Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

Trump’s medical team have suggested he could be discharged as early as today, but whether he will have the strength to get back on the campaign trail is yet to be seen. While conspiracy theories fly around, there's no doubt this has hurt his re-election chances and Biden continues to pull further ahead in the polls.

The “October surprise” has not been kind to Trump and his chances of retaining the White House are slim (FiveThirtyEight give him a 19% chance) but write him off you can't. I still look at the S&P 500 implied volatility curve and see it rising past the election. Granted, contested could get ugly but will it really be the mass brawl sweeping across the nation that is perhaps priced? I'm not so sure.

We saw a disappointing payrolls report on Friday, with the pace of hiring falling and suppressed by a 216k drop in government employment. While the participation rate pulled back to 61.4% which flattered the unemployment rate. The need for fiscal is absolutely there, but whether the DEMs decide to make a deal is a key theme for this week and could determine risk – given their polling the DEMs may wait until post the election and pass their original $3.4t stimulus in January. It makes watching the US bond market key and should traders see the 30-year part of the Treasury curve moving higher then it will have implications for equities and FX hedging policies.

The rise in COVID-19 cases will be followed, but whether it results in stringent shutdowns is another aspect. There are some measures being implemented in France with bars to be shut in Paris and that may be a headwind for EU equities. COVID-19 isn’t the political issue in Europe as it is in the US, although in the UK Labour are benefiting from the perception of Johnson’s handling of the pandemic.

In the week ahead, Brexit headlines will garner further attention and ‘Super Tuesday’ in Australia will also put the AUD in play, with the RBA and budget two event risks.

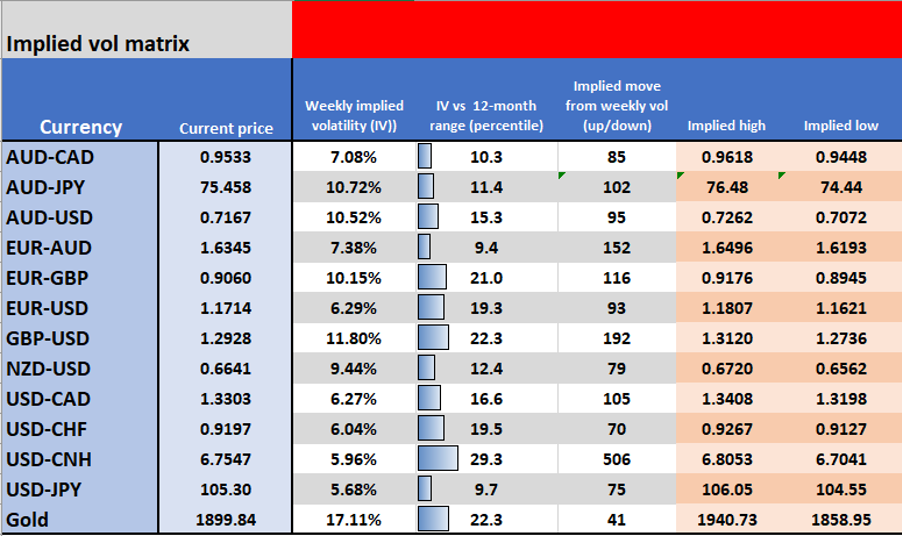

(Weekly implied volatility matrix)

Here’s what’s on the radar:

Monday

UK – Brexit talks will be ongoing ahead of the 15 October EU Summit, where ideally a deal would need to be in place for the EU to sign off, or at least debate. Look for ongoing headlines throughout the week, with traders also eyeing the rise in COVID-19 cases and the prospects for shutdowns. GBPUSD is approaching the top of its recent 1.3000 to 1.2700 range and signs that a ‘bare bones’ FTA with an implementation phase could see cable pushing up to 1.3500 by year-end. Although, much depends on the USD side of the equation as a DEM clean sweep would give this an extra leg higher (in my opinion). Using a simplistic real rates differential model (UK 5yr – US 5yr real rates), GBPUSD is ‘cheap’. EURGBP is trending lower in a channel and could be the cleaner trade ahead of the election, especially with COVID-19 concerns ramping up in Europe.

(Purple - UK 5yr – US 5yr real rates. Orange – GBPUSD)

(Source: Bloomberg)

Tuesday

US – September ISM services (01:00 AEDT). The consensus is that services grew at a slighter slower pace in September (from August), but at 56.2 this would still be a very solid number. This data point hasn’t been a volatility (vol) event for a while even if it is an important metric, but one to watch.

Australia - RBA meeting (14:30 AEDT). After the RBA introduced the line “continues to consider how further monetary measures could support the recovery” there’s been a belief the RBA may ease policy again either at this meeting or November. In fact, we see four of 24 economists calling for the cash rate to be cut by 15bp to 10bp and these same four are expecting the banks yield target on three-year Aussie bonds to come down from 25bp to 10bp. The RBA’s overnight rate currently resides at 13bp, so cutting the cash rate to 10bp would have minimal stimulatory impact, if at all, so it would surprise to see a cut at this meeting.

AUD positioning-wise, both asset managers and leveraged funds are neutral on the AUD, as is the case in the options market, where put volatility is trading at a mild premium to calls. Expectations of the RBA meeting being a vol event are therefore low and with the rates market trading 1.5bp below the RBA’s overnight rate and 4bp for November meeting, if rates are left on hold and they give little to suggest a cut is coming in November then the risks are skewed for a higher AUD. We also look for signs the RBA expand its asset purchase program.

Aside from short-term gyrations, as the market prices the outcome from the RBA statement vs expectations and positioning, we’ll then see the AUD revert back to taking its direction from the CNH (yuan), S&P 500 futures and industrial metals.

Australia – FY2021 Budget (19:30 AEDT). Aussie government Budgets are not typically vol events, but these are not normal times and even Scott Morrison has said this is the most important budget since WWII. The market will want to see what new fiscal support is announced that can create aggregate demand. Infrastructure spending, the acceleration of stage 2 and 3 personal income tax cuts and measures to boost business investment are on the menu. The bigger the better when it comes to fiscal, and I’d argue the market is expecting new FY21 deficit projections to move from $180b to $220b, with improvement seen in the two years ahead.

Wednesday

EU – ECB president Christine Lagarde speaks at 00:00 AEDT and again at 23:10 AEDT. ECB chief economist Phillip Lane speaks at 02:30 AEDT and recall he had a strong hand in pushing the EUR lower from 1.2000 in recent times – with inflation clearly a headache for the ECB, Lane’s comments at the NABE event could be quite insightful. Implied volatility hardly suggests traders see movement this week and 1-week EURUSD volatility (at 6.29%) sits below the 20th percentile of the 12-month range. Unless the market is genuinely surprised by a news release rallies into 1.1850 and 1.1580 are the higher conviction mean reversion levels to fade this week.

Thursday

US – FOMC minutes (05:00 AEDT). Despite moving to a Flexible Average Inflation Targeting regime the market had largely priced this in and the statement was taken as modestly hawkish. Watch for any clues that the Fed plan to increase asset purchases in December and increase the duration of its purchases. Data is key from here, as is the path of fiscal – in the absence of fiscal stimulus it suggests the December FOMC will herald major policy initiatives from the Fed.

(Fed speakers this week)

(Source: Bloomberg)

US – Once again most in the market will have one eye on the charts and another on political debates, with the Vice-Presidential debates taking place in Salt Lake City at 12:00 AEDT (Wednesday 21:00 ETD). You can find more intel here - but unlike the first Presidential debate, there has been no set agenda that I can see as yet. One suspects it will a far more civil affair from both camps and we may actually get some quality debate. The markets de-risked after Trump focused on the fact he may not accept the result. Will Pence give off a similar vibe?

Friday

Australia - RBA financial stability Review (11:30 AEDT). The release will get some local press given the RBA’s focus on the housing market and deferrals of mortgages and business loans. Unlikely to move the AUD too intently.

Canada – September employment report. The market expects 125,000 jobs to be created (down from 245k in August), with the unemployment rate due to drop 30bp to 9.9%. As with the US NFP, the participation could play a key role in determining the unemployment rate, with expectations this ticks up to 64.7%. We see ST trend support in play in USDCAD, or a bear flag, so a break of 1.3260 could indicate a move into 1.3140.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.