Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

Iowa event risk: The state that could propel Bernie Sanders to Democratic nominee

It seems far-fetched that Iowa’s caucuses might give a reading on which Democratic will face President Trump in the November general election, especially when you consider the state is 90% white and in no way a sample of America’s diversity. Further, 45% of the general election vote will come from cities and urban areas, of which Iowa comprises none.

Yet since 1976, in all but two cases, the Democratic winner at Iowa has gone on to lead the party into the presidential election. Iowa nominated Hillary Clinton, Barack Obama (twice), John Kerry, Al Gore… I could go on.

Winning Iowa provides a first-movers’ advantage. Being the first state to vote, the media attention is considerable and the winning campaign is thrust into the national spotlight. The process can legitimise a campaign, especially if an underdog wins.

In 1976, underdog and peanut farmer Jimmy Carter of Georgia rode an Iowa win all the way to the White House. Since then, Iowa has been on everyone’s radar.

The Iowa caucus isn’t held first because it’s important, rather it’s become important because it’s held first.

The caucuses

Iowa is fascinating because it holds a series of caucuses rather than primaries. Voters meet at public spots: town halls, churches, living rooms, anywhere - and express their vote by dividing into groups in the room. If you’re in a group with less than 15% of total votes, your chosen candidate is deemed unviable and you realign to your second preference.

After this second round vote, the candidates are proportionally awarded delegates. Come the Democratic National Convention in July, the candidate with most delegates from all state’s votes wins the election.

And to make matters more confusing, Iowa is releasing three sets of results this year (for the first time, and for transparency): the first expression of preference; the second expression of preference; and the state delegate equivalents.

The final number that matters is the state delegate equivalents as these are counted in the Democratic National Convention to crown a winner. But with three sets of results, we could have more than one nominee claiming a victory in Iowa.

Polls show two candidates leading the race for Iowa: former Vice President Joe Biden and Vermont Senator Bernie Sanders, with numbers showing the two neck-and-neck.

Sanders is an established name in Iowa, where he swept 49.6% of the vote in the 2016 caucuses, losing by only 0.3 of a percentage point to Hillary Clinton’s 49.9% victory. Of course, Biden is also an established name having served eight years as Obama’s Vice President.

A 10 January Des Moines/CNN/Mediacom Iowa poll shows 20% of voters giving Sanders their first choice vote. Warren tails at 17%; Buttigieg 16%; and Biden 15%.

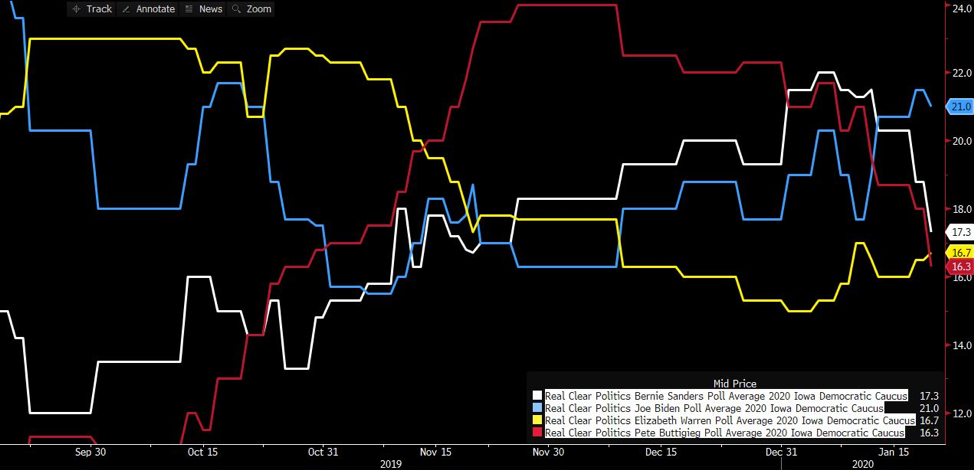

Meanwhile a poll from Real Clear, which takes an average of several polls, has Biden leading, suggesting Sanders’ favourability in Iowa is slipping.

Source: Bloomberg, Real Clear Politics

Remember though that second choices count in the caucuses, so you need to think how voters will realign if their first choice fails to meet the 15% threshold.

The next state to vote for a nominee is New Hampshire, where Sanders swept the 2016 primaries, with 60.4% against Clinton’s 38.0%. Sanders is projected to win the New Hampshire primaries again, but on a much slimmer victory. Biden is polling close behind.

First movers’ advantage

Let’s consider the two candidates leading polls: Biden and Sanders.

If Biden takes out the Iowa nomination, we wouldn’t expect much of a market reaction. Biden is the moderate liberal, business as usual candidate, campaigning on continuing the Obama administration’s work. It’s also way too early in the campaign for any meaningful market reaction.

But if Sanders wins the Iowa nomination, expect markets to take a step back and reconsider risk. Markets shouldn’t start to sell-off just yet, however they’ll prepare themselves to pull that trigger down the track, especially if Sanders proceeds to win New Hampshire as expected.

Remember, Sanders campaign is built on an anti Wall Street message: taking on the top end of town with a wealth tax, financial transactions tax, and by breaking up the big tech companies. Markets won’t see these policies favourably, and investors will move money into the safe havens if a Sanders presidency begins to look possible. We would expect gold, JPY, and CHF to be bid up, and the strong USD to be sold off.

As election year event risk kicks off, be sure to watch the Iowa caucuses to understand how markets might move as the year progresses. After all, Iowa has such a strong record of predicting the Democratic nominee.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.