Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

I guess this makes sense given the long weekend and traders minimising exposures to account for potential gaping risk. We are left with the S&P500 +0.5%, Dow +0.9% and NAS100 +0.6%, with implied vol -0.9 vols (our VIX index is sub-30), a mixed picture in FX vs the USD, WTI +1.1% and copper +0.5%.

US data was largely inspiring

Interestingly, there has been a small bid in US Treasuries, which I guess appeals to the nature of the two-way (positive and negative) news flow. On one hand, US data was solid – NFPs increased by a far bigger-than-forecast 4.8m, with the unemployment rate down to 11.1% and this despite the participation rate increasing to 61.5% (from 60.8%). Average hourly earnings fell to 5%, but this is a function of lower-paid workers coming back into the workforce. The underemployment rate fell to 18%, so there is still incredible slack in the labour market, and I am not sure we’re at the point where Trump can use the economy as an election carrot.

Consider initial jobless claims fell by 55k to 1.42m (vs 1.35m consensus), the 13th straight week of falls, while continuing claims increased by 59k to 19.23m - this is likely to stay north of 18m until we see the CARES act reworked, which is something Trump is working on with recent narrative that he wants to encourage people back to work.

The US trade balance widened to $54.6b, with exports -5.8% and imports -0.8% - this widening of trade should impact Q2 GDP, which is already looking incredibly weak.

COVID-19 developments

Data aside we have further worrying developments in the US virus case count, although as we’ve seen in the last nine days or so, the market chooses its increase or decrease its sensitivity to this issue seemingly when it wants. Today the news has weighed a touch, but there is no panic selling and implied vol has dropped on the day.

Impacting sentiment, we see the US national virus count rising 56,800 – the most since 9 May – Florida daily cases increased 6.4%, recording 10,109 daily cases (+102% WoW), while Arizona’s increased 4% (9.1% WoW). Houston reported a 4.3% increase in hospitalisation rates, with headlines that ICUs were at 102% of capacity. Dr Fauci, the nations top COVID spokesman detailed that the disease is mutating so it finds it easier to spread. Texas officials have ordered all residents to wear masks at all times.

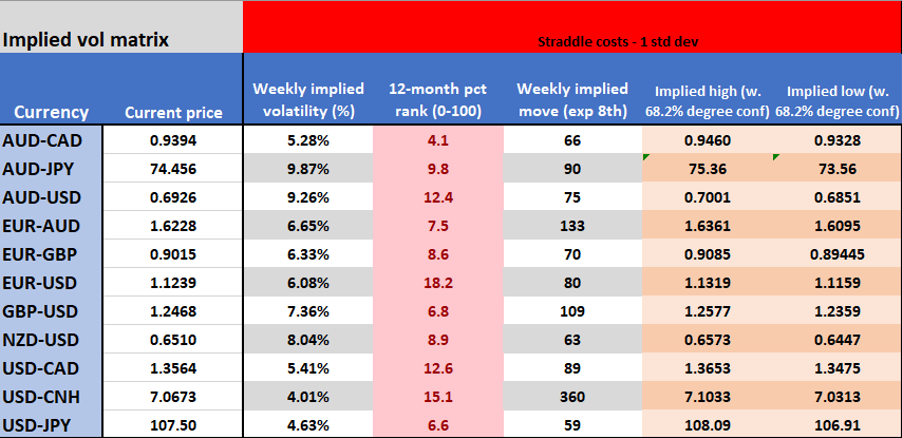

Weekly volatility matrix

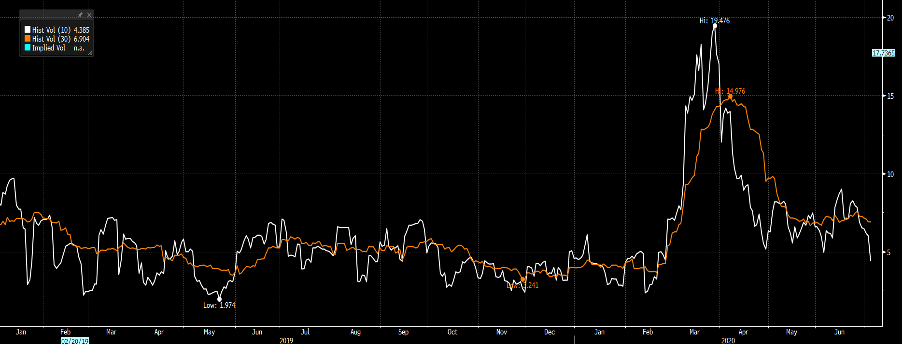

I talk about equity vols falling, but FX is becoming awful again in terms of realised and anticipated movement. Take a look at EURUSD 10- and 30-day realised volatility (RV) it is eyeing a re-test of the February lows. This is similar in AUDUSD and many other pairs too, and has big implications for strategy, notably carry, as well as risk and position sizing. For those using MT4/5 or cTrader, we can view the reduction in RV through Bollinger bands and the ATR.

EURUSD 10- (white) and 30-day realised volatility

AUDUSD 10 (white) and 30-day RV

Selling vol was a strong trade and last weeks implied vol matrix contained all FX moves, therefore it served me well as a risk and position sizing guide, not to mention a reversion tool. As we can see in this weeks vol matrix, implied vols are shot to pieces and sit at the lows of 12-month range. The implied moves are far lower than we’ve seen of late and we can see the implied range (with a 68.2% level of confidence).

As someone who takes the big picture into account before going into lower timeframes for execution, I can look ahead at tighter stops this week and therefore just ease out the position size a touch.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.