Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

As a result, as the political landscape continues to evolve, it is crucial to examine the challenges and opportunities that Trump represents while considering another presidential candidacy.

Resurgence of Donald Trump

The announcement of Ron DeSantis's withdrawal from the race for the Republican Party nomination, one of the main rivals of the former president, has left a scenario in which Donald Trump has a clearer chance of securing the Republican nomination. This turn of events has sparked deep interest worldwide, leading us to the need to further explore this situation and assess the possible impacts and consequences that version 2.0 of Donald Trump could have on American and global politics.

Challenges Ahead

Now, while Trump's return to the political stage has been welcomed with enthusiasm by his fervent supporters, it is important to recognize that the former president still faces considerable challenges in the future and ahead of the November elections. A significant obstacle is the legal scrutiny that Trump is facing, including ongoing investigations into his businesses and the events that led to the Capitol assault on January 6th. These investigations could pose legal and public relations challenges as he once again seeks the presidency.

Furthermore, it is important to note that the divisive rhetoric and polarizing policies that characterized Trump's previous term left a deeply divided nation. This undoubtedly presents a significant challenge as the former president seeks to win the support of more moderate and independent voters, as many of them may still have reservations about his leadership style and past policies.

Trade with Pepperstone

Possibilities of Defeating Joe Biden

One of the crucial questions surrounding Trump's possible candidacy is whether he now has the ability to defeat the current president, Joe Biden, in the 2024 elections. As we remember, this same battle paved the way for Joe Biden to the presidential seat.

Although it is premature to make definitive forecasts, history has taught us that sitting presidents often enjoy certain electoral advantages. According to historical data dating back to 1951, incumbents tend to lose when elections happen after a recession and when economic indicators such as employment and GDP growth are significantly depressed.

Despite the inflationary issues for the current administration, overall, the labor market is in good shape, and economic growth has exceeded expectations due to the current cycle of restrictive monetary policy. This undoubtedly poses a dilemma for more moderate voters as they must weigh a relatively good economic situation against potentially more controversial political dynamics under the leadership of former President Donald Trump.

Biden's Approval

Certainly, Biden's approval and his political initiatives will play a crucial role in shaping the electoral landscape.

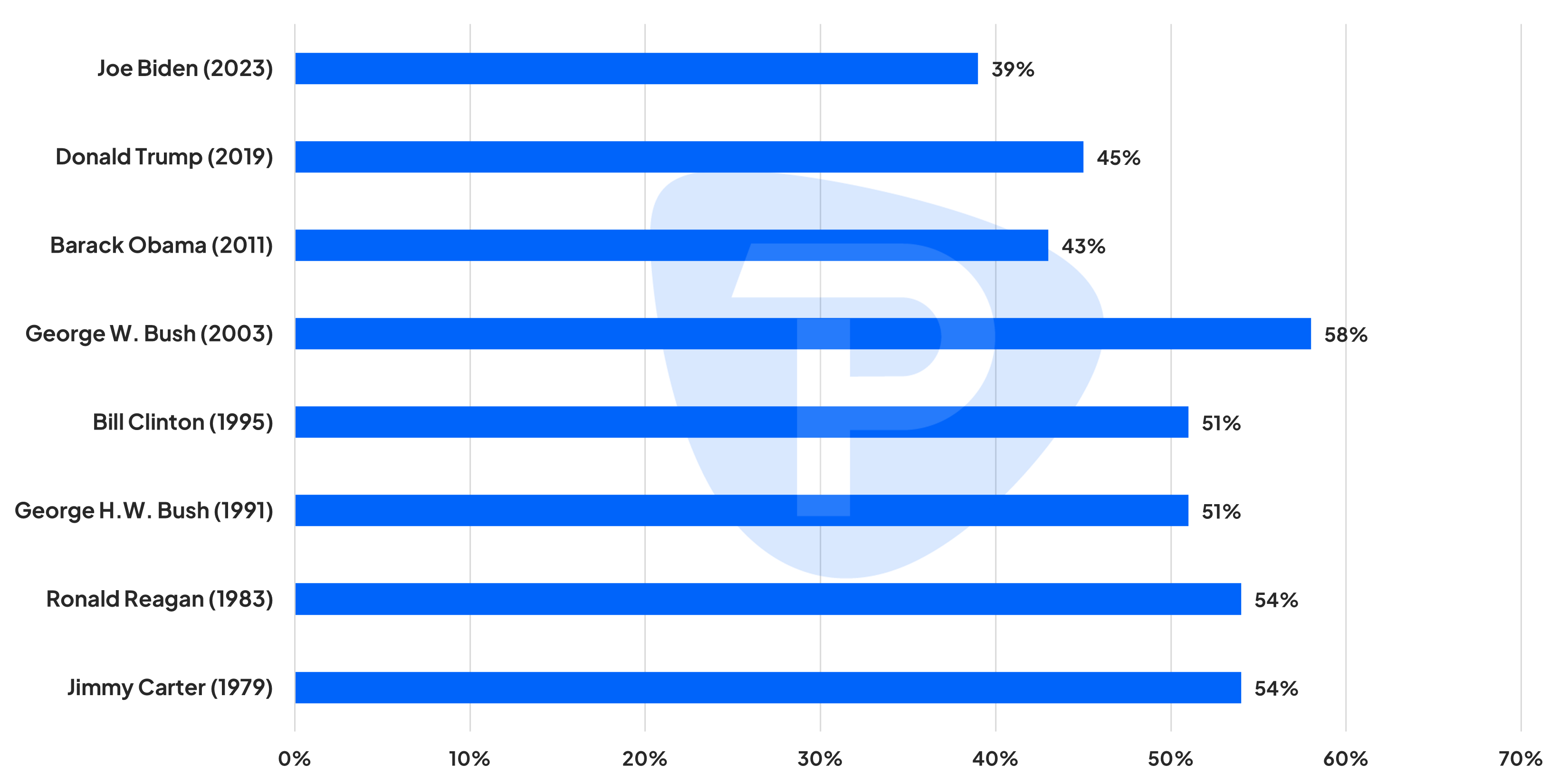

Compared to the last seven presidents, it is worth mentioning that Joe Biden maintains the lowest approval ratings prior to the presidential elections.

Approval Ratings (December Year Previous to Elections)

Obviously, this presents the following question: while sitting presidents have tended to have an advantage, with such approval levels, this may pose some complications for the current President Joe Biden in the November elections.

Market Implications

Trying to predict precisely what will happen to the markets following the elections is a somewhat difficult task. Nevertheless, I personally believe that there are certain dynamics to which we can assign a higher probability in case the former president returns to the White House.

It is worth mentioning that historically, markets have shown sensitivity to political changes, and a Trump victory would likely have implications for various financial assets.

Volatility:

The possible re-election of Donald Trump as President of the United States could mean an increase in market volatility. Given his inclination towards protectionist and conservative policies, a scenario of significant adjustments could be anticipated, especially in contrast to the current Democratic administration's policies, which have, to some extent, focused on repairing international relations.

Forex:

The foreign exchange market would be influenced in various ways:

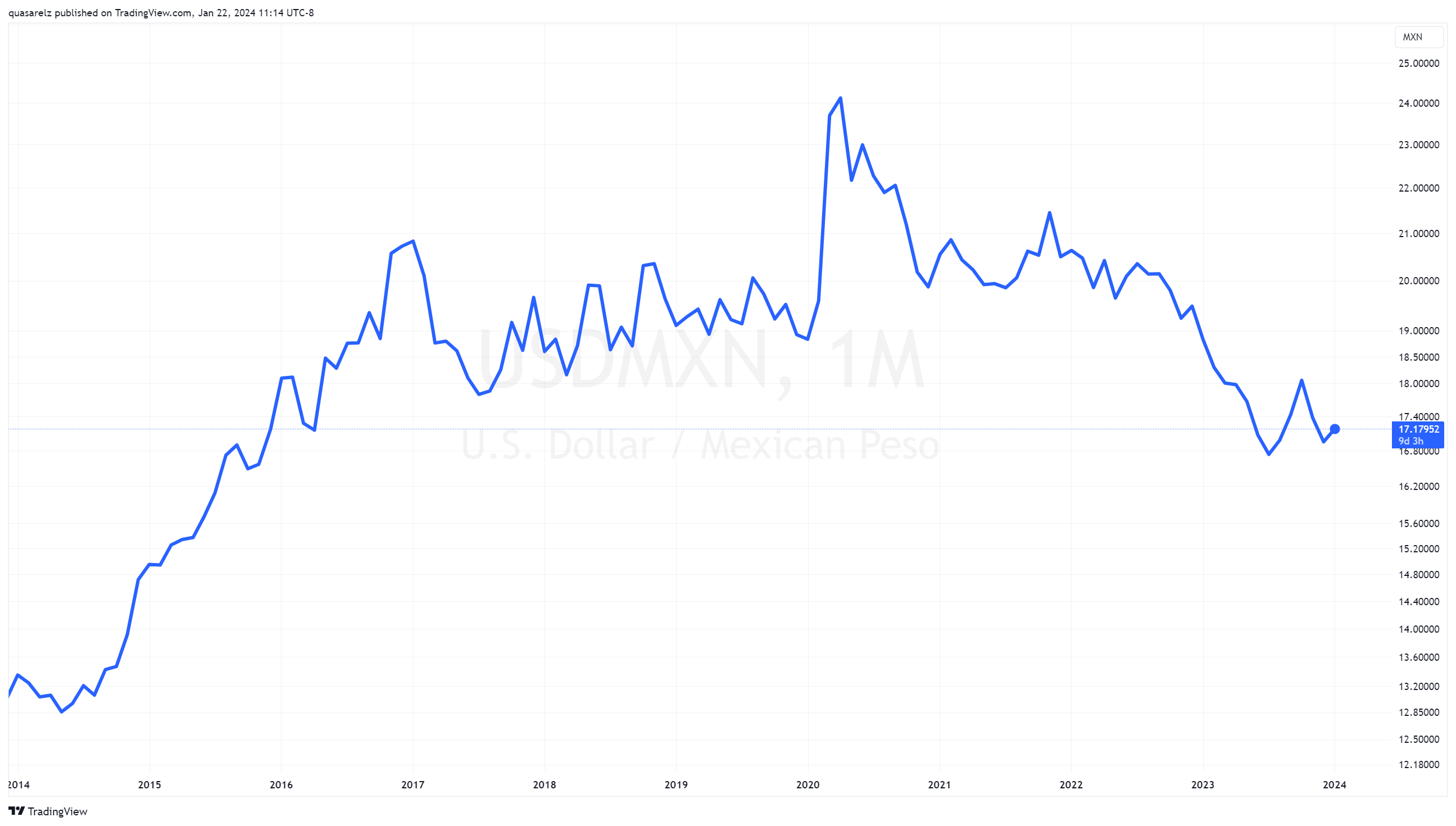

MXN (Mexican Peso):

This currency, closely tied to the U.S. economy, could experience fluctuations due to the influence of Trump's policies. Issues such as border security and possible measures against cartels could redefine Mexico-U.S. relations and, therefore, impact the value of the peso.

CNY (Chinese Yuan):

The yuan could face weakening in response to a more protectionist U.S. trade policy. Possible tariffs and trade tensions would be aimed at impacting the Chinese economy, which would in turn affect the value of the yuan.

EUR (Euro):

Trump's stance against increased U.S. aid to Ukraine and the possibility of the U.S. withdrawing from NATO could have significant consequences for the euro.

To some extent, we could summarize that a return of Trump to the White House could be favorable for the U.S. dollar.

Stocks:

Trump's return and his conservative agenda could significantly influence certain sectors of the stock market:

Energy Sector:

It is important to remember that Trump has shown a preference for fossil fuels, so renewable energy stocks could be disadvantaged in case of his return to power. At the same time, the fossil fuel sector could receive a boost.

In summary, the resurgence of Donald Trump in American politics poses challenges and opportunities for the 2024 elections. Although Trump now has a clearer opportunity to secure the Republican nomination following Ron DeSantis's withdrawal, Trump faces legal scrutiny and the challenge of winning the support of more moderate and independent voters due to his divisive rhetoric and polarizing past policies. Ultimately, Trump's return to American politics promises an interesting political landscape for 2024.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.