Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

March 2024 ECB Review: Projections Give Green Light For Cuts

Well, that was predictably dull.

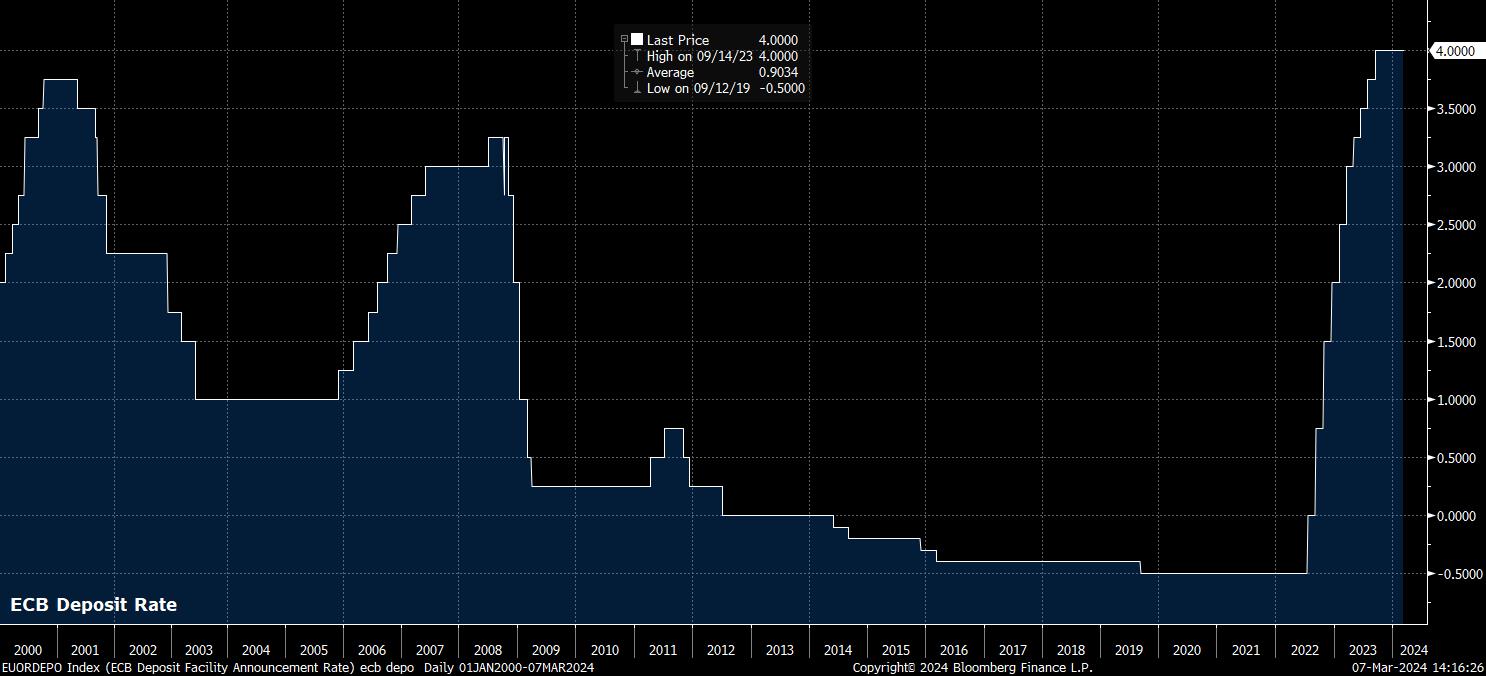

The March ECB meeting brought almost nothing by way of surprises, particularly when it comes to policy action, with the Governing Council maintaining the deposit rate at 4%, as markets had fully priced in advance of the meeting, while also making no changes to prior balance sheet plans, tapering the runoff of PEPP reinvestments in the second half of the year.

In a similar unsurprising vein, the policy statement produced little by way of fresh forward guidance, with the ECB yet again reiterating that policy will be set following a “data-dependent approach”, and that rates will remain at “sufficiently restrictive levels for as long as necessary” in order to achieve a return of inflation to the 2% target.

Naturally, this data-dependent approach continues to include a heavy focus on how policymakers view the inflation outlook evolving, particularly in respect to underlying inflationary dynamics, hence the emphasis that continues to be placed on incoming earnings data, with said figures for the first quarter set to be closely watched for indications of potential inflation stickiness. Said data is due after the April meeting, with any easing before these figures are known at this stage seeming highly unlikely.

Given that this lack of statement alterations was entirely expected, focus naturally fell on the ECB’s latest round of quarterly staff macroeconomic projections.

The inflation profile was downwardly revised across the forecast horizon. Headline CPI is now seen at 2.3% this year, down from 2.7% prior, before falling further to hit the 2% target in 2025, and dip below said target to 1.9% in 2026. Notably, this is the first time since the tightening cycle begun that the ECB staff have forecast the inflation target being achieved next year.

In many ways, the latest inflation projections should be interpreted as an implicit ‘green light’ to rate cuts in the relatively near future, with the ECB now displaying a greater degree of confidence that the inflation goal will soon be achieved, and with policymakers, especially those of a more dovish bent, seeking to avoid over-tightening – particularly via higher real rates as price pressures continue to fade.

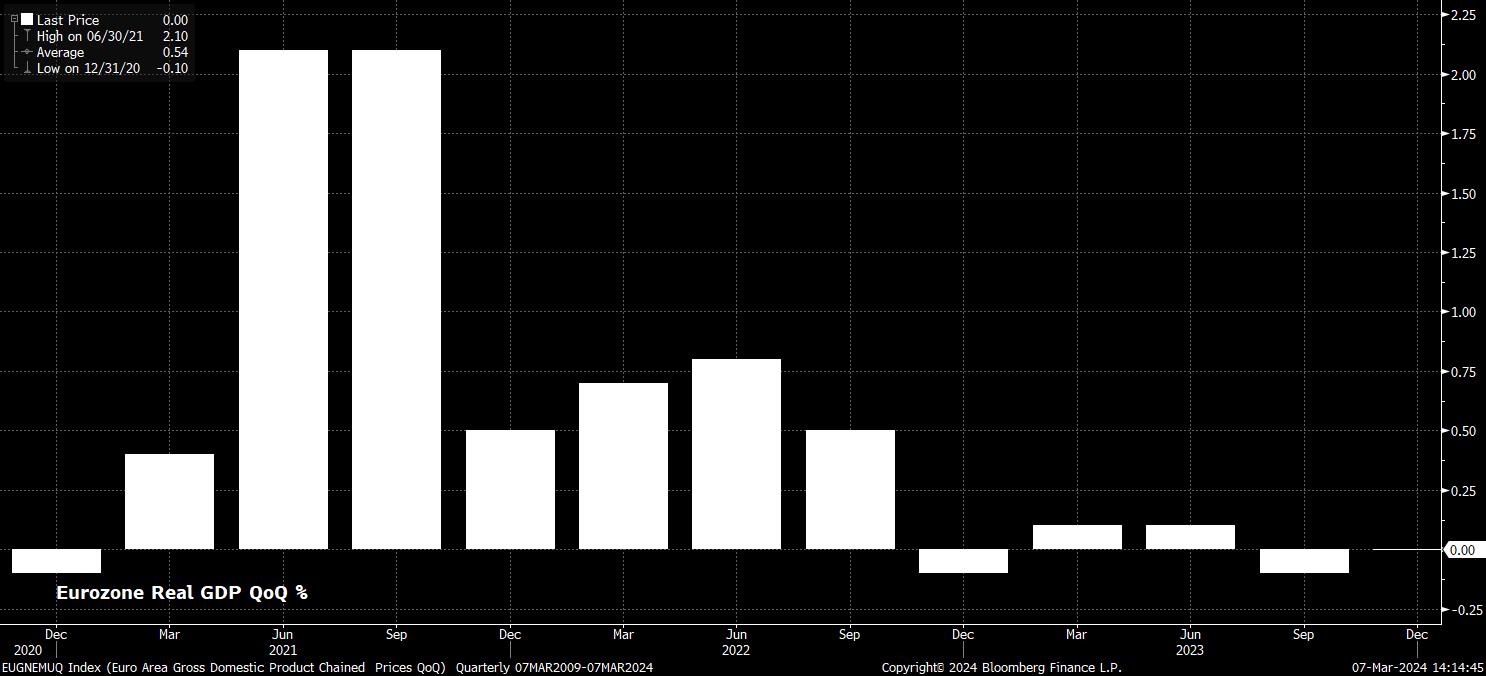

Meanwhile, in terms of GDP growth, and as has become rather typical of ECB forecast rounds of late, near-term growth expectations were knocked lower, as downside risks facing the economy persist, and leading indicators show scant signs of any improvement on the horizon.

This year, staff now see the economy growing by 0.6%, 0.2pp below the December projection, however growth is seen as proving more resilient beyond that, with the 2025 forecast unchanged at 1.5%, followed by a likely over-optimistic 1.6% pace of growth in 2026. The latter of these being an 0.1pp upgrade on the December forecast.

Besides the latest forecasts, President Lagarde’s post-meeting press conference was the other area of particular interest.

Once we got past the ever-tedious repetition of the already-released policy statement, Lagarde finally got into the meat of the guidance she wanted to provide. Sadly, this guidance was rather lacking – as always – in clarity, with straight answers to questions proving as elusive as ever.

In any case, the long and the short of what Lagarde had to say was that market participants should not go expecting anything – in terms of cuts, or fresh guidance – from the ECB until June. This not-so-subtle hint was framed in an almost unimaginable number of ways, though centres primarily around the ‘broad agreement’ among Governing Council members that policymakers will have more data at that point on which to make potential decisions on the magnitude, and pace, of policy normalisation.

The outlook that Lagarde outlined above is pretty much bang in line with that priced by the EUR OIS curve, with the first 25bp cut fully priced for June, unchanged from pricing before the decision, while implying a total of just under 100bp of cuts this year, a modest 6bp dovish repricing compared to a day prior.

Given this lack of shift in market pricing, and the lack of any sort of surprises in what Lagarde & Co. had to say, it perhaps goes without saying that volatility was thin on the ground in eurozone assets over the decision.

The EUR traded as flat as a pancake, albeit with risks continuing to tilt to the downside given the ECB being set to cut in advance of, and probably to a greater degree, than the FOMC. Eurozone fixed income markets were similarly subdued across the entirety of the curve, while equities did tick higher, in a move that was broadly in line with that of peers across the pond, as the path of least resistance for risk globally remains to the upside.

_2_Days_T_2024-03-07_14-21-50.jpg)

To sum up, the March ECB meeting was little more than a placeholder for the folk in Frankfurt. While the downwardly revised CPI forecast path, showing inflation at target next year, provides a green light to rate cuts, it is clear that policymakers do not yet have adequate confidence that said 2% target will be achieved to deliver any rate cuts just yet. That level of confidence will likely only come after the publication of Q1 earnings data, leaving the June ECB meeting as the likely start of policy normalisation, and when the first 25bp cut will be delivered.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.