Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

For those earning over 1m in NY, this tax rate has been suggested at 52% and California 56%. The 39.6% figure is very much in line with the campaign pledge and shouldn’t shock but the fact we’ve seen selling of risk suggests the market is far more sensitive to bad news and this will happen when froth is prevalent.

Whether this passes through the Senate is line ball and although the DEM’s have the majority through default of the 50/50 split (given Kamala Harris has the final vote), we’re hearing the more centrist contingent of the DEM Senators, such as Senator Manchin (DEM), have objections.

Either way, the news flow has hit a market with the S&P 500 dropping 4180 to 4124 and the NAS100 13950 to 13717. Consolidation seems to the order here in the short-term and it feels like we’re at the mercy of a period of choppy price action – time to take the timeframe in.

Long NAS100 and short US2000 as a pairs trade has been a great position since mid-March, but the ratio has found a base too – with large tech due to report next week the NAS100 could fire up, so again this is a position I will explore. Consider we’ve seen nearly a quarter of S&P 500 companies report and 75% have beaten on earnings, and when they’ve beaten, they’ve done so by a sizeable margin, yet the S&P 500 remains essentially unchanged through this period.

For clients interested in pairs (or long and short) trading I'm happy to focus more on these ideas going forward and may look at webinars here, as pairs trading can be a great way to reduce the broad macro sentiment and look to target two assets relativity more intently.

The ECB meeting was a non-event and Christine Lagarde, and the Council were incredibly vague on the future of bond purchases and we may have to wait for the 10 June meeting to get far more hard-hitting narrative. One factor was the lack of concern of EURUSD being north of 1.2000, and while Lagarde did push the notion that the EU economy was “not on the same page” as the US and perhaps this was designed to enforce policy divergence, in turn keeping the EURUSD suppressed.

For now, EURUSD continues to chop around above 1.2000 and after the rally from 1.1700 is finding better signs of supply and greater signs of indecision on the daily.

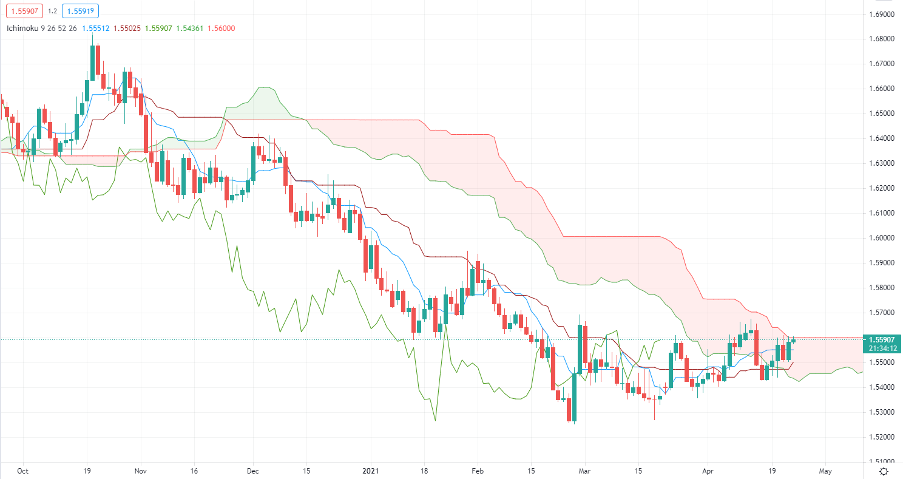

The spillover into FX markets has largely flowed into the JPY, with AUDJPY testing the mid-April lows before we saw the spike higher on 14 April. EURAUD is also looking interesting and for cloud watchers, price is eyeing a break above the i-cloud for the first time since November.

(EURAUD daily)

(Source: Tradingview)

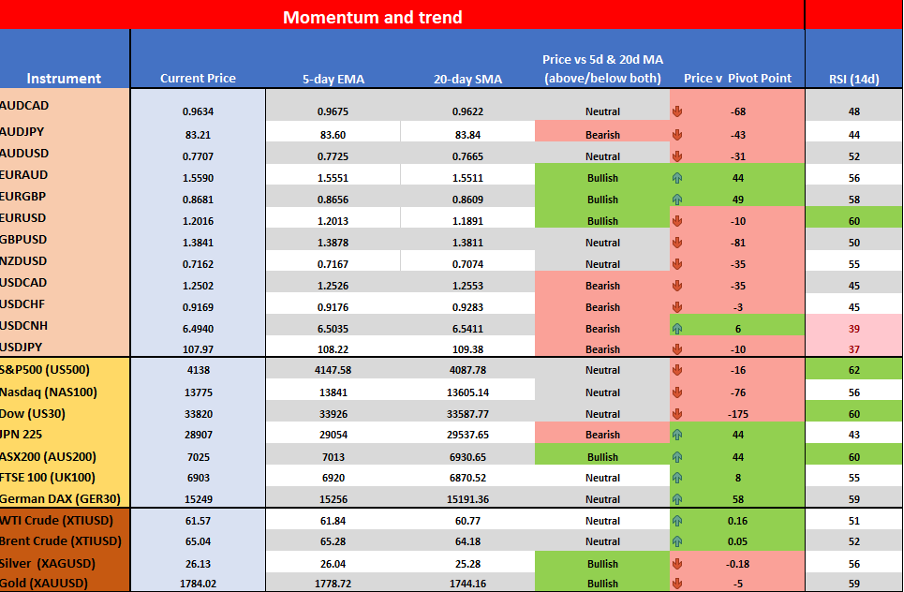

Taking a quick look at my basic trend model, where I’m really magnetised to a confluence of agreement (i.e, if the price is above both moving averages and the central pivot and has an RSI above 60) then immediately I’m drawn to this and have a bullish lean even before I’ve seen the chart. The opposite is true when we see a suite of pink together, such as is the case in AUDJPY. This isn't to say it won’t rally, of course it can, but the behaviour we’re seeing expressed in price action suggests the structure is progressively bearish and this may skew the near-term risk.

Fundamentally I quite like the AUD – on one count the correlation with the US500 is high, as it's with iron ore, so if you think either of these is due to have a near-term correction then that would shape your call on the AUD. The other thesis is domestically economics are improving - next week we get Q1 CPI which seems destined for a solid increase from the Q4 print, although certainly not enough to worry the RBA at this juncture. After yesterday’s Bank of Canada meeting showed the bank pulling back on accommodation the focus turns to the RBA, RBNZ and Norges bank, and obviously the Fed who will meet next week. There may be some subtle tweaks to the wording in the statement that may be seen as priming the market.

Barring any shock, the RBA should look to ease back on the run-rate of bonds purchased under its QE program in the September meeting. The rates market is pricing in a 50% chance of a hike by next year and two by 2024. This should keep the AUD supported.

(Gold weekly)

(Source: Tradingview)

In the commodity space, there's been some strong moves in softs, with wheat on a tear. Gold has found sellers on the day, seemingly a function of modest USD strength than anything else. I’ve focused on the double bottom on the daily of late, but flick to the weekly for oversight and we see a pronounced bull flag in play – Again, the levels I’ve been focused on ($1820/30) would coincide with a test of the channel high. This seems the higher probability level to fade rallies into, but a break out would get airtime and be well noted among the trading community.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.