Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

The Daily Fix: Trader thoughts - Reacting to the Phase One trade deal

Our calls suggest the ASX 200 unwinds closer to 6780 (+40p), while the Nikkei 225 and Hang Seng should open weaker to the tune of 0.5% to 0.7%. China A50 index futures are around 0.5% lower from the cash index close, but local participation may be more enthused by headlines that China is also suspending tariffs on certain US goods.

We look to the US for a guide, where there was no real love for the US-China trade deal - in fact, the daily candle (‘doji’) showed strong indecision, where in the last three hours of trade on Friday it was like the market shut up shop, with the S&P 500 tracking a 4-handle range. The fact the S&P 500 financial, energy and materials sectors fell 0.5%, 0.9% and 0.7% respectively does not help proceedings in Asia either. That said, energy may be the one to watch given WTI crude closed +1.5%, with price commanding a 60-handle for the first time since 16 September.

Also consider implied vol has been sold, with the VIX index closing at 12.6% and as long as vols stay low and the market focuses on central bank actions to keep liquidity abundant into year-end, and notably to keep the US repo market in check, it’s hard to see equities attracting too many sellers - In fact, I’d argue with vols here equities should have a smooth run into year-end.

(Pink - S&P 500, white - global money supply)

"(Source: Bloomberg)"

With FX markets opening for interbank trade on a quiet note, it leads us to believe that the open of S&P 500, gold and crude futures will also be an uneventful affair and shouldn’t affect the equity calls too greatly. That said, the session will be one where we adopt a more psychological approach and assess how Asia reacts to the more defined details of the Phase One trade agreement. Considering we reacted positively to headlines off a deal on Friday, but at that stage hadn’t heard the finer details, which, to be fair, are hardly compelling. Granted, we avoided the 15% tariffs (on the List 4A) on $160b of Chinese exports and thus we are not staring at punchy gapping risk this morning, but the agreement to suspend tariffs on this tranche of goods was already widely expected.

It’s certainly a positive that we saw the 15% tariff (implemented on 1 September) reduced from 15% to 7.5% (List 4a covering $120b of goods), but this is about it and recall last week the WSJ had been talking about a 50% reduction on a far more broad group of existing tariffs. As it is around $380b of tariffs remain in place, while the level of cynicism raised towards China buying upwards of $40b of US ag’s is deafening.

I guess sentiment has been best expressed in USDCNH, which despite selling off into 6.9229 in early Asia trade, rallied back to close at 7.0144, although we’re seeing small sellers in early FX trade. Friday’s weakness in CNH resonated, with traders once again fading moves in ZAR and BRL, with the AUDUSD sold from 0.6939, resulting in a firm rejection of the 200-day moving average (MA) and top of the I-cloud - although the early signs are that traders will use this weakness to buy the pullback. We also saw this sentiment spill over into selling in the BRL and ZAR.

Interestingly, the USD index closed down 0.23% on Friday, albeit coming off the earlier lows and closing just above the October and November double bottom, with most of the variability driven by moves in the GBP, with cable coming off a high of 1.3514, finding a steady bleed lower into 1.3331. I expect traders to be eyeing levels to start buying GBP again.

(The DXY failed to close through the double bottom neckline)

Another factor weighing on the USD was the November US retail sales, where the advance read grew 0.2% (vs expectations of 0.4%) and the control group element increased 0.1% (vs 0.3% eyed). This will not help the consumption component of US Q4 GDP, and it’s no surprise to see a solid bid through the bond market, with US Treasury 2’s closing -5bp, 5’s -7bp and 10’s -7bp.

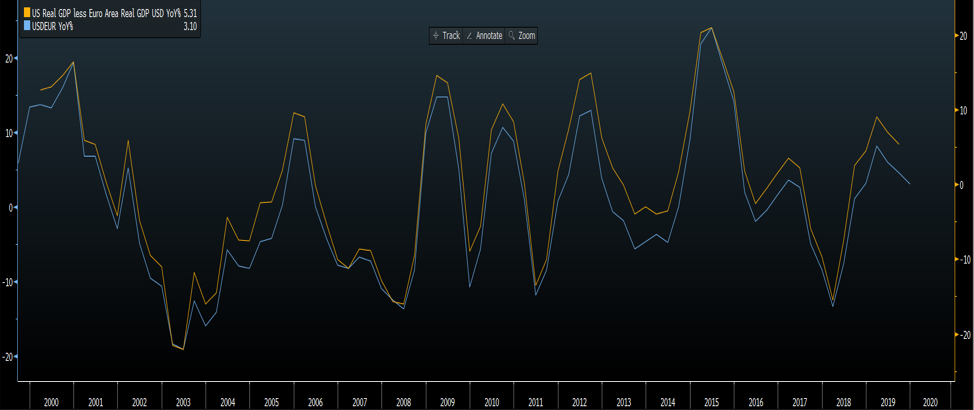

The prospect of a recession in the coming 12 months is certainly low, but the market has a growing thesis that the USD will be just that bit more sensitive to relative growth dynamics in 2020. We can already see on the Bloomberg chart the sensitivity between relative GDP trends in US-EU and USDEUR, and that will remain in place. If you take the view that the rest of the world will outperform the US on an economic basis, then you take the view that the USD will lose its shine in 2020.

"(Source: Bloomberg)"

On the docket today, and event risks that could affect exposures, the highlight will be China’s November industrial production (5% expected), retail sales (7.6%) and fixed asset investment (5.2%) due at 1:00pm AEDT. CBA Aussie PMI won’t move the AUD in any great capacity, if at all, but there could be some focus on European manufacturing (8:00pm AEDT), ahead of US Empire manufacturing (00:30 AEDT) and the Markit PMI print (01:45am AEDT). All-in-all, the data shouldn’t cause too much anxiety - so, as mentioned the real benefit comes from watching and reacting to the sentiment toward the Phase One deal seen in Asia.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.