Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

At a more micro level, Nvidia takes centre stage with the highly anticipated GTC conference a potential volatility driver for the AI juggernaut. We consider that the findings could impact the wider semiconductor space and even promote volatility across broad markets.

In the playbook, we break down what matters most in each event risk and what could drive market moves above all else, while offering trading thoughts on where the skew of risk resides.

This coming week there will be opportunities across markets, but more importantly, the ability to skillfully manage risk and assess correct position sizing will be where traders live to fight another day.

For a more detailed run-through of the week’s events, as well as analysis of the technical set-ups front of mind and the trades I am reviewing, join the livestream on TradingView on Monday at 1pm AEDT.

Good luck to all.

Key event risk for the radar this week

Nvidia GTC conference (18-21 March)

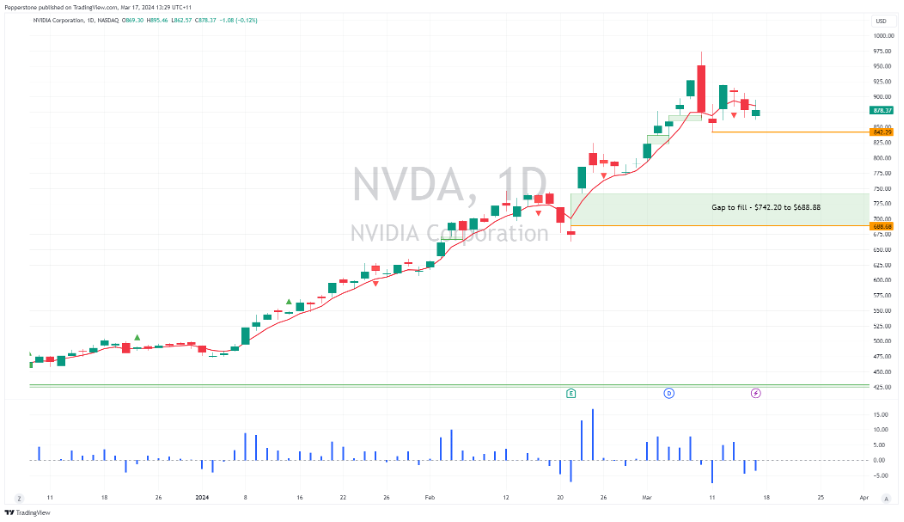

After a record 10 weeks of consecutive gains for Nvidia’s share price, investors get a chance to hear more about the future of generative AI, as well as new products in the pipeline and potential sales opportunities through the lens of the AI market leader. We hear from CEO Jensen Huang (on 18 March) and other key figures within the business. Expectations that the conference will hit the sweet spot are sky-high and the options market implies an -/+11.6% move in the share prices by Friday.

The importance of Nvidia to the broad US and even global equity market can’t be overstated and the read-through to semiconductors and the wider NAS100 is a real risk. AI has been the key equity theme for a while and will continue to be so, and Nvidia is at the epicentre of this. The prospect of a sell-on-fact scenario is a real risk.

Tencent – a key influence on the HK50 index, Tencent report earnings on 20 March with the options market implying a -/+3.8% move on the day of earnings. The HK50 index has formed a wedge pattern within a long-term bear channel – a set-up that needs monitoring – preference to chase strength should price break above 17,200.

FOMC meeting

(21 March at 05:00 AEDT) and Chair Jay Powell’s press conference (05:30 AEDT)

What to focus on:

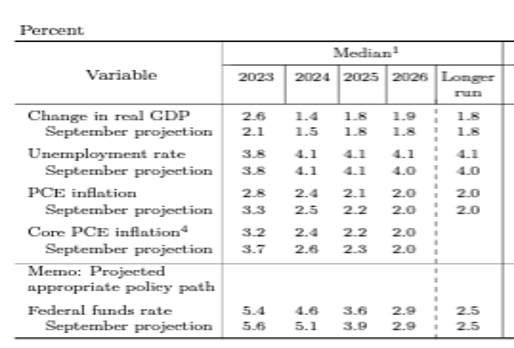

- The Fed won’t cut rates at this meeting and the guidance and overall tone will likely remain unchanged from prior commentary. US interest rate swaps price 75bp of cuts by year-end, so the FOMC statement, economic projection (SEPs) and Jay Powell’s press conference will need to reconcile against that pricing.

- The ‘dots’ are key – if 2 Fed members lift their projection for the fed funds rate in 2024 it will result in the median projection for the collective being reduced to 2 cuts (from 3) through 2024. Given market pricing for 75bp of cuts this year, a move towards 2 cuts for 2024 as the median ‘dot’ should cause US bond yields to spike higher, taking the USD higher and US equity and gold trade lower.

- The longer-term projection for the fed funds rate – or what is considered the ‘neutral rate’ for Fed policy - currently sits at 2.5% - could this be revised higher to 2.75%?

- If the Fed’s 2024 dot for 2024 remains at 4.6% (and for 3 rate cuts), but we also see an upgrade to the 2024 GDP forecast (currently 1.4%), we could feasibly see a relief rally in equity and gold and promote USD sellers.

Trader thoughts: The algo’s will be set to respond rapidly to the 2024 dot, as this is what matters above all else. A move to pencil in 2 rate cuts this year is not consensus but it is a real possibility and would likely see markets implied rate cuts by December 2024 reduced from 75bp to 60bp of implied cuts. This outcome would see the USD spike and see equity and gold trade lower. Conversely, if the 2024 ‘dot’ remains at 3 cuts, then we could see an immediate relief rally in risky assets and gold. The risk to markets seems balanced, so it seems prudent to reduce exposures over the FOMC meeting and look to react accordingly when the facts are known.

For a more thorough preview see Michael Brown’s preview.

BoJ meeting

(19 March – likely seen between 1pm and 4pm AEDT)

- Despite strong union wage increases on Friday, 29 of 31 economists see BoJ rates left at -0.1%, with a view that the BoJ send a strong signal they will hike rates in the April meeting. Market pricing, however, implies a 10bp hike at 50%, suggesting an elevated risk of JPY volatility over the meeting.

- We also look for changes to Yield Curve Control (YCC) and/or the pace of bond and ETF purchases.

Trader thoughts – Again, the algos will play a key role in determining initial market moves, and hedge funds will set them to respond squarely on whether we see a 10bp hike or not. While the broad market is short of JPY it feels that unless we see a 10bp hike and changes to the rate of JGB purchases then it will be hard to promote a material move higher in the JPY.

Swiss National Bank

(21 March at 19:30 AEDT)

- The Swiss swaps market prices the chance of a 25bp cut at 30%

- 18 of 20 economists see interest rates unchanged at 1.75%

Trader thoughts – Two weeks ago the broad view was that the SNB could cut rates by 25bp, perhaps even by 50bp – now the broad consensus view is that the SNB leave policy unchanged at 1.75%. Given market pricing, the risk is we see a bigger move lower in the CHF on a 25bp cut, than any potential rally in the CHF should the SNB leaves policy unchanged. Short CHFJPY and Long USDCHF positions subsequently look attractive – although, as many traders will attest to, trading over news like this needs to be carefully considered and position sizing is of paramount importance.

Banxico

(22 March at 06:00 AEDT)

- Mexican swaps price a 25bp cut at an 80% probability.

- 16 of 18 economists see a 25bp rate cut to get the overnight rate to 11%

Trader thoughts – With a 25bp cut - that commences a potential cutting cycle, largely priced by rates traders, a surprise outcome to leave rates unchanged could see USDMXN trade through 16.65 and into new cycle lows. Should the market get the expected 25bp cut we could see a move through 16.75, but the extent of the rally will be down to the statement and whether there is a strong appetite to cut again soon.

Bank of England

(21 March at 23:00 AEDT)

The BoE statement will likely be a low volatility event for the GBP, with the UK swaps market not pricing the first full 25bp cut until August. Look for a 7-1-1 split decision and a patient stance, with the BoE content with current market pricing on rate expectations.

Trader thoughts – I hold no real directional bias for the GBP from this meeting, so GBPUSD will likely take its direction from the UK CPI print and moves in the S&P500 and broad risk semantics. That said, the trend in GBPUSD skews risks to the downside, and I favour GBPUSD shorts, with stops above 1.2770.

For a more thorough preview see Michael Brown’s preview.

RBA meeting

(19 March at 14:30 AEDT)

- Aussie interest rate futures prices a zero probability of a cut at this meeting, with a full 25bp cut priced by September. We also see 38bp (or 1.5 25bp cuts) priced by December.

- The RBA statement will likely remain largely unchanged, guiding that “it will take some time before inflation is sustainably in the target range”, and “further increase in interest rates cannot be ruled out”. While other central banks actively express a bias for rate cuts, it would be a shock to the market if the RBA opened the door to cuts in this statement.

Trader thoughts – the RBA meeting will likely be a low-volatility affair, and AUDUSD is likely to take its direction this week from the FOMC meeting, as well as iron ore, copper, and Chinese equities. A break of 0.6550 may see the early March lows of 0.6477 revisited, although this would be unlikely unless the VIX index trades into 17% and we see broad de-risking through broad markets.

Norges (Norway) Bank

(21 March at 20:00 AEDT)

The market implies a zero probability of a change in Norwegian interest rates at this meeting, with the first 25bp cut not fully priced until September. I am biased for USDNOK to push towards the top of the range at 10.70.

China PBoC 1 & 5-year Prime rate

(20 March at 12:15 AEDT)

After a larger-than-expected cut last month to the prime rate (the benchmark rate that households and businesses can borrow from commercial banks), the PBoC are unlikely to cut the prime rate again this time around. A surprise cut would therefore likely see Chinese/HK equities rally.

Colombia central bank

(23 March at 05:00 AEDT)

The consensus is for rates to be cut by 50bp to 12.25%. Will this forum be the catalyst to see USDCOP break out of the tight trading range the pair has held throughout 2024?

Brazil central bank

(21 March at 08:30 AEDT)

The overwhelming consensus is that we see the Selic (interest) rate cut by 50bp cut to 10.75%.

Other key economic data points of note

China retail sales/industrial production/property sales (18 March), Canada CPI (19 March), UK CPI (20 March), Australia employment report (21 March), EU manufacturing and services PMI (21 March).

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.