- English (UK)

Analysis

Where We Stand – An interesting start to the week for markets, yesterday, with the Treasury complex once again providing the most intrigue.

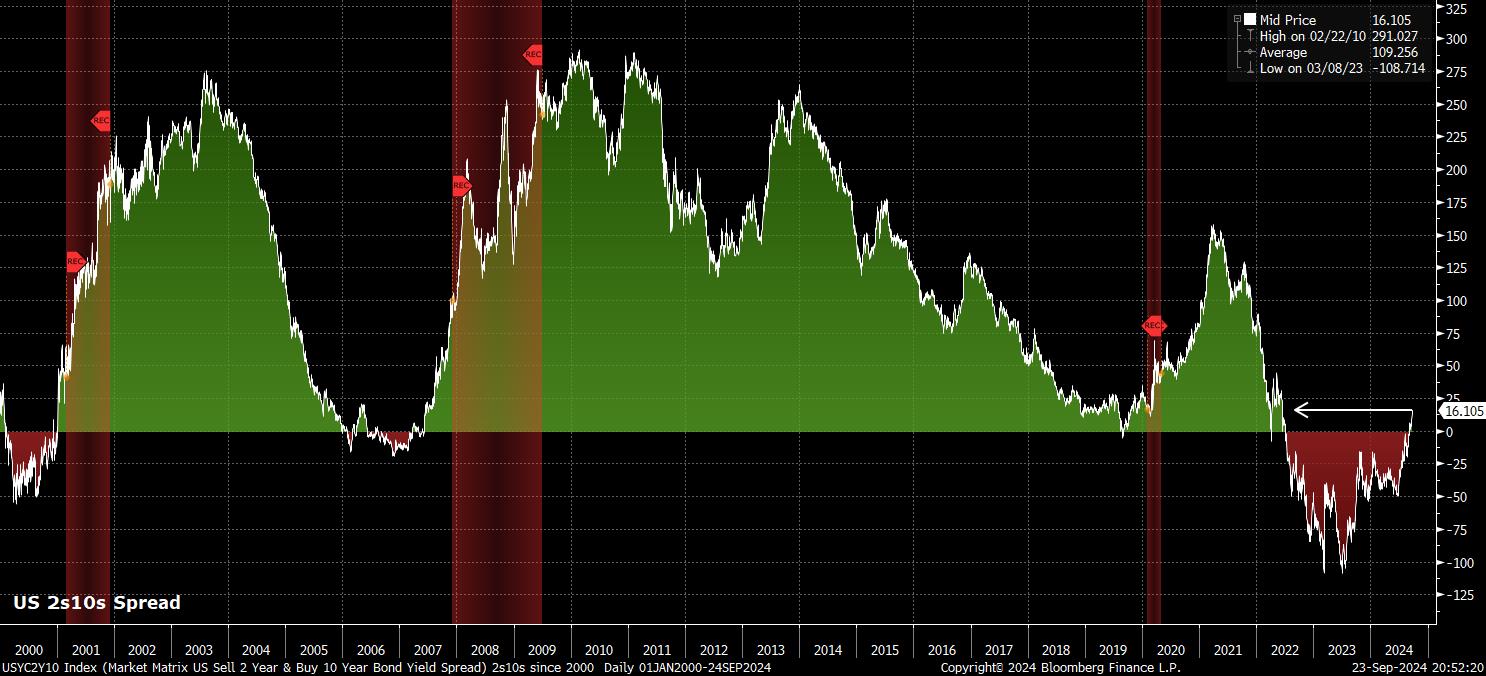

The long-end of the curve sold-off for the fifth straight day yesterday, the longest such run since the tail end of August, with benchmark 10-year yields at one stage rising as much as 5bp on the day, nudging back to 3.80% for the first time in almost three weeks. Once more, in keeping with the theme of last week, selling pressure was most concentrated in the belly, and long-end, of the curve, in turn driving a continued bear steepening, with the 2s10s hitting fresh wides since mid-2022.

The message being sent by the market here is a relatively clear one – as opposed to worrying that the FOMC might be caught behind the curve, the bond market seems to think that the Fed might well be in front of it. Easing too much, too soon, into an economy that fundamentally remains strong, with growth continuing to run at a solid clip, and inflation remaining above target. Only time will tell whether this is the start of a market tantrum, or merely participants struggling to digest an unusually proactive Fed though, either way, policymakers have a narrow tightrope to walk in communications this week.

Yesterday’s Fed speakers all stuck to a relatively familiar script, largely echoing Chair Powell’s remarks last week, in that further rate cuts are on the way, and that policy will remain on a data-dependent course, as the FOMC look to ensure not only a return to the 2% inflation target, but also the maintenance of full employment.

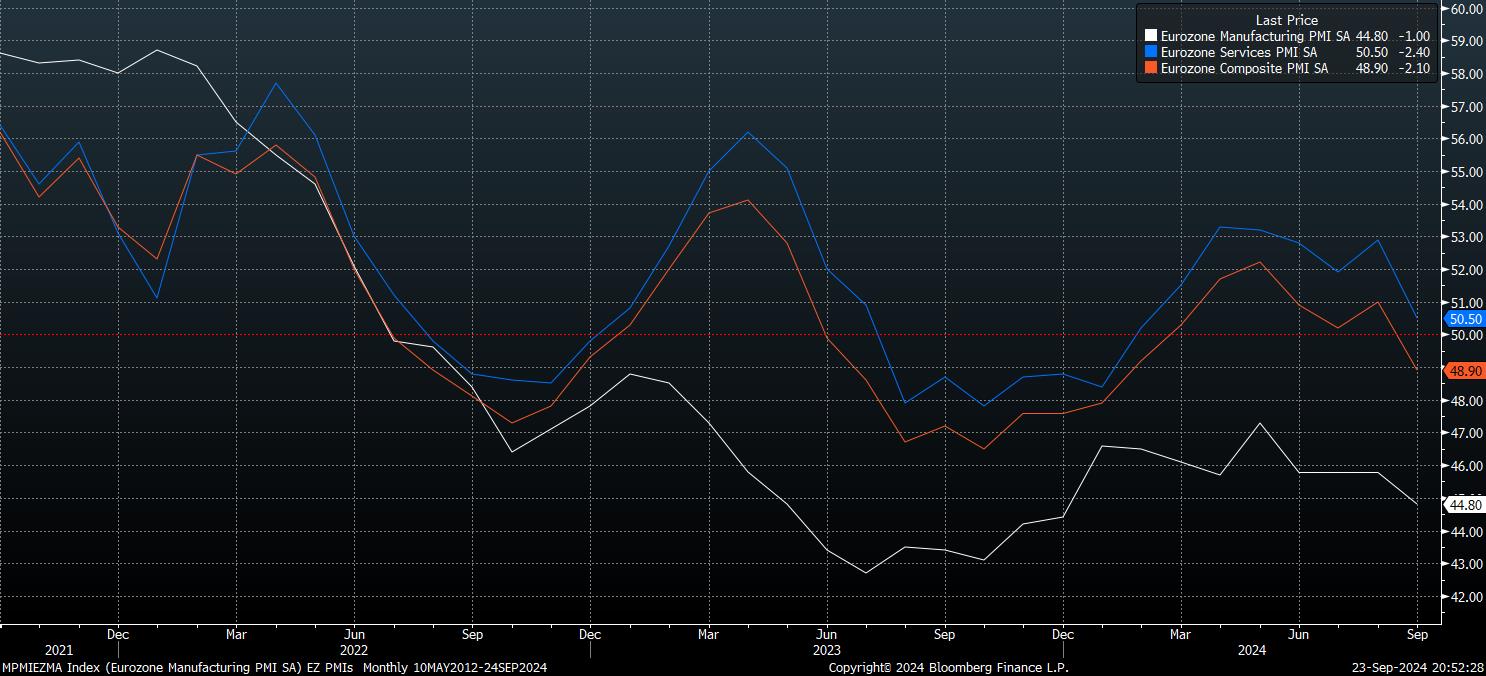

Meanwhile, across the channel, a strong economy is not a term that one would associate with the eurozone right now. Yesterday’s PMI surveys were rather grim, to say the least, with the bloc-wide measure of composite output falling to a paltry 48.9 according to the ‘flash’ September meeting, well below the forecast range, and an 8-month low.

Data on a sectoral level was little better, with services activity falling to a 7-month low, and barely remaining in expansionary territory at 50.5, while manufacturing output hit its lowest level in 9 months, as the PMI fell to a dismal 44.5. Commentary within the report indicated how this economic weakness also led to slower inflation, both in terms of input costs, and output prices.

To me, it seems that an October ECB cut is now a significantly under-priced outcome, with the EUR OIS curve discounting just a 40% chance of such action. Incoming data increasingly points to downside growth risks being borne out, at the same time as inflation continues to fall back towards target. A cool CPI print next Tuesday would really set the hares running on this idea, even if ECB policymakers have yet to hint at such a possibility, though the door to a more dovish stance has been forced open by the FOMC’s 50bp move last week.

Playing the EUR in the crosses seems like the most efficient way to take advantage of a potential back-to-back cut, particularly against those G10 central bank plotting a much more cautious stance back towards neutral. Short EUR/GBP, EUR/NOK (which is sat right on its 100-day MA), and EUR/AUD hence look attractive.

The Aussie should also continue to benefit from the positive risk outlook, with equities gaining once more yesterday, and the path of least resistance continuing to lead to the upside. The September labour market report, due next Friday, stands as the next significant risk for participants to navigate, and Wall Street could well continue to just grind steadily higher until that data drops.

Overnight, while the RBA kept policy settings unchanged, Chinese authorities decided to opt instead for the ‘kitchen sink’ approach, throwing the following at the ailing economy:

- A 20bp RRR cut, to 1.50%

- A cut to outstanding mortgage rates, as flagged a few weeks ago

- Introduction of a new swap facility to allow funds and brokers PBoC funding in order to purchase equities

- A total of 500bln CNY in liquidity support to the equity market

- The beginning of studies into a “stock stabilisation fund”

All of this reeks of panic, and while having been enough to send Chinese and Hong Kong equities around 3% higher during the APAC session, it seems unlikely to be enough to even scratch the surface of tackling the structural issues plaguing the world’s second largest economy. The debt-deflation loop looks set to remain for some time, leaving rally selling as the preferred strategy, likely for some time to come.

Look Ahead – A busier-looking data docket awaits today, albeit one that continues to lack top-tier releases.

More dismal German data is due, in the form of September’s IFO surveys, where the business climate index is set to fall to 86.0, which would be the lowest level since February. The Current Assessment and Expectations indices are also set to notch notable declines, in keeping with the recent trend of softening figures from Europe’s economic engine room, which is spluttering to a halt. It will be interesting whether any comments from today’s ECB speakers – Muller, Escriva, and Nagel – have a more dovish bent as a result.

Meanwhile, across the pond, the Fed’s larger-than-expected cut last week is set to have boosted consumer confidence. The Conference Board’s index is set to have risen to its highest level since February, at 104.0, though key will be whether this improvement in sentiment feeds through into still-resilient consumer spending.

Also, from the US, will be the latest Richmond Fed manufacturing survey, likely not a market-mover in and of itself, though another useful leading indicator ahead of the ISM PMI figures due next week. This week’s Treasury supply also kicks-off with a sizeable $69bln 2-year note auction, ahead of 5s and 7s being sold on Weds and Thurs respectively. Lastly, remarks are due from Fed Governor Bowman who, last week, was the first Board member in almost 2 decades to dissent, preferring a more modest 25bp cut; clarity on the rationale behind this dissent, and the FOMC’s most hawkish member’s view on how rapidly rates should return to neutral, will be closely watched.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.