- English (UK)

US nonfarm payrolls preview - markets even more sensitive to the outcome

After Jay Powell’s speech to the Senate, the market will be incredibly sensitive to the outcome of the NFP report and especially if we see a more extreme number relative to expectations of 215k – so an outcome number north of 300k or below 150k. The market is feeling, on balance, that the risks are for a strong number than a weaker one.

Average Hourly Earnings (AHE) matter, of course, and the market reaction becomes more problematic to gauge if we get a hot jobs print but a weaker AHE (the consensus is 0.3%) – unless we see AHE at or below 0.2%, I will still guess that an NFP print above 300k would see rate hike expectations rise further and the USD rally.

Jay Powell has essentially opened the door to 50bp at the 22 March FOMC meeting – he explicitly said if the data required it – meaning the NFP and US CPI print – that they would step up to 50bp again. He has given the Fed optionality, but one suspects he would be loath to do so as it is not a good look to change tactics when you’ve only just moved down to 25bp increments.

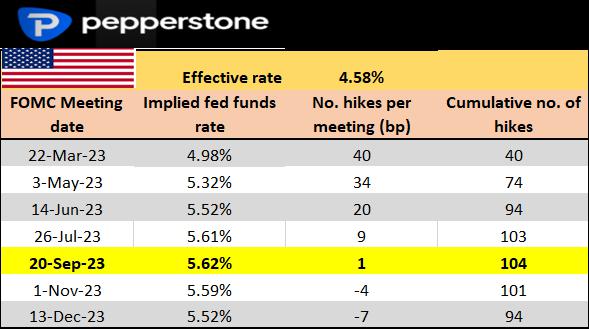

Rates pricing – we see market pricing and expectations of action for each FOMC meeting.

After Powell’s testimony to the Senate, we see that the rates market prices 40bp of hikes for 22 March - this equates to roughly a 60% chance of a 50bp hike at that meeting – in turn, the US2yr Treasury has pushed above 5% and US real rates have blown up – this is nirvana for the USD, and the buck hasn’t looked back here, and we see price firmly breaking out (in the DXY).

The USD bulls will point to increasing signs of central bank policy divergence creeping into FX markets, where the Fed are back to being the hawks of the central bank world – and while the ECB is expected to do more by year-end, the market prices a peak fed funds of 5.62% and that is far in excess of ECB pricing.

An AUDUSD liquidation - The prospect that the RBA are to follow the BoC and pause in its hiking cycle has clearly increased – many are talking about the Aus Q1 CPI print (released on 26 April) as the key determinant for that action. However, given the Q1 CPI print falls after the 4 April RBA meeting there is a real possibility that we get another rate hike in April, but whether that is a full 25bp is yet to be seen.

We get the Aussie Feb jobs report (16 March) and Feb monthly CPI (29 March) and that could affect rate expectations for the April meeting, but I think the Q1 CPI print is key for policy. The market prices 15bp of hikes for the 4 April meeting and 45bp in total.

The fact we are closer to an end for the RBA does suggest reduced buying support for AUDUSD should we see a blow-out US NFP this week – of course, the Fed want to hike by ‘just’ 25bp but putting 50bp on the table helps tighten financial conditions, but it would be a bitter blow to have to backtrack after only just coming down to 25bp increments – a weak NPF would validate that hope/position, but it would see the market paring back interest rate expectations and the USD would fall sharply.

Volatility is the name of the game and NFP holds the keys – we are seeing it in bond and interest rate markets. We’re just waiting for it to fully spill over in FX and equity too.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.