CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81.1% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Week ahead traders' playbook - 11 questions front of mind this week

It seems the script of having a protracted negotiation period is coming to fruition and the consensus view of the SPD/Green/FDP is looking more likely – the EUR has opened 7 pips higher, a rounding error and it could easily be faded in a few trades at this time.

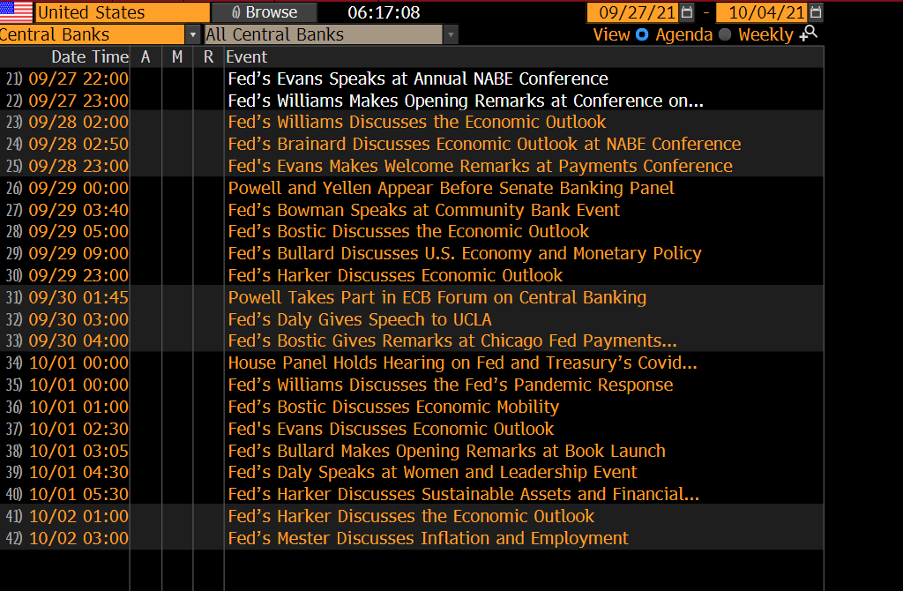

There's a few events to move things along this week and a couple of risks to watch on the calendar spring out as China PMI (Thursday 11:00 AEST – consensus 50.2) and US ISM manufacturing (Sat 00:00 AEST – 59.5). Most of the focus though is towards central bank speeches from BoE Bailey (today 01:00 AEST), ECB’s Lagarde and then a raft of Fed speakers (see below) – Let’s see if they can spice things up, because while we saw volatility kick up early last week, with the VIX index hitting 28.79%, we see things more subdued again, with the VIX closing at 17.75%.

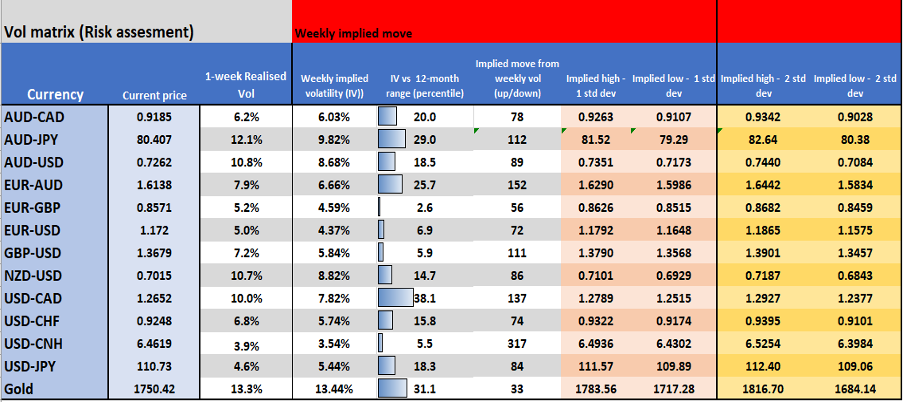

Here’s the weekly volatility matrix on key FX pairs and gold. I take the weekly implied (options) volatility (derived from Bloomberg) and divide by 15.9 to get the implied move through to Monday (expiry 4th) and project this to spot to see the implied range. I like to see what’s expected by way of movement and if the market, given the known event risk, is seeing an elevated risk of higher chance of movement.

(Source: Pepperstone - Past performance is not indicative of future performance)

Looking ahead, make sure you join me tomorrow where I’ll be talking to Nick Radge and Robert Carver – both legends in the fields of automated trading, backtesting and robust system design. Sign up here.

What’s on the mind this morning?

- Continue to watch the Evergrande saga and whether holders of the property giant’s USD denominated debt are made right on their $86m interest payment on its March 2022 bond. Traders will be watching USDCNH and AUD, but the HK50 seems the clearest representation of sentiment in our tradeable universe – after a bounce to 24,799 the HK50 has been a sellers’ market, so we ask can the HK50 close below 23830, subsequently opening the door for the bear trend to continue?

- US Treasury yields moved higher last week, with the US 5-year bond moving from 86bp to 95bp, and UST 10s from 1.36% to 1.45% - A new range has been established, with the US 10-year Treasury breaking above 1.37% - the IEF or TLT ETF are both vehicles to play further upside in yields (lower in price). Is there scope for the 10-year Treasury to push to 1.50/1.60%, with the IEF ETF (10yr US Treasury ETF) headed to $114 on this development?

- Would a further rise in US treasury yields start to impact equity sentiment? This wasn’t the case last week and I suspect won’t be this week either but watch tech – there are few corners of the market more vulnerable to higher bond yields than tech and long duration assets – energy and financials are the best hedges to a rising yield environment.

- The correlation between US bonds yields and USDJPY has picked up – higher yields are good for USDJPY. USDJPY looks a little stretched, so I’d be wary to chase here, but I would be looking for a re-test of 110.50 as a potential support zone within what is a progressively bullish trend.

- Will there be any impact at all in the JPN225 or JPY from Wednesday’s LDP Presidential election in Japan? USDJPY 1-week implied volatility sits at 5.44% - which equates to an 84-pips move (up or down). Also consider the amount of Fed speakers due this week, which could impact bond pricing.

- Our flow in XAUUSD has been strong of late, with client positioning now skewed 65% long. The pain trade is a break of 1742/38 opens another move to 1700 – higher US bond yields and USD strength would be the obvious trigger here.

- GBPUSD pushed to 1.3750 in the wake of the surprisingly hawkish BoE meeting but retraced 90-pips, where we see support on the hourly chart at 1.3660. There is now a 13% chance of a November hike priced, with a 90% chance of a hike in March 2022 - a strong UK employment report on 12 October could change that and push pricing closer to 40% for a November hike. Near-term I prefer playing a range and would counter moves into 1.3766 to 1.3610.

- SpotCrude has been strong, as is SpotBrent which sits at a 3-year high and eyes a test of $80. $76.98 is the big level in US crude and a closing break here and talk of $100 will increase – volatility is falling in crude and the trend at this stage is bullish – can we see $76.98 broken this coming week?

- The Norges bank was the first G10 FX central bank to raise rates last week, and signalled they’ll raise again this year – the NOK was the best performing currency last week, with a gain of 1.5%. With the BoJ unlikely to hike for many years (if at all), long NOKJPY (up 2.2% last week) is the ultimate expression of policy divergence among major central banks, as well as a bullish view on oil. NOKJPY is the highest since 6 July – can it push firmly above 13?

- Can the US500 break near-term resistance at 4487 and make a play at the all-time high? A break below 4421 would suggest a more cautious stance. US Q3 earnings (JPM report 13 October) will start to get more attention in the period ahead.

- Some stability in Crypto over the week – the 100-day MA in Bitcoin and Ethereum seems to have held firm, as it has on several occasions. The level to lean against it seems.

(Source: Bloomberg - Past performance is not indicative of future performance)

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.