while 16 of 27 economists call for a pause. AUD 1-week implied volatility is subdued at 11.5%, so no fireworks in the AUD are expected from the meeting. I think the RBA hold but the risk of a hike is under-priced. As I said in the RBA meeting playbook, I’d be fading big moves on the day - https://pepperstone.com/en-au/market-analysis/rba-meeting-preview/

- RBA gov Lowe speaks (Wed 12:30 AEST) –RBA gov Lowe speaks the day after the RBA meeting, so it’s a chance to explore the statement and the RBA's thinking in greater depth

- RBA financial stability review (Thurs 11:30 AEST) – likely to say the Aussie banks are well-capitalised. We listen for comments on rising concerns on mortgage repayments in the wake of the fixed-term cliff that is looming in Q2.

NZ

- RBNZ meeting (Tues 12:00 AEST) – market pricing (in interest rate futures) suggests a 25bp hike is a done deal, although there is a small chance of a 50bp hike being priced. Looking out the rates curve we see a peak rate expectation of 5.28% (by July), suggesting the market sees 53bp of hikes in total – the move in the NZD, therefore, comes on how the policy statement reconciles with this pricing.

UK

- BoE speakers – Tenreyro*2, Huw Pill(Wed 02:30 AEST / 17:30 BST)

Europe

- ECB speakers – Simkus, Vujcic, Lane (Thurs 00:00 AEST)

Japan

- Tankan index (Mon 09:50 AEST) – We look across the outlooks for large/small manufacturers and service industry – hasn’t been a market mover for a while, but could get some focus if we see a big beat/miss

- Labor cash earnings (Fri 09:30 AEST) – the market expects a tepid growth in earnings of 1.3%, with negative real wage growth of 2.3%. Unlikely to move the JPY, but the market is on edge for tweaks to BoJ policy in the months ahead.

Canada

- March employment report (Thurs 22:30 AEST) – the market eyes 15k net jobs created, with the U/E rate ticking up to 5.1% and wages also a bit hotter at 5.5% (from 5.4%) – unlikely to move CAD rates which are now on the lookout for signs that the BoC could start to cut policy in 2H23. USDCAD is trending lower and has scope for 1.3400 – would close shorts on a close above the 5-day EMA.

Chart of the day - The NAS100 has rallied 12.5% since the 13 March low, and while starting to look overbought, momentum is clearly strong. The closing break of the bull flag and 12,893 horizontal resistance offers a technical target of 13,800. Price is bull trending and hugging the upper Bollinger Band, with pullbacks contained to the 5-day EMA. Fundamentally, if capital continues to flow into US treasuries and yields – both nominal and real – are grinding lower, then growth stocks and mega-cap tech should outperform. A weaker US non-farm payrolls this Friday and further concerns around the US banks that keep rate cuts priced for 2023 would be a bullish catalyst.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.