- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

That said, the more work I do the more it feels like this has real legs and Bitcoin et al have a place in the portfolio.

There's no doubt crypto is becoming a mainstream product, allowing both retail and ever more so institutional accounts the ability to diversify and reduce portfolio variance. The lack of any significant correlation to a major equity benchmark or government bond market is therefore key.

Crypto has movement in an otherwise tranquil financial backdrop

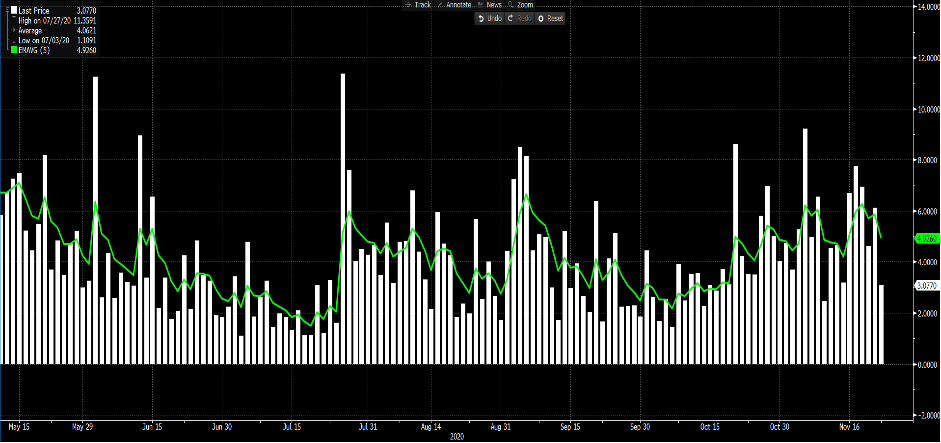

Those looking more short-term see 20-day realised volatility in crypto far higher than that of say gold, FX, or any equity index and that appeals. The volatility (vol) in Bitcoin resides at 39%, which is certainly lower than the statistical vol in Ethereum (62%), Bitcoin Cash (62%), Ripple (123%) and Litecoin (70%). This is likely a function of participation and liquidity.

(Daily high and low % range, with 5-day moving average)

For traders who've the risk tolerance and can respect more extreme moves (higher or lower), these instruments exude significant movement amid a backdrop of falling volatility in other financial markets. Recall, volatility comes with risk not just reward, so do consider the vol regime and adapt your risk management and position sizing accordingly. Personally, while I know each coin has its own fundamental story, as a pure trading vehicle the vol in Bitcoin bests suits my strategy. However, others like more extreme movement.

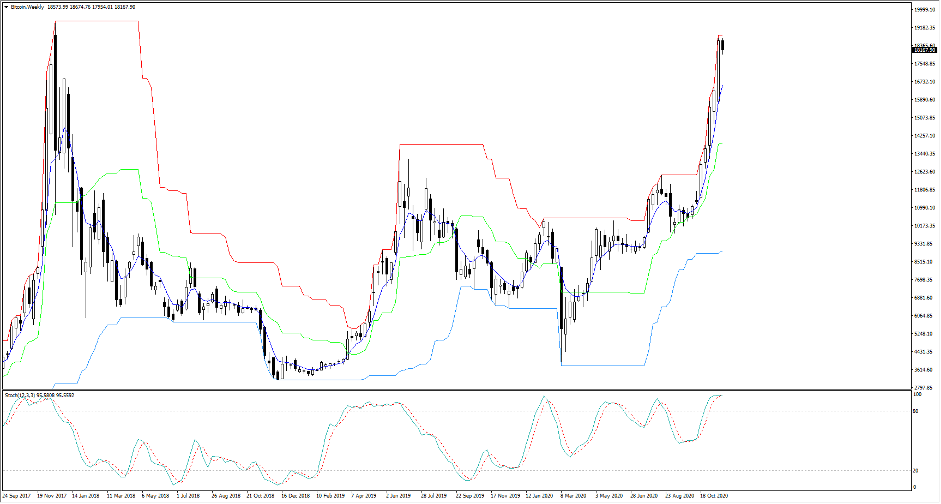

Bitcoin is also a trend and momentum dream having built a solid base into $10,000 and then exploding through the August highs, where pullbacks throughout the recent 92% rally have been limited to 10%. Buying weakness from here seems the way to go. However, is it just a case of leaving orders 6-10% away from the market or given the extended nature of the short-term move is a more meaningful correction coming?

(Bitcoin weekly chart)

Profit taking aside, the market is searching for a fundamental reason that could cause a 20%+ downside reaction and it is not immediately clear. Regulation has always been a concern but this isn't on the radar at this point and while the recent news flow has seen some incredibly lofty price forecasts, which tend to precede profit taking, unless we hear something that genuinely shocks pullbacks should be contained.

Timing is always key in trading and Bitcoin as a FOMO vehicle is something most talk about especially when price is a whisker away from all-time highs (ATH). Headlines of a market at ATH brings out an emotional reaction, with some feeling this is a neutral place to initiate shorts and others feeling it's at these levels for a reason and the start of something far more significant.

While I would be looking for pullbacks here, it would not shock to see headlines in the weeks ahead of “Bitcoin makes a new all-time high”.

The list of positive factors continues to grow and the more I look at the space the more I see crypto as a mainstream asset class. I mentioned the portfolio diversification angle and while the list is far more extensive than this, here are a few factors that stand out.

- The search for the best hedge against currency debasement sees investors head straight to Bitcoin. G7 central bank balance sheets are only going higher and global money supply is seemingly inspiring both equity and crypto investors.

(Blue – Bitcoin, Pink – global money supply, yellow – S&P 500)

(Source: Bloomberg)

- While this is a long-term factor the architecture is set-up for Bitcoin to appreciate, whereby the rewards for miners are reduced by 50% every 210,000 blocks that are mined. This is a form of quantitative tightening which for any fiat currency is wholly bullish. In theory and unless something changes the last Bitcoin will be produced in 2140.

- Various central banks have been moving towards a digital payment system. China is leading this charge with its Digital Currency Electronic Payment. Other central banks, like the BoE are constructive on digital currencies too.

- The adoption story is real and there's not enough supply to keep up with demand. PayPal announced (on 21 October) that it will allow US customers to buy and sell Bitcoin, Bitcoin Cash, Ethereum and Litecoin from the customer’s account. It's a gradual rollout but given PayPal’s huge global distribution the market sees this as a big step forward.

- PayPal is not the first mover here and Robinhood and Cash App by Square have been allowing individuals greater ease to buy and sell crypto for months. With calls that Cash App alone is hovering up to 40% of issued Bitcoins.

- Investing legends own Bitcoin. Of late, we’ve heard from Stan Druckenmiller, Paul Tudor Jones and Bill Miller, who have disclosed their interests. While Blackrock CIO Rick Rider has disclosed his personal holding (not in his fund) and suggested Bitcoin could replace gold “to a large extent”.

- Passive fund involvement has been well documented with Fidelity Investments launching a Bitcoin fund with a minimum investment of $100,000. The Greyscale Bitcoin Trust, a vehicle that now has total assets of nearly $10b also offers more sophisticated investors access to Bitcoin. In fact, further afield it has been the changes at a custodial level which has meant that institutional funds can invest in crypto and the rise of institutional participation seems to be the major difference between current momentum and the 2017 rally.

- Helped by its purchase of prime brokerage platform Tagomi in May, crypto exchange Coinbase has seen a $14b increase in institutional assets in custody since April. With trading volume 20x what they were at the start of the year.

While I have clearly missed a great run, the more I look at the evolution the more crypto looks compelling. After the recent run and the pickup in insatiably bullish stories and forecasts, it feels like the risk of buying now have increased and risk/reward favours a pullback before another leg higher. Either way, it feels like this move has been driven by institutional flows as opposed to retail and that makes this so much more different than 2017.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.