Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

Gold playbook - could inflation fears set off the next bull market?

in a world where Commodities and Crypto have been on a tear and US equity indices are bull trending, XAU has been shunned – is it now time to add some exposure as Gold potentially plays catch up to almost every other asset class?

Certainly, the signs are starting to look promising, with XAU gaining for five straight days – a fate it achieved just seven times in the last 12 months.

Daily chart of Gold

(Source: Tradingview - Past performance is not indicative of future performance)

We’ve seen $80 added to the XAUUSD price since late September - in the process, the price has broken the June downtrend and while it wouldn’t surprise to see a re-test of the former downtrend at $1786 – a rejection here, with good buying through $1890 and we eye the real prize - $1833, where things could get very interesting for traders through here.

A break of $1833 and talk of $2000 will clearly ramp up, but importantly flow dynamics will become a far bigger consideration which could accelerate the rate of change in the move higher - driven by increased demand for short-dated call options, hedging flow from dealers and buying from systematic trend-following funds in Gold futures. A closing break of $1833 would be huge for the Gold market.

I will turn more bearish on a move through $1782

Hedging inflation risks through the Gold market

The notion of hedging rising inflation risks is helping, where market-based measures of inflation expectations have been pushing higher. The 5-year ‘breakeven’ rate (the difference between 5yr nominal US Treasuries and 5yr Treasury Inflation Protected Securities) has recently lifted from 2.43% to 2.94%; an all-time high. The Fed’s gauge of inflation expectations has risen from 2.14% to 2.43% and now eyes the 2.55% level seen in May.

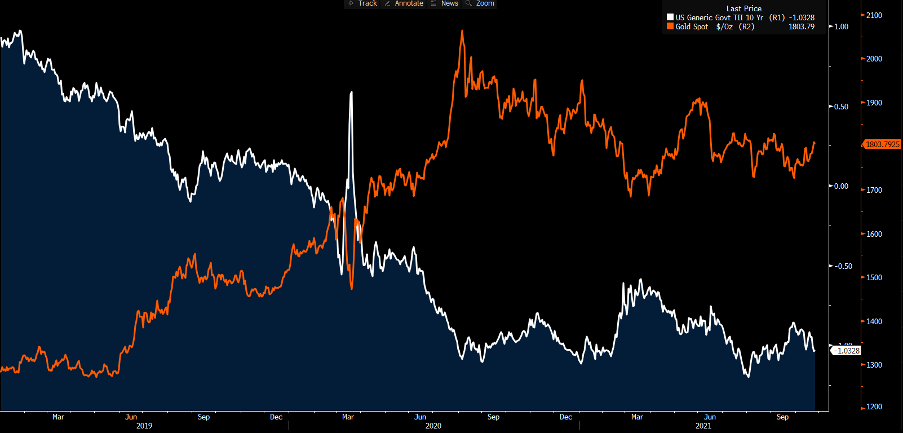

Importantly for Gold we look at US ‘real’ (adjusted for inflation-expectations) rates – that is both towards the Fed funds rate and the Treasury yield, which have been pushing deeper negative, with US 10yr reals (adjusted for inflation expectations) rolling over from -82bp to -103bp. Not only do negative real rates provide a tailwind for inflation in an improving economy, but tactically it offers reasons to buy Gold. As the expected real return in the bond market turn deeper negative, in turn, gold, with no yield, becomes relatively more attractive – it’s here that we see one of the core investment philosophies - Gold as a ‘store of value' proposition.

Gold vs US 10yr real Treasuries

(Source: Bloomberg - Past performance is not indicative of future performance)

As long as market-based measures of expected inflation are moving higher, and central banks are warming to the idea that inflation may be higher for longer then gold should find support. Some have taken this one step further believing that that inflation is starting to show signs of getting out of control. If we do see increased evidence of lasting inflation that could become quite problematic for central banks and government then Gold should fly – but as I say, this still seems a low probability.

The rise in inflation concerns has been met with a strong move higher in short-term bond yields – US 2yr Treasuries have gone from 20bp in Sept to 43bp as the market prices in rate hikes (from the Fed) over this period. A break above 50bp (on the US 2yr Treasury) could start to negatively impact the gold market, especially if the USD started to resume a bull trend. However, the important fundamental factor to watch is whether US real rates keep falling, meaning inflation expectations are outpacing the move in yields.

Could $100 be the next catalyst for Gold bull market?

We should then consider that as long as inflation expectations are being heavily influenced by energy markets, perhaps the big driver of Gold will actually come from energy markets. Nat gas, WTI and Brent crude are therefore front and centre, and if we see crude breaking $100 and NG above $6.50, with a renewed bid in metals, then worries of inflation will push gold higher. It's not just these core inputs, but we watch for any signs of ever-increasing inflation in the data flow too, notably wage data. These could come from corporate headlines or data points such as the US Employment Cost Index (29 Oct), US PCE deflator (29 Oct), ISM manufacturing prices paid (2 Nov) and non-farm payrolls hourly earnings (5 Nov).

As always, it’s important to have an open mind. My own view is that high inflation will be with us for a while, but it should ultimately prove to be manageable. If it does get out of control, I can say with conviction that when the market lets you know they are worried it will not be a one-day affair – recognise the signs early and react accordingly.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.