Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

A state with more representative demographics of the national vote, the Nevada vote is considered a better gage of candidates’ viability and the Super Tuesday (3 March) result.

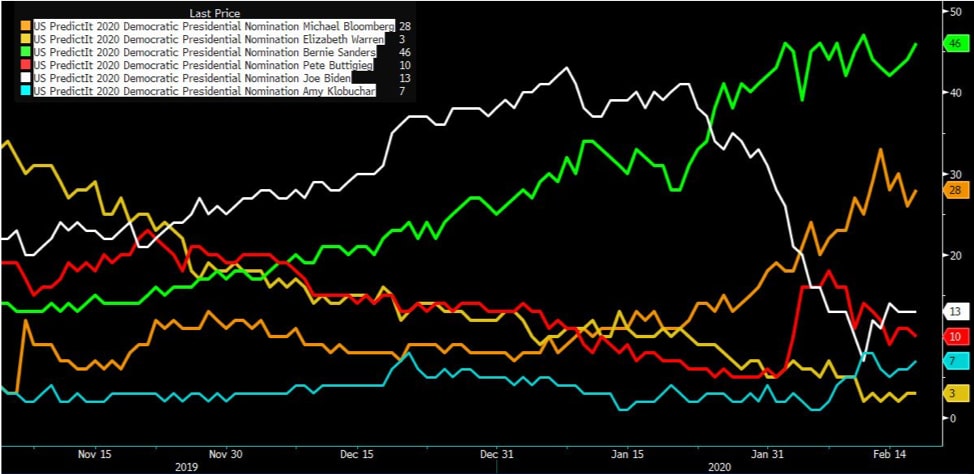

For the overall nomination, PredictIt markets have Sanders with a clear lead: a 46% chance of winning. Bloomberg has surged to 28% while Biden has plummeted to 13%. Buttigieg holds onto double digits at 10% and Amy Klobuchar’s 7% chance has overtaken once favourite Elizabeth Warren, who has fallen to 3%.

Iowa and New Hampshire, the first states to vote, delivered surprise results. Pete Buttigieg proved more popular than expected and Joe Biden’s assumed lead wasn’t the case. At this point, Bernie Sanders is the one to beat - and polls show him sweeping Nevada with a double-digit lead. So will Nevada’s caucus day reflect the national appetite?

I think the most important result so far is the poor outcome from Former Vice President Joe Biden, who for so long was the assumed favourite. He is however expected to do well amongst minority voters, unlike moderate rivals Buttigieg and Klobuchar. As Iowa and New Hampshire are more than 90% white and unrepresentative of the wider US population, Nevada’s better representation of minorities makes it the first proper litmus test for the democratic nomination.

If Biden performs well, he’s back in the race. But a poor showing in Nevada and the following South Carolina primaries, and his campaign could be over.

USD impact

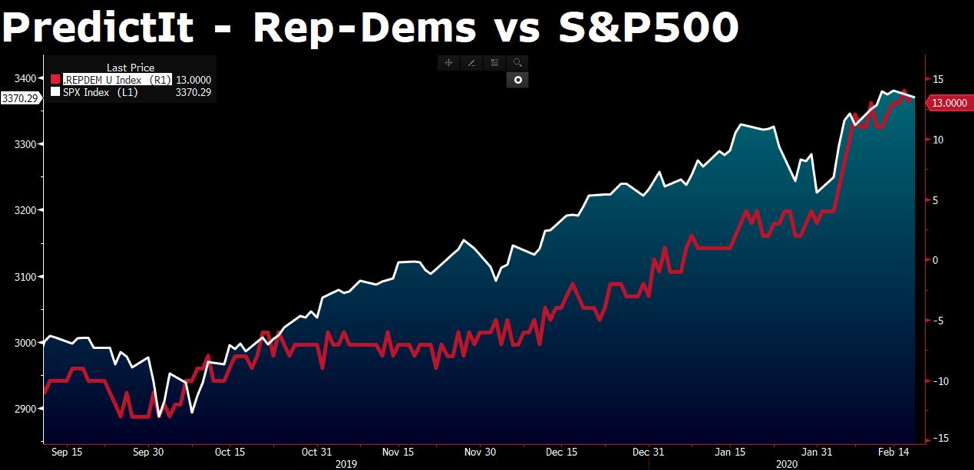

Source: Bloomberg

The USD and US share CFDs are strong and will continue to be so as long as markets believe Trump will be elected for a second term. Politics aside, the markets like the status quo and predictability. This means that if Trump gets reelected, markets continue to hum along as they are.

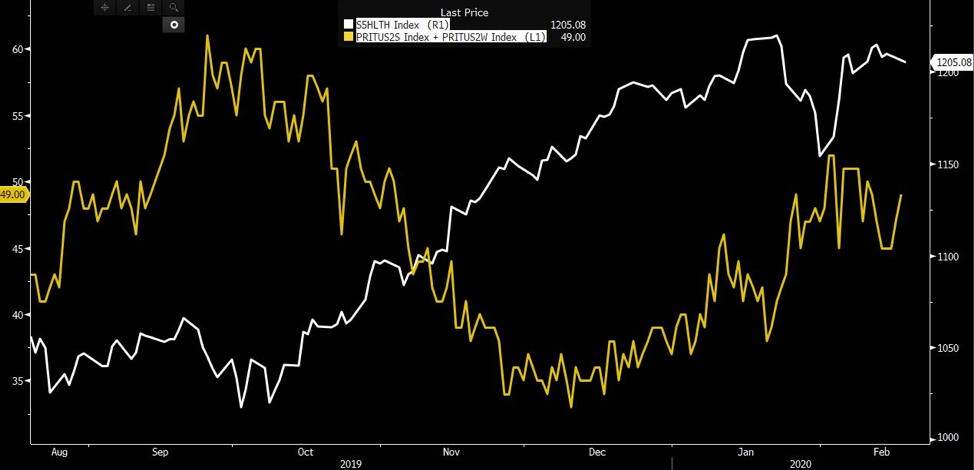

One corner of the US share CFD market that seems sensitive to the democratic candidate so far is the healthcare sector, which comprises 13.8% of the S&P 500 index. You’ll see the health sector (white) having opposite moves to the chance of a Bernie Sanders or Elizabeth Warren nomination (yellow). The two candidates have targeted health sector profits and propose universal health care plans. The lower the odds of either candidate winning, the better healthcare share CFDs perform.

Healthcare has performed better when the more progressive candidates haven’t been.

Source: Bloomberg

What about gold?

Investors continue to see the US share CFD market as unstoppable, almost a safe haven amid deteriorating global growth.

Nevada is probably too early for a market reaction, but Super Tuesday on 3 March does present event risk. If Sanders emerges a clear favourite, investors may begin to hedge some of the risk of financial forms, pushing gold higher. But as long as markets believe Trump will win the election anyway, the share CFD market should continue its rally.

If polls turn and start to suggest Sanders could in fact defeat Trump in the November election, well that changes the game completely. Not only will gold fly, but that record-high US share CFD market could see some serious selling off.

For a fuller understanding of the candidates’ market-moving policies, see our chart below.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.