Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

Short selling - how traders can open up a new world of opportunity

Short selling simply involves selling an equity or ETF (Exchange-Traded fund) CFD to open a position and buying back to close at a time of the traders choosing, similar to unleveraged physical share trading - there is no expiry date.

- Increased opportunity for all - CFD’s are the most effective vehicle for non-institutional participants to trade a potential move lower in a share or ETF price

- Two-way opportunity - Think of two-way opportunity in share CFDs in exactly the same way you can go long or short on gold, crypto, the US30, or SpotCrude. It doesn’t need to be any more complicated than that.

- Take short positions in an equity CFD on the day of an IPO – most other brokers have to wait a period to source ‘borrow’ to lend to clients – Pepperstone offer shorts from the initial tick on the day of listing on an exchange.

- Trading characteristics - Hold times on short positions tend to be of a shorter duration than that of long trades

- Full control - You can still utilise the full range of Pepperstone’s indicators, risk management tools and charting features, just as you would with any other strategy.

Contracts-for-difference (CFDs) change the game when it comes to short selling equities, making the ability to profit from a move lower in a stock’s price accessible to those outside of the institutional circles. Many of whom typically get set for drawdown in a share price by short-selling physical shares, after first borrowing the stock, or by buying put options.

Short selling equity CFD’s is about price discovery and increased opportunity, but for many, it is a practice that is simply not understood.

Many question the mechanics of selling something they don’t actually own. However, in effect, it doesn’t need to be complicated, and essentially mirrors the principle of selling many of Pepperstone’s tradable spread-based instruments – for example, just as you would sell the US30 (to open) if your analysis offered a probability that the index was to fall and buying back to close at an open-ended time in the future - the same is true when shorting an equity CFD.

There is no set expiry date like we see in the options market and for those buying puts, so traders can hold a CFD – long or short - until such time they chose to close.

Example

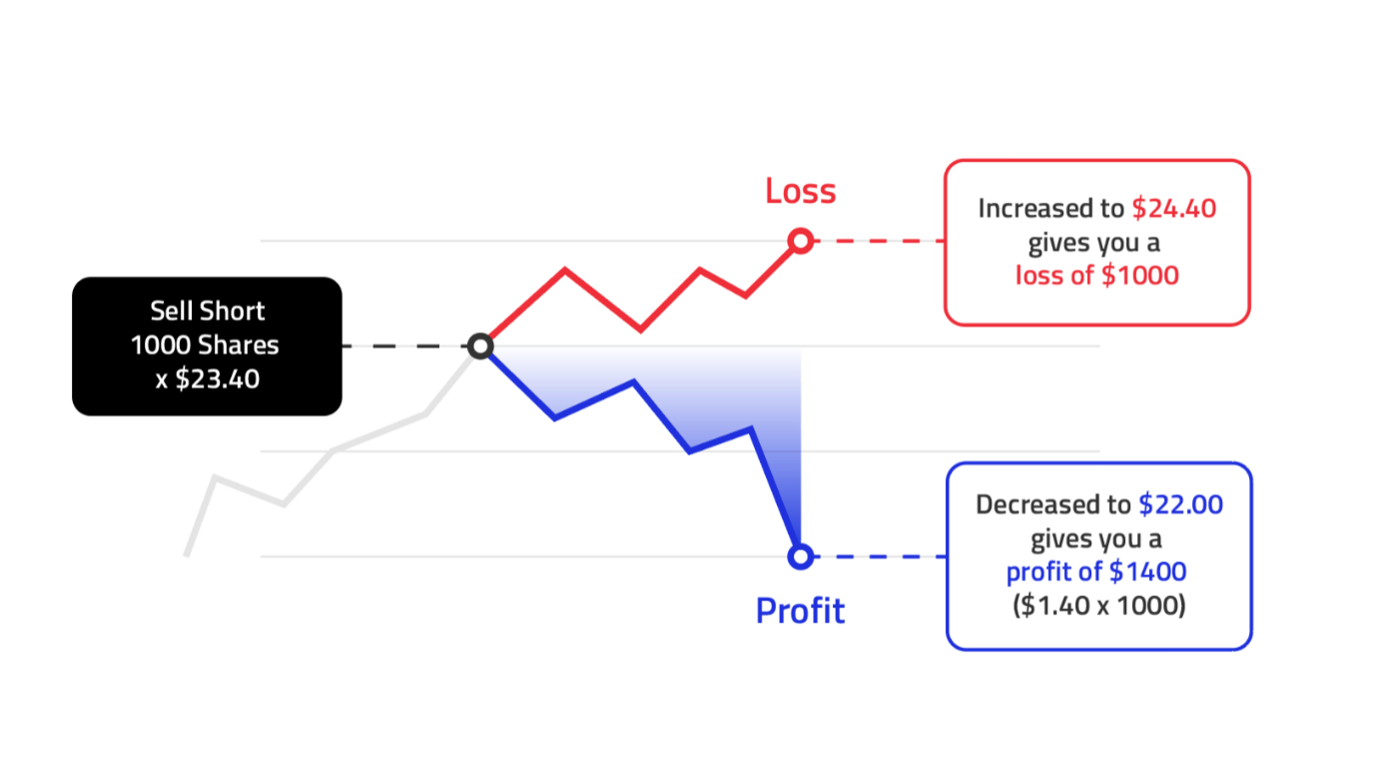

The underlying bid-offer spread on Company X is trading at $23.40 - $23.50 – and offered on a 20% margin rate (5 times leverage)

I sell short 1000 shares at $23.40, for a face (notional) value of $23,400. Given the leverage, I place $4680 as margin

The shares fall to $22.00, and I buy back shares for a gain of $1.40 and therefore a profit of $1400 ($1.40 *1000)

Think of share CFD’s as essentially a swap - an agreement between the broker and the client to cash settle the difference between the opening and then closing price of the underlying share price.

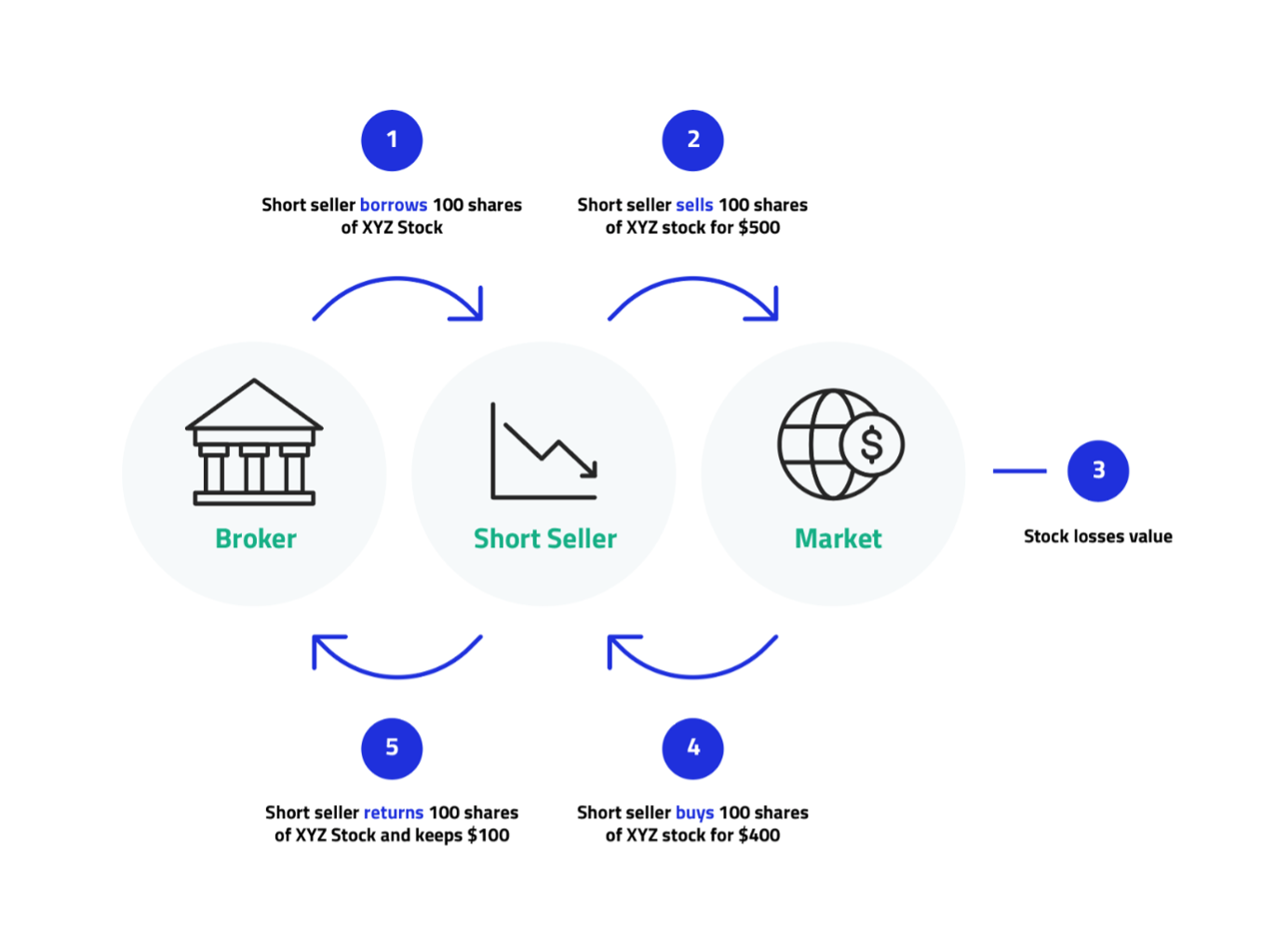

Traders can get caught up in the technicalities of a broker sourcing ‘borrow’ to lend to the client to sell into the market. However, by leaving the behind-the-scenes aspects of shorting to us, it means you can concentrate on trading, managing risk and growing the capital in your Pepperstone account.

If you’re comfortable selling (or buying) to open a position in gold, Bitcoin or SpotCrude – then, in reality, short selling a share CFD is really no different. Pepperstone provide the underlying market share price, we source the necessary ‘borrow’ from our LPs and you have is the choice to sell if you think price is going to fall.

Mechanics of short selling

The characteristics of shorting

For traders, the ability to react to any trading environment and volatility regime means short selling can greatly improve the ability to potentially profit from the equity markets.

Short selling can also offer a dynamic hedge for existing core portfolio holdings. Meaning investors not having to liquidate physical equity portfolio holdings through a period of drawdown, only to buy back at a later date. This can be costly.

Key considerations when short selling

Typically equity prices fall faster than when they rally – the term ‘up the stairs, down the elevator’ is a well-used adage in markets. This can mean that hold periods on shorts are lower in duration than long positions.

The fact that there are pension funds and other money managers who can only go long, means that if a stock falls precipitously into a ‘value’ area then these funds will buy, and shorts will be quick to cover. You also tend to see major central banks offering soothing language if financial conditions are threatened and they want equity markets to move higher.

Traders need to consider a number of key factors when short selling:

- Has the company got structural problems? Such as liquidity or balance sheet constraints or does it source revenue from a trend in decline. Over the years short sellers have a strong pedigree for identifying failing businesses and accelerating the inevitable.

- Traders can express a macro market thematic through shorting equities – for example, if the risk is we see falling oil prices, then the trader could short sell an energy equity CFD.

- Think tactically - Sometimes a trader will be bearish on a commodity, and rather than sell the commodity as a CFD (such as gold or copper), they short sell a resource name instead – the percentage moves in equity can be far more pronounced than the commodity.

Whatever your view, CFDs allow traders the ability to trade a positive or negative view on any timeframe. The flexibility short selling offers opens up new opportunity for dynamic traders, not just in equity CFDs but many more instruments. Trade your way, but never miss an opportunity.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.