Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

The question for Bitcoin CFD traders is two-fold:

- Will the ensuing price action (post-halving) be different from the three prior halving cycles?

- Will there be any noticeable changes in the trading environment at or around halving?

Background

At the heart of Bitcoin’s ecosystem, Bitcoin miners (individuals, groups, companies) use incredible computational power and energy, competing to solve an ever-changing cryptographic puzzle. When an entity is fortunate enough to calculate and solve the puzzle as proof of work the outcome, they gain the privilege of adding a block (of transactions) to the blockchain.

The subsequent reward for adding a block to the blockchain is bitcoin (BTC). It is where all speculation and investment in BTC begins.

For every 210k blocks that are verified (which typically takes four years to play out), we see the number of new Bitcoins that can be created cut by 50%, as is the reward to miners; Hence the term the ‘halving’.

In 2009 the number of coins available to be mined stood at 21m and the reward for a miner showing proof of work stood at 50 Bitcoins (BTC).

Post 2012 halving the number of coins that could be mined was reduced to 10.5m with the reward set at 25 BTC. In 2016 this fell 50% to 5.25m coins, with 12.5 BTC as the reward, and in 2020 2.625m and 6.25 BTC.

At the upcoming halving, the number of new Bitcoins that can be mined will fall to 1.313m and the reward for a miner showing proof of work falling to 3.125 Bitcoin’s.

Essentially, this four-year cycle will continue until the final halving plays out in the year 2140 when the block reward falls to 0 and all 21m coins are pushed into circulation. Hence, BTC has a scarcity value which underpins the longer-term investment case.

The impact on BTC miners

With changes in energy costs, falling fees (paid to miners), the complexity of the cryptographic puzzles increasing and half the reward on offer for proof of work, invariably there will be miners who halt operations as their margins will become too skinny and even unprofitable.

Of course, mining entities can look to reduce their input costs to stay in the game, and a higher BTC price will also offset the reduced reward on offer, but we will see miners drop out.

In this dynamic, the ‘hash rate’ (essentially the number of guesses attempted per second to solve a puzzle) will likely fall. In fact, one could argue the recent pullback in the BTC price is in anticipation of a lower hash rate, which could also have big implications for the BTC ecosystem. Notably, a lower hash rate increases the concentration risk (few miners ultimately capture more of the BTC available), making the system less robust.

The history of halvings

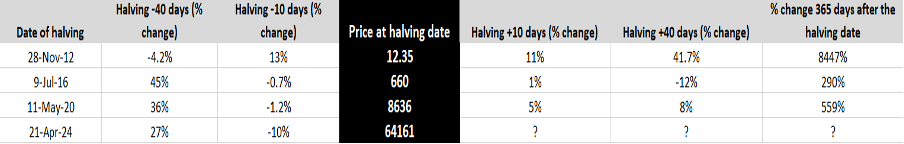

We have seen three prior halvings in 2012, 2016 and 2020 and while this is not a significant sample size the staggering gains in the ensuing 12 months can be logically explained by the reduction in supply.

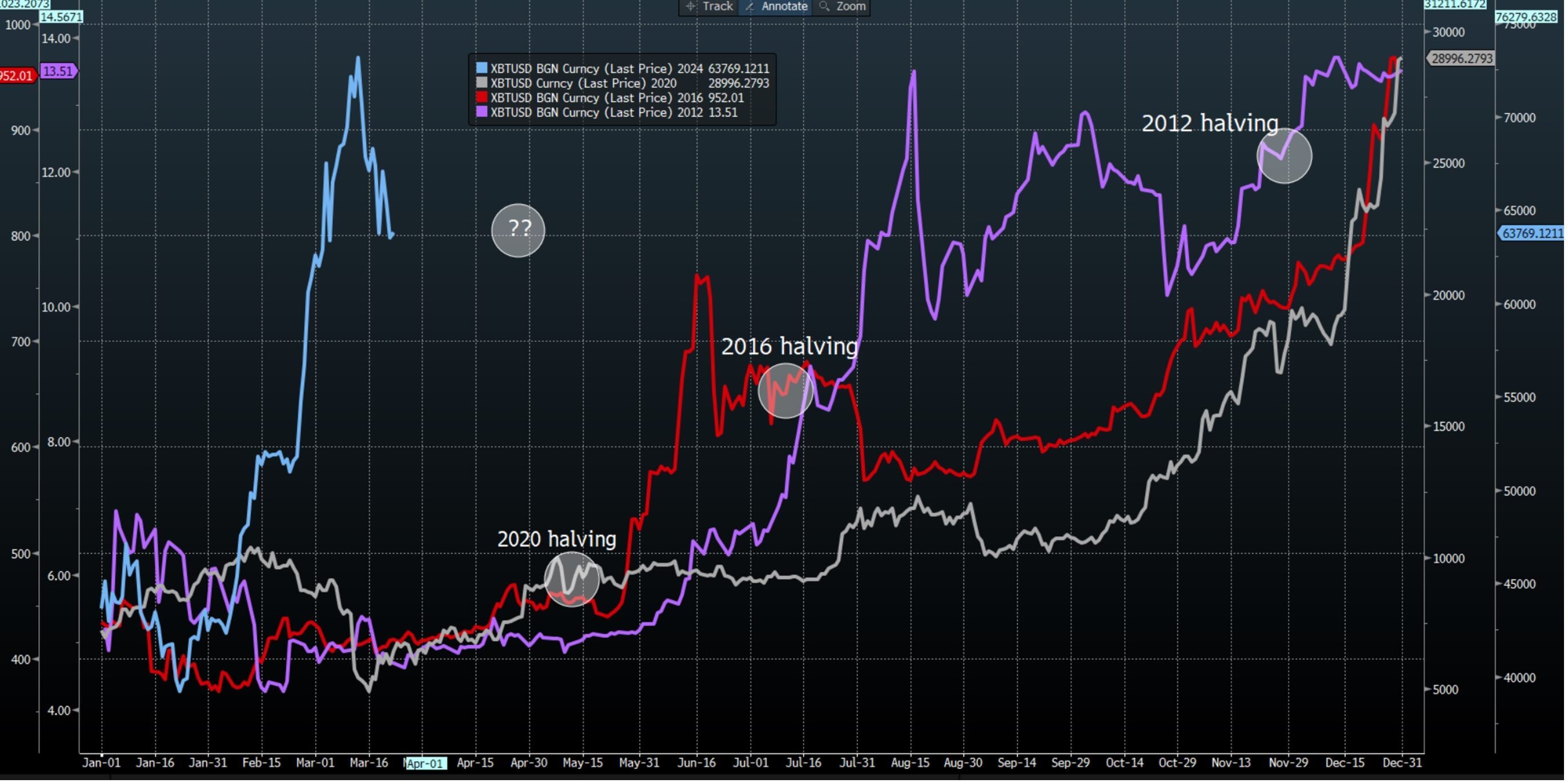

Moves in BTC in 2012, 2016 and 2020

As has also been the case in 2024, in prior halvings BTC ran hard in the months before the halving date, with the price then subsequently pulling back into the event.

Once the halving played out in 2020 and 2012, we saw a strong performance in the BTC price, but this wasn’t the case in 2016, so it is hard to really say with conviction that the halvings had any noticeable immediate impact.

Is this time therefore different?

At its most simplistic nothing really changes from the fact that if you reduce supply, at a time when broad demand and adoption are increasing – like it is presently - then you get a move higher in price. That is as true now as it was in 2012, 2016 and 2020.

Increasing the scarcity of an asset typically leads to upside momentum in price.

Where things have changed greatly and why this time could well be different are:

- While many TradFi traders are still brushing up on their understanding of the halving, the big players in the crypto scene have a thorough understanding of the halving and are well aware of the risk and opportunity and are positioned for it.

- There has been a sizeable increase in institutional participation that is vastly different from episodes in 2012, 2016 and 2020 and is fitting with the evolution in the range of vehicles to trade and invest in BTC. New products, such as the BTC cash ETF have increased awareness, and institutional involvement, while we also see a greater influence from derivatives which are changing the structure and intraday flows.

- Liquidity - the ease by which an order can be filled - has improved significantly in the past two years. The depth of liquidity has important implications as to the extent of any changes in price. Typically, increased liquidity results in lower percentage changes over a period.

- In the past few years, we’ve seen a significant reduction in the cost to trade BTC – this reduces the drag on the portfolio but improves liquidity in the underlying market.

- The number of daily transactions on the Bitcoin network is many multiples of what they were in 2012 - 2016.

- Increased regulatory scrutiny, KYC, and monitoring.

Will there be a change in the trading environment?

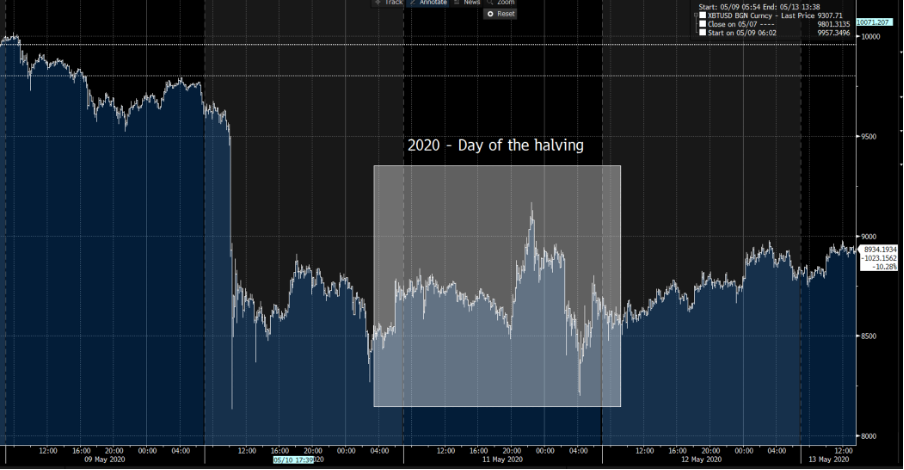

As we look at the countdown clock to the exact moment of the halving, but unlike a US CPI print or FOMC meeting, it is incredibly unlikely we get a sudden knee-jerk reaction in the BTC price once the reward for miners is cut in half.

Why should it? If we know the outcome there should be no surprises.

Case in point, as we saw in the last halving in 2020 (and as shown above), on the day of the halving price action proved to be uneventful, although we did see volatility in the days leading into the event.

As was the case in 2012 and 2020 in the days following the halving the buyers stepped in and we saw a solid rally emerge.

Some will now be watching the hash rate closely to see if this is affected, but we also need to consider that BTC and the wider alt-coins space have been trading as a high beta risk asset – i.e. the NAS100 rallies 1%, and then BTC often gains 3%+. So if do see the NAS100 sell-off this will likely affect BTC regardless of changing supply dynamics derived from the halving.

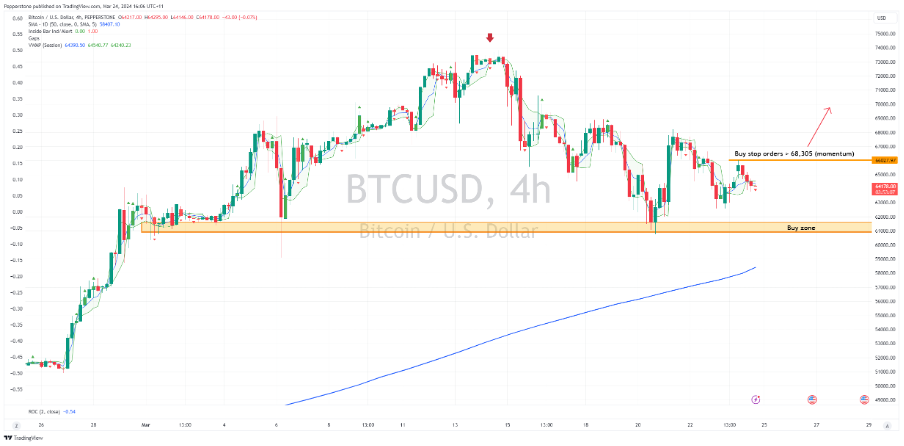

We can clearly see that BTC has underperformed US equity markets since mid-March, which is fitting with prior halving cycles. Perhaps this lends weight to the idea that post-halving BTC will have a cleaner positioning structure and the bulls could have more impetus to push for a run higher in the days post halving.

The trade?

BTC 4HR set-up

As we see on the 4-hour chart, the key level to focus on this time around is the horizontal support into 61,200 to 60769. Should it get to this key support zone, then the bulls will want to see this aggressively defended, as a closing break could see 59,415 come into play, perhaps even the 50-day MA at 58,382.

Conversely, I’d want to see an upside break of 68,305 to feel compelled to initiate momentum longs.

The halving is a clear event risk for BTC and the alt scene, so it’s worth being aware of what’s involved. As always, an open mind and a strong willingness to react to price action will serve us well as traders.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.