Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

Volatility in NZDUSD on 75bp rate cut but downside remains

The central bank has committed to a 0.25% interest rate for at least the next 12 months, citing constrained global demand for NZ exports and dampened domestic production, spending, and investment.

Last week the RBNZ revealed a toolkit of unconventional economic policy including negative rates, interest rate swaps, and large-scale asset purchases. Governor Adrian Orr said it was all in preparation and that there was no need for them yet.

Forward guidance has been a key play here. The bank said this morning that should more stimulus be required, quantitative easing (QE) in the form of large-scale government bond purchases is the next step. This would be the first implementation of QE in New Zealand. Holding rates at 0.25% for 12 months rules out negative interest rates for at least the next year. Markets now have a fair understanding of the RBNZ’s path for the next year.

Tomorrow the NZ government will reveal a ‘multi-billion’ dollar fiscal relief package tomorrow, including a targeted wage subsidy scheme. This will support parts of the faltering economy and save some jobs, but the fallout will still likely be felt across the country. Air New Zealand is operating at 85% capacity and will commence job cuts amid global travel restrictions.

Late to react?

The RBNZ was the last of major global central banks to act on the economic slowdown despite its reputation for getting ahead of the curve. Measures announced by Prime Minister Jacinda Ardern on Friday might have forced the RBA into action, as requirements that all international arrivals must self-isolate for 14 days threatens to tip the economy into a deep recession. The measures to ‘flatten the curve’ have been called some of the strictest in the world.

The RBNZ had been scheduled to review rates on 25 March. Today’s decision effectively brought that date forward. There will be no review on 25 March. The next policy review will be 13 May 2020.

NZDUSD outlook

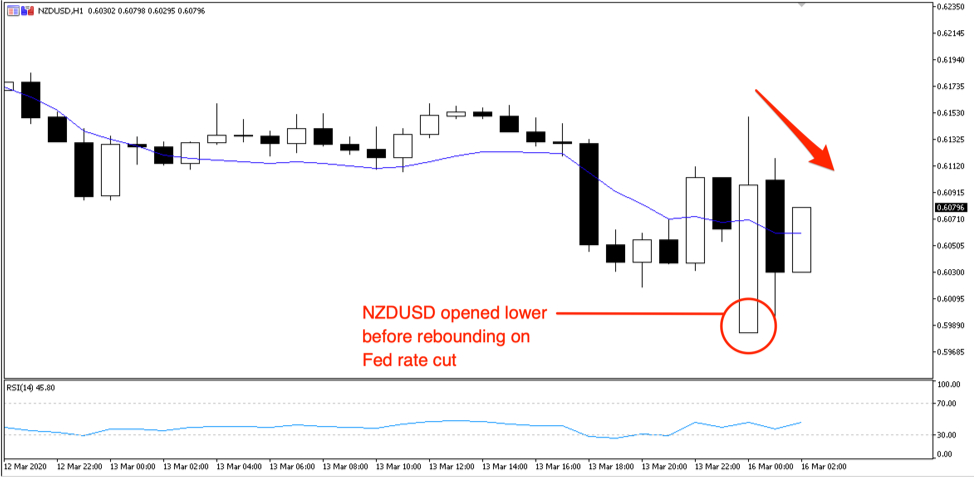

The NZDUSD forex pair opened lower Monday morning at a post-GFC low below 0.6000 but rebounded quickly when the US Federal Reserve announced rates being taken to near zero in a 100bp emergency cut.

NZDUSD opened lower after the RBNZ cut 75bp from the official cash rate. NZDUSD rebounded when the Fed cut rates by 100bp shortly after.

"Source: Pepperstone"

The outlook for NZDUSD remains to the downside as global investors demand more USD amid the panic.

The RBA will likely follow suit with a monetary policy update shortly, by either slashing rates to 0% or 0.25%, or announcing bond market intervention. AUDUSD has been trending down since early 2018, and last week fell a massive 5c, opening Monday at 0.6600 and closing Friday just above 0.6200. NZDUSD takes a cue from AUDUSD, so Aussie downside typically means kiwi downside too.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.