Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

Trader talk - the stage is set for the Fed to start a taper process

The stage is in place for the Fed to start the process towards cutting its own pace from $80b a month of US Treasury purchases. This should start tomorrow (the FOMC meeting starts at 4:00am AEST), with the Fed altering its statement to acknowledge the improvement in economics, but shying away from hinting too intently that they’re seeing the “substantial progress” in economics needed to start the tapering process sooner.

Joe Biden is also expected to speak, although there is no set time. Biden should offer more colour around his “American Families Plan” – the full size of the fiscal package will likely garner the reaction in markets, while we should get additional headlines on personal taxes, which should frame our understanding of the prospect of passing the Senate.

If I look at overnight implied volatility in FX pairs like USDJPY (now 6.2%) it sits at the bottom percentile of the 12-month range, but I’d expect this to gravitate higher into the London trade – either way, for risk management purposes the market is not seeing the FOMC meeting as a vol event, but more of a stage setter for a markedly different statement in June. I expect markets to wear a far higher volatility into and around this period.

Near-term though, do not underestimate the resolve of the Fed. The US data is improving, we’ve seen that in the PMI series, last month’s payrolls, retail sales and consumer confidence smashed expectations at 121.7. We look for a May NFP print potentially north of 1m jobs and that should take the broad unemployment rate to 7.3% and closer towards the Fed’s target of 4%. Clearly progress is being made, but there's far more to be done and the Fed will hold off from reducing accommodation as long as possible.

Inflation expectations are making a renewed push again, with 10-yr breakeven rates breaking out to 2.40% and we’ve all seen the moves in commodities.

(5yr UST)

(Source: Tradingview)

Bond markets have responded into the FOMC, with all parts of the Treasury curve moving +5bp higher on the day. The 5yr Treasury fascinates (see above), as we see this has seen a sharp move up from 77bp into 88bp in the past few days, with Eurodollar rates markets pricing in a few more basis points of hikes by 2023. Technically, the set-up suggests a further push higher in yield and this may weigh again on the NAS100, with Microsoft – the second biggest stock by market cap – doing a good job of acting as a headwind (-2.7% in post-market), with the focus on Azure which has disappointed relative to incredibly lofty expectations.

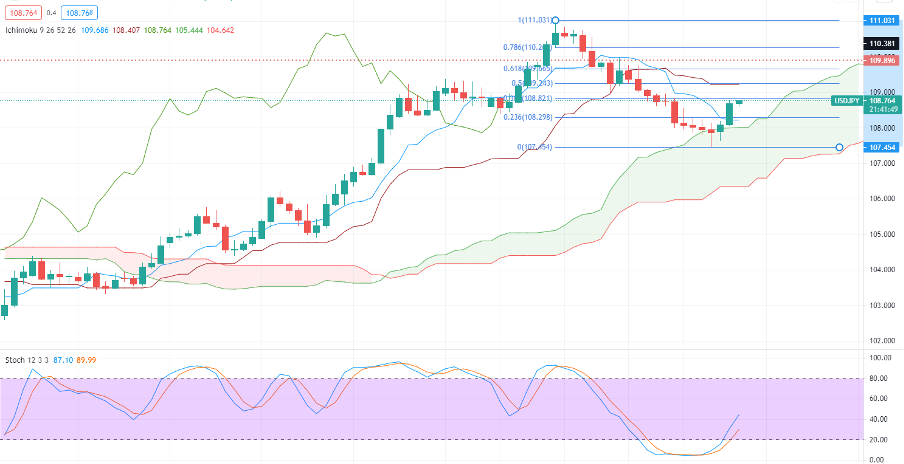

I've been looking for a turnaround in US Treasuries and that is playing out – US financials are in a solid uptrend, and we’ll likely see Macquarie (MQG) breaking to new highs in Australia today. The USD has found a better bid, with USDJPY the natural beneficiary. The USDX has seen indecision in the price action, a reflection that traders still see near-term attractions of the EUR, but USDJPY is the proxy of US rates and is moving in close correlation. A break of 108.21 (the 38.2% Fibo) takes the pair into 109.22.

(Source: Tradingview)

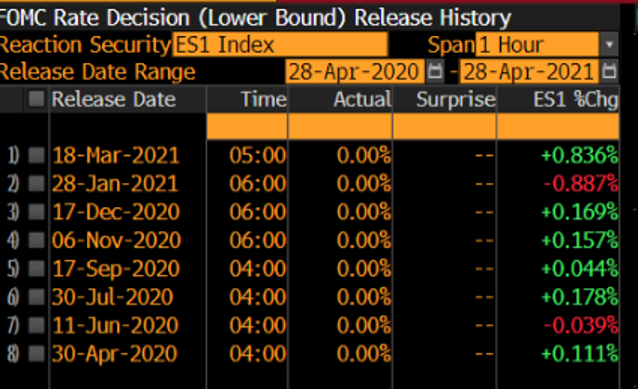

Will the FOMC meeting be the catalyst? Let’s look at the pedigree in the hour after the statement drops.

S&P 500 futures – the equity market typically likes what they hear from Powell.

(Source: Bloomberg)

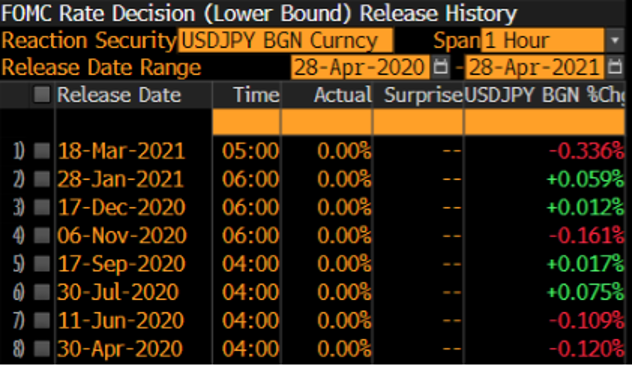

USDJPY – No clear pedigree – a mixed reaction.

(Source: Bloomberg)

Gold has typically reacted positively to the Fed narrative.

(Source: Bloomberg)

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.