Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

Trader Insights – a calming of nerves but it might not last long

S&P500 futures have tracked a 44-point range on the day, a big range contraction from Monday where we saw an impressive high-low range of 119 points. The NAS100 closed unchanged, while the S&P500 cash market closed -0.2%, in what was quite a choppy intraday tape – the close-to-close percentage change well below the daily implied move that the VIX index was implying at 19% (implies daily moves in the S&P500 of -/+1.2%).

Perhaps a fair amount of the liquidation played out yesterday, but equity traders has been treated to some good corporate earnings and perhaps that’s helped to a small degree. This was especially true for those trading the US30 index, where UnitedHealth (closed +5.2%) is by far the biggest influence on the index given its high price and 8.14% weight on the index.

31% of S&P500 companies closed higher, so breadth was poor, but we did see big tech hold in this time and that has kept the broad index in check, with the daily price action showing some indecision to push lower after Monday's big bearish technical breaks.

AI names notably have been firm, with Nvidia, AMD and Broadcom looking well supported and IBM also finding better buyers. Higher beta plays are holding in but once again ‘value’ areas of the market are finding few friends and that is an area of focus for the short sellers.

We have seen some calming of volatility with the cash VIX -0.8 vols to 18.4%. However, in the options world, the big volume has been towards further buying VIX calls, where we saw 1.09m VIX calls traded vs 431k VIX puts - so further hedging of equity risk and traders positioning for higher volatility and drawdown in the US equity markets.

One could argue that the equity markets have held in well considering we’ve seen a further sell-off in the US bond market, with the 10-year Treasury +7bp and new highs (in yield) in the run we’ve seen since 8 March. US 10-yr real rates (nominal bonds adjusted for inflation expectations) have also risen 8bp to 2.25%, and when the real cost of capital is on a one-way trend higher (tighter), equity faces greater headwinds.

US 10yr real rates

We see the US 10yr real rate sitting at 2.25% so we are still well below the levels seen in October 2023 (of 2.58%) when Jay Powell performed the famous pivot, which contributed to a strong rally in equity - but we’re headed that way, and it is getting great trader focus.

The USD remains supported, and the high volatility, and sell-off in US bonds/rates have seen a further unwind of carry positions, with the MXN and BRL notably seeing big sellers. The EUR looks well supported in this backdrop, not because of any rates or cyclical story, but because it has been a funding currency for the carry trade, so as carry trades are unwound the EUR has benefited – long EURAUD looks attractive in this backdrop.

AUDUSD is trending lower, partly a reflection of poor risk sentiment but also because it is a cheap expression of the Chinese yuan, where there is a growing belief the PBoC must allow a gradual depreciation. A lower CNH should lead to a lower AUD and the (inverse) correlation between AUDUSD and USDCNH is on the rise. The fact the PBoC have held the yuan in check with the USD for a period, and with the USD now trending higher this dynamic is not good for a Chinese economy with already low inflation.

Gold has seen a choppy intraday tape and traded a range of $2395 to $2363 on the day. Again, the resilience of gold in the face of rising bond yields and USD strength has been noted – the use of gold as a geopolitical hedge within the portfolio keeps the yellow metal supported, so we watch headlines around Israel’s actions as this seems to be the fundamental driver…for now.

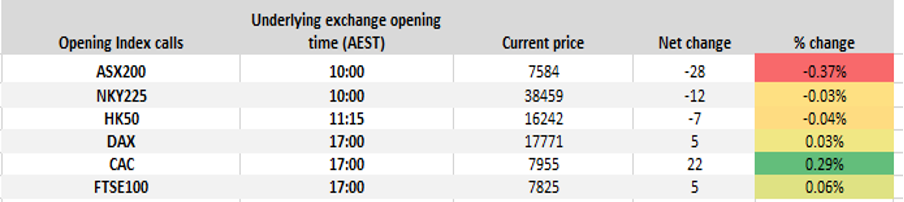

Asia & EU equity index calls

Looking ahead we see a mixed picture expected for the Asia equity open, where the ASX200 looks to set off as the region’s underperformer. The ASX200 is one of the key ‘value’ markets, so when value is in the doghouse the buyers look elsewhere.

By way of event risk, we look towards NZ and UK CPI (16:00 AEST) where the consensus for UK CPI for headline CPI is to drop towards 3.1% (from 3.4%) and core to come in at 4.1% (from 4.5%). UK interest rate futures price 43bp of cuts this year, so the outcome of the inflation data could impact that pricing and by extension the GBP – that said, trade GBP vs the crosses as a play on expected interest rate changes, as GBPUSD is moving more in alignment with broad risk sentiment. We also get earnings from 20 US companies, although none should move the broad markets.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.